Introducing @RISK to Undergraduate Cadets Attending West Point: 1 of 22

advertisement

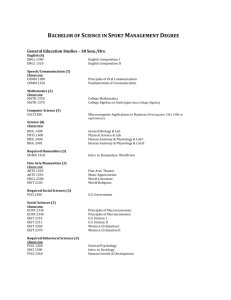

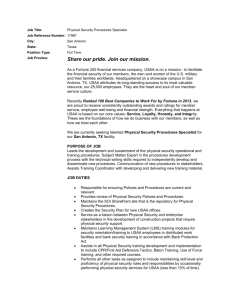

Introducing @RISK to Undergraduate Cadets Attending West Point: Investing and Gambling for Active Learning Major Ernest Y. Wong Department of Systems Engineering United States Military Academy 1 of 22 Agenda • Goals of SE350, Systems Modeling and Design • Active Learning through Simulations • Kolb’s Experiential Learning Model (investment case study) • Experience • Observe • Generalize • Test • Promoting Bloom’s Taxonomy of Cognitive Learning • Challenges in Teaching Simulation • Student Feedback • Conclusions 2 of 22 Goals of SE350, Systems Modeling and Design Core Engineering Sequence Learning Model Overview Crawl Walk Run Introductory Course Methods Course Design Course SE300 SE350 SE450 3 of 22 Goals of SE350, Systems Modeling and Design Core Engineering Sequence Learning Model Overview Crawl Walk Run Introductory Course Methods Course Design Course SE300 SE350 SE450 • Introduces non-Engineering majors to a systematic problem solving framework • Acquaints undergraduate students to engineering concepts and terminology --Stakeholder Analysis --Problem Definition --Value Hierarchy --Alternative Generation --Cost Benefit Analysis --Pareto Principle --Functional Decomposition --Assessment & Control 4 of 22 Goals of SE350, Systems Modeling and Design Core Engineering Sequence Learning Model Overview Crawl Walk Run Introductory Course Methods Course Design Course SE300 SE350 SE450 • Builds upon the mathematics and basic science concepts learned in the undergraduate core curriculum • Introduces non-Engineering majors to various quantitative methods • Focuses on the application of economic, deterministic, and stochastic models 5 of 22 Goals of SE350, Systems Modeling and Design Core Engineering Sequence Learning Model Overview Crawl Walk Run Introductory Course Methods Course Design Course SE300 SE350 SE450 • Develops student teams capable of helping satisfy client needs and proposing solutions to actual problems --West Point Cemetery --Army/Navy Game Site --Cadet Summer Training --Cadet Ethics Training --Post 9/11 Traffic Flow --Army UAV Cmd & Cntl --Soldier Pre-Deployment Tng 6 of 22 Goals of SE350, Systems Modeling and Design Core Engineering Sequence Learning Model Overview Crawl Walk Run Introductory Course Methods Course Design Course SE300 SE350 SE450 • Builds upon the mathematics and basic science concepts learned in the undergraduate core curriculum • Introduces non-Engineering majors to various quantitative methods • Focuses on the application of economic, deterministic, and stochastic models --Decision Analysis (Risk and Uncertainty) --Engineering Economy (Time Value of Money) --Optimization Techniques --Forecasting --Spreadsheet Modeling --Monte Carlo Simulation 7 of 22 David Kolb’s Experiential Learning Model 8 of 22 Student Investment Ideas (1. Experience) “RISKLESS” ASSETS BEST FITTING DISTRIBUTION PARAMETERS Constant 1. ING Savings Account Mean = 3.00% Constant 2. Edward Jones INDYMAC CD Mean = 3.60% Constant 3. USAA 104-Month CD Mean = 5.20% “MODERATELY RISKY” ASSETS Uniform 4. Fidelity Ginnie Mae Fund Min = -0.26% Max = 12.27% Normal 5. Oppenheimer Int’l Bond Mean = 2.31% Stdv = 3.00% Normal 6. Dodge & Cox Balanced Mean = 10.68% Stdv = 4.00% Normal 7. Vanguard Target Retirement 2045 Mean = 4.65% Stdv = 5.00% Normal 8. Franklin Templeton Founding Mean = 5.90% Stdv = 6.00% Normal 9. Fairholme Fund Mean = 11.08% Stdv = 10.00% Normal 10. USAA Cornerstone Strategy Mean = 4.26% Stdv = 10.00% Normal 11. Aegis Value Mean = 18.02% Stdv = 11.00% Normal 12. Vanguard Wellington Mean = 5.62% Stdv = 12.00% Normal 13. USAA S&P 500 Mean = 9.60% Stdv = 14.35% Normal 14. Vanguard Energy Admiral Mean = 23.07% Stdv = 15.25% Normal 15. Vanguard Healthcare Mean = 15.76% Stdv = 16.00% Normal 16. Prudent Bear Mean = 9.10% Stdv = 18.00% Normal 17. Cohen & Stears Realty Mean = 18.00% Stdv = 19.00% Normal 18. USAA Extended Market Mean = 5.24% Stdv = 21.00% “RISKY” ASSETS Normal 19. Wal-Mart Mean = 19.70% Stdv = 33.00% Normal 20. Pepsico Mean = 11.20% Stdv = 45.00% Normal 21. Starbucks Coffee Mean = 22.60% Stdv = 84.61% Normal 22. Advanced Micro Devices Mean = 42.60% Stdv =209.00% Triangular Min = -50.00% Mean = 20.00% Max = 150.00% 23. Miami, Florida Real Estate Triangular Min = -100.00% Mean = 50.00% Max = 300.00% 24. Poker 9 of 22 Focusing on Starbucks Coffee (2. Observe) Normal Distribution Mean = 22.60% Stdv = 84.61% Normal(22.613, 84.610) 9 8 7 Values x 10^-3 6 5 @RISK Student Version For Academic Use Only 4 3 2 1 < 39.5% 55.5% 0.0 5.0% 161.8 250 200 150 100 50 0 -50 -100 -150 -200 -250 0 > Although we can expect to earn a 22.60% annual return on SBUX, what is the probability that we lose money on the stock? Would you invest $24,000 of your own money in SBUX? 10 of 22 Simulate a Portfolio of All 24 Ideas (2. Observe) “RISKLESS” ASSETS 1. ING Savings Account 2. Edward Jones INDYMAC CD 3. USAA 104-Month CD “MODERATELY RISKY” ASSETS 4. Fidelity Ginnie Mae Fund 5. Oppenheimer Int’l Bond 6. Dodge & Cox Balanced 7. Vanguard Target Retirement 2045 8. Franklin Templeton Founding 9. Fairholme Fund 10. USAA Cornerstone Strategy 11. Aegis Value 12. Vanguard Wellington 13. USAA S&P 500 14. Vanguard Energy Admiral 15. Vanguard Healthcare 16. Prudent Bear 17. Cohen & Stears Realty 18. USAA Extended Market “RISKY” ASSETS 19. Wal-Mart 20. Pepsico 21. Starbucks Coffee 22. Advanced Micro Devices 23. Miami, Florida Real Estate 24. Poker Wouldn’t you rather invest $1000 into each asset and accept an expected annual gain of 17.53% (vs. 22.6%) with just a 7.29% chance of losing money (vs. 39.5%)!?! 11 of 22 The Central Limit Theorem (3. Generalize) The Central Limit Theorem tells us that if enough independent samples of almost any distribution are averaged together, the resulting distribution is normal. Uniform(-0.26667, 12.267) Triang(-92.026, 51.655, 302.43) Normal(22.613, 84.610) 0.20 9 0.18 8 6 5 0.16 7 0.14 + For Academic Use Only 0.08 0.06 0.04 4 5 @RISK Student Version + For Academic Use Only 4 3 Values x 10^-3 @RISK Student Version 0.10 Values x 10^-3 6 0.12 @RISK Student Version 3 For Academic Use Only 2 2 55.5% 0.0 5.0% > 161.8 14.9% 80.1% 0.0 300 250 200 150 100 50 0 -50 0 -100 250 200 150 100 0 39.5% 50 -50 < -100 > 11.64 -150 -250 9 10 8 7 5 4 3 6 90.0% 11 < 0.36 2 0 1 1 0.00 -200 1 0.02 5.0% > 232.1 12 of 22 Student Investment Ideas (4. Test) “RISKLESS” ASSETS BEST FITTING DISTRIBUTION PARAMETERS Constant 1. ING Savings Account Mean = 3.00% Constant 2. Edward Jones INDYMAC CD Mean = 3.60% Constant 3. USAA 104-Month CD Mean = 5.20% “MODERATELY RISKY” ASSETS Uniform 4. Fidelity Ginnie Mae Fund Min = -0.26% Max = 12.27% Normal 5. Oppenheimer Int’l Bond Mean = 2.31% Stdv = 3.00% Normal 