Numerical Methods for Contingent Claims Analysis of Investment Decisions by

advertisement

Numerical Methods for Contingent Claims Analysis

of Investment Decisions

by

James C. Meehan

MIT-EL 88-O1OWP

May 1988

NUMERICAL METHODS FOR CONTINGENT CLAIM ANALYSIS

OF INVESTMENT DECISIONS

by

James Carl Meehan

Submitted to the Alfred P. Sloan School of Management

on May 6, 1988, in partial fulfillment

of the requirements for the degree of

Master of Science in Management

ABSTRACT

In this thesis I examine the numerical methods used in

option valuation with analysis focusing on the more complex

options associated with investment decisions. Two options

implicit in many projects are identified and analyzed: i)

the option to halt construction of a project, and ii) the

option to shut down the production lines once the project is

complete. The partial differential equations governing the

values of these two options are derived, discretized, and

solved using numerical techniques.

Thesis Supervisor: Dr. Robert S. Pindyck

Title: Mitsubishi Bank Professor of Applied Economics

2

Acknowledgements

I wish to acknowledge the Center for Energy Policy

Research of the MIT Energy Laboratory for financial support.

I would like to thank my thesis advisor Robert Pindyck, my

reader Patricia O'Brien, Max Senter, and Rich Bernius for

their comments and suggestions.

I wish to thank Marcy Abelson for her patience and

understanding throughout the process.

I also thank my

parents for their love and support during my five years at

MIT.

3

1.

Introduction

Since the publication of the seminal paper by Black and

Scholes in 1972 [2], contingent claims analysis has been one

of the most studied topics in finance.

The purpose of my

thesis is to show how contingent claims analysis can be

applied to the valuation of investment decisions which often

include imbedded options.

Many investment decisions have options-like

characteristics which are ignored when standard discounted

cash flow (DCF) methods are employed in the valuation of

projects.

These implicit options can often significantly

impact the valuation of a project as has been shown in Majd

and Pindyck [7], McDonald and Siegel [8,9], and Myers and

Majd

[11].

The value of this thesis lies in the extension of

current models which incorporate contingent claims analysis

in investment decision making.

I will focus on the

numerical methods used in solving the equations arising from

these models.

The importance of a methods paper such as

this is that as models grow in complexity, analytical

solutions are often unavailable, and

numerical analysis

must be employed to estimate solutions.

In this thesis, I will concentrate on a problem which

exhibits two different types of options characteristics and

explain how numerical methods are used to value the

contingent claims.

The problem can be broken down so that

4

each of the options can be analyzed with relatively

straight-forward numerical techniques.

The problem is also

one in which the deficiencies of DCF methods are readily

apparent.

In Section 2 I will describe the general nature of the

problem, and I will give a specific example of a project

which can be analyzed using these methods.

In Sections 3

and 4 I will provide a complete analysis of each part of the

problem.

These two sections will be broken down into

subsections each of which will focus on a specific aspect of

the problem.

In Subsections 3A and 4A I will derive the

partial differential equations (PDEs), from which most of

the analysis proceeds in the literature.

Subsections 3B and

4B will focus on the transformation and discretization of

the PDEs used to obtain finite difference approximations of

the PDEs.

In the C Subsections, I will explore the

numerical methods used in solving the finite difference

equations.

2.

Section 5 will conclude.

The Problem

Suppose a firm is deciding whether or not to invest in

a project with the following characteristics:

1) spending decisions and associated cash outlays occur

continuously over time,

2) there is a maximum rate at which the cash outlays

can be productively spent over time,

5

3) there are no cash inflows from the project until

construction is complete,

4) capital in place has no alternative use and thus no

salvage value,

5) the size of the project is fixed, i.e. there exists

no flexibility to build half a factory or two

factories,'

6) construction can be stopped and started again

costlessly, and,

7) the capital markets are sufficiently complete so

that the completed project will not affect the

opportunity set available to investors.

A project which exhibits these characteristics includes

an embedded option that is ignored in DCF analysis.

More

precisely, the decision to invest in the project at any

given time is like a compound option.

For example, assume

that in any period, I have the option to invest one million

dollars in a project that is currently ten million dollars

from completion.

If I invest this period, then next period

I have the option to invest one million dollars in a project

that is currently nine million dollars from completion.

If

I choose not to invest this period, then next period I would

have exactly the same option as I have this period.

1 This

As we

is another option which can be valued using

methods similar to those described below; however, we will

ignore this option in our analysis.

6

shall see this option can be valued independently of the

other underlying option that we will study.

In addition to the above assumptions, suppose that the

project, once completed:

8) produces a good which has an observable price in a

competitive market,

9) produces a good with a constant, known marginal cost

10) can be shut down if the price of the good falls

below marginal cost, and re-started later

costlessly, and

11) has a known

life expectancy

of T.

The economics of this option value is readily seen from

assumption (10), and adds to the value of a completed

factory.

The above set of assumptions may seem overly

restrictive; however, some of the restrictions serve only to

simplify the analysis and can be relaxed.

To frame the problem in more concrete terms, as well as

to build a base case scenario with which to later test the

numerical methods, consider a firm that is trying to decide

whether to build a widget factory which will take a minimum

of five years to complete.

By a minimum completion time of

five years, I mean that if construction were to proceed at

the maximum possible rate and not stop, the factory would be

complete in five years.

7

Suppose, for example, that the widget factory were only

half completed and the price of widgets were to drop to one

tenth of the variable cost to produce widgets.

It may make

sense for the firm to treat the half completed factory as a

sunk cost and stop investing in the project.

A value

maximizing firm will value this option to halt construction

in much the same fashion that financial options are valued.

This implies that the firm will demand that the price of

widgets be at some value above the variable cost of

production before it will invest in a given period.

This option to halt construction and restart it makes

the time it takes to complete a widget factory dependent on

the price evolution of widgets, and thus uncertain.

I will

suppose, though, that a completed widget factory has a

useful life of 10 years, independent of the number of years

for which it is actually profitable for the factory to

produce widgets.

An important difference between the two

parts of the problem is that the time it takes to complete

the factory is uncertain due to the uncertainty of price

evolution, whereas the useful life of the factory is known

with certainty once construction has been completed.

Lastly, I will take the marginal cost of producing

widgets to be a constant $1, the maximum rate of investment

in a widget factory to be $1 million per year, and the

maximum rate of production of widgets to be 1 million per

year.

8

We assumed above that the price of the good, in our

example the price of widgets, is exogenous.

We will also

assume that price evolves according to:

dP = (

- 6)Pdt + oPdz

(1)

In other words, the price of widgets follows geometric

Brownian motion, also known as the diffusion process, where

dz is the increment of the Wiener process.

The parameter

is the total rate of return demanded by the market for

holding widgets and includes an appropriate risk premium.

As can be seen from (1), the rate of growth of P is

less than

by an amount 6, which corresponds to the

convenience yield, or rental rate, realized by holding

widgets in reserve.

The convenience yield on a commodity is

similar to a dividend paid on common stock, as it is the

return from holding the asset which when added to the

capital appreciation of the asset gives the total return.

The assumption that the price of widgets is exogenous, along

with the need to further assume that widgets can be shorted

makes the analysis especially well-suited to handle projects

which produce commodities.

