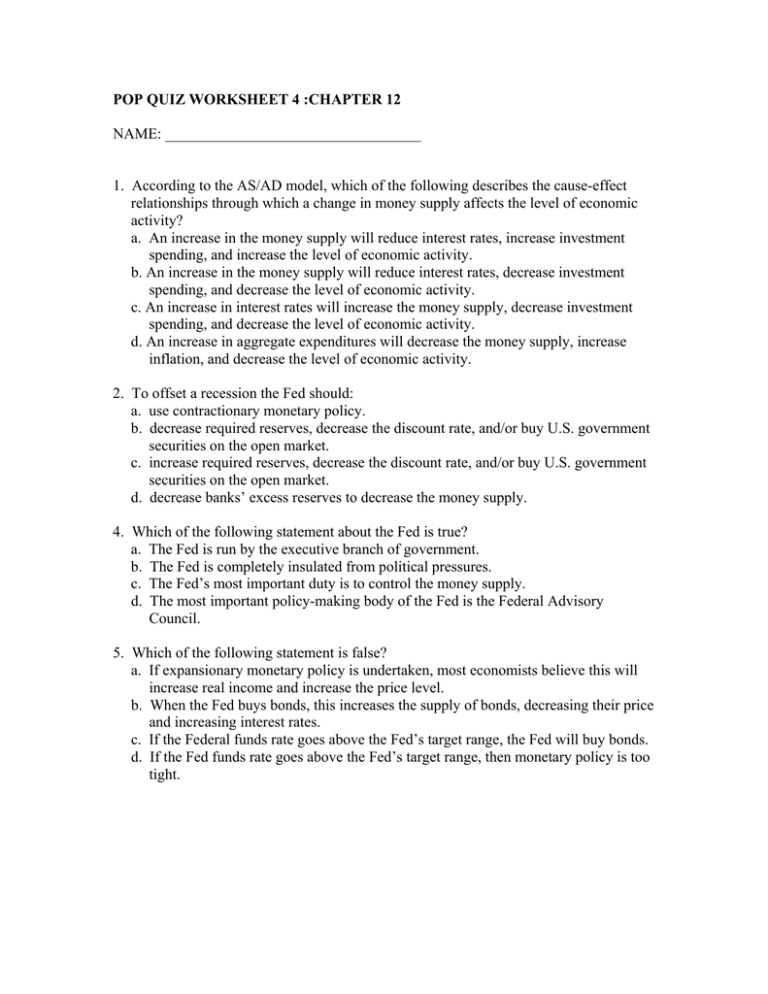

POP QUIZ WORKSHEET 4 :CHAPTER 12 NAME: __________________________________

advertisement

POP QUIZ WORKSHEET 4 :CHAPTER 12 NAME: __________________________________ 1. According to the AS/AD model, which of the following describes the cause-effect relationships through which a change in money supply affects the level of economic activity? a. An increase in the money supply will reduce interest rates, increase investment spending, and increase the level of economic activity. b. An increase in the money supply will reduce interest rates, decrease investment spending, and decrease the level of economic activity. c. An increase in interest rates will increase the money supply, decrease investment spending, and decrease the level of economic activity. d. An increase in aggregate expenditures will decrease the money supply, increase inflation, and decrease the level of economic activity. 2. To offset a recession the Fed should: a. use contractionary monetary policy. b. decrease required reserves, decrease the discount rate, and/or buy U.S. government securities on the open market. c. increase required reserves, decrease the discount rate, and/or buy U.S. government securities on the open market. d. decrease banks’ excess reserves to decrease the money supply. 4. Which of the following statement about the Fed is true? a. The Fed is run by the executive branch of government. b. The Fed is completely insulated from political pressures. c. The Fed’s most important duty is to control the money supply. d. The most important policy-making body of the Fed is the Federal Advisory Council. 5. Which of the following statement is false? a. If expansionary monetary policy is undertaken, most economists believe this will increase real income and increase the price level. b. When the Fed buys bonds, this increases the supply of bonds, decreasing their price and increasing interest rates. c. If the Federal funds rate goes above the Fed’s target range, the Fed will buy bonds. d. If the Fed funds rate goes above the Fed’s target range, then monetary policy is too tight. 6. During an expansionary phase of the business cycle, fiscal and monetary policy can logically be coordinated to: a. run a deficit and increase the money supply. b. run a surplus and increase the money supply. c. reduce government spending, increase taxes, increase the discount rate, increase reserve requirements, and/or sell U.S. government debt on the open market. d. increase government spending, reduce taxes, decrease the discount rate, decrease reserve requirements, and/or buy U.S. government debt on the open market. 7. Which of the following statement is false? a. An increase in the discount rate signals that the Fed wants the money supply tightened. b. When the economy is below full employment, expansionary monetary policy will help boost output. c. The Fed targets interest rates in setting monetary policy. d. Banks earn more profits when they hold more reserves than are required by law. 8. Which of the following statements is true? a. The money multiplier is a relatively stable value that changes very little and only infrequently. b. If expansionary monetary policy leads to an increase in expected inflation, then nominal interest rates will definitely fall. c. The real interest rate equals the nominal interest rate plus expected inflation. d. If the real interest rate is 6 percent and the expected rate of inflation is 4 percent, then the nominal rate of interest will be 10 percent. 9. Which of the following is true concerning the Fed’s tools to change the money supply? a. An increase in the reserve requirement will increase banks’ excess reserves and increase the money multiplier. b. Changing reserve requirements is potentially the most powerful tool and is therefore the tool that is most used. c. Changing the discount rate is the most powerful tool because banks are not that fond of borrowing from the Fed. d. Open market operations refers to the Fed’s buying and selling of U.S. government securities and is the Fed’s most used tool.