into Gas Running Michael Stoppard:

advertisement

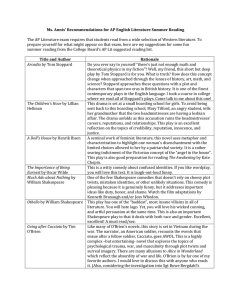

Cover Story Michael Stoppard: Running into Gas Michael Stoppard is Head of Global Gas Strategy at information provider and market analyst IHS. In this exclusive interview with Living Energy, he offers his analysis of the booming natural gas market. Text: Ed Targett Photos: Jocelyn Bain Hogg E xplorers used to say that there were three possible reactions when drilling a test well: “Good news, we’ve found oil. Bad news, we’ve found nothing. Really bad news, we’ve found gas.” Why was that? Michael Stoppard: Gas is complicated. Oil is about getting the resource out of the ground and selling it into the world’s most liquidly traded fluid market; with relatively manageable technological challenges. In the case of natural gas, it is wellhead to burner tip; integrated development all along the chain. You have to put in the financing, the logistics, the marketing; you have to find a customer; ev- erything must be arranged in advance, so you need a 20-year plan for what to do with the gas before you bring it out of the ground. Despite that complexity, there has been a massive turnaround in perceptions of natural gas, and we are now said to be in the Golden Age of Gas. What has changed so fundamentally? M. Stoppard: I think there have been two fundamental changes, and they have both affected our old friends, supply and demand. On the supply side, we are seeing a very significant increase in the resource base. I like to say we’re “running into gas,” not “running out” of it! We’re finding gas u Living Energy · No. 9 | December 2013 9 Cover Story Cover Story in very significant places and more widely distributed; that’s the supply push. And on the demand side, the world has an appetite for good clean energy, for affordable energy – and that’s what natural gas provides. “Sometime between 2030 and 2040, natural gas may overtake oil and coal as the most important global energy source.” Michael Stoppard, Head of Global Gas Strategy, IHS CERA How much gas is out there? M. Stoppard: What we know is that reserves are increasing very significantly; five years ago, the oil and gas industry often used the metric of 60 to 70 years of gas reserves at today’s consumption levels, but that was based on a very narrow definition of gas resources, proven gas reserves. If you take a wider and more realistic view of the potential resource and you include technically recoverable resources – and resources that, based on mathematical exercises, you believe have a very good chance of being discovered in the future – we’re now beginning to talk about 250 years of supply, rather than 60 or 70 years. That gives you some sense of the huge potential of the resource base. In terms of actual proven reserves, we’ve seen a 30 percent increase in gas reserves since the year 2000, despite very significant consumption of gas. That’s an incredible growth. Is that mostly conventional gas, or is that shale? M. Stoppard: I think there are three fundamental drivers of this resource push and supply push. The first and most important one in terms of potential size, though it is still somewhat speculative outside of North America, is shale gas. The volumes are enormous and, just as importantly, they’re very widely distributed: They bring in a whole set of countries that had not previously been considered to be significant hydrocarbon resource holders. Thus, shale gas is by far the biggest new resource base. The second driver is the deep-water discoveries of conventional gas. The region that’s really getting the exploration and production industry excited is East Africa – Mozambique and Tanzania. But it’s Michael Stoppard is in charge of global gas strategy at IHS CERA, a company that supplies critical knowledge and independent analysis on energy markets, geopolitics, industry trends, and strategy. 10 Living Energy · No. 9 | December 2013 much more than that: The eastern Mediterranean is another really hot area, with big gas discoveries in Israel and Cyprus. We’re seeing it in Australia, we’re seeing it in Brazil, we’re seeing it in the Black Sea; a lot of deep-water conventional gas is being discovered. Gas and power are of course intrinsically interlinked. How do you expect gas-to-power to develop over the next 20 years? M. Stoppard: I think it’s an exciting story. Electricity demand in the world will grow, and gas will be a fuel and technology of choice in this electricity story. The global gas business today is approximately 3.2 trillion cubic meters. It’s going to grow by about 50 percent by 2030 – and sometime between 2030 and 2040, we at IHS think that natural gas will catch up with oil and coal and potentially