The option to halt construction is the same as in Majd

and Pindyck's time-to-build paper [7] where the price of the

underlying good has replaced the value of a completed

factory as the exogenous state variable.

The problem is

still one of optimal control of investment decisions leading

to the completion of the project.

9

Their model estimates the

value of flexibility implicit in projects which require a

period of time to be built and provides an optimal decision

rule which gives the minimum value needed for investment to

occur over time.

Since we assume price, not value, is exogenous, the

valuation of the flexibility associated with time-to-build

and the derivation of the optimal decision rule will

encompass the second part of our problem.

The first problem

is to calculate the value of a completed factory.

To do

this we will draw on McDonald and Siegel's valuation model

of the option

They argue that since the

to shut down [9].

firm can decide to shut down at any time during the life of

the project, the value of a completed factory is equivalent

to the value of an infinite number of options to produce.

Summing the value of these options will give the value of

the completed project that takes into account the option to

shut down.

3.

Modeling the Option to Shut Down

Given that a completed widget factory exists, how much

is it worth?

[0, T], the firm has the

At every time

option to produce widgets

or to shut the factory down.

I

will write the value of this option for any price level and

time prior to maturity as:

C = C(P(t),T

On the "maturity date"

- t)

the value of the cash flow,

10

(2)

and the

r(P(r)), depends upon the price of widgets at time

marginal cost of producing widgets MC.

This future cash

flow is:

(3)

i(P(T)) = max[O, P(T) - MC]

per widget produced at time

.

For 6 > 0 McDonald and Siegel [9] show that the present

value of this claim on future earnings, conditional on

information at time O, corresponds to the value of a

European call option on a stock paying a continuous

proportional dividend of 6 expiring at time

.

They also

show that the value of a completed project is obtained by

summing the values of the individual claims:

V(P(O)) =

(4)

C(P(O),)d

The first subsection will go through the steps used to

replicate the individual claims on the future cash flows;

however, keep in mind we are really interested in the total

value of the project given by (4).

3a.

Replicating the Option to Shut Down

Suppose you construct a portfolio W consisting of an

option to produce one widget at time

, and short C,

widgets, where subscripts denote partial derivatives:

(5)

W = C - CP

Total differentiation of (5) gives dW = dC - CdP;

the portfolio W includes a short position of C

however,

widgets.

In

order to short, restitution of the convenience yield must be

11

made to the party from which the widgets were borrowed.

Thus, the amount 6PCpdP must also appear in the equation

describing the change in the value of the

portfolio

W:

dW = dC - CdP

- 6PCpdt

(6)

By Ito's Lemma we know:

dC = -Ctdt + CdP

2 Cppdt

oa2p

+

(7)

The first two terms in the right-hand side of (7) appear

from non-stochastic differentiation of (2).

The third term

arises from the stochastic process assumed on P.

Substituting

(7) into (6) yields:

dW = [o02 p2

C

(8)

6PCp - Ct]dt

-

The important characteristic of (8) is that the terms

involving dP have dropped, and with them the uncertainty

involving the change in the value of the portfolio W.

This

implies that the portfolio should earn a riskless rate of

return over any time period:

(9)

dW = rWdt

where r is the continuously compounded riskless rate of

return.

Substituting

(9) into (8) yields:

rW

=

-

a2p2Cpp

PCp - Ct

(10)

Substituting (5) into (10) and rearranging gives the oft

seen second order PDE:

½f2 p 2 Cpp

+

(r - 6)PCp - Ct

12

-

rC = 0

(11)

The call price must satisfy (11) for every price and

for each point in time.

The equation is subject to the

following boundary conditions:

C(P(T),O) = max[O,P(T) - VC]

(12a)

C(O,T - t) = 0

(12b)

- t) = e6 (t -

lim C(P(t),T

P-+

)

(12c)

Condition (12a) states that at expiration, the call

expiring at time T is either worthless, or worth the

difference between the prevailing price P(T) and the

variable cost to produce.

Condition (12b) states that if

the price drops to 0 the call is worthless.

Condition (12c)

states that as the price of the underlying asset gets very

large, the value of the option to not produce goes to zero,

and the value of the option to produce the underlying asset

grows at the fair market rate discounted by the convenience

yield.

McDonald and Siegel [9] show that (11), subject to the

boundary conditions (12a) - (12c), has a closed-form

solution given by:

C(P(O),T) = P(O)ed,

6

TN(d1 ) - VCe-rTN(d 2 )

[ln(P(O)/VC) + (r - 6 + %

d2

d

-

)]do t

JT

(13)

(13a)

(13b)

where N(x) denotes the area under the standard normal curve

between -

and x.

However, no closed-form solution to (4)

exists unless the project is infinitely lived.

Given that T

is finite, the solution to (4) would normally proceed as an

13

approximation of the left-hand side of (4) using the righthand side of (13).

The approximation involves numerical

integration of the area under the standard normal curve.

I will present an alternative method for approximating

the left-hand side of (4) using finite differencing

techniques.

The reason for this approach is twofold; the

simplicity of (13) will provide a good example to illustrate

the numerical methods before attempting more difficult

models, and the approximations obtained using the numerical

technique can be directly compared to the closed-form

solutions to estimate how quickly the numerical method

converges.

3b.

Transformation and Discretization

There are two things which we hope to accomplish

through

a transformation

of (11).

The first is to write

dimensionless, or unitless, equation.

a

By doing this we are

left with a simple, but very general form devoid of

unnessary symbols and units.2

To accomplish this in (11)

we divide everything currently denominated in dollars, i.e.

C, P, MC, by the marginal cost MC, which is analogous to the

strike price of a financial option.

The second goal of the transformation is to eliminate P

from the coefficients of the partial derivative terms in

2 For

more on dimensionless forms and a more indepth

coverage of numerical methods see Ames [1].

14

(11).

I will describe why this elimination is desirable

from a numerical perspective in the next subsection.

Ignoring the reason for a moment I will employ the following

3

transformation:

C(P(t),

- t)

X

where

(MC)D(X,T

- t)

(14)

(14a)

ln(P/MC)

and the variable cost VC has been normalized to 1.

Notice

that since C(P(t),T - t), MC, and P are denominated in

dollars, D(X,T - t) and X are dimensionless.

(14) we find:

Differentiating

(15)

Cp = DxMC/P

2

Cpp = [DXX - D]MC/P

(16)

(17)

Ct = DMC

of (15) - (17) into (11) and (12a) - (12c)

Substitution

gives:

½o2 DX

+ (r -

6 -

22

)Dx

- Dt

- rD = 0

(18)

Subject to:

D(X,O)

= max[0,ex

(19a)

- 1]

(19b)

lim D(X,T - t) = 0

X

-o

= e 6 (t - t)

lim e-XD

X-+

Notice

that all of the coefficients

side of (18) are constant.

(19c)

of the left-hand

By applying the transformation

(14), we have succeeded in writing a unitless equation with

3 Brennan

paper

and Schwartz use this transformation in their

[3].

15

constant coefficients.

An equation that is to be solved

numerically should exhibit these two properties at a minimum

before the methods to be described below are applied.

