Energy Transition Designing an Electricity Market for

advertisement

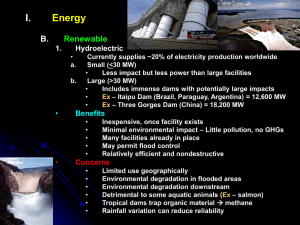

Designing an Electricity Market for Energy Transition As far as technology goes, the German energy transition can be ­successful. However, it requires a market model that ensures ­cost-­efficiency, rewards innovation, and is socially fair. All power ­producers should play their part in social and economic account­ ability if the progress of the energy transition is to continue. Text: Claus Peter Müller von der Grün Illustration: Mariela Bontempi Power Market Design ccording to Michael Suess, the key elements for a prosperous national economy are humans, capital, resources, and energy – ener­ gy that is reliable, affordable, and sustainable. “The transition to a new energy system will not be for free,” says the CEO of the Siemens Energy Sector. “Nevertheless, electricity must be affordable for consumers and industry alike. What we need is world-class solutions, not mediocrity. Germany’s next moves will be watched closely by other countries.” The Ger­ mans are pursuing ambitious goals. As part of what has been termed the “energy transition,” they want to abandon nuclear power by 2022, in­ crease the overall share of power ­generated by renewable sources from 23 percent of national consumption today to 80 percent by 2050, and si­ multaneously reduce greenhouse gas emissions by 80–95 percent against 1990 figures. There is little doubt that this indus­ trial and engineering nation will be able to master this transition in tech­ nical terms. However, is it also pursu­ ing that goal appropriately in terms of cost efficiency and burden shar­ ing? This question is still being de­ bated in Germany. Critics say that tapping into renewable energy sourc­ es is too expensive and will lead to a redistribution of money from the bot­ tom to the top; moreover, they say that it also accelerates greenhouse gas emissions. And Suess puts it bluntly by saying: “It would be irre­ sponsible to continue the current subsidy scheme – we would burden the power customers and the indus­ try for decades to come.” To Understand the Energy Transition, One Must Understand the Germans To comprehend Germany’s approach to the energy transition, it is neces­ sary to understand the Germans themselves. The country’s drive to liberalize the electricity markets in line with 1990s European directives has been exemplary. The state in­ creasingly withdrew from the busi­ ness of supplying power. Energy com­ panies were privatized and sold off the grids, while a regulatory agency was established to ensure free access to these networks. At the same time, The Climate Scientist “Rising emissions are by no means the result of the ­energy transition.” Rising emissions are not due to the energy turnaround, but mostly to other economic and political factors, and they would increase (probably even more strongly) even without this transition. This is why we need ­integrated approaches including capacity markets, investments in lowemission backup systems, and flexible load management, enabling a ­reform of the remuneration scheme for renewables and an overhaul of the European emissions trading system. Felix Chr. Matthes is the Research Coordinator for Energy and ­Climate Policy at the Oeko-Institut in Berlin, Germany, as well as a member of the European Commission Directorate-General for the Energy ­Advisory Group on the Energy Roadmap 2050. 16 Living Energy · No. 8 | July 2013 Germans are generally environmen­ tally aware and extremely skeptical towards nuclear power. In 2011, follow­ ing the Fukushima disaster, German Chancellor Angela Merkel announced an even more rapid exit from nuclear power than was originally foreseen in 2002. It has been ­decided that by 2022, all German ­nuclear power stations will have been taken off the grid. Meanwhile, Germany has already been actively encouraging solar, wind, and biomass energy since 1990, thanks to its so-called “Energy Feedin Law,” which guarantees that re­ newable sources can feed into the networks at a politically predeter­ mined price. Ten years later, a more robust Renewable Energy Law (Er­ neuerbare-Energien-Gesetz, EEG) was passed that entrenched this obliga­ tion even more effectively. However, as more and more renewable energy capacity was created by the EEG, it ­became increasingly apparent that there was a disparity between the benefits of the energy transition and its costs as well as its redistributive effects. It is expected that in 2013, providers of renewable energy will earn revenues of €6.6 billion, and be reimbursed a total of approximately €20.3 billion. If one-time effects are taken into account, the shortfall to be covered is