Research Michigan Center Retirement

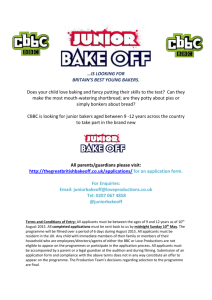

advertisement