Recall from calculus the following Taylor expansions:

D(X + X) =

2 + (1/6)Dx..X

3 + O(X4 )

D(X) + DX + DXX.X

(20)

D(X - X)

D(X) - DX + D.XX

2

3 +

- (1/6)D...X

(X4)

(21)

To obtain a finite difference approximation to (18) we will

discretize the function D(X,r - t) as follows:

D(X,T - t) = D(iAX,jAt) = D,j

(22)

By subtracting (21) from (20) and rearranging we obtain

as an approximation

to D.:

D.--(DLj -D 1,j)/X

By adding (20) and (21) we can approximate D.

D. .

(D.+,j

- 2Dij

+ D,_,j

)/(AX)

(23)

as:

(24)

Finally, to obtain a forward difference approximation of Dt,

we can write

the same Taylor

expansion

as in (20), but for t

which gives:

Dt

(Di,j.1

- D,j)/At

(25)

Applying these particular discretizations to (18) with

some rearranging gives:

= cDi.l,j

Di,j+l

with

k

t,

h

+ coDi,j + c 1Di 1,j

X,

R - k/h2

2 + h(r - 6 - o2 )]

c, = R[ld

c, - 1 - R2 - kr

16

(26)

(26a)

(26b)

(26c)

- h(r - 6 -

c 1 =-R[a2

2 )]

(26d)

As can be seen from (26) any value Di,j.1

in terms of Di,j.

This method

is classified

can be solved

as an explicit

method in numerical analysis since any value can be

calculated explicitly from values already known.

The most

desirable property of the coefficients of (26) is that they

do not depend on i or j.

The importance of this properties

will be addressed in the next section where I will focus on

the numerical methods used to solve (26).

3c.

Numerical Method

Perhaps the main theme of numerical analysis is

convergence.

Convergence requires that the solution to

(26) approach the solution of (18) using boundary

conditions (19a) - (19c), as both h and k go to 0.

Proving

the convergence of a numerical method is equivalent to

showing that the method is both consistent and stable.

Stability of a method is guaranteed if the error associated

with the numerical solution does not grow with the number of

steps required to arrive at the solution.

In other words,

any roundoff error introduced in computing the values of the

option at the boundaries must be bounded as both k and h

decrease.

Numerical solutions obtained by unstable methods

are of no value, since errors soon swamp the solution of the

finite difference equation.

17

A numerical method is consistent if in the limit as h

and k go to 0, the finite difference equation is no longer

an approximation of the partial differential equation, but

is exactly the same as the PDE.

Most finite difference

approximations are derived to ensure consistency; however,

an excellent example of inconsistency in a reasonably

derived finite difference equation is given in Ames, p. 62

[1].

In Ames' example the difference equation approximating

one PDE converges to the solution of another PDE even though

a stable numerical method was employed.

Our explicit method is easily shown to be consistent.

If we subtract (26), which is the approximation to (18)

obtained by approximating the derivative terms using (23) (25), from the exact representation

expansions

[-%½a/12

of (18) using the Taylor

(20) and (21), we get:

- (r - 6 - ½o 2 )/6]X2D ,,z

+

tDt + O(X4

+

t2 )

(27)

which approaches 0 as both X and t approach 0.

Stability is guaranteed provided that the sum of the

coefficients of the right-hand side of (26) is less than or

equal to one, and that the coefficients are all positive.

By adding (26b), (26c), and (26d) we see that the sum of the

coefficients of (26) is less than or equal to one.

From

(26b) - (26d) it can also be seen that two restrictions on k

and h ensure that the coefficients are always positive:

h <

'2 /2r 18

6 - ~2

(28)

R < (1 - r)/o2

(29)

Notice that the stability conditions are simple functions of

the parameters and not of the state variables as they would

have been if the transformation had not eliminated the

dependence

of the coefficients

on P.

A good approximation to the left-hand side of (4) can

be calculated by numerically integrating (26) over the range

0 to T.

The result will be used as a boundary

condition

for

the second part of the problem to be described in the next

section.

The code for implementing the algorithm given above can

be found in Appendix A.4

Table 1 compares approximations of

the value of the option to produce one widget generated by

the code in Appendix A with the closed form solutions for a

given set of parameter values.

Table 1 includes option

values for three different price levels: MC, and the nearest

grid points to 10% above and below MC.

4 All

results were obtained using programs written in

FORTRAN 77 for the IBM 4341. Appendix B contains an older

implementation of the algorithm that I wrote in TruBasic for

the IBM PC.

19

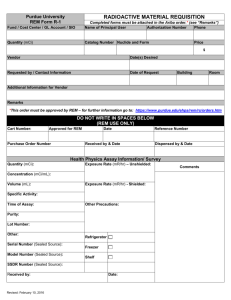

Table

r = 0.02

Yr

1

2

3

4

5

10

4.

6 = 0.06

1

o = 0.2

MC = 1

Price

1.0000

Actual Estimate

0.0585

0.0586

0.0702

0.0709

0.0747

0.0759

0.0760

0.0776

0.0754

0.0774

0.0634

0.0658

Price

0.9013

Actual

Estimate

0.0131

0.0250

0.0282

0.0381

0.0360

0.0451

0.0402

0.0488

0.0425

0.0506

0.0420

0.0471

k = 0.01

Price

1.1095

Actual Estimate

0.1106

0.1168

0.1190

0.1212

0.1203

0.1209

0.1184

0.1183

0.1148

0.1146

0.0899

0.0903

Modeling the Option to Delay Investment

We have solved above for the value of a completed

factory over a range of prices.

as a boundary

condition

to delay investment.

These values will be used

in the problem

of valuing

the option

First, I would like to give a general

description of the second part of the problem which examines

the value of the option to delay investment while in the

process of investment.

In the next subsection I will

discuss the boundary condition details.

Firms which are considering an investment program face

the following decision at any point in time: should they

invest today and get one step closer to a completed factory,

or should they delay investment?

In our simple model this

decision is based on two variables, the price of the good

which the factory produces, and the amount of money per unit

of good to be produced which still needs to be invested in

construction, which will be designated K.

20

It is useful to

view this decision as an option whose value I will designate

as F(P(t),K(t)).

I will use I(t) to represent the control variable which

is the rate at which the firm decides to invest at any time.

K is related to I in the following manner:

dK = -Idt

such that

(30)

K(0) = K,,.

(30a)

where I is bounded by 0 and some maximum rate i.

As was the case above, the economic idea motivating the

application of contingent claims analysis is straightforward.

In the analysis that follows, we hold that it is

not one decision which is being made to invest or not

invest; rather, that a stream of decisions need to be made,

taking into account any changes that have occurred in the

marketplace.

In short a decision to invest today does not commit one

to invest in the future.

What does happen; however, is that

a firm which invests today relinquishes the option value

which it enjoys if it does not invest today.

A firm will

invest in a given project if and only if the current option

is worth more exercised than not exercised.

From options theory we know that a call option is

always worth more unexercised than exercised unless the call

is written on a dividend paying stock.

As described above

the parameter 6 in the assumption of price evolution (2), is

similar to a dividend payout.

21

In fact, by assuming 6 > 0,

we have allowed for the possibility of the option to be

worth more exercised than not exercised.

For the case of

8 = 0, investment would never occur since the value of the

option to invest would grow at the same risk-adjusted rate

as the underlying asset.

4a.

