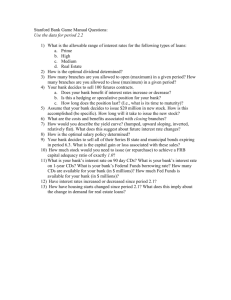

Can Structural Models Price Default Risk? Comments on: Stephen M Schaefer

advertisement

Comments on: Can Structural Models Price Default Risk? Evidence from Bond and Credit Derivative Markets by Jan Ericsson, Joel Reneby and Hoa Wang Stephen M Schaefer London Business School Moody’s Corporation & The Salomon Centre, NYU Stern School of Business THIRD CREDIT RISK CONFERENCE New York, 16-17 May 2006 What does the paper find? 1. Leland Toft model: 9 prices CDS reasonably well (on average) 9 but … underestimates bond spreads (> CDS premia) 2. Leland model and Fan Sundaresan model do less well. 3. Liquidity effect: 9 errors in bond spreads: sensitive to liquidity factors 9 errors in CDS: less sensitive to liquidity factors Comments on Ericsson, Reneby & Wang 2 Why I liked the paper • Shows us that despite a poor press so far (at least one) structural model has the potential to explain (at least some) prices • Good news … (personal view) since structural models allow us to understand more easily relation between credit risk and fundamental company information on assets, asset risk and capital structure Comments on Ericsson, Reneby & Wang 3 Comments: The data • Sample is quite small: 9 includes only 731 bond-CDS price pairs from 71 entities 9 56% Baa; 26% A • Bonds and CDS not maturity matched 9 complicates interpretation of differences in pricing performance Comments on Ericsson, Reneby & Wang 4 Asset Volatility Parameter • Asset vol. estimates: 9 9 27% [for Leland Toft] 31% [for Leland / Fan Sundaresan] • Own recent work with Strebulaev (and some previous work by others) suggests this may be a somewhat high M ean M ean M ean All AAA 0.34 0.33 0.22 BB B CCC 0.08 AA A BBB Quasi-M arket Leverage 0.16 0.28 0.38 0.52 0.71 0.80 0.23 EquityVolatility 0.26 0.29 0.32 0.43 0.63 0.77 0.22 Estimated Asset Volatility 0.21 0.21 0.21 0.24 0.28 0.34 Comments on Ericsson, Reneby & Wang 5 and credit exposure highly sensitive to asset volatility (Leland-Toft Model; parameters as in Leland (2005)) 0.250 Default Prob w . Asset Vol =23% Moody's Default Prob. BBB 1970-2005 Default Prob w . Asset Vol = 27% Default Probabiity 0.200 0.150 0.100 0.050 0.000 0 5 10 15 20 Horizon Comments on Ericsson, Reneby & Wang 6 Why is there a difference in success of model in explaining CDS vs. Bond spreads? • Model: 9 No interest rate uncertainty so, for given maturity, model will give CDS premium and bond spread that are identical. 9 So differences in model premia / spreads in Table 4 due to: – Maturity differences between CDS (ave. 4.4 years) and bonds (ave. 9.4 years) – CDS premium in model assumed continuous • For given maturity, since model prices are the same, difference in errors between bond spread and CDS premia is just equal to (minus) CDS basis in data Comments on Ericsson, Reneby & Wang 7 CDS vs. Bond Spreads • In practice, i.e., with uncertain interest rates, triangular arbitrage between CDS, risky debt and defaultable debt does not hold exactly But • .. holds approximately and market practitioners will intervene when basis diverges too much from zero (adjusting for repo rate, funding costs etc.) • and .. relevant “riskless rate” will be swap rate rather than Treasury rate ⎛ Difference ⎞ ⎜ in errors ⎟ = [Y − Treas] − CDS ⎝ ⎠ = [144 Y − Swap ]−CDS Swap −Treas 244 3 + [14 4244 3] - CDS basis changes over time Comments on Ericsson, Reneby & Wang 8 Difference in pricing errors: Bond Spread to Treasury – CDS Premium (Credit Rating – A) 120 100 basis points 80 60 40 Bond/Treas Spread - CDS (lhs) 20 0 Jan-99 Jul-99 Jan-00 Jul-00 Comments on Ericsson, Reneby & Wang Jan-01 Jul-01 Jan-02 Jul-02 Jan-03 Jul-03 9 … compared to Swap / Treasury Spread (5 Years) 120 100 basis points 80 60 40 Bond/Treas Spread - CDS (lhs) Swap Treas Spread (lhs) 20 0 Jan-99 Jul-99 Jan-00 Jul-00 Comments on Ericsson, Reneby & Wang Jan-01 Jul-01 Jan-02 Jul-02 Jan-03 Jul-03 10 Implications ⎛ Difference ⎞ Y − Swap Swap −Treas ]−CDS ⎜ in errors ⎟ = [144 244 3 + [14 4244 3] ⎝ ⎠ -CDS basis ≈0 changes over time • Difference in average error for bond spreads and CDS most likely due to measurement of bond spreads against Treasuries rather than against swaps. • Measured against swaps, model would probably explain bond spreads and CDS premia about equally well. • Liquidity exposure of CDS probably more similar to bond spreads vs. swaps than bond spreads vs. Treasuries. • And …. strongly endorse basic message: second generation structural models have great potential to help us understand credit risk pricing Comments on Ericsson, Reneby & Wang 11