Concepts Review for the Second Exam on Wednesday, November... Basic Insuring Principles: Principle of Indemnity

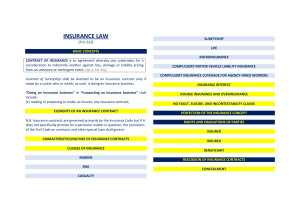

advertisement

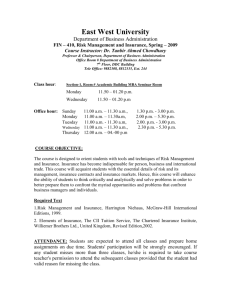

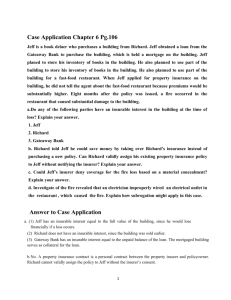

Concepts Review for the Second Exam on Wednesday, November 18 2009 Basic Insuring Principles: Principle of Indemnity Proximate cause of loss Peril Adverse selection Definition of Insurance --- as a financial loss sharing arrangement Subrogation Insurable interest Utmost Good Faith Contract is both unilateral and one of adhesion Statutory purpose of insurance reserving and policyholder surplus How interest rate risk impacts insurance operations Insurance Demutualization How an insurer might deal with interest rate risk –e.g. rising interest rate environment shorten asset maturity structure, consider a short hedge; decreasing interest rate environment locking in a long, fixed rate, consider a long hedge Entire Contract Provision Sections to the Insurance Contract --- Declarations, Insuring Agreements, Exclusions, Conditions, Application What is required for an insurance policy to exist --- offer, acceptance, consideration, competent parties, legal form Conditions that may give rise to the denial of a claim Did the insurance policy come into existence? Is the insurance contract voidable? Concealment or misstatement of a material fact Is the claim specifically excluded in the policy? Was there insurable interest? Was insurable interest shown when required [e.g. life insurance – at inception of the contract, auto, home, casualty insurance – time of loss] What insurance contract provision might limit the amount of the payment of a claim? Methods for paying claims under the contract --- Actual Cash Value, Cost to Repair or Replace, valued amount specified in the policy [e.g. $1,000 limit in HO policy on loss of Silverware due to theft] Special Insurance Features that govern settlement Was the policy written on occurrence based or claims made underwriting? In the case of life insurance, has the policy been in existence beyond the 2 year incontestability period? How does the exclusion section of an all-risk policy seek to define the insurance coverage? Different Types of Insurer Reserves --- IBNR [Incurred But Not yet Reported Reserves], Unearned Premium Reserves [particularly important when looking at the volume of business for a small insurer rationale for use of reinsurance. Advantages and Disadvantages of centralized versus decentralized claim settlement processes for an insurer An understanding of those provisions within the insurance contract that reinforce the principle of indemnity when settling claims --- Actual Cash Value, Insurable Interest, Subrogation, Exclusions, Appraisal, Conditions when seeking settlement --- proof of loss, immediate notice, cooperation The Role of Independent Agents, Insurance Brokers and Independent Claims Adjusters to sn insurers operations. The difference between insurance operations and investment operations within an insurance company] The main difficulty encountered in applying rating factors to determine credible premiums The different rate making methods --- Pure Loss Premium Method, Loss Ratio Method, Judgment Method What might constitute a material misrepresentation for home, auto and life insurance policies? What are the conditions that must exist in order for one to be legally liable and covered by insurance? Civil not criminal wrong Failure to do something a reasonable person would do or do something a reasonable person would not do – which causes injury to another. Breach of contract