Replicating the Option to Delay Investment

Drawing to a large extent on the above analysis,

consider a portfolio consisting of a long option to invest

in the project and short F

units of a completed project or

a portfolio which spans the completed project:

W = F - FP

(31)

The change in the value of the portfolio W is slightly

different from above.

Letting I represent the control

variable which is the rate of investment per unit of good to

be produced we can write:

dW = dF - FdP

- 6FpPdt - Idt

(32)

The first three terms of the right-hand side of (32) appear

for the same reason as they appear in (6); the last term is

the amount of investment which the firm makes during any

time period.

Majd and Pindyck [7] show that a firm which can

costlessly start and stop construction on a project which

does not expire (i.e. in 100 years the investment

opportunity will still exist) will either choose to invest

at the maximum rate i or not invest at all.

22

Using Ito's Lemma and the above fact we see that the

value of the option associated with the investment program

must satisfy:

O2 p2

P > P

Fpp + (r - 6)PFp - iF,, - rF - i = 0,

½2 p2 fp

+ (r - 6)Pfp - rf = 0,

where

P

P*

F(P,O) = V(P)

(33a)

(33b)

(34a)

lim F(P,K) = e6 K/i

P- oo

(34b)

f(O,K) = 0

(34c)

f(P*,K) = F(P*,K)

(34d)

fp(P*,K) = F(P* ,K)

(34e)

I have used f(P,K) to represent the value of the

investment program when P is below the critical value P*, so

that I could explicitly write the continuous condition (34d)

and the differentiable condition (34e) at the free boundary

P .

Equation (33b) has an analytic solution given by:

f(P) = aP"

a

[(2rc 2

+

(r -

6 -d2

)2 )

(35)

-

(r -

6

-_

2

)]/cr 2

(35a)

and the coefficient a must be determined along with the

solution for F in the upper region using the conditions

(34d) and (34e).

Notice that the solution

to (33b) is

independent of K.

Using (34d), (34e), and (35) we can write the free

boundary condition for the upper region as:

F(P*,K) = P*Fp (P*,K)/a

(36)

which will serve as the lower bound in the upper region.

23

4b.

Transformation and Discretization

The transformation which will be employed is necessary

for the same reasons as explained above; however, it is more

complex and will therefore be explained in steps.

Integrating (30) subject to the initial condition (30a)

gives:

t = (.x

- K)/I

(37)

Recall that (33a) describes the upper region in which

investment always occurs, which implies that the control

variable I is always chosen to be the maximum rate i.

Letting

F(P,K)

G(P,

equal the minimum completion time K ../i and

- t) we have:

ha 2p 2 Gp

+ (r - 6)PGp - Gt - rG - i = 0

(38)

which is the same as (11) except for the constant term i.

The form of (38) is more often seen in the literature than

(33a), and I believe it to be more natural since t has

replaced K as a state variable.

I will write (38) in dimensionless form, as above, by

dividing everything denominated in dollars by the marginal

cost of production.

Unlike the transformation used on (11),

which had to be kept rather simple in order to perform the

numerical integration, I further transform (34a) using:

G(P,

X

- t)

MCe-r tH(X,T - t)

(42/a)[ln(P/MC) - (r - 6 -

a2)t]

(39)

(39a)

The same theme is apparent if you compare (39) and (39a)

24

with (14) and (14a), and the additional complexity will be

justified below.

Differentiating (39) we obtain:

Gp = MCe-r t (2/(P))Hx

= MCe-rt (42/(oP2 ))[(T2/6)Hx

Gp

Gt

=

(40)

MCert

[-rH

Substitution

+ Ht -

(42/o)(r -

6 -

- H.]

(41)

o 2 )H.]

of (40) - (42) into (38), (34a),

(42)

(34b),

(36) gives:

- ier t /MC

Ht = H

lim exp[-rt

X oo

-

/

(43)

(ci/2

- (4

H(X,O) = e

VO (X)/MC

4

6 _ ½2 )t)]H (X,T - t) =

2 (X

+ (r -

(44a)

)'

H(X',

- t) =

2/(ca)H 1(X*,u - t)

(44c)

The most striking feature of (43) is its simplicity in

relation to (33a) gained by the transformations.

This

simplicity allows for numerical methods which when employed

lead to rapidly converging approximations, and which also

have broader application.

Again, using discretizations of the form of (22), (23),

(25), and the definition of the mesh ratio R in (26), yields

an approximation

Hi, j+

of the form:

= RHi+ 1 ,j + (1 - 2R)Hi j + RHi

,j - kier t /MC

(45)

In the next subsection I will discuss the numerical method

used to solve

(45).

25

4c.

Numerical Method

Equation (43) is the simple diffusion equation with the

addition of the last term which is a function of time.

The

simple diffusion equation has been thoroughly studied in

engineering disciplines, and (45) is known to be a

consistent approximation to (43).

To assure convergence

then we only have to prove stability.

The coefficients of the H terms in the right-hand side

of (45) are easily seen to sum to one.

In addition, the

coefficients will all be non-negative provided that the mesh

ratio R < .

This simple condition assures stability, and

therefore convergence.

Notice that the condition on the

mesh ratio R is no longer a function of the parameters of

the problem.

This allows for a general routine to be

written which will be stable for any set of parameters.

Also, Ames [1] shows that by setting R = 1/6, convergence is

obtained at a quicker rate due to the symmetry of the

numerical method.

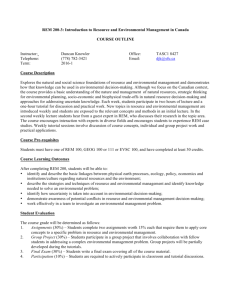

Figure 1 shows the critical price for at every stage of

the investment project.

As expected the critical price is

well above the marginal cost of production before the

construction begins due to the lead time required for

construction.

As the project nears completion the critical

price approaches the marginal cost of $1.

26

critical price

oO 0o*+

b

o0* c)

0

b

t4

-

O

-

obb¼%

t

-

t.

-

t4 .6* t+

- o

bob

O

a

t*

tor

o3

4

3o

¼%~

00000 cb b

1

0

0B

1

b

3

, 0

a

oc

Cn

to

CD

a

CD

-S

-h

0

0

aoI

r

i

m CD b

0

b

a

0q

0

27

C

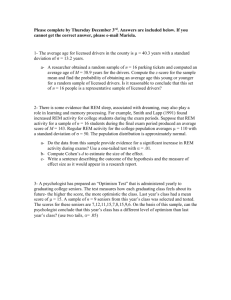

Figure 2 shows the value of a completed factory at the

critical price level over the investment period.

This value

is always seen to be above the present value of the amount

remaining to be invested.

NPV analysis suggests investment

if the present value of the completed project is above the

present value of the costs.

However, Figure 2 makes it

clear that by including the value of the option to delay

investment, a spread above construction costs is required

for investment to be optimal.

5.

Conclusion

I have thus far tried to avoid discussing the practical

problems encountered when applying these methods to "real

life" decisions, mainly to allow the focus to be on the

methods themselves.

In addition, I have made some overly-

restrictive assumptions which served to simplify the models

so that the most important aspects of the analysis might be

clarified.

For example, the assumption that the maximum

rate of investment for construction is constant over time

can be relaxed so that different investment profiles can be

accommodated.

One of the difficulties of applying the model to actual

investment decisions is the estimation of the parameters.

