I Spotlight: DUNN Capital Management

DUNN President Martin Bergin

(left) with founder Bill Dunn

Spotlight: DUNN

Capital Management

I

T IS known as the Sailfi sh Capital of the World, a small sleepy town of roughly 16,000 residents popular with holidaymakers and charter fi shermen.

Located on Florida’s picturesque Treasure

Coast, Stuart is a world away from the fi nancial centres of New York and London.

Yet it is home to one of the world’s oldest managed futures fi rms and a pioneer of the quant trading movement that now dominates the CTA space.

“It is impossible to consider the current success of managed futures without regarding its founder

Bill Dunn,” says Tyler Resch, a portfolio manager at Institutional Advisory Services Group (IASG), a leading industry database and futures broker.

Managing more than $1bn in assets, DUNN Capital Management is a true industry survivor with a near 40-year track record boasting a compound double-digit rate of return unmatched by rivals.

Having suffered a heavy drawdown in the years before the fi nancial crisis, the fi rm has bounced back to recover the losses and in April reached a record high.

DUNN Capital’s evolution started in the early

70s when Dr William ‘Bill’ Dunn was working with a large defence contractor for various branches of the military and the Department of

Defense in Washington DC, conducting operations research and systems analysis studies.

But the physics Ph.D decided there was a better way to make a living. He began to apply his research and mathematical skills to the world of fi nance.

He started researching the equity markets to develop a trend-following system using historical price data to determine whether to go long or short. But in a pre-computing world, Dunn found there was too much data to process in reasonable time and instead looked to futures. At the time, there were just a dozen or so tradable contracts and the Commodity Futures Trading

Commission (CFTC) and the National Futures

Association (NFA) had yet to come into existence.

“After several years of studying the possibility that recent past history might be suggestive of future market performance, research showed that it was. I shared this approach with my associates and together we walked bravely into the future,” recalls Dunn, responding to questions posed by CTA Intelligence.

020_023_CTA03_Profile.indd 20 05/06/2013 15:13

profile

Friends, family and co-workers pooled

$137,000 to begin fully trading Dunn’s managed futures programme in the DC suburbs during October 1974, trading only 11 markets.

Dunn decided there was no necessity to be in any particular location, other than to be aligned in time with the markets on the East

Coast, and in 1980 opted for the warmer climes of Stuart, with offices right on the waterside.

“I thought Stuart would be more comfortable than the DC environment for me and the family, and I was right,” Dunn says.

The programme

Dunn Capital’s approach and philosophy has remained consistent down the years, using quantitative, statistical and systematic strategies to profit from major trends in up or down markets and avoid losses by exiting losing trades in days.

But the scope of the markets traded and its models have dramatically expanded. It now trades 24 hours a day on exchanges around the world, typically deploying a six-to-seven month holding period, and almost always has a position – whether long or short – in every market it trades.

“Everything we do is 100% systematic. There’s no over-ride, no individual decision-making whatsoever. That is the focus of the firm,” says

Dunn President Martin Bergin, who joined the firm in 1997 having been working with

Dunn via Fairfax, Virginia-based accountants Homes, Lowry, Horn & Johnson.

The original programme was written on punch cards, before the firm had its own computer. Computer server time had to be rented, or the programme had to be run on computers at the local library, from punch cards prepared weekly by Dunn.

unaware that anyone else was doing anything similar, Dunn was in largely uncharted territory at the time, although his first customer, an institutional investor, had actually invested in others using trend-following strategies but did not let on.

Dunn’s now flagship WMA fund began trading in 1984 as the financial markets took off and still utilises the original trend-following algorithm that Dunn developed in 1974.

In 2006, WMA (then the World Monetary Assets system) and Dunn’s smaller agricultural-focused

Standard programme were combined to become the World Monetary and Agriculture programme.

Their portfolios were folded together and the number of futures traded increased from 26 to 53.

Bergin explains: “At the time we were using three parameters for each of the 26 markets we traded. We would look at each market on an individual basis.

“In ’06 we had been researching for about three years and it became evident to us that it wasn’t important how each individual market did standing on its own. What was important was how the portfolio as a whole performed.

“Instead of using just three models for each market we started using portfolio-wide models,

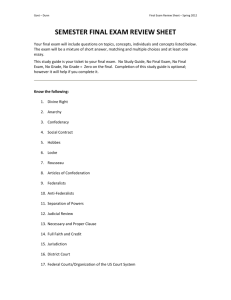

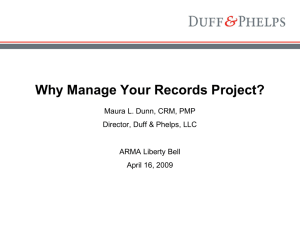

DUNN’s WMA fUND groWTh

45000 Growth of $1000 in Dunn Capital Management WMA fund

40000

35000

WMA

Barclay CTA Index VAAMI

S&P500 VAMI

30000

25000

20000

15000

10000

5000

0

Dec-84 Dec-86 Dec-88 Dec-90 Dec-92 Dec-94 Dec-96 Dec-98 Dec-00 Dec-02 Dec-04 Dec-06 Dec-08 Dec-10 Dec-12 and went from three to a 100 or more. At the same time we folded in all these other markets as liquidity grew due the increase in electronic markets, thereby allowing us to trade larger

AuM, especially in the agricultural sector.

