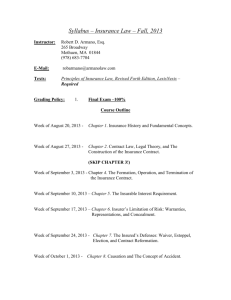

Risk Management & Insurance: Types, Handling, Business Coverage

advertisement

Objective 5.02 Understand risk management and insurance. YouTube - Risk is our Business 1 Topics • • • • Types of risk Ways to handle risks Business Insurance Uninsurable risks 2 Risks & Risk Management What is risk? The possibility of incurring a loss. What is risk management? It is a systematic process of managing risk to achieve set objectives. 3 Types of Risk • Different types of risk: Economic and non-economic Pure risk and speculative Controllable risk and uncontrollable Insurable risk and uninsurable 4 Types of Risk -Economic Results in financial loss. Three categories of economic loss: Personal risk – Result in personal losses Property risk – Loss of personal or business property including money, buildings and vehicles. Liability risk – Harm or injury to other people or their property because of your actions. Example: Fred’s Diner incurred a loss due to a fire. 5 Examples of Economic Risks Personal risk – Alex went snowboarding at Snowshoe and broke his leg. The hospital bill was $1400. Property risk – Harding invested in stock market and lost money when his stock’s value dropped. Liability risk – A customer slipped on spilled water in the store aisle before an employee cleaned the spill. 6 Types of Risk Non-economic Risk May result in embarrassment or inconvenience without financial impact. Examples: Requesting customers to move to another check-out lane. Inviting a guy to the Sadie Hawkins Dance 7 Types of Risk • Pure Risk Threat of a loss without an opportunity for gain. Examples: Frost damages your strawberry patch. Mona drives to work every day. 8 Types of Risk • Speculative Risk Offers the chance of gain or loss. Example: Mary opened a shoe store that operated for only six months. 9 Types of Risk Controllable Risk Occurs when conditions can be controlled to lessen the chance of harm. Examples: Sears installed centralized customer service stations in order to increase convenience. Will travels by motorcycle to school, wearing a helmet and leather jacket. 10 Types of Risk • Uncontrollable Risk Cannot be controlled or reduced by your actions. Example: Riding along a highway with other speeding automobiles. You can control your driving but not the other drivers. 11 Ways to Handle Risks • Transfer the risk Allowing someone else to assume the risk. Examples: A book company has a contract for a trucking company to transport its books. Joan rides the bus to work. 12 Insurable Risks • Insurable Risk Meets criteria of an insurance company for coverage. Examples: An artist purchased property insurance to cover his collection. Owner purchased liability insurance for the business. Automobile insurance is purchased to cover liability and property damage risks 13 Unpredictable Risk Unpredictable amount of loss Example: A competitor of Staples, an office supply store, moved right across the street. 14 Ways to Handle Risks Avoid Transfer Insure Assume 15 Ways to Handle Risks • Avoid the risk Declining to engage in particular activities. Example: A book company declines an order to produce 6000 books in one day. Goggle, Inc. declined expanding their business into a new city. Joan does not drive a vehicle for fear of having an accident. 16 Ways to Handle Risks • Transfer - Insure the risk Purchasing insurance to cover risk. Example: General Electric sells insurance to customers to cover their appliances. A book company has a life insurance policy on its key employees. Kyle insures his auto for property damage since he still owes money to the bank. 17 Ways to Handle Risks Example: Mary runs a coffee shop and offers a variety of services. A & G Inc ‘s company vehicle is paid for and dropped the property damage (comprehensive & collision) insurance. Tom signed for a $10,000 loan for new equipment. 18 Business Insurable Risks Businesses share risks with other businesses by purchasing insurance Insure personnel (human resource) Insure property (assets of business) Insure business operations (future income of the business) 19 Business Insurable Risks • Personnel (Labor) Health insurance provides protection against the high costs of individual health care. Disability insurance provides payments to employees who are unable to work for an extended period due to serious illness or injury. Life insurance pays the face amount of the insurance policy upon the death of the insured. 