Executive Pay for Performance

Marwaan R. Karame

Direct: 212-248-0866 mrk@ev-advisors.com

www.ev-advisors.com

All rights reserved. No part of this report may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or any information storage and retrieval system, without the written permission of Economic Value Advisors.

Copyright © 2003-2009 Economic Value Advisors

Executive Pay for Performance

Presentation objective:

Applying the concepts of Economic Value (also known as Economic Valued Added or

Economic Profit), so that we can maximize the long-term wealth of shareholders, by motivating managers to think, act, and get paid like owners.

Demonstrate how to create an effective executive pay for performance incentive plan using

@Risk.

Introductions …

Economic Value Advisors, based in Manhattan, is a Value Based Management consulting firm that focuses on maximizing the long-term value of businesses and the wealth of shareholders through a fundamental concept of applied corporate finance and economics, known as Economic Value (also known as Economic Value

Added or Economic Profit).

In each of these services we assist companies to do one or all of the following:

Improve - Enhance the existing operations of a business by doing more with less

Divest - Sell a business when the alternative of keeping it is less profitable.

Invest - Invest in profitable growth opportunities through new initiatives or acquisitions.

Our full VBM implementation extends beyond adopting a measure of performance

(Economic Value), but rather it instills a Value Based Management business philosophy that aligns the interests of management and shareholders.

As a result, we help to create a shareholder centric culture that encourages a corporate mindset of management ownership and shareholder accountability across all levels and functions of an organization.

Copyright © 2003-2009 Economic Value Advisors

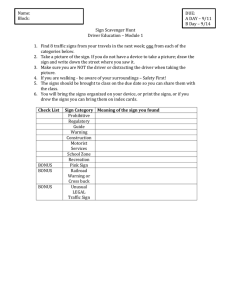

Topics covered, schedule and agenda

When discussing executive pay for performance we need to start from the very beginning by clearly defining our ultimate objective and determining how to measure performance against that objective.

In order to answer this question, we need to introduce the business philosophy of Value

Based Management.

1. Defining Value Based Management

The economic meaning of value

Value Based Management defined

Why maximize long-term shareholder value?

How to measure value creation

2. Economic Value

Calculating Economic Value – simple case

Shortfalls of traditional measures

Putting Value Based Management to practice

3. Executive pay for performance

Motivating managers to think, act, and get paid like owners.

Using @Risk to calibrate an executive incentive plan that pays for creating shareholder value

4. Shareholder / Management Alignment

Wealth Leverage – a shareholder / management alignment index is used to determine how strongly management incentive is aligned to shareholders.

Sections:

1.

2.

Defining Value Based Management

Economic Value - creating value

3.

Executive Pay for Performance

4.

Shareholder/Management alignment

“Price is what you pay, value is what you get."

- Warren Buffett

1.

Defining Value Based Management

Learning Objectives:

Define value based management

Understand why maximizing long-term shareholder wealth is in the best interests of all stakeholders.

Identify a company’s sole objective

Determining the source of value and wealth

Copyright © 2003-2009 Economic Value Advisors

To define a Value Based Management business philosophy we draw from …

… key economic principles of human behavior.

The rational-actor paradigm is a fundamental concept of economics that simply states that people act:

Rationally Maximize Value Self-Interest

When people make mistakes, or are fraudulent, or are perceived to act irrational, the problem can be traced to not having either:

The Right People

The Right

Information

The Right

Incentive

Copyright © 2003-2009 Economic Value Advisors

Source: Managerial Economics, A Problem Solving Approach by Luke M. Froeb and Brian T.

McCann, pg 4-5.

4

The objective of any company is dictated by the invisible hand principle

Corporate social responsibility is, simply, to maximize long-term shareholder wealth

“... But the study of his own advantage naturally, or rather necessarily, leads him to prefer that employment which is most advantageous to society.

… By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it.”

- Adam Smith, An inquiry into the Nature and Causes of the Wealth of Nations (New

York: Modern Library, 1937), p. 423

Forbes: The World’s Billionaires 2009

(Ranking by Net worth)

1. Bill Gates - $40 billion

2. Warren Buffet - $37 billion

Source: ww.Forbes.com

Owners of companies, by necessity, must contribute to society in order to promote their own self interest.

The best way for owners to maximize their own selfinterest is by taking into account the self interest of others and to exchange something of value.

Anecdotal evidence

Rated #1 and #2 as the wealthiest men in the world, Bill

Gates and Warren Buffett provide anecdotal evidence that the best way to maximize shareholder wealth is by serving society in a meaningful and beneficial way.

The poorest countries tend also to be the most corrupt. This year's report brackets together New Zealand, Denmark and

Finland as the least corrupt countries.

Somalia and Myanmar suffer from the most corruption, defined as the abuse of public office for private gain.

- The Economist, Sep 27th 2007

From a macro perspective, wealth and healthy functional societies go hand in hand.

Honest free societies create the greatest level of wealth per capita.

Copyright © 2003-2009 Economic Value Advisors

5

How can managers impact society when maximizing shareholder value?

“Our mission is to create value over the long haul for the owners of our Company.