about €16.1 billion. Photos: Öko-Institut – Institute for Applied Ecology, EXX/Studioline Leipzig A Power Market Design The Energy Exchange CEO “Market and competition as guiding principles.” What we need is a regulatory framework with the market and competition as its guiding principles. Cross-border trading of electricity within the ­European market is the key to success in the energy transition. We have to strengthen the energy-only market price signal and integrate renewables more closely into defining market pricing. Peter Reitz is the CEO of the European Energy Exchange (EEX) in Leipzig, Germany. Renewables Already Taking the Place of Nuclear Power The exit from nuclear power has fur­ ther increased the challenge of the energy transition. Until 2010, Germa­ ny’s nuclear power facilities generated 22 gigawatts – covering around a quarter of the maximum load of 80 gigawatts, at an overall ­national gross installed capacity of 174 giga­ watts. About 9 gigawatts of nuclear power capacity was immediately tak­ en off-line in 2011. The remaining 13 gigawatts will be gradually phased out by 2022. At the same time, the share of electricity generated from renewable sources, including hydro, increased to 23 percent in 2012, up from just 16 percent in 2009. This rapid growth in renewable ener­ gy exceeded expectations, and the government had to reduce genera­ tion subsidies for new facilities. Given that these feed-in tariffs are differen­ tiated by renewable energy source, the size of the installation, and other factors, a highly complex regulatory system has evolved. Today, suppliers u Living Energy · No. 8 | July 2013 17 Power Market Design Power Market Design Suggestions from Business Germany’s Distinct Path Ends at the Border In order to cope with the electricity, grids must be expanded and modi­ fied. However, expansion cannot keep up with planning and requirements because approval procedures are cumbersome and citizens will not tol­ erate new power lines in their neigh­ borhoods. However, if even the Ger­ mans themselves won’t accept the technical consequences of the energy transition, why should their neigh­ bors? Poland, for example, doesn’t want to transport wind power from northern Germany through its transi­ tion grids to Bavaria, just because the grids within Germany are stressed. In addition, cheap renewable power from Germany has a negative impact on the margins of Polish generators. 18 Living Energy · No. 8 | July 2013 Regardless of its renewable energy expansion, Germany still requires conventional power stations to cover its energy needs on days when there is little sun or wind. Gas turbines would be especially suited for ramp­ ing up to balance out fluctuations in renewable power. However, modern and efficient gas turbines are shut down as it is currently more economi­ cally attractive to use cheap but CO2intensive lignite as a fuel for power generation. For the price of certifi­ cates permitting CO2 emissions in 31 European countries has fallen to less than €5 per tonne of CO2, although the EU had expected the price to rise to €30 per tonne of CO2 by 2020. The economic crisis has contributed to the devaluation of certificates in some countries, but so has the growth of renewable energy in Ger­ many and other countries, which freed up excess emissions certifi­ cates. There is no question that the EEG legislation, with its economic ­incentives for investors, has allowed Germany to become a leading nation in the application of renewable ener­ gy. However, today, it is not just for­ mer critics of green energy, but also wind and solar pioneers who are call­ ing for moderation and a redesign of the market rules. The Industry Manager “Siemens is going in the right direction.” The current design of the electricity market does not provide a suitable framework for the energy transition. One of the reasons is that ­operators are not reimbursed for the cost of keeping power stations on standby, so they can step in when wind and solar energy are lacking. The solutions proposed by Siemens are a step in the right direction. Ewald Woste is the Honorary President of the German Federal Association of Power and Water Suppliers, a group of public utilities, and Chairman of Thüga, a holding group with shares in 100 German energy and water utilities. In contrast, the Dutch are happy to accept excess electricity from Germa­ ny for a low or even a negative price, which means they are paid for reliev­ ing their German neighbors of their excess power production. Ultimately, if nothing goes because wind farms are producing more electricity than the grid can handle, they are switched off. The energy providers are reimbursed for 95 percent of the electricity they