SUPERVISION OF INSURANCE OPERATIONS United Nations Conference on Trade and Development

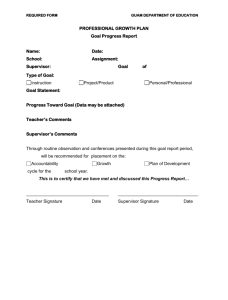

advertisement