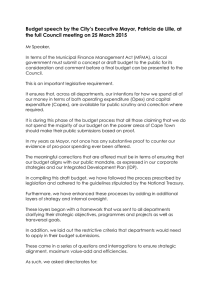

CITY OF CAPE TOWN DRAFT BUDGET For the financial period

advertisement