Course Instructor: Dr. Tanbir Ahmed Chowdhury

advertisement

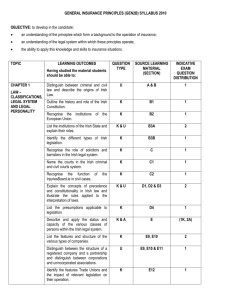

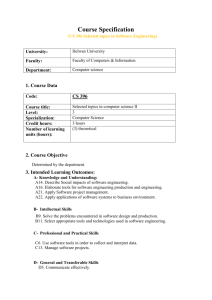

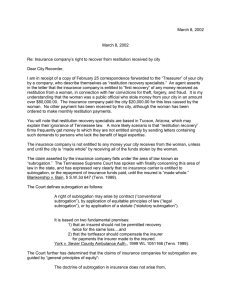

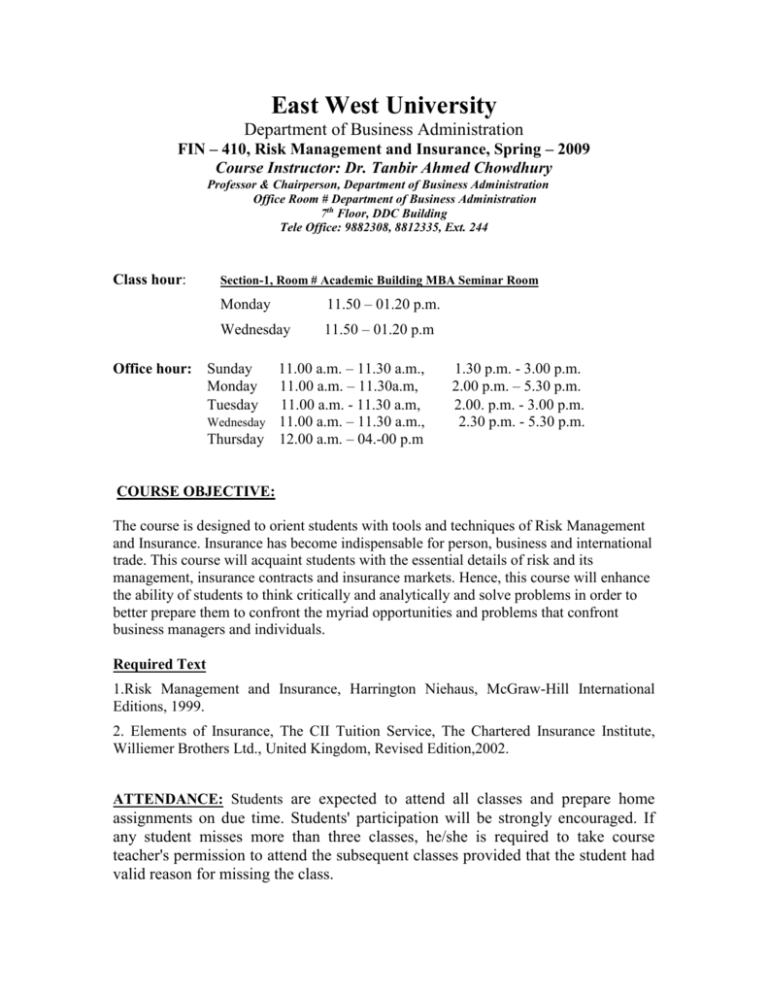

East West University Department of Business Administration FIN – 410, Risk Management and Insurance, Spring – 2009 Course Instructor: Dr. Tanbir Ahmed Chowdhury Professor & Chairperson, Department of Business Administration Office Room # Department of Business Administration 7th Floor, DDC Building Tele Office: 9882308, 8812335, Ext. 244 Class hour: Section-1, Room # Academic Building MBA Seminar Room Monday 11.50 – 01.20 p.m. Wednesday 11.50 – 01.20 p.m 11.00 a.m. – 11.30 a.m., 11.00 a.m. – 11.30a.m, 11.00 a.m. - 11.30 a.m, Wednesday 11.00 a.m. – 11.30 a.m., Thursday 12.00 a.m. – 04.-00 p.m Office hour: Sunday Monday Tuesday 1.30 p.m. - 3.00 p.m. 2.00 p.m. – 5.30 p.m. 2.00. p.m. - 3.00 p.m. 2.30 p.m. - 5.30 p.m. COURSE OBJECTIVE: The course is designed to orient students with tools and techniques of Risk Management and Insurance. Insurance has become indispensable for person, business and international trade. This course will acquaint students with the essential details of risk and its management, insurance contracts and insurance markets. Hence, this course will enhance the ability of students to think critically and analytically and solve problems in order to better prepare them to confront the myriad opportunities and problems that confront business managers and individuals. Required Text 1.Risk Management and Insurance, Harrington Niehaus, McGraw-Hill International Editions, 1999. 2. Elements of Insurance, The CII Tuition Service, The Chartered Insurance Institute, Williemer Brothers Ltd., United Kingdom, Revised Edition,2002. ATTENDANCE: Students are expected to attend all classes and prepare home assignments on due time. Students' participation will be strongly encouraged. If any student misses more than three classes, he/she is required to take course teacher's permission to attend the subsequent classes provided that the student had valid reason for missing the class. Penalty for Cheating by Students in Examinations As per East West University rules “There is zero tolerance for cheating at EWU. Students caught with cheat sheets in their possession, whether used or not used, & / or copying from cheat sheets, writing on the palm of hand, back of calculators, chairs or nearby walls, etc. would be treated as cheating in