20 Business Insurable Risks- Property Insurance is purchased to protect business from financial loss due to damages to their: Vehicles Buildings Equipment Building contents, including inventory. Perils that could cause a loss Fire, theft, vandalism, hail, smoke, ice, water, windstorm 21 Business Insurable Risks- Business Operations • Protection for business operations that result in accidents, injuries, and property damage. Worker’s Compensation Insurance provides protection for employees who are injured on the job or become ill because of the job. Liability insurance covers damage to property of others by employees at work. 22 Worker’s Comp Most worker’s comp claims require drug testing before payment is made. 23 HEALTH INSURANCE PROVIDERS • Managed Care Plans Health Maintenance Organization (HMO) • Consists of a staffed medical clinic to serve members. Objective-preventive care Members are entitled to a wide range of prepaid health care services, including hospitalization. Preferred Provider Organization (PPO) Provides a group of physicians, a clinic, or a hospital that contract with an insurance company. Providers agree to charge a set fee for services. Members are encouraged but not required to use the PPO services. 24 Uninsurable Risks Some risks are Too expensive for businesses to insure Uninsurable due to nature of risk 25 Examples of Uninsurable Risks Economic conditions Recessionary period in economic cycle Consumer demand Service your business provided is going out of style Actions of competitors Walmart opened near small retail stores taking most of customers Technology changes Old production techniques are replaced by new technology Local factors Large employer closes, employees laid off Business operations Unused tobacco fields due to tobacco lawsuits 26 Insurance Vocabulary Policy - contract between the insurer and insured Premium – cost of insurance Insurer – company offering policy Insured – policyholder who buys a policy 27 Insurance Vocabulary Claim- when policy holder needs insurer to pay for a financial loss Co-pays- the amount the policyholder owes on a health insurance claim Deductible - amount paid by policyholder before insurance pays Face amount- $ value of life insurance policy 28 Health Insurance Coverage • Hospital insurance Classified as medical insurance. Covers for most or all of the charges during a stay in the hospital. • Surgical Insurance Covers all or part of the surgeon’s fees for an operation. 29 Health Insurance Coverage • Regular medical insurance Covers fees for nonsurgical care given in the doctor’s office, the patient’s home, or a hospital. • Major medical insurance Covers cost of extended and specialized care out of the hospital such as medicine and special nursing care. 30 Health Insurance Coverage • Comprehensive Medical Policy Combines the features of hospital, surgical, regular, and major medical insurance. Most common group health insurance policy 31 Health Insurance Coverage Dental Insurance Contains deductible and coinsurance to reduce the cost of premiums. Covers examinations, X rays, cleaning and filling. Covers dental injuries resulting from accidents. Covers part of complicated dental work such as crowns or bridges. 32 Health Insurance Coverage • Vision Care Insurance Covers eye examinations, prescription lenses, frames, and contact lenses. Some plans cover the cost of laser eye surgery that eliminates the need for glasses. 33 HEALTH INSURANCE PROVIDERS Health insurance may be obtained through employer related groups. Options include: Group health insurance Managed care plans Health Maintenance Organizations (HMO) Preferred Provider Organizations (PPO) State Government Programs 34 HEALTH INSURANCE PROVIDERS • Group Health Insurance Most popular way to buy health insurance Companies pay part or all of the premium for their employees 35 HEALTH INSURANCE PROVIDERS • State Government Assistance Workers Compensation provides medical and survivor benefits for people injured, disabled, or killed on the job. Paid for by employer but required by state Department of Labor 36 Life Insurance Principles • Life insurance protects survivors against financial loss associated with death. • Two basic types: Term Permanent 37 Types of Life Insurance Term Life Insurance Provides financial protection from losses resulting from a death during a definite period of time (term). Least expensive form of life insurance. Only life insurance that is purely life insurance without savings and investments. 38 Types of Life Insurance Permanent Life Insurance Lasts a lifetime as long as premium is paid Builds cash value through an investment feature Part of the premium paid is used for insurance that provides protection The insurance company invests part of the premium Examples: whole life, universal life 39 Types of Life Insurance Group Life Insurance Covers a group of people that work together Offers term insurance Employer offers coverage through employer Individual is covered by their employer Ex: Builders Inc. offers employees group term life insurance with a policy face amount of up to 4 times their salary 40