That’s what our economic system demands of us. That’s what allows us to contribute meaningfully to society. That’s what keeps us from acting shortsighted. As businessmen and businesswomen, we should never forget that the best way for us to serve all our stake-holders – not just our share owners, but our fellow employees, our business partners and our communities – is by creating value over time for those who have hired us.

That, ultimately, is our job.”

- Roberto C. Goizueta (Former CEO of The CoCa-Cola Company)

Who did he impact?

Nick Smith

Whitehead

Woodruff & Evans

Foundations

Emory University

How did he impact them?

Roberto Goizueta’s dentist, bought 100 shares in 1984 for $6,237.50, which by mid-1997 climbed to a value of $180,000 after four stock splits.

Has a value of $7.6 billion, almost all from their holdings of 119 million Coke shares, which has allowed them to increase charitable giving from $5 million in 1980 to about $220 million in 1997.

Emory University endowment increased from $250 million in 1981 to one of the nation’s largest at $3.8 billion. The university holds about 40 million Coke shares, making up 63% of the endowment’s value. As a result, Emory has built facilities, offered scholarships, endowed professorships, and expanded programs.

Copyright © 2003-2009 Economic Value Advisors

Source: The Wall Street Journal’s tribute to Roberto Goizueta, October 24 th , 1997

6

VBM gauges success based on the value created for others

“Price is what you pay. Value is what you get.” – Warren Buffett

Defining management performance based on short-term stock price success is both impractical and does not necessarily ensure a company manages to value.

"Try not to become a

[person] of success, but rather try to become a [person] of value."

- Albert Einstein

Copyright © 2003-2009 Economic Value Advisors

7

Value Based Management goes beyond managing to earnings

Reported earnings doesn’t represent the true economics of a business

Earnings can often lead to the wrong behavior when tied to compensation as demonstrated by the following excerpt from Enron’s in-house risk management manual:

“Reported earnings follow the rules and principles of accounting. The results do not always create measures consistent with the underlying economics. However, corporate management’s performance is generally measured by accounting income, not underlying economics. Therefore, risk management strategies are directed at accounting, rather than economic, performance.”

Enron Economic Profit vs Net Income

$1,500

$1,000

$500

$0

($500)

($1,000)

($1,500)

($2,000)

1993 1994 1995 1996 1997 1998 1999 2000

Year

Economic Profit Net Income

The Smartest Guys In The Room by

Bethany McLean and Peter Elkind page 132.

Copyright © 2003-2009 Economic Value Advisors

8

Creating value begins by managing towards the right measure

Determining how to increase Shareholder Value is often confusing

Operations

Capacity Utilization

Capital Turnover

Capital budgeting

Volume

Inventory

Which measure should you focus on?

Sales & Marketing

Sales Growth CRM

ROI Margins

Market Share

Human Resources

Sales per Employee

Balanced Scorecard

Subjective Evaluations

Finance

EPS IRR

NPV EBIT

Cash Flow

EBITDA

Copyright © 2003-2009 Economic Value Advisors

9

Economic Value is the true measure of value creation

Economic Value provides focus, simplicity, and line of sight

Economic Value is a truism of finance and economics

Economic Value - different names, same concept:

Economic Value Added (EVA)

Residual Value or Income

Economic Profit

Shareholder Value Added (SVA)

Cash Value Added (CVA) …

Your return on investment must be higher than the cost of capital

Long-term

Shareholder Value

Economic Value

Return on investment

Borrow

Profit

10%

5%

5%

Yes

5%

10%

-5%

No

Copyright © 2003-2009 Economic Value Advisors

10

The concept of Economic Value is well established

Economic Value is endorsed by all facets of the business community

Business Academics

"... there is no profit unless you earn the cost of capital. Alfred

Marshall said that in 1896,

Peter Drucker said that in 1954 and in 1973, and now EVA

(economic value added) has systematized this idea, thank

God."

- Peter Drucker

Wall Street Analysts

"Economic Value Added (EVA) is a superior metric ... EVA has a higher correlation with wealth creation than do EPS,

ROE, or cash flow."

- Steven Milunovich

Copyright © 2003-2009 Economic Value Advisors

Institutional Investors

"Unlike earnings or ROE or any of those other measures, EVA gets at what we're really after: the creation of value by earning returns above our required cost of capital across time."

- Bob Boldt, Senior Investment

Officer

Corporations

“Economic Profit is the way to keep score. Why everybody doesn’t use it is a mystery to me.”

- Roberto Goizueta, Past CEO

11

However, the “measure” of value is not what creates wealth

“Wealth is the product of a [person’s] capacity to think.” – Ayn Rand

There is no substitute for the “right” people:

Integrity

Judgment

Leadership

Competence

Diligence

Intelligence

Strategy

Vision

Passionate work ethic

Regardless of the measure used to access performance (accounting or economic based), it is only as accurate as the managers and employees that measure it.

It’s the genuine adoption of a VBM business philosophy that will maximize longterm shareholder wealth versus simply the adoption of a measure.

Genuine adoption of a VBM business philosophy requires managers to measure, manage, and reward performance with the honest intent, spirit, and principle of maximizing long-term shareholder value.

Copyright © 2003-2009 Economic Value Advisors

12

Sections:

1.

2.