6. Dodge & Cox Balanced Mean = 10.68% Stdv = 4.00% Normal 7. Vanguard Target Retirement 2045 Mean = 4.65% Stdv = 5.00% Normal 8. Franklin Templeton Founding Mean = 5.90% Stdv = 6.00% Normal 9. Fairholme Fund Mean = 11.08% Stdv = 10.00% Normal 10. USAA Cornerstone Strategy Mean = 4.26% Stdv = 10.00% Normal 11. Aegis Value Mean = 18.02% Stdv = 11.00% Normal 12. Vanguard Wellington Mean = 5.62% Stdv = 12.00% Normal 13. USAA S&P 500 Mean = 9.60% Stdv = 14.35% Normal 14. Vanguard Energy Admiral Mean = 23.07% Stdv = 15.25% Normal 15. Vanguard Healthcare Mean = 15.76% Stdv = 16.00% Normal 16. Prudent Bear Mean = 9.10% Stdv = 18.00% Normal 17. Cohen & Stears Realty Mean = 18.00% Stdv = 19.00% Normal 18. USAA Extended Market Mean = 5.24% Stdv = 21.00% “RISKY” ASSETS Normal 19. Wal-Mart Mean = 19.70% Stdv = 33.00% Normal 20. Pepsico Mean = 11.20% Stdv = 45.00% Normal 21. Starbucks Coffee Mean = 22.60% Stdv = 84.61% Normal 22. Advanced Micro Devices Mean = 42.60% Stdv =209.00% Triangular Min = -50.00% Mean = 20.00% Max = 150.00% 23. Miami, Florida Real Estate Triangular Min = -100.00% Mean = 50.00% Max = 300.00% 24. Poker 13 of 22 Re-Examining Modeling Assumptions (4. Test) Normal(42.607, 209.06) Advanced Micro Devices (AMD) Normal Dist. Mean = 42.60% Stdv =209.00% 2.0 1.8 1.6 1.2 @RISK Student Version 1.0 For Academic Use Only 0.8 Has about a 42% chance of losing money. 0.6 0.4 0.2 < 41.9% 53.1% 5.0% 0 600 500 400 300 200 100 0 -100 -200 -300 -400 0.0 -500 Values x 10^-3 1.4 > 386 Distribution for 12 $2000 Investments into AMD/E15 0.700 Mean=0.4259027 0.600 0.500 For Academic Use Only 0.300 0.200 0.100 -1.5 -0.375 0.75 27.28% 1.875 67.72% 3 5% 1.434 0 Distribution for 24 $1000 Investments into AMD/I24 0 1.000 0.900 0.800 0.700 0.600 0.500 0.400 0.300 0.200 0.100 0.000 Yet when we make 12 separate purchases into AMD, does it make sense that the chance of losing money falls to 27%? @RISK Student Version 0.400 0.000 x x 0 -1.5 Mean=0.4256299 @RISK Student Version For Academic Use Only -0.625 0.25 17.77% 1.125 77.23% 0 2 5% 1.2098 We are still investing $24,000 but chance of losing money now drops to 18%. The Central Limit Theorem states that if enough independent samples of almost any distribution are averaged together, the resulting distribution is normal. 14 of 22 Bloom’s Taxonomy on Cognitive Learning Level 2 Goals Level 1 Goals 15 of 22 Approach in SE350--Systems Modeling & Design 1. Experience: Student investment ideas (ownership of familiar concepts) 2. Observe: Understanding histograms (application of familiar concepts) 3. Generalize: Investment diversification (progression to new concepts) 4. Test: Modeling assumptions (understanding of modeling limitations, risks, and tradeoffs) 16 of 22 Students Insights into Modeling with @RISK • Is there such a thing as “riskless” investments? • What data should be used to try to determine a best fitting distribution? • Which idealized distributions are indeed best from BestFit? • What about modeling distributions with infinite tails? How realistic is this? 17 of 22 Challenges in Advancing Up Bloom’s Steps However, some students complained that they: • Did not feel that they were equipped with adequate knowledge to interpret the simulation results (KnowledgeRecall) • Did not know what actions to take to improve system performance (UnderstandingGrasp) • Focused mainly on the mechanics of building the simulation model and believed