“It was very evident you could get better risk adjusted performance by combining a large number of non-correlated markets which provides better diversification and therefore a more robust revenue stream,” says Bergin.

The driver for the change was research driven.

Around a third of Dunn’s 20 or so employees work in research and development, headed by Dunn’s son Daniel, vice-president of systems analysis.

Everything we do is 100% systematic.

There’s no over-ride, no individual decision-making whatsoever. That is the focus of the firm

“Everything is very research intensive,” Bergin says. “We do not implement changes on anything until we’ve proven it out through research and out of sample testing.

“Our dedication to the process can sometimes work against us because it takes a long time make changes due to our thoroughness. But I think it helps us in the long run because we don’t end up making mistakes along the way or fooling ourselves into believing something may be profitable, when in reality it was just a creation of data-mining.”

He admits most of the research does not pan out, but that’s the scientific process.

Fees and risk management

Dunn’s approach to risk and return differs somewhat from many of its peers, and it is one of a handful of CTA managers to eschew management fees.

It has always viewed risk as if it was the investor, which given roughly half firm’s assets are linked to employees, friends and family, either through personal money or retirement plans, is not surprising.

020_023_CTA03_Profile.indd 21 05/06/2013 11:23

profile

“They back themselves with their own money and put real confidence in their programmes,” says ML Capital COO Richard Day, which partnered with DUNN in 2011 to help build its European profile through a Ucits fund.

Day says DUNN stands out as different from most other CTAs, from its compensation model to a focus on “wealth expansion” rather than “capital preservation”, which he says “resonates very well with investors”.

Bergin explains: “One of the key philosophies of our firm is we want to be on the same side of the table as the investor. We invest our capital in the same programmes right along with our investors and we don’t charge a management fee as we don’t want any conflicts between us and the investor. Therefore, when the investor makes money, we make money. And if the investor doesn’t make money we don’t make money. It’s been the same since Bill founded the firm in 1974.”

DUNN views risk based on the chances of losing a significant amount of money within a certain timeframe, using at Value at Risk (VAR) measurement. From inception, Dunn designed its risk with a one percent chance of losing 20% or more in a rolling one-month period, and since

1974 the firm has met the target, surpassing a 20% loss in a one month period in 1.2% of the time in real trading, Bergin says. It works out an annual volatility of somewhere between 34% and 36%.

It’s not a goal of DUNN’s to be different but it’s clear we’re doing something different from the rest of the industry

But the trading environment of recent years and a growing risk aversion from some investors resulted in Dunn making some change in January this year.

“Since 1974 the industry as a whole has been reducing volatility,” Bergin says. “We basically stayed the same. The industry currently, on average, is about a third of the volatility that we are. So there are two ways to approach that.

“One is, if you’re looking at allocating money to us, you could always allocate a third of what you would normally allocate to get the same basic-adjusted risk. For most institutions that doesn’t really work, so the goal of the changes was to lower our overall risk without sacrificing returns, thereby making our product more appealing to institutional investors.”

DUNN’s research department questioned why it was continuing to dial risk to its historical target even during trading environments that offered few trending opportunities.

What DUNN devised, based on its analysis of the current environment, was to dynamically change the VAR target when the market isn’t at its peak

020_023_CTA03_Profile.indd 22 for trending. So now 5% of the time DUNN will have a VAR of -20 or more, while 95% of the time it will be lower than that.

“Based on everything we can determine, we would expect our downside volatility to reduce by about 25% under this scenario and we would expect our average (monthly, at 99% confidence)

VAR to go down from 20 to 15,” Bergin says.

“And our volatility would come down from close to 36% to something in the neighbourhood of 23%. The goal here is to provide increased risk adjusted returns, and provide the investor with something that’s a little different than others in the industry are doing,” he adds.

“We’re trying to address the needs of the investors. The outcome should be performance similar to what we were already providing with a reduction in downside volatility. We’re not giving away any performance, yet reducing the downside risk.”

Trading approach and recent performance

One key attraction of DUNN may be the non-correlation of its returns to rivals as well as the equity markets.

According to BarclayHedge data, DUNN made money in 2006 and 2007, was up over

50% in 2008, and lost just half of a per cent in 2009 when the industry as a whole posted losses, especially the big players. In 2010 the firm made over 30%. The past two years have been tough for the managed futures industry but DUNN managed to make 6% in 2011.