Defining Value Based Management

Economic Value - creating value

3.

Executive Pay for Performance

4.

Shareholder/Management alignment

"... there is no profit unless you earn the cost of capital. Alfred

Marshall said that in 1896, Peter

Drucker said that in 1954 and in

1973, and now EVA (economic value added) has systematized this idea, thank God."

2.

- Peter Drucker

Economic Value – creating value

Learning Objectives:

Understand how to calculate Economic Value

Demonstrate Economic Value embodies all other measures

Economic Value leads to value enhancing operating decisions

Shortfalls of other traditional measures

Economic Value’s ability to be understood and used at the shop floor level

Copyright © 2003-2009 Economic Value Advisors

A simple Economic Value case study

Case study highlights:

Carl Carlton, CEO

Aspiring Entrepreneur

Total Investment $1,000

Sources of Funds:

−

−

Personal savings: $500 in stocks

$500 Debt / Lender - Dad

C.C. calling his Stock Broker to sell

Cost of Capital:

Opportunity cost – was earning a 15% return in the Stock Market

Dad charging him 5% after tax

Weighted Average Cost of Capital = 10%

Fund Source

Equity

Debt

Capital

Amount

% of Total

Investment

$500

+$500

50%

50%

$1,000 100%

X

X

Rate

15%

5%

=

=

Weighted

Average

7.5%

+2.5%

10.0%

Copyright © 2003-2009 Economic Value Advisors

14

Economic Value is simple common sense

There are 2 simple methods for calculating Economic Value

$200

1) Economic Value =

$300

NOPAT

_

Sales

- Expenses

EBIT

2

- Taxes

NOPAT

$2,500

-$2,000

$500

-$200

$300

$100

Capital Charge

Capital

X Cost of Capital

Capital Charge

$1,000

X 10%

$100

$200

2) Economic Value =

30%

20% spread

_

10%

Cost of Capital X

DuPont Formula

1) NOPAT – Net Operating Profit After Tax

2) EBIT – Earnings Before Interest and Tax

3) ROC – Return on Capital

Return on Capital

NOPAT

Capital

$300

$1,000

30%

=

=

=

NOPAT Margins

NOPAT

Sales

$300

$2,500

X

X

X

Capital Turns

Sales

Capital

$2,500

$1,000

= 12%

X

2.5x

Copyright © 2003-2009 Economic Value Advisors

$1,000

Capital

15

Economic Value - a simple yet robust measure of performance

Economic Value offers clarity into 4 value creating mandates

Economic

Value

=

ROC

Return on

Capital

_

Cost of

Capital

X

Capital

DuPont Formula

Profit Margins

NOPAT

Sales

X

Capital Turns

Sales

Capital

4. Optimize Capital Structure

• Financial flexibility

• Dividend policy

• Investor disclosure

1. Improve operations and efficiency by increasing margins

• Reduce manufacturing Costs

• Process improvements

• JIT, Lean Manufacturing

• Six Sigma, Kanban, TQM

Copyright © 2003-2009 Economic Value Advisors

2. Divest capital – doing more with less

• Sell a business when the alternative of keeping it is less profitable

• Reduce overhead expenses

• Maintain Sales while reducing

Net Working Capital and

Fixed Capital Turns

3. Invest profitably by allocating capital towards value creating investments

• Value creating acquisitions

• Invest in positive NPV equipment and facility initiatives

• Establish foreign and domestic joint ventures

• Invest in marketing and research development

16

Economic Value’s greatest strength – making daily decisions

You have an opportunity to increase sales with a new customer

Sales opportunity of $500,000, but you will require an increase of $200,000 of inventory

Projected operating expenses are 95% of sales. Should you take on the new customer?

Potential New Customer

Economic Profit Analysis ($)

Sales Increase

- Incremental Costs

= Operating Income Increase x 1 - Tax Rate

(1) = NOPAT Increase

Working Capital Increase x Cost of Capital

(2) = Capital Charge Increase

(1-2) Economic Profit

Year

500,000

475,000

25,000

60.0%

15,000

200,000

10.0%

20,000

(5,000)

Copyright © 2003-2009 Economic Value Advisors

17

Economic Value applies to every business decision

Your daily operating decisions determine the value created

Taking on a potential new customer

Negotiating a supplier contract

Adding human resources

Making an equipment purchase

Prioritizing customer orders

Divesting idle assets

Acquiring a business

Make versus buy decisions

Developing a new product line

Adding a new shift

Upgrading equipment

Negotiating past contracts

Copyright © 2003-2009 Economic Value Advisors

18

VBM compensation incentive must be tied to the right measure

Traditional measures, independently, do not necessarily increase value.

Earnings measures (Net Income, EPS, EBITDA, Operating Income, etc.) can lead to investment at inadequate rates of return.

Return measures (ROE, ROC, ROA) can lead to rejecting good investments that diminish current returns or accepting poor investments that enhance current returns.

Long-term shareholder value can only be maximized by increasing a company’s Economic Value over the long-term.

Copyright © 2003-2009 Economic Value Advisors

19

Carlton decides to make his first acquisition

Year 2 Highlights

Tough year with price war

Increased competition

Decides to buyout competitors

Skimps on due diligence

Loses site of the end goal

C.C. closing Patterson’s Lawn Care acquisition

Acquisition Highlights

Crazy Patterson’s Lawn Care

High margins due to ‘stripped’ down operating expenses

Carlton underestimates Mr.

