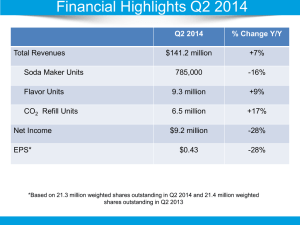

This item excludes: 1. Change in debt 3. Dividends

advertisement