would have been able to supply. Photo: Thüga/Mierswa Kluska are reimbursed according to more than 4,000 different subsidy rates. Furthermore, discussions about im­ posing a brake mechanism for elec­ tricity prices or waiving the EEG con­ tributions for electricity-intensive industries were disconcerting for po­ tential investors, who then brought forward their investments in order to benefit from the old rules. On top of this, because prices for pho­ tovoltaic modules have fallen faster than the planned decline of feed-in tariffs for renewable generation, there was an added benefit in doing fast business. Although politicians had only reckoned on photovoltaic in­ stallations increasing by a maximum capacity of 2 to 3 gigawatts a year, there was a record expansion of 7 to 8 gigawatts a year. Renewables Success Distorts Emissions Trading The corporate sector has its own views on the matter. Suess sees an ur­ gent need for a fundamental shift in the power market design that inte­ grates the renewables into the com­ petitive market, and creates a level playing field for fossil and renewable power generation. “Germany needs a power market design that is oriented towards the future. The guiding prin­ ciple must be to achieve the objec­ tives of the energy transition as costefficiently as possible.” The German association of munici­ pally determined infrastructure un­ dertakings and economic enterprises (VKU), for instance, is in favor of an integrated market model in which the state sells the rights to build wind power and photovoltaic facilities by means of auctions. The winning bid­ der would then receive a subsidy for investment costs. In return, the com­ pany would offer its energy produc­ tion on the energy market at margin­ al costs. At the same time, operators of conventional power stations would receive a fee for making their capacity available. Technology and M ­ arket ­Design Must Succeed Siemens has also developed a model for shaping the energy transition: “For the transition to be a success, u “The energy transition must be achieved as cost-efficiently as possible.” Michael Suess, CEO, Siemens Energy Sector Living Energy · No. 8 | July 2013 19 Power Market Design 1. “Feed-in Responsibility for Electricity Providers” He recommends a “feed-in responsi­ bility” for providers of renewable en­ ergy. The priority feed-in for renew­ able energy is abolished. Operators of wind, solar, and biomass power plants should sell their product on the open market and carry the risk for providing a safe, predictable elec­ tricity supply. To compensate for fluc­ tuations in their production during conditions of intermittent sun or wind, they should purchase supple­ mental capacity options. Operators of wind and solar power facilities will have to forecast their generation and hedge their risk with reliable power from flexible sources, renewable or conventional. Niehage expects that options and preferential pricing will create a sensible mix of volatile and flexible energy supply. Cost pressure will serve as an incentive for innova­ tion and drive interest in smart grids, for example. For suppliers of renew­ able energy providers can ensure ­security of supply, for instance, by purchasing additional electricity or com­pensating customers for reduc­ ing their demand in times of power scarcity. 20 Living Energy · No. 8 | July 2013 2. “Technology-Specific ­Renewable Support” Niehage recommends that initially, politicians must bring about a con­ sensus on the path for expanding re­ newables, including their geographi­ cal location. In the future, support for renewables can be differentiated by technology. Very mature technolo­ gies, such as photovoltaic, are left to compete without subsidies. For tech­ nologies that are on the road to matu­ rity, such as onshore wind, there are mechanisms that steer their build-up, including by geographical criteria. These mechanisms should also en­ sure that windfall profits are avoided, e.g., by introducing competition be­ tween different sites. Niehage be­ lieves that this would be an incentive for cost-efficiency. Very early-stage technologies such as power-to-gas storage still need a regulatory envi­ ronment that minimizes risks, e.g., through guaranteed feed-in tariffs, preferential feed-in, and the exemp­ tion from grid costs. However, all technologies must follow a clear path towards free competition on the ­market. 