Patterson

Copyright © 2003-2009 Economic Value Advisors

Mr. Patterson pleased with negotiations

20

Traditional measures can encourage value destroying growth

Drivers are important but should not be maximized independently

Sales

EBIT

NOPAT

NOPAT Margin

Capital

Return on Capital

Cost of Capital

Capital Charge

Economic Value

Base

Business

$1,000

$83

+

$50

5%

$1,000

5%

10%

- $100

- $50

New

Business

$200

$67

$40

20%

$500

8%

10%

- $50

-$10

=

Total

Business

$1,200

$150

$90

7.5%

$1,500

6.0%

10%

- $150

- $60

Copyright © 2003-2009 Economic Value Advisors

21

Benchmarking – CVS/Caremark

Despite CVS’s increased NOPAT Margin, Economic Value has declined

Revenue and Revenue Growth

100,000.0

90,000.0

80,000.0

70,000.0

60,000.0

50,000.0

40,000.0

30,000.0

20,000.0

10,000.0

0.0

80%

70%

60%

50%

40%

30%

20%

10%

0%

Despite CVS’s increasing revenue and NOPAT

Margins, Economic Value has declined due to a lack of focus on capital efficiency resulting in a decline in

Capital Turns.

Most probably the reduction in Capital Turns is due to the company’s inability to fully capitalize on their minute clinics.

2006

Revenue

2007

Revenue Growth

2008

$ in millions

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

(1.0%)

0.00x

0.50x

Return on Capital - Drivers

1.00x

Size of bubble is based on Revenue

2008

2006

1.50x

2.00x

Capital Turns

2007

2.50x

7.3% Avg. Cost of

Capital

3.00x

3.50x

NOPAT, Capital Charge, Economic Value

$6,000.0

$4,000.0

$2,000.0

$0.0

-$2,000.0

-$4,000.0

-$6,000.0

2006

Capital Charge

2007

NOPAT

2008

Economic Value

$1,600.0

$1,400.0

$1,200.0

$1,000.0

$800.0

$600.0

$400.0

$200.0

$0.0

-$200.0

$ in millions

Copyright © 2003-2009 Economic Value Advisors

22

Carlton doesn’t make the same mistake twice

Year 3 Highlights

Turns around business

Successfully integrates merger

Focuses on Economic Value

Searches for seller with less business savvy

C.C. acquires Billy’s Mowing Service

Acquisition Highlights

Billy’s Mowing Service

Not his core competency

Billy wants a business more suited for his size

Billy McGuire mowing his last lawn

Copyright © 2003-2009 Economic Value Advisors

23

Economic Value strikes the right balance between value drivers

Compensation tied to Economic Value ensures the right behavior

Sales

EBIT

NOPAT

NOPAT Margin

Capital

Return on Capital

Base

Business

$2,500

$625

$375

15%

$1,500

25%

Cost of Capital

Capital Charge

Economic Value

10%

- $150

$225

+

New

Business

$2,000

$167

$100

5%

$500

20%

10%

- $50

$50

=

Total

Business

$4,500

$792

$475

10.6%

$2,000

23.8%

10%

- $200

$275

Copyright © 2003-2009 Economic Value Advisors

24

Benchmarking – Catalyst Health Solutions

NOPAT Margins are not the only way to create value for shareholders

Revenue and Revenue Growth

3,000.0

2,500.0

2,000.0

1,500.0

1,000.0

500.0

0.0

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Although Catalyst’s NOPAT Margin has been declining, the company’s capital efficiency has been a major contributor to its rise in Economic Value.

Catalyst’s ability to increase capital turns seem to be driven by a strong capability in valuing acquisitions and post-acquisition integration, which has resulted in strong Revenue and NOPAT growth while maintaining discipline in the amount of capital invested.

2003 2004 2005

Revenue

2006 2007

Revenue Growth

2008

$ in millions

Return on Capital - Drivers

4.0%

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

(0.5%)

0.00x

2.00x

4.00x

2005

2003

2006

2004

2007 2008

9.1% Avg. Cost of

Capital

6.00x

8.00x

10.00x

12.00x

14.00x

Capital Turns

Size of bubble is based on Revenue

$60.0

$50.0

$40.0

$30.0

$20.0

$10.0

$0.0

-$10.0

-$20.0

-$30.0

-$40.0

$ in millions

NOPAT, Capital Charge, Economic Value

2003 2004

Capital Charge

2005 2006

NOPAT

2007 2008

Economic Value

$25.0

$20.0

$15.0

$10.0

$5.0

$0.0

Copyright © 2003-2009 Economic Value Advisors

25

All performance measures cascade into Economic Value

Copyright © 2003-2009 Economic Value Advisors

26

How a Forklift Driver ‘drives’ Economic Value

Cultivating ownership accountability right down to the shop floor

Forklift Driver - “As inventory gets closer to shop floor, the capital charge on inventory is reduced …

… and warehouse space can be consolidated to reduce the overall invested capital, … which directly increases a company’s Economic Value

Copyright © 2003-2009 Economic Value Advisors

27

Economic Value is fundamental to a VBM business philosophy

A VBM philosophy requires an operating measure that …

…captures all operating measures …

Margins

IRR

EBIT

Capital Turns

Market Share

Returns

Production

EPS

NPV

Sales

Cash Flow

Etc …

Copyright © 2003-2009 Economic Value Advisors

… is used in every aspect of business …

Acquisition Analysis

Performance Measurement

Incentive Compensation

Financial Planning

Communication

Goal Setting

Operating Decisions

Strategic Planning

… binds functions with a common language

Finance

Human Resources

Operations

Sales & Marketing

… most importantly, is directly tied to shareholder value

28

Sections:

1.