the exam hall. The only penalty for cheating in the exam hall is expulsion from EWU." Course Contents: This course will cover the following topics: Scope of Insurance Marine Insurance Classification of Marine Insurance Types of Marine Policies Fire Insurance Types of Fire Insurance Accident Insurance Theft, Fidelity Guarantee, Glass, Live Stock, Credit, Motor. Engineering Insurance Insurance of the Person Personal accident and sickness insurance Ordinary Life Assurance- Term, Whole life, Endowment, Annuity. Other policies based on Term, Whole life, Endowment, Annuity. Risk and its Management Risk Different Meanings of Risk Comparison of Pure Risk and its Management with other types of Risk. Risk Management The Risk Management Process Losses from Pure Risk Risk Management Methods Risk Measurement and Risk Pooling The Pervasiveness of Risk Basic Concepts from Probability and Statistics Random Variables and probability Distributions Characteristics of Probability Distributions Expected Value Variance and Standard Deviation Sample Mean and Sample Standard Deviation Risk Reduction through Pooling Independent Looses Elements of Insurance: Principles Insurable Interest Law of Contract Subject Matter of Insurance Contracts Essential features of insurable interest Application of Insurable Interest to different types of insurance Principles of Indemnity, Subrogation and Contribution General features of Indemnity Distinction between Insurance and Wagering Indemnity applied to various branches of insurance Subrogation How Subrogation arises When Subrogation arises Extent of Subrogation Ex gratia payments Principles of Utmost Good Faith Duty of disclosure Material facts Representations Breaches of Utmost Good Faith Void Voidable and unenforceable contracts Course Evaluation The distribution of total marks of 100 will be as follows: 1.Quizzes 15 percent 2. Assignments 10 percent 3. Class Performance 10 percent 4. Fist Mid-term Examination 20 percent 5. Second Mid-term Examination 20 percent 6. Final Examination 25 percent Total 100 percent Grading Policy: Guideline for converting numerical scores to letter grades: Numerical Scores (in %) Letter Grades 97 - 100 A+ 90 - below 97 A 87 - below 90 A- 83 - below 87 B+ 80 - below 83 B 77 - below 80 B- 73 - below 77 C+ 70 - below 73 C 67 - below 70 C- 63 - below 67 D+ 60 - below 63 D - below 60 F Examination Particulars Date Examination February 18, 2009. First Mid-Term March 18, 2009. Second Mid-Term April 29, 2009 Final