Decision Making Under Uncertainty

advertisement

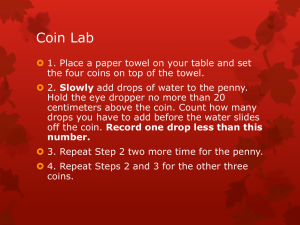

Decision Making Under Uncertainty What’s in a decision? Sven Roden Unilever Think Clearly – Act Decisively – Feel Confident How to get senior managers interested in decision analysis… This is a demonstration to illustrate all the key fundamentals of decision-making when faced with uncertainty, while still keeping it so simple as to be “obvious”. Making it thoughtprovoking and experiential creates a high impact event. This example has been adapted from an exercise developed and demonstrated by the Strategic Decision Group (www.sdg.com) We will demonstrate the principles of Decision Making Under Uncertainty using a simple (but real) example • This is a personal investment decision. • The outcome is uncertain. • The potential gains/losses are real. What is the most that you are willing to invest? Let’s create the most simple decision we can… Decision Uncertainty Good Outcome Net Profit Coin Coin - £ X Invest –£X Bad Don’t Invest Decision 0 0 Uncertainty –£X 0 What is the value of the coin? Ultimately, you have to work out what the coin is worth to you… … but here is some information that may help you! £240 to buy a 1982 minted ½ Krugerrand (based on £400 per ounce) Source: http://www.taxfreegold.co.uk/krugerhalfdates.html Krugerrands are legal tender in South Africa. The coin has a face value of ~ £ 0.03. Source: http://www.reuters.com/finance/currencies Spot price for 1 troy ounce of gold is US$ 945 Source:http://www.ft.com/markets/commodities The uncertainty is a simple(ish) call… do you think the toy will end up inside or outside the circle? Correct Call Incorrect Call Coin 0 You get to make the call “inside” or “outside” after the toy has been wound up and allowed to run Unfortunately, we can only offer this investment opportunity to one person We will sell this bond certificate to the highest bidder… “Random Walk” game rules 1. The selected person plays the game once. 2. The highest bidder will purchase the right to play the game – no collusion between bidders. 3. VISA Payment is cash or cheque; no refunds. 4. I will “release” the wind up toy. 5. The person calls: “Inside the circle” or “Outside the circle”. NB: Should any part of the toy be touching or outside the line, the toy is “outside the circle”. 6. If the call is correct, the person wins the coin. 7. If the call is incorrect, the person wins nothing. 8. I keep the amount paid to play, regardless of the outcome. MasterCard On your bid card please can you write… Your Name (so we can identify you!) Your bid in £ (i.e. how much you are willing to pay for the bond certificate) How much the coin is worth to you The certificate acknowledges the first important “decision” of this session We define a decision as an “irrevocable” allocation of resources with the purpose of achieving a desired objective. Probabilities quantify the person’s judgment about the likelihood of winning Correct Call Probability = p Probability = 1 – p Incorrect Call Probability is a measure of a person’s degree of belief in a proposition based on all their previous information and knowledge (including theoretical postulations). The decision has now been made, so the amount bid is a sunk cost; that’s behind us now! Decision Uncertainty Correct Call Outcome Coin p= Invest –£ Bid 1–p= Incorrect Call Don’t Invest 0 0 To evaluate if the decision was a good one, we must establish a value for the deal Deal Decision Uncertainty Correct Call Outcome Coin p= Keep 1–p= Incorrect Call Sell 0 ? What is your minimum selling price? The value of the deal is the person’s minimum selling price or “Certain Equivalent” Deal Uncertainty Correct Call Outcome Coin p= Certain Equivalent 1–p= Incorrect Call 0 The person is indifferent between having the deal or its Certain Equivalent. It is important to recognise that good decisions are not the same as good outcomes Good Outcomes Good Decisions .6 .4 .7 .3 Preferred Results What we would like! 40 –6 15 4 Balances the probabilities of good and bad outcomes consistent with preferences What we need to do! Another way to value the deal is to calculate its “Expected Value” (probability-weighted average) Deal Uncertainty Correct Call p= Outcome V (Value of coin) Expected Value 1–p= Incorrect Call 0 EV = p x V + (1 – p) x 0 The Expected Value (or “mean”) is the average return from each game if it were repeated many times. The difference between “Expected Value” and “Certain Equivalence” reflects attitude towards risk Certain Equivalents £ EV Risk Averse Risk Neutral Risk Preferring Risk Attitude This is a matter of preference; there is no “correct” risk attitude for your personal decisions. However, large commercial organisations would be well advised to generally make risk neutral decisions. Risk aversion should only become important if the decision involves outcomes that are large in relation to your wealth Certain Equivalence Risk neutral line (CE = EV) Snr manager Middle manager Jnr manager Expected Value Risk averse people tend to risk neutrality when they feel the stakes are small. What is your call? Inside the Circle? Outside the Circle? Several insights emerge from the demonstration • • • A decision is an irrevocable allocation of resources. Probability is the quantitative language for communicating about uncertainty. Correct Call Probability = p Probability = 1 – p Probabilities represent judgment, which includes experience and information. Incorrect Call Certain Equivalents € EV • The value of an uncertain deal depends on its characteristics and one’s attitude toward risk. Risk Averse Risk Neutral Risk Attitude • We must distinguish between the quality of the decision and its outcome. • Achieving alignment as a group is an additional challenge. Risk Preferring