The same problem of estimating the appropriate o in the

future which exists in valuing financial options is also a

major issue in applying the above models.

28

value of completed factory (millions $)

44

44

44

*4

44

4

44

44

44

44

b

b

b

b

0

b

O

b

O

b

O

b

b

o

0

0

a

a

C

a

0

0

b

a

b

a

tot

O1

44

_ .

b

11

3

b

a

O_

.

0-T

a c

CD

-44

00

3

o

11

t

:3

-o

0

h

11

b

CDf

29

)

Appendix

C

C

C

A

PROGRAM TO INITIALIZE PARAMETERS AND PASS THEM TO SUBROUTINES

SHUTD AND BUILD FOR APPROPRIATE CRUNCHING. ALL DESIRED OUTPUT IS

HANDLED BY THE SUBROUTINES.

REAL K, MC, INV, INVR, PRICE(1000), FVAL(1000)

DATA DEL, R, SIG, XMAX, TMAX, MC /.06, .02, .2, 5., 10., 2./

DATA K, INV, INVR, CAPAC /.01, 5000000., 1000000., 1000000./

CALL SHUTD(DEL, R, SIG, XMAX, TMAX, MC, K, H, IMAX, PRICE, FVAL)

ISHIFT = NINT(-1.*(R - DEL - .5*SIG*SIG)*INV/(INVR*H))

H = H*SQRT(2.)/SIG

CALL BUILD(DEL,R,SIG,INV,INVR,CAPAC,MC,ISHIFT,H,FVAL,IMAX)

STOP

END

C

C

C

C

C

C

C

C

C

C

SUBROUTINE TO CALCULATE THE VALUE OF THE OPTION TO SHUT DOWN AND

SUMS THEM TO OBTAIN VALUE OF A COMPLETED PLANT,

GIVEN A SET OF PARAMETERS

DEL

-- PAYOUT RATE ON AN ANNUAL BASIS

-- RISKLESS RATE OF INTEREST ON AN ANNUAL BASIS

R

SIG

-- STANDARD DEVIATION ON AN ANNUAL BASIS

TMAX -- USEFUL LIFE OF THE PROJECT IN YEARS

XMAX -- SUITABLY LARGE NUMBER USED IN PLACE OF INFINITY

MC

-- MARGINAL COST OF PRODUCTION

K

-- TIME INCREMENT

C

RETURNS

C

C

C

C

H

PRICE

FVAL

IMAX

-----

STEP SIZE IN X

VECTOR CONTAINING PRICES CORRESPONDING TO FVAL

VECTOR CONTAINING VALUE OF A COMPLETED FACTORY

MAX INDEX USED IN FVAL AND PRICE

C

C

C

PRINTS THE VALUE OF THE OPTION TO SHUT DOWN FOR EVERY YEAR 0

THRU TMAX AND FOR THREE PRICE/MC RATIOS: .9, 1.0, 1.1

SUBROUTINE SHUTD(DEL,R,SIG,XMAX,TMAX,MC,K,H,IMAX,PRICE,FVAL)

REAL MC,K,PRICE(1000),FVAL(1000),OLDVAL(1000),NEWVAL(1000)

REAL MESHR,TABLE(3,21)

INTEGER II(3)

SIGSQ = SIG*SIG

H = SIG*SQRT(3.*K)

MESHR = 1./(3.*SIGSQ)

C

CHECK THE STABILITY CONDITIONS

IF (H.GE.SIG/ABS(R - DEL - .5*SIGSQ).OR.MESHR.GE.(1. - R)/SIGSQ)

* THEN

IFLAG = 1

GOTO 900

END IF

30

CALCULATE MAX X INDEX NEEDED FOR VECTORS. REMEMBER FORTRAN

DOES NOT ALLOW FOR NON-POSITIVE ARRAY SUBSCRIPTS.

C

C

IMAX = NINT(2.*XMAX/H) + 1

II(2) = (IMAX + 1)/2

II(1) = NINT(LOG(.9)/H) + 11(2)

11(3) = NINT(LOG(1.1)/H) + II(2)

DO 10 I = IMAX,1,-1

REALI = I - (IMAX + 1)/2

X = REALI*H

PRICE(I) = MC*EXP(X)

OLDVAL(I) = MAX(O.,EXP(X) - 1.)

10 CONTINUE

DO 20 L = 1, 3

TABLE(L,1) = OLDVAL(II(L))*MC

20 CONTINUE

COMPUTE COEFFICIENTS AND CALCULATE MAX T INDEX

C

C1 = .5*MESHR*(SIGSQ + H*(R - DEL - .5*SIGSQ))

CO = 1. - MESHR*SIGSQ - K*R

CNEG1 = .5*MESHR*(SIGSQ - H*(R - DEL - .5*SIGSQ))

JMAX = NINT(TMAX/K)

KINV = NINT(1./K)

WRITE(6,401) K, H, C1, CO, CNEG1, JMAX, IMAX

401 FORMAT(5(lX,F10.6),1X,I5,1X,I5)

DO 60 J = JMAX

C

C

- 1, 0, -1

CALCULATE THE NEXT VALUE OF THE OPTION AT INFINITY AND ADD THE

TRAPEZOID TO THE ESTIMATE OF THE INTEGRAL

*

REALJ = J

NEWVAL(IMAX) = C1*2.*H*EXP(XMAX + DEL*(REALJ + 1.)*K

- TMAX) + C0*OLDVAL(IMAX) + (C + CNEG1)*OLDVAL(IMAX - 1)

FVAL(IMAX) = FVAL(IMAX) + MC*(NEWVAL(IMAX) + OLDVAL(IMAX))*K/2.

ICOUNT = ICOUNT + 1

IF (ICOUNT.GE.KINV) THEN

JFLAG = 1

IYEAR = IYEAR + 1

END IF

CALCULATE THE NEW OPTION VALUE FOR EVERY POINT DOWN THE COLUMN

AND ADD THE NEW TRAPEZOID TO THE ESTIMATE OF THE INTEGRAL

C

C

*

30

DO 30 I = IMAX - 1,2,-1

NEWVAL(I) = C1*OLDVAL(I + 1) + CO*OLDVAL(I) +

CNEG1*OLDVAL(I - 1)

FVAL(I) = FVAL(I) + MC*(NEWVAL(I) + OLDVAL(I))*K/2.