2.

Defining Value Based Management

Economic Value - creating value

3.

Executive Pay for Performance

4.

Shareholder/Management alignment

3.

Executive Pay for Performance

Objectives:

Review overall structure of a Value Based Management incentive compensation

Present parameters of the compensation design

Apply @Risk to calibrate an effective incentive system

Copyright © 2003-2009 Economic Value Advisors

Traditional incentive plans are poorly structured

Bonus

$36,000

Maximum

$30,000

Target

Bonus

$24,000

Threshold

2.

No

Incentive

80%

Threshold

3.

Achieving

100% of

Goal

120%

Maximum

2.

No Incentive

1.

2.

3.

4.

Wrong performance measures or too many conflicting measures

Threshold and caps that result in year-end “sand bagging” and budget negotiations, which incent mediocrity

Targets are independent of shareholder value

Each year is independent of other years, leading to short-term thinking

1.

Performance

Copyright © 2003-2009 Economic Value Advisors

30

Value Based Management (VBM) Incentive Plan

Bonus Declared

Use the right measure of performance

No limits

Bonus reserve

Multi-year targets based on improvement (3 years)

4.

Target Bonus

Bonus

Bonus

Reserve

Bonus

Reserve

3.

1/3 of the remaining bonus reserve is paid

Up to 100% of the

Target Bonus is paid

Interval

$x,xxx,xxx

2.

5% probability of Zero

Cumulative Bonus over 3 years

EVI Target

$x,xxx,xxx

Economic Value Improvement (EVI) Excess

= Actual EVI – EVI Target

= Actual EVI - $x,xxx,xxx

1.

Copyright © 2003-2009 Economic Value Advisors

31

Economic Value Improvement (EVI) Target

Bonus Declared

The Economic Value Improvement (EVI)

Target is the EVI required to get a shareholder return on the Market Value, equal to the cost of capital.

Bonus

Reserve

Bonus

Bonus

Reserve

Target Bonus

1/3 of the remaining bonus reserve is paid

Up to 100% of the

Target Bonus is paid

Interval

$8,500,000

5% probability of Zero

Cumulative Bonus over 3 years

EVI Target

$820,000

Economic Value Improvement (EVI) Excess

= Actual EVI – Expected EVI

= Actual EVI - $820,000

1.

Copyright © 2003-2009 Economic Value Advisors

32

Estimating the Economic Value Improvement (EVI) Target

EVI target is derived by determining the Growth Value (GV)

1.

Market Value (MV) of the company is determined by taking the market value of the equity and debt. For a private company, we add the discounted future Economic Value to ending capital or discount the Free Cash

Flows. In either case, we get the same answer.

2.

Operations Value (OV) is determined by assuming the current Economic

Value stays constant into perpetuity (Economic

Value ÷ Cost of Capital) and then we add the capital invested. This represents the value of the company if no additional growth is expected.

3.

Growth Value (GV) is determined by simply subtracting the COV from the Market Value of the business. FGV represents the expected

Economic Value

Improvement imbedded in the Market Value of the

Company

4.

Economic Value

Improvement (EVI)

Target is the constant

Economic Value

Improvement needed to get a return equal to the cost of capital on the GV and hence the Market

Value.

Market Value

(MV)

$473.3 million

GV = MV – OV

Economic Value

÷ Cost of Capital

$ 365.0 million

Capital

$18.1 million

GV

$90.2 million

OV

$383.1 million

EVI

$820,000

EVI

$820,000

EVI

$820,000

GV x Cost of Capital = $9.02 million.

For every dollar of EVI there is an additional $11 of value created to shareholders ($1 + 1/10%). By dividing $9.02 million by the $11, management is required to generate approximately $820,000 dollars of EVI annually.

Copyright © 2003-2009 Economic Value Advisors

33

Economic Value Improvement (EVI) Target – Benchmarking against peers

The Estimated EVI Target is further supported by peer analysis

3 Yr Economic Profit Improvement as % of Gross Profit

8.0%

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

20% 30% 40% 50% 60% 70% 80%

An EVI Target of $820,000 for our Client, based on a

Discounted Economic Value Valuation, represents

0.8% of Gross Profit and lies within the 29 th percentile among our Client peers.

Based on peer analysis the EVI Target as a % of

Gross Profit should fall within the 75 th and 50 th percentile or 6.7% and 4.0%, respectively.

As a result, the estimated EVI Target falls below the range of $5.3 million and $3.2 million range, assuming $97.9 million in Gross Profit at the end of

2008.