surpass them to become the most important global energy source of the future. This is because of electricity: If you look at the growth forecasts for gas demand and by sector, more than 50 percent of the growth demand is in electricity, so the great high hopes that the oil industry and the gas industry have for gas are really tied with the future of electric power. When it comes to shale, the stars seem to have aligned beautifully for the USA. Other countries have struggled to replicate that thus far. M. Stoppard: It was never going to be the case that we would find and produce significant amounts of shale in a two-year period. Even in the USA, there was actually a 15-year gestation period. Particularly in Europe, the expectations have swung too far the other way. If you take the view that this is a medium- to long-term business, we believe that this can scale up. The challenges are different in each play, there are infrastructure issues; if you don’t have pipelines in place or indeed markets next to you, that will take time to develop. You have to reach agreement on the fiscal regime and the environmental regulation, so there’s a huge amount of work to be put in place. u “Huge potential”: Experts say there may be 250 rather than 60 to 70 years’ worth of gas reserves, as previously believed. Natural Gas: Expanding Globally 150 terawatt-hours – the rise in global gas power generation in 2012 187 trillion cubic meters – total proven reserves of natural gas 30 consecutive years – liquefied natural gas (LNG) trade growth up until 2012 36% – the rate at which LNG trade has grown over the past 5 years 3,364 billion cubic meters – global natural gas production in 2012 73.5 million tonnes – the spot and short-term LNG market in 2012 US$ 7.8 billion – the amount Beijing is spending to shift from coal to gas power by 2014 3 quadrillion British thermal units – the rise in US gas production since 1998 Sources include the IEA, BG Group, EIA, Total, BP. Living Energy · No. 9 | December 2013 11 Cover Story We’ve been talking about shale a little bit. What other forms of unconventional gas are coming onstream, and will they play a significant role in gas-to-power? M. Stoppard: Well, first of all, we do see shale gas as the game changer, and I don’t think the other types of gas are of the same order of magnitude, or can have the same transfor- mative effect. Coal bed methane is not necessarily new, but has been around for a long time; there are very exciting developments under way in Australia, notably in Queensland, to develop coal bed methane – they call it coal seam gas – and those are big projects going ahead, so it’s one to watch. We shouldn’t forget tight gas, either; lots of tight gas reservoirs Michael Stoppard “Shale gas is by far the biggest new resource base, and we believe it will be a game changer.” Michael Stoppard Michael Stoppard, Managing Director and Chief Gas Strategist at IHS CERA, has over 20 years of specialized experience in the international gas business and is responsible for the development and coordination of IHS CERA’s global and interregional coverage of gas markets and LNG. In 2009–10, Stoppard led the development of the IHS CERA Global Energy Scenarios. He is the author of numerous reports, including analyses of business models, gas and power convergence in Europe, and LNG trading. He is also a member of IHS CERA’s Energy Research Council. When he is isn’t working (“Leisure?! What’s that?”), he enjoys studying history and learning languages – currently Arabic. Before joining IHS CERA, Stoppard was a research fellow at the Oxford Institute for Energy Studies. In addition, he served as a Parliamentary Special Advisor on energy regulation for the House of Commons Trade and Industry Committee in the UK. The app version of Living Energy features a film of our interview with Michael Stoppard. Siemens.com/energy-channel/ cera-stoppard Living Energy at 12 Living Energy · No. 9 | December 2013 have potential, particularly in the Middle East. Let’s talk a little bit more about LNG... M. Stoppard: We at IHS expect LNG demand to double by 2030, from 240 million tonnes per year to about 480 million tonnes. It’s certainly a growth business, and we think that that growth is resistant against a number of scenarios. There’s a sense among many buyers that they are simply paying too much for their LNG, and they are looking to move away from oil indexation to hub indexation. Do you see a major shift? M. Stoppard: Most of the gas that is traded internationally across the world is on an oil-indexed basis. The traditional reason for that is that natural gas was competing with oil: It was displacing oil in power generation and heating, and the one thing