Document 10435123

advertisement

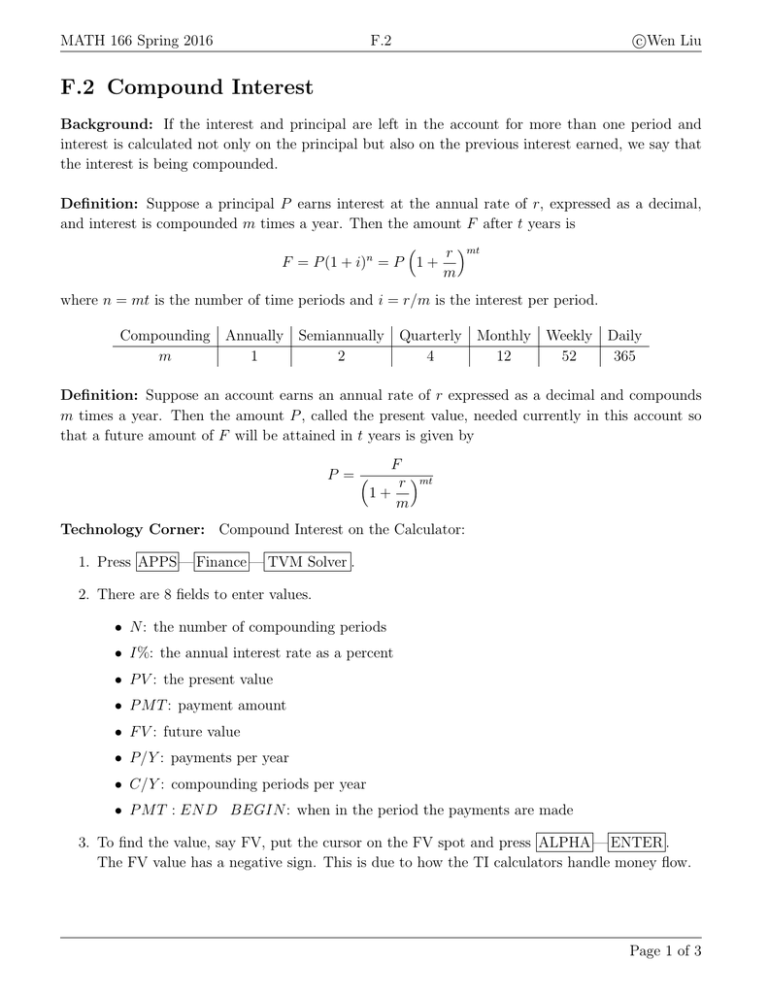

MATH 166 Spring 2016 F.2 c Wen Liu F.2 Compound Interest Background: If the interest and principal are left in the account for more than one period and interest is calculated not only on the principal but also on the previous interest earned, we say that the interest is being compounded. Definition: Suppose a principal P earns interest at the annual rate of r, expressed as a decimal, and interest is compounded m times a year. Then the amount F after t years is r mt n F = P (1 + i) = P 1 + m where n = mt is the number of time periods and i = r/m is the interest per period. Compounding Annually Semiannually Quarterly Monthly Weekly m 1 2 4 12 52 Daily 365 Definition: Suppose an account earns an annual rate of r expressed as a decimal and compounds m times a year. Then the amount P , called the present value, needed currently in this account so that a future amount of F will be attained in t years is given by P = F r mt 1+ m Technology Corner: Compound Interest on the Calculator: 1. Press APPS — Finance — TVM Solver . 2. There are 8 fields to enter values. • N : the number of compounding periods • I%: the annual interest rate as a percent • P V : the present value • P M T : payment amount • F V : future value • P/Y : payments per year • C/Y : compounding periods per year • P M T : EN D BEGIN : when in the period the payments are made 3. To find the value, say FV, put the cursor on the FV spot and press ALPHA — ENTER . The FV value has a negative sign. This is due to how the TI calculators handle money flow. Page 1 of 3 MATH 166 Spring 2016 c Wen Liu F.2 Examples: 1. Suppose $1000 is deposited into an account with an annual yield of 8% compounded quarterly. Find the amount in the account at the end of 5 years. 2. Find the present amount needed to attain a future amount of $8100 in 29 years with an annual interest rate of return 2.3% if compounded monthly. 3. Find the time for an account earning interest compounded annually at the rate of 5% to grow from $4000 to $4800. To check your answers using your calculator: N I% PV P MT FV P/Y C/Y P MT Problem 1 20 8 1000 0 Problem 2 Problem 3 4 4 highlight END Definition: • Suppose a principal P earns interest at the annual rate of r, expressed as a decimal, and the interest is compounded continuously. Then the amount F after t years is F = P ert Page 2 of 3 MATH 166 Spring 2016 F.2 c Wen Liu • If $1000 is invested at an annual rate of 9% compounded monthly, then at the end of a year there is 1000 (1 + 0.09/12))12 = 1093.81 in the account. This is the same amount that is obtainable if the same principal of $1000 is invested for one year at an annual rate of 9.381%. We call the rate 9.381% the effective annual yield. The 9% annual rate is often referred to as the nominal rate. • Suppose a sum of money is invested at an annual rate of r expressed as a decimal and is compounded m times a year. The effective yield ref f is r m ref f = 1 + −1 m Technology Corner: To find the effective rate: 1. Go to APPS — Finance —scroll down to C:Eff and press ENTER . 2. Enter the nominal rate in % followed by a comma, the number of compounding periods per year, and ) . Then press ENTER again. Examples: 1. Find the accumulated amount after 3 yr if $5100 is invested at 5%/year compounded continuously. 2. One bank advertises a nominal rate of 3.22% compounded semiannually. A second bank advertises a nominal rate of 3.21% compounded daily. What are the effective yields? In which bank would you deposit your money? Page 3 of 3