An EVI target at the 29 th percentile is justified (under the proposed total compensation design, i.e. interval, target bonus, bonus reserve) based on future growth prospects of the industry, simulation results, and the other factors.

Copyright © 2003-2009 Economic Value Advisors

34

Interval

The interval helps establish a balance between strong incentives, limited retention risk, and reasonable shareholder cost by providing exceptional pay for outstanding performance, average pay for expected performance, and below average pay for poor performance.

Bonus

Steeper slope increases risk

(small interval)

Bonus

Reserve

Bonus Declared

Target Bonus

Flatter slope decreases risk

(larger interval)

1/3 of the remaining bonus reserve is paid

Up to 100% of the

Target Bonus is paid

Bonus

Reserve

Interval 1

$8,500,000

2.

5% probability of Zero

Cumulative Bonus over 3 years

EVI Target

$820,000

Economic Value Improvement (EVI) Excess

= Actual EVI – Expected EVI

= Actual EVI - $820,000

1. Interval will change at a constant ratio to Target Bonus. If Target Bonus does not change, then the interval will stay constant.

Copyright © 2003-2009 Economic Value Advisors

35

Economic Value Interval - bottom up approach

Monte Carlo analysis confirms our analysis – using a bottom up approach

Using various distributions per driver of Economic Value we can simulate various combinations of assumptions to come up with a range of

Economic Value and valuation results.

In the case of our Client, a triangle distribution was used for the key drivers of value.

MONTE CARLO SIMULATION

LTM

12/31/08 12/31/09 12/31/10

Growth Phase

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15

Transition Phase

12/31/16 12/31/17

Stable Growth

12/31/18 Continuing Value

Sales

Sales Growth

Triangle Distribution Min

M. Likely

Max

NOPAT

NOPAT Margins

Triangle Distribution Min

M. Likely

Max

Capital

Capital Charge

Capital Turns

Triangle Distribution Min

M. Likely

Max

Cost of Capital

Triangle Distribution Min

M. Likely

Max

Return on Capital

Triangle Distribution Min

M. Likely

Max

Spread

Economic Value

Economic Value Check

Discount Rate

PV of Economic Value

Terminal Value

NOPAT / Economic Value Growth

Median

Standard Dev

Minimum

Maximum

1.8%

7.5%

0.0%

0.0%

9.1%

$1,042

(1.8%)

---

---

---

$37.7

3.6%

---

---

---

$12.1

(1.2)

85.8x

---

---

---

10.0%

---

---

---

310.4%

---

---

---

300.4%

$36.5

0.0000

1.00x

---

$810.2

(22.3%)

(24.1%)

(20.1%)

(12.1%)

$970.4

19.8%

8.3%

15.0%

32.6%

$1,083.0

11.6%

7.7%

13.0%

24.6%

$1,223.2

13.0%

7.1%

11.5%

19.7%

$1,339.8

9.5%

6.7%

10.3%

16.5%

$1,527.0

14.0%

6.5%

10.3%

16.2%

$1,688.5

10.6%

6.3%

10.3%

15.9%

$1,855.9

9.9%

6.2%

10.3%

15.6%

$2,128.9

14.7%

6.0%

10.2%

15.3%

$2,279.2

7.1%

5.9%

10.2%

15.0%

$21.9

2.7%

1.8%

4.2%

7.9%

$17.2

(1.6)

47.0x

43.8x

46.1x

50.7x

9.5%

9.0%

10.0%

11.0%

127.3%

---

---

---

$51.4

5.3%

1.8%

4.2%

7.9%

$32.8

(3.2)

29.6x

22.9x

25.6x

32.5x

9.8%

9.0%

10.0%

11.0%

156.9%

---

---

---

$54.0

5.0%

0.1%

3.7%

8.4%

$41.3

(4.3)

26.2x

11.0x

25.6x

32.5x

10.4%

9.0%

10.0%

11.0%

130.8%

---

---

---

$43.8

3.6%

(0.3%)

3.6%

8.4%

$52.0

(5.1)

23.5x

11.0x

25.6x

32.5x

9.8%

9.0%

10.0%

11.0%

84.2%

---

---

---

($4.5)

(0.3%)

(1.4%)

3.4%

8.6%

$49.2

(4.8)

27.2x

11.0x

25.6x

32.5x

9.7%

9.0%

10.0%

11.0%

(9.1%)

---

---

---

$48.7

3.2%

(0.8%)

3.0%

7.4%

$70.5

(7.3)

21.7x

11.0x

25.6x

32.5x

10.4%

9.0%

10.0%

11.0%

69.1%

---

---

---

$39.4

2.3%

(0.2%)

2.6%

6.1%

$83.6

(9.1)

20.2x

11.0x

25.6x

32.5x

10.8%

9.0%

10.0%

11.0%

47.1%

---

---

---

$37.7

2.0%

0.3%

2.2%

4.8%

$101.1

(9.9)

18.4x

11.0x

25.6x

32.5x

9.8%

9.0%

10.0%

11.0%

37.3%

---

---

---

117.8%

$20.3

0.0000

Outputs

0.91x

$18.5

MVA

$284.7

147.2%

$48.2

0.0000

0.83x

$40.1

120.4%

$49.7

0.0000

0.75x

$37.4

74.4%

$38.7

0.0000

0.69x

$26.6

(18.9%)

($9.3)

0.0000

0.62x

($5.8)

Inputs

Legend

Stats

Tot End Capital Intrinsic Value

$42.9

$327.6

Inputs / Outputs

Valuation

Debt & Equiv.