that the producers needed was confidence that they would have a market at the end of the pipeline or the end of the delivery of the LNG ship. The way to ensure that you would have a market for your gas was to ensure that you had a stable price. There’s a difference between predicting the chances of getting cheaper LNG, and anticipating the chance of getting hub-indexed LNG, which is not necessarily the same thing. This is something people need to think through very carefully. Are we going to see more LNG coming into Europe? M. Stoppard: That’s a very important and interesting question. The vast majority of LNG marketers today are spending their time running around Asia. You only have to open a newspaper and look at the prices to see that the prices are a lot higher in Asia, so everybody wants to get those premium prices and sell to the Asian market. But there’s a huge question mark about whether that’s sustainable. Our view is that you can only fit so much gas into the Asian market, and that the market will actually need to clear in Europe, so we will see increasing volumes of LNG coming to Europe. Here in the UK, the government is considering capacity markets to try and stimulate investment in new CCGT or even keep mothballed plants online. Do you think that will work? M. Stoppard: Yes, and it’s not just the UK. Capacity mechanisms are being discussed in most of the capitals of the EU now; the issue has raced right up the priority list and is also much discussed in Brussels. The devil may be in the detail. There are different ways of setting up capacity mechanisms, but the bottom line is that if you are bringing in an intermittent source of supply – solar power or wind power – you need to make sure you have a backup source, and that will need to be remunerated. So we expect to see some movement in that direction, and that will be to the benefit of gas-fired power generation. Do you see power-to-gas becoming an important part of the energy mix? M. Stoppard: I think, first of all, we should explain briefly what powerto-gas is, because it is a totally novel idea. When we’ve got surplus renewable power in the system – for example, when the wind is blowing and there is not much electricity demand – what do you do with that energy? The idea is to use electrolysis to turn the electricity into gas. It’s too early to say much about power-to-gas; the costs look very high to begin with, but what has been really striking is the short time it has taken from the conception of the idea to the first pilot demonstration projects. This has been really impressive. It shows how much excitement and potential there is to the idea. What do you make of its prospects? M. Stoppard: It is effectively competing with other technologies for power storage, but I am moderately optimistic about it. What I find very attractive about the idea is that it is being presented as an alternative form of storing power, but the big advantage of power-to-gas is that you are not just storing power, it is actually a way of moving power around underground with minimal environmental foot- Michael Stoppard (left) met with Living Energy correspondent Ed Targett at the IHS CERA Headquarters in London to discuss the prospects of the global gas markets. print, by using the existing gas pipeline infrastructure. You could take the power at the coast of the Baltic Sea and the North Sea and export it through the German pipeline grid down south; that’s a very attractive advantage. On that note, gas is often described as one of the best partners for renewables; why is that? M. Stoppard: I think there are three reasons why gas and renewables are really good partners. First of all, gas is clean, like renewables, particularly in terms of pollution and the local smog: The SOx and NOx and particulates are so low – and that naturally goes together well with renewables, which are also obviously a clean solution. In addition to air pollution, there’s the consideration of low carbon emissions. If you are pursuing a low-carbon strategy with renewables, it makes sense to do that in conjunction with natural gas, which has the lowest carbon emissions of all fossil fuels. A third, critical point is speed of response. That is the ability of gasfired turbines to ramp up very quickly, ramp down, and follow the weather, as wind energy comes and goes intermittently and quite quickly. This is yet another area where gas technology has an advantage. p Ed Targett is a freelance journalist who has reported from Seoul, Brussels, and London for a range of national and international publications, including the BBC. He currently lives in England and focuses on energy and sustainability issues. Living Energy · No. 9 | December 2013 13