3. “Refocusing on Climate Protection“ In order to not lose sight of the goal of climate protection in the course of the energy transition, Niehage calls on German and European policy mak­ ers to reform the European Union Emission Trading Scheme (EU ETS). Ambitious targets post-2020 need to be defined in order to create a reli­ able long-term outlook, potentially supported by measures like a floor price. In addition, Niehage believes that a sector-specific solution could be modeled on the example applied to the automobile industry, where manufacturers are obliged to reduce the average emissions of their cars 5. “Strategic Reserve as Short-Term Solution” over a period of several years. This would also be an option for power producers: “Industry demands in­ vestment security,” Niehage says. “Regulation in the shape of gradual mandatory reduction of emission limits creates predictability; a CO2 price that fluctuates between €4 and €25 per tonne does not.” 4. “Attributing Costs of the Energy Transition ­Fairly” The energy transition has to be de­ signed to be socially acceptable and economically viable. Therefore, Nie­ hage believes that the process of “eroding solidarity” in the electricity market must end. Only about half of the tariff that German electricity con­ sumers pay per kilowatt-hour actual­ ly goes towards electricity production and related costs. The other half is the customer’s share of the fixed costs of energy supply, such as elec­ tricity tax, contributions to combined heat and power generation, EEG con­ tributions, or grid costs. Because all of these expenses are included in the cost of each kilowatt-hour, selfsuppliers who generate part of their power consumption themselves (for instance, from solar panels) can also reduce their contributions to the grid costs, even though the entire electric­ ity network still is at their disposal. This is why fixed costs should be ­separated from actual energy costs. Customers should pay for the energy they have purchased as well as their share of fixed infrastructure costs – which could, for example, be mea­ sured in terms of the connected load of their house. Photo: Grund Grün/Klaus-Peter Kappest it won’t suffice to simply reach the targets,” says Udo Niehage, the com­ pany’s management representative for the energy transition, referring to the target of a 80 percent share of re­ newables in gross energy consump­ tion by 2050. “The market conditions must also be a ­success. Otherwise, other countries won’t want to aspire to an energy transition of their own.” Niehage has an ambitious goal: “We must ­create a new regulatory frame­ work within which the energy transi­ tion can continue to develop further.” He proposes the following five-point guideline for a new energy market model. Power Market Design Finally, Niehage believes that security of supply needs to be taken into ac­ count. On winter days or when there is little sun or wind, the country needs a strategic reserve of power stations that can be ramped up as required. The Federal Network Agency and the grid operators would define this re­ serve annually in accordance with the market and its fluctuations. Capacities would be auctioned on a regional ­basis to ensure, for example, that re­ gional energy demands are taken into account in network capacities. This will provide some breathing space for the next years. In the medium term, however, Germany will have to take a critical decision regarding capacity: Either it relies on the energy-only market to deliver the signals for in­ vestments in new, flexible power plants. This means that power prices will have to rise and become more volatile. Or – if the government feels that this creates too much pressure – a capacity mechanism will need to be introduced. However, examples in other countries have shown that this is a very complex matter that can re­ sult in significant costs. The solution for organizing the elec­ tricity market has to be convincing. Germany doesn’t need integrated supply networks within the bound­ aries of its constituent federal states or even smaller regions, he argues; rather, “at the end of the day, the rules of the electricity market must apply to the whole of Europe.” p The Green Trader “This proposal doesn’t go far enough.” The proposal from Siemens is good; however, it doesn’t go far enough. ­Renewables must take on responsibility, but all the costs of the damage caused by coal-powered generation or the risks posed by nuclear power should also be included in the price of electricity. Every power generator must be able to offer the same fair conditions to end customers. Eberhard Holstein is the founder and CEO of Grundgrün Energie GmbH, Berlin, a direct marketing and trading company that brokers green energy at the energy stock exchange. Claus Peter Müller von der Grün is the correspondent of Frankfurter Allgemeine Zeitung for Hesse und Thuringia. He also specializes in issues relating to energy provision, healthcare policy, and urban development. Living Energy · No. 8 | July 2013 21