the problem was solved once they ran the simulation (ApplicationApply) • Found it difficult to go beyond just providing a single “optimal” solution (AnalysisAnalyze) • Expressed unease with having to deal with uncertainties and coming up with open-ended recommendations (Synthesis & EvaluationSynthesize & Judge) 18 of 22 Positive Student Feedback • “I see a lot of potential for Excel.” • “I thought the projects were very applicable.” • “I liked learning how to use the simulation models.” • “I really liked the systems modeling and design portion of the course—it was straight-forward and applicable.” • “I liked the projects; they gave me a chance to actually figure out which course of action to take instead of me knowing exactly which decision making process to use.” • “I wish I had more of these projects.” • “I wish I had majored in Systems Engineering instead of xxxxxxxx.” I hear, I forget. I see, I remember. I do, I understand. --Chinese Proverb 19 of 22 Course Feedback (n=123) Answers: [5] Strongly Agree [4] Agree [3] Neutral [2] Disagree [1] Strongly Disagree Course - SE350 (Spring 2005) Answer Answer Answer Answer Answer [5] [4] [3] [2] [1] (no rsp) A1. This instructor encouraged students to be responsible for their own learning. 42 (42%) 48 (48%) 9 (9%) 0 (0%) 0 (0%) 0 (0%) A2. This instructor used effective techniques for learning, both in class and for outof-class assignments. 37 (37%) 48 (48%) 12 (12%) 2 (2%) 0 (0%) 0 (0%) A3. My instructor cared about my learning in this course. 43 (43%) 49 (49%) 6 (6%) 1 (1%) 0 (0%) 0 (0%) A4. My instructor demonstrated respect for cadets as individuals. 56 (57%) 37 (37%) 5 (5%) 1 (1%) 0 (0%) 0 (0%) A5. My fellow students contributed to my learning in this course. 36 (36%) 42 (42%) 14 (14%) 5 (5%) 2 (2%) 0 (0%) A6. My motivation to learn and to continue learning has increased because of this course. 29 (29%) 41 (41%) 17 (17%) 9 (9%) 3 (3%) 0 (0%) B1. This instructor stimulated my thinking. 35 (35%) 49 (49%) 12 (12%) 3 (3%) 0 (0%) 0 (0%) B2. In this course, my critical thinking ability increased. 33 (33%) 44 (44%) 16 (16%) 5 (5%) 1 (1%) 0 (0%) B3. The homework assignments, papers, and projects in this course could be completed within the USMA time guideline of two hours preparation for each class attendance. 32 (32%) 54 (55%) 10 (10%) 3 (3%) 0 (0%) 0 (0%) C1. This course helped me learn to use the engineering design process to design, manage or reengineer systems or processes. 32 (32%) 45 (45%) 16 (16%) 4 (4%) 2 (2%) 0 (0%) C2. This course taught me to communicate effectively both orally and in writing. 32 (32%) 29 (29%) 30 (30%) 8 (8%) 0 (0%) 0 (0%) C3. This course improved my ability to solve real-world problems through quantitative techniques. 28 (28%) 53 (54%) 13 (13%) 4 (4%) 1 (1%) 0 (0%) C4. This course provided me with practical, problem-solving experiences applicable 34 to my future as an Army officer. (34%) 44 (44%) 14 (14%) 5 (5%) 2 (2%) 0 (0%) C5. Course exercises and designs improved my ability to model, analyze, or prototype real-world problems or systems. 54 (55%) 11 (11%) 3 (3%) 1 (1%) 30 (30%) 0 20 of 22 (0%) Goal of Systems Engineering at USMA “We are preparing graduates who are scientifically literate and capable of applying mathematical, engineering, and computational modes of thought to the solution of complex problems.” --Dean, United States Military Academy 21 of 22 Questions? ernest.wong@usma.edu 22 of 22