CONTINUE

31

IF (JFLAG.EQ.1) THEN

DO 40 L = 1, 3

TABLE(L,IYEAR + 1) = NEWVAL(II(L))*MC

CONTINUE

ICOUNT = 0

JFLAG = 0

40

END IF

C

SWAP THE VALUES OF NEWVAL INTO OLDVAL

DO 50 I = IMAX,1,-l

OLDVAL(I) = NEWVAL(I)

50

CONTINUE

60 CONTINUE

WRITE(6,402)

(PRICE(II(I)),

I = 1, 3)

DO 70 J = 1, NINT(TMAX) + 1

WRITE(6,402)

402

(TABLE(I,J),

I = 1, 3)

FORMAT(3(1X,F9.6))

70 CONTINUE

900 IF (IFLAG.EQ.1) WRITE(6,499)

499 FORMAT('AN ERROR HAS OCCURRED')

RETURN

END

C

C

C

C

C

C

C

C

C

C

C

C

C

SUBROUTINE TO CALCULATE THE VALUE OF THE INVESTMENT PROJECT,

GIVEN A SET OF PARAMETERS

DEL

-- PAYOUT RATE ON AN ANNUAL BASIS

R

-- RISKLESS RATE OF INTEREST ON AN ANNUAL BASIS

SIG

-- STANDARD DEVIATION ON AN ANNUAL BASIS

INV

-- TOTAL AMOUNT NEEDED TO BE INVESTED FOR CONSTRUCTION

INVR

-- MAX YEARLY RATE OF INVESTMENT

CAPAC -- YEARLY CAPACITY

MC

-- MARGINAL COST

ISHIFT -- CONSTANT TO LINE UP TWO PARTS OF PROBLEM

H

-- STEP SIZE IN X DIRECTION

FVAL

-- TERMINAL BOUNDARY CONDITION

IMAX

-- MAX INDEX OF FVAL VECTOR

C

C

PRINTS THE CRITICAL PRICE FOR EVERY POINT IN TIME

SUBROUTINE BUILD(DEL,R,SIG,INV,INVR,CAPAC,MC,ISHIFT,H,FVAL,IMAX)

REAL INV,INVR,MC,K,FVAL(1000),OLDVAL(1000),NEWVAL(1000)

TAU = INV/INVR

K = H*H/6.

MESHR = 1./6.

RIMAX = (IMAX + 1)/2

JMAX = NINT(TAU/K)

SIGSQ = SIG*SIG

ALPHA = (SQRT(2.*R*SIGSQ + (R - DEL - .5*SIGSQ)**2) - (R - DEL -

*

.5*SIGSQ))/SIGSQ

WRITE(6,401) K, H, TAU, JMAX, IMAX

401 FORMAT(3(1X,F10.6),1X,I5,1X,I5)

32

DO 10 I = IMAX, ISHIFT + 1, -1

REALI = I - (IMAX + 1)/2

*

PRICE = EXP(SIG*REALI*H/SQRT(2.)

+ (R - DEL - .5*SIGSQ)*

TAU)*MC

OLDVAL(I) = FVAL(I)*EXP(R*TAU)/MC

10 CONTINUE

DO 60 J = JMAX - 1, 0, -1

REALJ = J

NEWVAL(IMAX) = MESHR*(SQRT(2. )*SIG*H*EXP(DEL*(K*(REALJ + 1.) *

*

*

TAU) + R*(REALJ + 1.)*K + SIG*(RIMAX*H- (DEL + SIG*SIG/2. R)*(REALJ+ 1.)*K)/SQRT(2.)))

+ (1. - 2.*MESHR)*OLDVAL(IMAX)

+ 2.*MESHR*OLDVAL(IMAX - 1)

DO 30 I = IMAX - 1, 1, -1

REALI = I - (IMAX + 1)/2

NEWVAL(I) = MESHR*(OLDVAL(I + 1) + OLDVAL(I - 1)) +

(1. - 2*MESHR)*OLDVAL(I) - (INVR/CAPAC)*K*EXP(R*REALJ*K)/

*

*

*

*

402

MC

IF (NEWVAL(I).GT.SQRT(2.)*NEWVAL(I + 1)/(SIG*ALPHA*H +

SQRT(2.))) GOTO 30

RTIME = REALJ*K

PRICE = EXP(SIG*REALI*H/SQRT(2.) + (R - DEL - .5*SIGSQ)*

RTIME)*MC

A = EXP(-R*RTIME)*MC*NEWVAL(I)/PRICE**ALPHA

WRITE(6,402) I,A,RTIME,PRICE,EXP(-R*RTIME)*MC*NEWVAL(I ISHIFT)

FORMAT(I3,4(1X,F12.9))

DO 20 L = I - 1, 1, -1

REALL = L - (IMAX + 1)/2

PRICE = EXP(SIG*REALL*H/SQRT(2.) + (R - DEL - .5*SIGSQ)*

*

20

30

40

50

60

900

RTIME)*MC

NEWVAL(L) = (A*EXP(R*RTIME)*PRICE**ALPHA)/MC

CONTINUE

GOTO 40

CONTINUE

DO 50 I = IMAX, 1, -1

OLDVAL(I) = NEWVAL(I)

CONTINUE

CONTINUE

RETURN

END

33

Appendix

B

SUB read_in_standard_normal

OPTION BASE 0

DIM standard_normal(30,9)

FOR i = 0 to 30

FOR j = 0 to 9

READ standard_normal(i,j)

NEXT

NEXT

j

i

DATA .5000,.4960,.4920,.4880,.4840,.4801,.4761,.4721,.4681,.4641

DATA .4602,.4562,.4522,.4483,.4443,.4404,.4364,.4325,.4686,.4247

DATA .4207,.4168,.4129,.4090,.4052,.4013,.3974,.3936,.3897,.3859

DATA .3821,.3873,.3745,.3707,.3669,.3632,.3594,.3557,.3520,.3483

DATA .3446,.3409,.3372,.3336,.3300,.3264,.3228,.3192,.3156,.3121

DATA .3085,.3050,.3015,.2981,.2946,.2912,.2877,.2843,.2810,.2776

DATA .2743,.2709,.2676,.2643,.2611,.2578,.2546,.2514,.2483,.2451

DATA .2420,.2389,.2358,.2327,.2296,.2266,.2236,.2206,.2217,.2148

DATA .2119,.2090,.2061,.2033,.2005,.1977,.1949,.1922,.1894,.1867

DATA .1841,.1814,.1788,.1762,.1736,.1711,.1685,.1660,.1635,.1611

DATA .1587,.1562,.1539,.1515,.1492,.1469,.1446,.1423,.1401,.1379

DATA .1357,.1335,.1314,.1292,.1271,.1251,.1230,.1210,.1190,.1170

DATA .1151,.1131,.1112,.1093,.1075,.1056,.1038,.1020,.1003,.0985

DATA .0968,.0951,.0934,.0918,.0901,.0885,.0869,.0853,.0838,.0823

DATA .0808,.0793,.0778,.0764,.0749,.0735,.0721,.0708,.0694,.0681

DATA .0668,.0655,.0643,.0630,.0618,.0606,.0594,.0582,.0571,.0559

DATA .0548,.0537,.0526,.0516,.0505,.0495,.0485,.0475,.0465,.0455

DATA .0446,.0436,.0427,.0418,.0409,.0401,.0392,.0384,.0375,.0367

DATA .0359,.0351,.0344,.0366,.0329,.0322,.0314,.0307,.0301,.0294

DATA .0287,.0281,.0274,.0268,.0262,.0256,.0250,.0244,.0239,.0233

DATA .0228,.0222,.0217,.0212,.0207,.0202,.0197,.0192,.0188,.0183

DATA .0179,.0174,.0170,.0166,.0162,.0158,.0154,.0150,.0146,.0143

DATA .0139,.0136,.0132,.0129,.0125,.0122,.0119,.0116,.0113,.0110

DATA .0107,.0104,.0102,.0099,.0096,.0094,.0091,.0089,.0087,.0084

DATA .0082,.0080,.0078,.0075,.0073,.0071,.0069,.0068,.0066,.0064

DATA .0062,.0060,.0059,.0057,.0055,.0054,.0052,.0051,.0049,.0048

DATA .0047,.0045,.0044,.0043,.0041,.0040,.0039,.0038,.0037,.0036

DATA .0035,.0034,.0033,.0032,.0031,.0030,.0029,.0028,.0027,.0026

DATA .0026,.0025,.0024,.0023,.0023,.0022,.0021,.0020,.0020,.0019

DATA .0019,.0018,.0018,.0017,.0016,.0016,.0015,.0015,.0014,.0014

DATA .0013,.0013,.0013,.0012,.0012,.0011,.0011,.0010,.0011,.0010

END SUB

SUB STANDARD_NORMAL_LOOKUP(N,X(),STNTAB(,))

