In Brief CORPORATE LAW REFORM

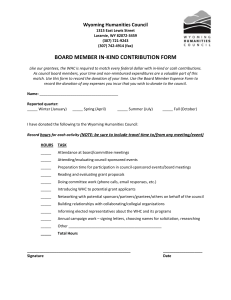

advertisement

In Brief Commercial and corporate legal issues unpacked ISSUE 1 OCTOBER 2007 CORPORATE LAW REFORM The Corporate Laws Amendment Act 24 of 2006 The Corporate Laws Amendment Act No. 24 of 2006 ("the Act"), which brings about significant amendments to the Companies Act No.61 of 1973, was expected to come into force at the beginning of October. This has not happened yet, but we expect its commencement very soon. It is likely that the Act will come into force in stages, and that some financial reporting standard provisions may be delayed, pending the establishment of the Financial Reporting Standards Council and the Financial Reporting Investigations Panel. This however remains to be seen. For purposes of this briefing, we have assumed that the whole Act will become effective. WHAT DOES THE ACT INTRODUCE? HOW IS SECTION 38 RELAXED? HOW IS SECTION 228 TIGHTENED? The Act introduces the following significant changes: A company may give financial assistance for the purchase of or subscription for its own shares or shares in its holding company if so authorised by special resolution, and if the board is satisfied that: A special resolution (instead of an ordinary resolution) will now be necessary to dispose of the whole or greater part of the assets or the whole or greater part (instead of "substantially the whole") of the business undertaking of the company. • a further exception to the section 38 prohibition against financial assistance; • stricter requirements under section 228 for the disposal of an undertaking or the greater part of the assets of a company; • the concepts of the widely held company ("WHC") and limited interest company ("LIC"). The Act erroneously also refers to "public interest companies", which we assume were intended to be references to WHCs; and • the establishment of the Financial Reporting Standards Council (FRSC) and the Financial Reporting Investigations Panel (FRIP). • subsequent to the transaction, the company's consolidated assets will exceed its consolidated liabilities; and • subsequent to providing the assistance and for the duration of the transaction, the company will be able to pay its debts as they fall due in the ordinary course of business. This relaxation will, amongst other things, facilitate black economic empowerment transactions. Is your company a WIDELY HELD COMPANY or a LIMITED INTEREST COMPANY? Turn the page to find out. The use of the words "greater part" introduces a more objective test to be applied with respect to the portion of the business to be sold - a test which is already applied in respect of the assets. A Widely Held Company is subject to substantially stricter financial reporting provisions under the Act than a Limited Interest Company. PAGE 2 WHCs are subject to substantially stricter financial reporting provisions under the Act than LICs. It is therefore imperative to determine into which category your company falls. WHC A company is a WHC if: • its articles provide for an unrestricted transfer of its shares in that the articles do not contain an “effective right of pre-emption”. This is defined as a pre-emptive right which operates in favour of all shareholders of the company and upon every proposed sale of shares to a person who is not a shareholder of the company; • its articles permit the offering of shares to the public; • it decides by special resolution to be a WHC; or • it is a subsidiary of a WHC. LIC A company is a LIC if it is not a WHC. CAN A COMPANY CONVERT FROM A WHC TO A LIC? A WHC may convert to a LIC: • prior to the commencement date of the Act, if it ceases to fall within the definition of a WHC, for example, by adding an effective right of preemption to its articles; or • after the commencement date of the Act, if it on or prior to its next AGM ceases to fall within the definition of WHC and passes a special resolution to become a LIC, provided that the directors certify that the company will not in the following financial year seek to become a WHC (section 1(7) of the Act). CONTACT Alexia Christie Director achristie@mallinicks.co.za (021) 410 9034 Trudie Broekmann Senior Associate tbroekmann@mallinicks.co.za (021) 410 9042 Carmen Abrahams Associate cabrahams@mallinicks.co.za (021) 410 2231 www.mallinicks.co.za Public companies • A public company not listed on the JSE may or may not, in terms of its articles, place a restriction on the transfer of its shares. In the absence of an effective right of pre-emption in its articles, it will be a WHC. Such a company can amend its articles by special resolution to include an effective right of pre-emption and so become a LIC. • A public company listed on the JSE may not, under the JSE rules, place any restriction on the transfer of its shares. It therefore will not be able to provide for an effective right of pre-emption in its articles. Such a listed company will automatically be a WHC and will have to comply with all the stringent provisions of the Act, which are applicable to WHCs. Private company A private company may or may not be a WHC, depending on whether its articles provide for an unrestricted transfer of shares. If a private company's arti- cles comply with Table B of the current Companies Act 61 of 1973, it is likely to be a LIC. WHAT ARE THE TRANSITIONAL PROVISIONS OF THE ACT? Impact on WHCs A company that falls within the definition of a WHC on the commencement date of the Act may delay compliance with the new section 285A(1) of the Act (which contains many of the new stringent audit requirements) until commencement of its next financial year. In terms of section 285A(1) a WHC: (a) must comply with new financial reporting standards as defined within the Act; (b) must comply with the provisions of the Act and Schedule 4 that are applicable to public interest companies; and (c) must prepare financial statements that fairly present the financial position and the results of the operations of the company (and its subsidiaries, if applicable) in accordance with paragraph (a). A WHC that elects to delay compliance with section 285A(1) must: • until commencement of its next financial year, continue to comply with the accounting and disclosure provisions in sections 286, 288 to 291 and Schedule 4 of the current Companies Act 61 of 1973, as they applied prior to the commencement date of the Act; and • thereafter, comply with all the provisions applicable to "public interest companies" and/or WHCs under the Act. Impact on LICs Until such time as accounting standards for LICs are developed under the Act, each LIC must prepare its financial statements for each financial year ending on or after 31 December 2005, in accordance with accounting practices adopted by that LIC, which comply with the framework for the preparation and presentation of financial statements included in the financial reporting standards as defined in the Act. These practices must be attached to any financial report that is based on such practices. It is not clear whether financial statements already prepared and presented in respect of these years will need to be amended. Please contact us should you require any assistance to determine whether your company will be a WHC or a LIC under the Act, or the impact of any provision of the Act. DISCLAIMER © 2007 Mallinicks Inc. The information contained in this briefing is provided for general information purposes only and should not be relied upon in relation to any specific situation. Please obtain specific professional advice for your particular needs.