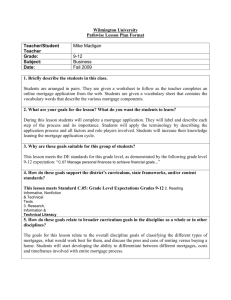

A I C-

advertisement