Equity Value

0.0

$327.6

58.7%

$41.3

0.0000

0.57x

$23.4

36.3%

$30.4

0.0000

0.51x

$15.5

27.5%

$27.8

0.0000

0.47x

$12.9

45.6%

$35.5

0.0000

0.42x

$15.0

Shares Out.

Shares Price Current Price xpected Return

0.003890

$84,227.79

$35.37

238033.4%

23.4%

$23.1

0.0000

0.38x

$8.9

$43.4

2.0%

0.9%

1.8%

3.6%

$77.9

(7.9)

27.3x

11.0x

25.6x

32.5x

10.2%

9.0%

10.0%

11.0%

55.8%

---

---

---

$32.9

1.4%

1.4%

1.5%

2.3%

$98.6

(9.8)

23.1x

11.0x

25.6x

32.5x

9.9%

9.0%

10.0%

11.0%

33.3%

---

---

---

$2,479.5

8.8%

5.7%

10.2%

14.7%

$28.7

1.2%

1.0%

1.0%

2.1%

$87.5

(8.8)

28.3x

11.0x

25.6x

32.5x

10.1%

9.0%

10.0%

11.0%

32.8%

23.0%

25.0%

33.0%

22.7%

$19.8

0.0000

4.65x

$92.3

Copyright © 2003-2009 Economic Value Advisors

36

Economic Value Interval - bottom up approach

Based on driver assumptions – average bonuses will be at target bonus

0.07

0.06

0.05

0.04

0.03

0.02

0.01

0.00

5.0%

Total Bonus Declared / 3 years

0.40

6.58

90.0% 5.0%

Total Bonus Declared / 3 years

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

-1.5039

8.9568

3.2505

1.8679

0.9263

1.9816

4.6581

5.9192

5000

0.09

0.08

0.07

0.06

0.05

0.04

0.03

0.02

0.01

0.00

5.0%

Bonus Paid and Earned / 3 years

1.40

4.41

90.0% 5.0%

Bonus Paid and Earned / 3 years

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

0.0784

6.0677

2.8869

0.9075

1.7103

2.2746

3.5336

4.1037

5000

0.04

0.03

0.02

0.01

0.00

0.07

0.06

0.05

5.0%

Total Bonus Declared / 5 years

1.22

9.82

90.0% 5.0%

Total Bonus Declared / 5 years

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

-0.8087

12.9219

5.3890

2.5640

2.0492

3.6123

7.2499

8.9472

5000

0.08

0.07

0.06

0.05

0.04

0.03

0.02

0.01

0.00

5.0%

Bonus Paid and Earned / 5 years

3.04

7.03

90.0% 5.0%

Bonus Paid and Earned / 5 years

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

1.4330

9.6208

5.0374

1.2136

3.4454

4.1723

5.8758

6.6074

5000

Copyright © 2003-2009 Economic Value Advisors

37

Bonus Declared, Bonus Reserve, and Bonus Earned/Paid

Bonus Declared

The Bonus Declared provides the starting point in determining the bonus earned/paid and the amount left in the bonus reserve to ensure short-term performance wasn’t made at the expense of long-term shareholder value.

Target Bonus

Bonus

Bonus

Reserve

3.

1/3 of the remaining bonus reserve is paid

Up to 100% of the

Target Bonus is paid

Bonus

Reserve

Interval

$8,500,000

5% probability of Zero

Cumulative Bonus over 3 years

EVI Target

$820,000

Economic Value Improvement (EVI) Excess

= Actual EVI – Expected EVI

= Actual EVI - $820,000

Copyright © 2003-2009 Economic Value Advisors

38

Simulating Ownership

Manage short-term demands while delivering long-term results.

"Companies perform better when all important parties

- management, employees, and directors - have the incentive of ownership in the business."

- George R. Roberts, Co-Founder of KKR

Bonus

Declared

Target Bonus

A Share of the

Improvement in Economic Value

Copyright © 2003-2009 Economic Value Advisors

Bonus

Reserve

Beginning Balance

Current Year's

Bonus Declared

Bonus

Paid

100% up to

Target Bonus

1/3 of Any

Remaining Balance

39

Bonus Declared

Strong incentive for yearly as well as cumulative long-term performance

It is best to look at a Value Based Management incentive system in terms of a multi-year period (i.e. cumulative 3 year bonuses), where long-term performance is the objective versus year to year performance.

Nevertheless, from a year to year bases there is a healthy balance of receiving an approximate 1x bonus in each of the years by creating expected returns to shareholders, while having strong incentive to exceed those expectations and deliver outstanding results.

