Risky Models Palisade EMEA 2012 Risk Conference London

advertisement

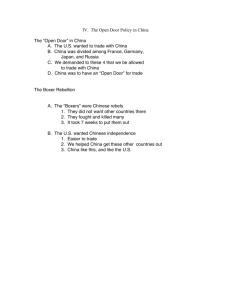

Risky Models Palisade EMEA 2012 Risk Conference London 1 © 2012 Captum Capital Limited Modelling Risk Estimate probability of future events Probabilities based on: Statistical analysis of historic data Expert opinion Wisdom of crowds Subjective best guess Risk models used to make decisions 2 Subjective Risk Perception Decision makers: Have a poor appreciation of probabilities Are risk averse Are loss averse 3 US Masters 2012 Sudden Death Play-off Final 10th Hole – Camilla Par 4 Augusta National 4 10th Hole Playoff Louis Oosterhuizen (South Africa) Reached green in 3 shots 15 feet from pin Bubba Watson (United States) Reached green in 2 shots 8 feet from pin 5 Bubba Wins! Oosterhuizen – Bogey 5 Watson – Par 4 6 Toss a coin... T H 0.5 7 + 0.5 = 1 Risk Perceptions 1. 2. 0.75 £300 P=1.0 £100 0.25 3. 0.5 0.5 8 £500 - £300 4. 0.25 0.75 - £500 £700 - £100 650 Perceptions 1. 2. 0.75 P=1.0 £300 £100 14% 3. 0.5 26% £500 4. 0.5 35% © Dr. Kelvin Stott 9 0.25 0.25 0.75 - £300 26% - £500 £700 - £100 Loss Aversion Utility £100 Loss Profit Prospect Theory - £100 10 Kahneman & Tversky (1974) Multiple Milestones 11 TAMIX Option Value 12 Tamix Option Cash Flow Year Cash Flow 0 1 2 3 4 -1.00 0 -12.55 0 157.35 P NPV 1 0.5 0.5x0.9 -1.00 -10.00 100.00 Cash Flow in £000s Discount Rate R = 12% rNPV = -1 + 0.5 x -10 + 0.45 x 100= £39,000,000 13 @Risk Option Value 14 TAMIX Model Output 15 What does it mean? 16 rNPV $million) Probability of Happening -1.00 50% -6.00 5% 39.00 45% Risk Impact Matrix Insignificant Moderate 3 Major 4 Catastrophic 1 Minor 2 1 1 2 3 4 5 Unlikely 2 2 4 6 8 10 Possible 3 3 6 9 12 15 Likely 4 4 8 12 16 20 Certain 5 5 10 15 20 25 Rare 17 5 NHS Risk Assurance All NHS Trusts are required to have a Risk Assurance Framework How useful is it? Different people assign different risk probabilities & impacts Non-quantifiable risks 18 NHS Risk Examples Risk Rating Real Risk Service demand exceeds contract budget Likely 4 Impact 5 [Finance Director] 20 25 EWTD limits availability of junior doctors Certain 5 Impact 4 [Medical Director] 20 10 Risk 19 The Monty Hall Problem Originally proposed by: Steve Selvin in the American Statistician 1975 Named after: Monty Hall, host Let’s Make a Deal 20 The Game Three doors; one hides a car, the others hide goats You choose one of the 3 doors The host opens a door you haven’t chosen to reveal a goat Should you stick with your original choice – or swap? 21 Monty Hall @ Risk Model 22 The logic of the problem Stick Swap £ 0 0 £ 0 0 0 £ 0 0 £ 0 0 0 £ 0 0 £ 1:3 chance to win 23 2:3 chance to win Decision Tree Solution Player picks Door 1 Car Location Host Total opens P 1/6 Car Goat Door 3 1/6 Car Goat 1 Door 3 1/3 Goat Car 1 Door 2 1 /3 Goat Car Door 1 1/2 Door 3 24 Switch Door 2 1/2 Door 2 Stay A Controversial Game A newspaper column received several thousand complaints about this solution Experiments show ~80% think there is no difference between staying or switching Even after training in probability, ~70% still choose the wrong answer 25 St Petersburg paradox Presented the problem and its solution in Commentaries of the Imperial Academy of Science of Saint Petersburg (1738) The problem was invented by Daniel's cousin Nicolas Bernoulli who first stated it in a letter to Pierre Raymond de Montmort of 9 September 1713 Daniel Bernoulli 1700 -1782 26 The paradox is a classic problem in probability and decision theory, based on a lottery game The game You start with £1 A coin is tossed: Heads – your stake is doubled Tails – game over Keep tossing the coin as long it comes up heads 27 Some plays Payout 28 1 T £1 2 H–H-T £4 3 H–H–H-T £8 4 H–H–H–H–H-T £32 What’s the problem? The Expected Value of the game is unlimited! 29 Heads Model N=0 Head? No Yes N=N+1 30 End 1000 Plays 600 500 Average Payout per Play £3.30 400 300 200 100 0 0 1 2 3 # Heads 31 4 5 6 Payout 32 # Heads 0 1 2 % Plays 50 27 12 Payout £1 £2 £4 3 4 5 6 16 7 2 2 0.5 ~0.0002 £8 £16 £32 £64 £65536 Summary Risk Models depend on Probabilities! Decision makers: Have a poor appreciation of probabilities Are risk averse Are loss averse 33 About Captum Innovation in Life Sciences Licensing Technology Valuation Modelling behaviour, innovation, value See us at 34 Risk Analysis using Contact Captum Capital Limited Michael Brand e: mjb@captum.com t: +44 (0) 115 988 6154 m: +44 (0) 7980 257 241 35 Cumberland House 35 Park Row Nottingham NG1 6EE United Kingdom www.captum.com