It took its hit in 2012 when it lost 18.6% but has made that back in the first quarter of

2013, including a 16.8% return in February, which was not a good month for trend following, according to the benchmark indices.

“It’s not a goal of DUNN’s to be different but it’s clear we’re doing something different from the rest of the industry. Just look at January and February 2013,” Bergin says, suggesting the higher gearing of the larger managers towards financials may be part of the reason.

Risk is initially allocated evenly to each market

DUNN trades, so what happens in wheat has the potential to contribute the same as what happens in a ten-year bond, depending on the strength of the signals in each market.

The current composition of the WMA fund is around 60% in currency, interest rates and stock indices, while commodities such as metals, energy, grains and softs make up the rest of the portfolio.

WMA’s “reversal” trading strategy, one of two underlying algorithms, is such that it has a position in every market it trades. Another underlying algorithm is a more opportunistic trading strategy.

Models distinguishing daily between signals and noise to determine position sizes which reverse between net long and net shorts.

“Each model has one vote,” Bergin explains of the process. “Then you basically add the positives and negatives to come up with you’re net position; what your strength is in that market.

05/06/2013 11:23

profile

“You could have a situation where the longs and shorts offset each other and the net position is zero. That may last for one day, maybe a week, but it’s a very rare occurrence and it doesn’t last very long.

“You can come across occasions, like in 2012, where due to the fact that you have very limited opportunities in trend following, where you may end up with small positions, either long or short, across a wide variety of markets, just due to the fact you’ve got equal voting on each side. That process can actually help you during periods of non-trending markets.”

Surviving drawdowns

Dunn’s risk-adjusted returns have long been favourable compared to peers, but a drawdown period between 2003 and 2007, which

Bergin admits was “deep and significant”, was a driver for the changes that began in 2006 and also produced a change in its investor base.

In the 1980s, the firm’s external investors were almost all institutional, Bergin says, but during the drawdown it lost its largest institutional accounts, and firm assets dropped from $1.5bn at their peak to $100m.

“Most of our money that was left was high-networth individuals and family offices,” he says.

“The reality is performance trumps everything.”

The firm is well known for its aggressive approach to the market and the logical concern is whether the reward will justify the risk, says

IASG’s Resch. “In recent years there has been great speculation that the original long-term trend followers have lost their ‘edge’ and that alpha could be found more efficiently elsewhere.

Despite the arguments for and against this thesis, the numbers do speak for themselves.

DUNN Capital Management occupies the third floor of the

DUNN Building on the banks of the St.

Lucie River in beautiful Stuart, Florida

“The WMA Program struggled in the early

2000s but in the recovery of this drawdown it has been positive five out of the last seven years. This positive performance has clearly caught the eye of investors as the fund’s assets under management have increased by more than five fold over the last five years.

“A programme must adapt to be a viable investment over the last 30 years and given Dunn

Capital’s ability to achieve this, it is hard to believe that it will not be able to adapt to the markets we face ahead.”

Dunn’s WMA has had ten drawdowns of more than 25% in the past 28 years, on average bouncing back with 135% returns in the succeeding 36 months, according to an investor note seen by CTA

Intelligence .

Bergin says the firm is happy with the changes made in 2006 which have increased performance and more recently reduced volatility.

Dunn has raised new assets every month for the past 18 to 24 months, Bergin says, and the inflows are growing larger each month. Institutional money is now represents 25% to 30% of assets in WMA, and 40 to 45% of firm wide AuM, Bergin says. “It’s clear that the comfort level from the institutional space is much better than it was.”

Firm AuM is now over $1bn, including more than $300m under management in WMA. The other assets are invested in other Dunn-related funds, which include strategic alliances with four other smaller CTAs, from short- and long-term trend-followers to pattern recognition traders.

under a fee-sharing partnership programme that has been running since the early 1980s,

Dunn provides services and capital and takes the managers under its umbrella, although Bergin stresses the firm has to have “full visibility” and is in most cases, involved “early on in the design of the systems” from the code to risk management.

Although more motivated by driving performance than the accumulation of assets, Bergin believes Dunn can become a larger player, managing as much as $3bn in its WMA fund without a material reduction in performance.

The future

After nearly 40 years in business, Dunn says he has seen “many more managers came along with similar programs, and the investors and managers generally did very well”.

His firm has put changes in place for the future, launched a ucits fund in Europe, has a presence on the AlphaMetrix managed accounts platform, and is mulling a low-cost ’40 Act product in the uS

– providing the right partnership can be found.

And to reassure investors, Dunn, 78, three years ago agreed ten-year succession strategy for Bergin to take control of the firm, whereupon Dunn will become an employee for life.

“I expected to be in business for a long time and had no particular plan to ‘retire’,” he says.

“Things have worked out pretty well for Dunn and its clients.”

020_023_CTA03_Profile.indd 23 05/06/2013 11:24