0.06

0.05

0.04

0.03

0.02

0.01

0.00

2009

5.0%

Total Bonus Declared / 2009

-0.71

3.02

90.0% 5.0%

Total Bonus Declared / 2009

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

-1.4469

4.2094

0.9624

1.1268

-0.4087

0.2162

1.8551

2.6171

5000

0.08

0.07

0.06

0.05

0.04

0.03

0.02

0.01

0.00

2010

5.0%

Total Bonus Declared / 2010

-1.06

4.08

90.0% 5.0%

Total Bonus Declared / 2010

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

-3.6531

6.5299

1.4045

1.5719

-0.5560

0.3541

2.5308

3.5766

5000

0.04

0.03

0.02

0.01

0.00

0.07

0.06

0.05

2011

5.0%

Total Bonus Declared / 2011

-2.60

4.37

90.0% 5.0%

Total Bonus Declared / 2011

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

-5.4074

7.1782

0.8107

2.1206

-1.9349

-0.6484

2.3432

3.6632

5000

Copyright © 2003-2009 Economic Value Advisors

40

Bonus Reserve – 3 year ending balance

There is a expected balance of 0.20x multiple left in reserve by the 3 rd year

0.30

0.25

0.20

0.15

0.10

0.05

0.00

5.0%

Bonus Reserve (Ending) / 3 years

-1.71

2.45

90.0% 5.0%

Bonus Reserve (Ending) / 3 years

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

-3.8026

4.1188

0.2082

1.1801

-1.1381

0.0000

1.1648

1.9646

5000

The expected bonus reserve after three years is

0.20x, which will provide a decent buffer in case of an atypical bad year.

There is a 25% chance of having zero balance in the reserve at the end of three years.

The most frequent occurrence is a zero balance in the bonus reserve, which means that the bonus paid is fully warranted by cumulative EVI improvement.

There is only a 5% probability of having a negative 1.71x bonus reserve in the 3 rd year.

Copyright © 2003-2009 Economic Value Advisors

41

Sections:

1.

2.

Defining Value Based Management

Economic Value - creating value

3.

Executive Pay for Performance

4.

Shareholder/Management alignment

4.

Shareholder/Management Alignment

Objectives:

Understand how to quantify the alignment of management and shareholder self interests

Introduce the concept of Wealth Leverage as the measure of

Shareholder/Management alignment

Review Client’s Wealth Leverage under the proposed compensation design

Copyright © 2003-2009 Economic Value Advisors

Wealth Leverage – aligning Management and Shareholder self interests

Healthy balance between short-term results and long-term performance

10.0%

7.6%

Management

Wealth

Shareholders

Wealth

-7.6%

Wealth Leverage quantifies how strongly Shareholder and Management self interests are aligned. Wealth Leverage measures how much management’s total long-term wealth will rise or fall for every 1% rise or fall in

Shareholder’s long-term wealth.

In the case of our Client, for every 10.0% increase in Shareholder wealth management’s long-term total wealth will increase 7.6%.

Too high a Wealth Leverage may encourage unnecessary risk taking, while too low a wealth leverage provides week shareholder/management alignment. A Wealth Leverage that fall between 50-100% alignment provides the right incentive 1 .

- 10.0%

Wealth Leverage

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

0%

Wealth leverage above the line may encourage management to incur too much risk

20% 40% 60%

Shareholder Wealth Change

Wealth leverage below the line

The optimal Wealth Leverage falls within a range of 50% - 100% provides week shareholder/management alignment

80% 100%

Optimal Wealth Leverage - Lower Limit Optimal Wealth Leverage - Upper Limit Total Wealth Leverage

1. Stephen F. O'Byrne and S. David Young, "Top Management Incentives and Corporate Performance," Journal of

Copyright © 2003-2009 Economic Value Advisors

Applied Corporate Finance (Winter 2005) 43

Wealth Leverage – Monte Carlo Simulation

Bonus Wealth Leverage falls within a range that provides optimal incentive

0.07

0.06

0.05

0.04

0.03

0.02

0.01

0.00

5.0%

Wealth Leverage / 3 year

1.1652

1.2271

90.0% 5.0%

Wealth Leverage / 3 year

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

1.1378

1.2501

1.1995

0.0189

1.1719

1.1848

1.2120

1.2218

5000

0.07

0.06

0.05

0.04

0.03

0.02

0.01

0.00

5.0%

Wealth Leverage / 5 year

1.1652

1.2271

90.0% 5.0%

Wealth Leverage / 5 year

Minimum

Maximum

Median

Std Dev

10%

25%

75%

90%

Values

1.1378

1.2501

1.1995

0.0189

1.1719

1.1848

1.2120

1.2218

5000

The 3 and 5 year Wealth Leverage for the total bonus declared is 119.9%. As to be expected, the 3 and 5 year should equal.

The total Wealth Leverage is then the weighted average of the bonus and salary. Since salary is for the most part independent of performance, the

Wealth Leverage for salary is zero.

Compensation

Bonus

Salary

Total Wealth Leverage

Wealth

Leverage

119.9%

0.0%

% of Total

Comp

63.9%

36.1%

Weighted

Average

76.7%

0.0%

76.7%

Client’s Wealth Leverage is 76.7%, which fall within the optimal range of 50-100%, providing a healthy balance of management/shareholder alignment and incentive to take intelligent risks.

Copyright © 2003-2009 Economic Value Advisors

44