DIM Z(25)

FOR STN = 1 TO N

SELECT CASE X(STN)

CASE

IS < -3.09

LET Z(STN) = 0

CASE IS > 3.09

LET Z(STN) = 1

CASE ELSE

34

LET ROOT = ABS(ROUND(1000*X(STN)))

LET I = INT(ROOT/100)

LET J1 = INT((ROOT - 100*I1)/10)

LET K1 = ROOT - 100*I1 - 10*J1

IF J1 = 9 THEN

LET I2 = I

+ 1

LET J2 = 0

ELSE

LET I2 = I1

LET J2 = J1 + 1

END IF

IF I2 = 31 THEN LET NEXT_ENTRY = 0 ELSE LET NEXT_ENTRY =

STNTAB(I2,J2)

LET LOOK = STNTAB(I1,J1) + Kl*(STNTAB(I1,J1) NEXT_ENTRY)/10

IF X(STN) > 0 THEN LET Z(STN) = 1 - LOOK ELSE LET Z(STN) =

LOOK

END SELECT

NEXT STN

END SUB

REM

INVEST

9

REM

REM This program solves both the upper and lower regions of the

REM free boundary problem similar to the one posed in the "time to

REM build "working paper of Saman Majd and Robert S. Pindyck.

REM The difference is that price (P) replaces value (V) as a state

REM variable in the formulation.

REM The code was last revised on January 21, 1987 by James C. Meehan.

REM

REM ----------------------------------------------------------------OPTION BASE 0

REM

REM Specify the desired location of output file.

REM

PRINT "Where do you want the data? "

PRINT

PRINT "1.

Print all output

to an IBM or Epson printer"

PRINT "2. Write all output to diskette"

PRINT "(Enter 1 or 2)"

INPUT INFO

IF INFO = 1 THEN

OPEN #1: PRINTER

SET #1

: MARGIN

132

ELSE

INPUT PROMPT "Enter file name for output: ": FILE$

OPEN #1 : NAME FILE$, ACCESS OUTPUT, CREATE NEW

END IF

REM

REM

REM

REM

REM

R

S

D

Enter the parameters of the problem.

-- annual riskless rate of interest, r

-- annual standard deviation, sigma

-- annual convenience yield, delta

35

REM INV -- total investment, Ko

REM T

-- life of the project, T

REM COST -- operating cost per unit of output, C

REM Y

-- number of years investment project would take if

REM

investment proceeded at the maximum rate in each period

REM K(C) -- maximum annual rate of investment in period c, k

REM

REM Factor is used to normalize the horizontal axis.

REM

INPUT PROMPT "Enter annual riskless rate: ": R

INPUT PROMPT "Enter annual standard deviation: ": S

INPUT PROMPT "Enter annual convenience yield: ": D

INPUT PROMPT "Enter total investment, to the nearest integer: ": INV

INPUT PROMPT "Enter life of project: ": T

INPUT PROMPT "Enter operating cost: ": COST

INPUT PROMPT "Enter number of stages of investment project: ": Y

LET FACTOR = 10INT(LOG10(INV))

DIM K(50)

DIM DD(2)

FOR C = 1 TO Y

REM

REM CC is used to reverse the numbering of the horizontal axis.

REM

LET CC = Y + 1 - C

PRINT "Enter maximum annual rate of investment in stage"; C

INPUT K(CC)

LET DUM = DUM + K(CC)

LET K(CC) = K(CC)/FACTOR

NEXT C

IF DUM >< INV THEN PRINT "WARNING: Sum of investments at each stage does

not equal total investment."

REM

REM Set dt equal to an arbitrarily small number.

REM The smaller is dt, the longer the program takes to run.

REM l/dt must be evenly divisible by 4.

REM

LET DTINV = 12

LET DT = 1/12

REM

REM Select form of the output file.

REM

INPUT PROMPT "Would you like to see annual or quarterly output? (Enter a

or q) ": N$

SELECT CASE N$

CASE "A","a"

LET N = 1

CASE "Q","q

LET N =4

CASE ELSE

PRINT "PLEASE ENTER q OR a NEXT TIME."

PRINT "AS A PENALTY FOR NOT READING INSTRUCTIONS, YOU WILL BE

REQUIRED TO START AGAIN."

36

STOP

END SELECT

PRINT

PRINT

PRINT

PRINT "RUNNING"

REM

CALL READ_IN_STANDARD_NORMAL

REM

REM

REM

Do initial computations.

REM Compute alpha from the analytical solution in the 1Lower region.

REM

f(P,K) = a*P'alpha

REM Compute minimum value of dx given the values of dt and sigma.

REM Check to see if solution is stable given parameters of problem.

REM Arbitrarily set epsilon equal to half of dx.

REM Compute p+, po, and p- used in the explicit method.

REM

LET SS = S*S

LET STUFF = R - D - SS/2

LET ALPHA = (-STUFF + (STUFF*STUFF + 2*R*SS)^.5)/SS

LET DX = S*DT .5

IF DX > SS/ABS(STUFF) THEN

PRINT "Solution is not stable for input parameters gi ven."

STOP

END IF

LET EPSILON= DX/10

LET PU= DT*( SS/DX + STUFF )/ (2*DX)

LET PD= DT*( SS/DX - STUFF )/ (2*DX)

LET PF= 1-PU-PD

REM

REM Initialize arrays.

REM

DIM INDEX(200)

DIM G(200,49)

DIM DUMMY1(200)

DIM DUMMY2(200)

REM

REM Set upper and lower boundaries of vertical axis.

REM

LET B=O0

LET M = 200

REM

REM Fill in terminal boundary condition.

REM

V(P) = sum from tau = 1 to T of Vt(P)

REM

where Vt(P) = P*exp(-delta*tau)*N(dl) - C*exp(-r*tau)*N(d2)

REM

REM Compute upper = derivative of V w.r.t. P as P goes to infinity =

REM

sum from tau = 1 to T of 1/(1 + delta) tau

REM

FOR L=M TO B STEP -1

LET VALU = 0

37

LET UPPER = 0

FOR TAU = 1 TO T

LET UPPER = UPPER + 1/(1 + D)^TAU

LET DD(1) = (LOG(EXP(L*DX)/COST) + STUFF*TAU)/(S*TAU.5)

LET DD(2) = DD(1) - S*TAUt.5

CALL STANDARD_NORMAL_LOOKUP(2,DD,STANDARD_NORMAL)

LET VALU = VALU + EXP(L*DX - D*TAU)*Z(1) - COST*EXP(-R*TAU)*Z(2)

NEXT TAU

LET DUMMY1(L) = VALU

LET G(L,0) = VALU

NEXT L

REM

REM Loop over entire horizontal axis, filling in column to the left

REM in dummy2(i), and saving desired columns in matrix g(i,j) which

REM corresponds to the option value expressed in the transformed

REM variable x.

