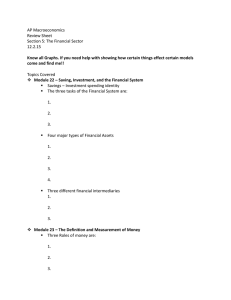

Outline for Midterm 2 I. Savings and Investment (Chapter 13) A.

advertisement

Outline for Midterm 2 I. Savings and Investment (Chapter 13) A. Bonds and Stocks 1. 2. B. National Savings 1. 2. C. How to find the equilibrium Policies that shift supply and demand Finance (Chapter 14) A. Present and Future Value calculations 1. B. Investment decisions Investment Choice 1. 2. 3. 4. 5. III. Public and Private Savings Budget Deficits a) “Crowding out” b) Ricardian Equivalence Market for Loanable Funds 1. 2. II. Comparison Pricing of Bonds a) Different interest rates and default rates Fundamental Analysis Efficient Markets Hypothesis Random Walk asset price fluctuation a) Why is it good to pick stocks randomly? Portfolio diversification Risk aversion Unemployment (Chapter 15) A. Computation 1. 2. 3. 4. How does the BLS measure unemployment? Who is or is not counted as employed? a) Part time and full time b) Military personnel Who is and is not counted as unemployed? a) Discouraged workers Labor Force Participation Rate IV. Money and the Fed (Chapters 16 & 17) A. Money 1. 2. 3. B. The Money Supply 1. C. Fractional Reserve Banking a) Reserve Ratio b) Money Multiplier effect c) Computation of the money supply The Federal Reserve 1. 2. V. Functions of Money Fiat vs. Commodity money Measures of Money a) Components of M0 and M1 Structure of the Fed a) Board of Governors b) Regional Banks c) Federal Open Markets Committee Operation of the Fed a) Three ways the Fed affects interest rates (1) Open Market Operations (2) Discount Rate (3) Reserve Requirements AD-AS and Gov’t Invention (Chapters 20 & 21) A. Aggregate Demand 1. 2. B. Why is it upward sloping? a) Wealth Effect b) Interest Rate Effect What types of things shift it? Aggregate Supply 1. 2. Long Run a) Why is it vertical? b) What shifts it? Short Run a) Why is it upward sloping? b) C. Economic Shocks 1. D. What are three theories for why it is upward sloping? How do permanent and temporary shocks to supply and demand affect prices and GDP in the short run and the long run? Federal Reserve Intervention 1. How does the Fed affect Aggregate Demand? 2. When does the Fed pursue “tight” or “loose” monetary policy? 3. What are the benefits and risks of Fed intervention? 4. What are some challenges to the effectiveness of Fed policy?