Does Competition Reduce Price Discrimination? New Evidence from the Airline Industry No. 07‐7

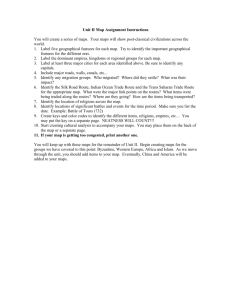

advertisement