REM

LET PERIODS = Y*DTINV

FOR J=1 TO PERIODS

LET JJ = INT((J - 1)/DTINV) + 1

LET DUMMY2(M) = PU*UPPER*2*DX* EXP( M*DX+(R - D)*(J-1)*DT) +

PF*DUMMY1(M) + (PU+PD)*DUMMY1(M - 1) - K(JJ)*DT*EXP(R*(J - 1)*DT)

LET L = M

DO WHILE

L > 0

LET L = L - 1

LET DUMMY2(L) = PU*DUMMY1(L + 1) + PF*DUMMY1(L) + PD*DUMMY1(L 1) - K(JJ)*DT*EXP(R*(J - 1)*DT)

REM

REM Check derivative condition to see if free boundary has been

REM reached.

REM If so, use the analytic solution on the remainder of the

REM range.

REM

LOOP WHILE DUMMY2(L) - DUMMY2(L+1)/(ALPHA*DX +1) > EPSILON

LET INDEX(J) = L

LET A=EXP(-(R*J*DT))*DUMMY2(INDEX(J))/ EXP( INDEX(J)*DX*ALPHA )

FOR L=INDEX(J)-l TO 0 STEP -1

LET DUMMY2(L)= A* EXP( L*DX*ALPHA ) * EXP(R*J*DT)

NEXT L

REM

REM See if column needs to be saved in g matrix.

REM

IF MOD(J*N,DTINV) = 0 THEN

LET COUNT = COUNT + 1

FOR L = M TO B STEP -1

LET G(L,COUNT) = DUMMY2(L)

NEXT L

END IF

FOR I,= M TO B STEP -1

LET DUMMY1(L) = DUMMY2(L)

NEXT L

NEXT J

38

PRINT

PRINT

PRINT

REM

REM Set number of columns to be written to 5 if writing to disk,

REM and 10 if writing in condensed mode to the printer.

REM

PRINT #1: "

SUMMARY OF INPUTS"

PRINT #1

PRINT #1

IF INFO = 1 THEN

LET COL = 10

PRINT #1: CHR$(27);CHR$(69);

ELSE

LET COL = 5

END IF

PRINT #1, USING "<###################

is

####.##,

Rate", R,

": "Riskless

"Standard Deviation", S

PRINT #1, USING "<###################

is ####.##,

Yield", D, "Total Investment is", INV

PRINT #1, USING "<################### is ####.##,

T, "Cost per Unit", COST

FOR C = 1 TO Y

LET CC = Y + 1 - C

PRINT #1: "In stage";

: "Convenien

.ce

": "Life of P'roject",

C;

PRINT #1, USING "maximum rate of investment is ####.###,":

K(CC)*FACTOR

NEXT C

PRINT #1:

PRINT #1,

PRINT #1,

PRINT #1

PRINT #1

PRINT #1:

IF INFO =

PRINT

USING "Calculations will use step size in x of ##.###,

USING "Calculations will use step size in t of ##.###,

"

OUTPUT"

1 THEN PRINT #1: CHR$(27);CHR$(70);

#1

PRINT #1

IF INFO = 1 THEN PRINT #1: CHR$(15)

LET V = N*Y

IF V - COL + 1 > 0 THEN LET VV = V - COL + 1 ELSE LET VV = 0

FOR TABLE = 1 TO ( INT(V/COL)+1 )

PRINT #1: "

Value of"

PRINT #1: "

underlying

Stages remaining, and"

PRINT #1: " Price

asset

Value of contingent claim"

PRINT #1: "

FOR J= V TO W STEP -1

PRINT #1, USING "###

": J;

NEXT J

PRINT

PRINT

#1

#1

FOR L = M TO B STEP -1

IF EXP(L*DX) < 100 AND EXP(L*DX) > COST/2 THEN

39

": DX

": DT

PRINT #1, USING ">####.## >######.##

": EXP(L*DX),

G(L,O)*FACTOR;

IF TABLE < INT(V/COL) + 1 AND INFO = 1 THEN LET CONTROL = VV

ELSE LET CONTROL = VV + 1

FOR J=V TO CONTROL STEP -1

IF INDEX(J/(N*DT))=L THEN LET Q$="*" ELSE LET Q$=" "

LET DUMMY= G(L,J)* EXP(-(R*J/N))

PRINT #1, USING ">####.## # ": DUMMY*FACTOR, Q$;

NEXT J

IF CONTROL >< VV THEN

IF INDEX(VV/(N*DT))=L THEN LET Q$="*" ELSE LET Q$=""

LET DUMMY= G(L,O)*EXP(-(R*VV/N))

PRINT #1, USING ">####.## # ": DUMMY*FACTOR, Q$

END IF

END IF

NEXT L

PRINT

PRINT

PRINT

PRINT

#1

#1

#1

#1

LET V = V - COL

IF V - COL + 1 < 0 THEN LET VV = 0 ELSE LET VV = V - COL + 1

NEXT TABLE

CLOSE #1

END

40

References

1.

Ames, William F., Numerical Methods for Partial

Differential Equations, Second Edition, (Orlando:

Academic Press, 1977).

2.

Black, Fisher and Myron Scholes, "The Pricing of Options

and Corporate Liabilities," Journal of Political

Economy,

81 (May/June,

1973), 637-659.

3.

Brennan, Michael J. and Eduardo S. Schwartz, "Finite

Difference Methods and Jump Processes Arising in

the Pricing of Contingent Claims: A Synthesis,"

Journal of Financial and Quantitative Analysis,

20 (September, 1978), 461-473.

4.

Cox, John C. and Mark Rubinstein, Options Markets,

(Englewood Cliffs, NJ: Prentice Hall, 1985).

5.

Courtedon, Georges, "A More Accurate Finite Difference

Approximation for the Valuation of Options,"

Journal of Financial and Quantitative Analysis, 17

(December,

1982), 697-705.

6.

Geske, Robert and Kuldeep Shastri, "Valuation by

Approximation: A Comparison of Alternative Option

Valuation Techniques," Journal of Financial and

Quantitative Analysis, 20 (March, 1985), 45-71.

7.

Majd, Saman and Robert S. Pindyck, 1987, "Time to Build,

Option Value, and Investment Decisions," Journal

of Financial Economics, 18 (March, 1987), 7-27.

8.

McDonald, Robert L. and Daniel R. Siegel, "Investment

and the Valuation of Firms When There Is an Option

to Shut Down," International Economic Review, 26

(June, 1985), 331-349.

9.

McDonald, Robert L. and Daniel R. Siegel, "The Value of

Waiting to Invest," Quarterly Journal of

Economics, (November, 1986), 707-727.

10. Merton, Robert C., "The Theory of Rational Option

Pricing," Bell Journal of Economics and Management

Science, 4 (Spring, 1973), 141-183.

11. Myers, Stewart C. and Saman Majd, "Calculating

Abandonment Value Using Option Pricing Theory",

Working paper no. 1462-83 (MIT Sloan School of

Management, Cambridge, MA, 1983).

41

12. Press, William H. et al., Numerical Recipes, (Cambridge:

Cambridge University Press, 1987).

42