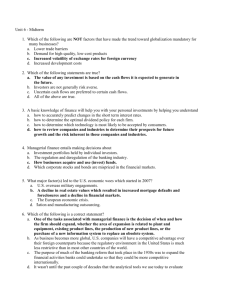

BUS-525 Fall 2010 Midterm 2 : November 15

advertisement

BUS-525 Fall 2010 Midterm 2 : November 15 Name: ——————————————— Score: ——————————————— 1. (2 points) The static trade-o¤ model discusses the relationship between a …rm’s value and its debt-toequity ratio. What are the three e¤ects in the basic static trade-o¤ model? ANS: (a) The original MM Theory states that a …rm’s value is not a¤ected by the size of its debt. (b) The revised MM Theory states that a …rm’s value increases with the size of its debt due to the debt’s tax shield. (c) Financial distress costs increase with the size of a …rm’s debt. 2. (2 points) JibJab has $1,000 of extra cash. It can retain the cash and invest it in Treasury bills yielding 10 percent, or it can pay the cash to shareholders as a dividend. Shareholders can also invest in Treasury bills with the same yield. Suppose the corporate tax rate is 30% and the personal tax rate is 35% for all individuals. The investment horizon is two years. If the tax rate on dividends is 15%, …nd the dollar amount JibJab’s investors will receive in the following two scenarios: (1) having the dividends up-front and investing in Treasury bills themselves and (2) letting JibJab do the investing and receiving dividends later. Conclude with the right action JibJab should take. ANS: (1): In two years, investors receive: 1000 (1 15%) (2): In two years, investors receive: 1000 [1 + 10%(1 [1 + 10%(1 30%)]2 (1 35%)]2 = $964:09 15%) = $973:17 JibJab should invest on behalf of investors and return the earnings as dividends in two years. 3. (1 point) Which of the following statements is the LEAST likely to be correct? (a) The static trade-o¤ theory says, given the debt signal, a more pro…table …rm will have more debts. (b) The pecking-order theory says, given the debt signal, a more pro…table …rm will have more debts. (c) The static trade-o¤ theory says, if the …nancial distress costs are known, a …rm can have an optimal debt-to-equity ratio. (d) The pecking-order theory says, because …nancial needs di¤er in time, a …rm does not have an optimal debt-to-equity ratio. ANS: (b) 4. (1 point) Which of the following statements is the LEAST likely to be correct? (a) Everything else being equal, a long maturity bond will drop more in price at an interest rate hike than a short maturity bond. (b) In a rising interest rate environment, bonds with large coupon payments have less re-investment risk. (c) Without changes in capital structure, a corporate bond yield hike necessarily increases the company’s WACC. (d) Corporate tax rate is not part of WACC calculation. ANS: (d) 5. (1 point) Which of the following statements is the MOST likely to be correct? (a) Both dividends and stock repurchase can be used to reduce the agency costs by cutting free cash ‡ows available to managers. 1 (b) On the ex-dividend date, the stock should drop by (the per-share dividend payout) times (1corporate income tax rate). (c) Unlike stock repurchase, dividends send to the …nancial market a signal of increasing earnings prospect. (d) Since investors can always create homemade dividends, …rms should stop paying dividends and instead use the cash on negative NPV projects. ANS: (a) 6. (1 point) Modigliani and Miller argue that, in a perfect market without taxes, a …rm should be indi¤erent between dividends and stock repurchase. However, in the real world, stock repurchase has outpaced dividends recently. Which of the following is NOT a reason why …rms prefer stock repurchase? (a) Stock repurchase tends to increase stock prices that will be bene…cial to executives who have stock options as compensation. (b) It is easier to stop repurchase than dividend payout because investors treat the cut in dividends as a signal of bad management. (c) Even though capital gains and dividends are taxed at the same rate, stock repurchase is favored because not the full amount of sales proceed is taxed. (d) Stock repurchase has the danger of being seen as stock price manupulation, which is illegal and can be prosecuted by the SEC. ANS: (d) 7. (1 point) Which of the following statements is the LEAST likely to be correct? (a) Preferred stocks are in many ways similar to bonds, but dividends paid on preferred stocks do not o¤er a corporate tax shield. (b) For a …rm that is near bankruptcy, the agency costs of debt may include managers’risky investment decisions. (c) Given agency costs of equity, more debts will lead to higher …rm values. (d) Managers, acting on behalf of shareholders, have no incentives to include protective covenants in debt contracts. ANS: (d) 8. (1 point) Which of the following statements is the LEAST likely to be correct? (a) In a world without corporate taxes, a …rm’s cost of equity increases with the size of debt. (b) In a world with corporate taxes, a …rm’s cost of equity increases with the size of debt. (c) In a world with corporate taxes, a …rm’s value does not increase with the size of debt. (d) In a world with corporate taxes, a …rm’s WACC decreases with the size of debt. ANS: (c) 9. (2 points) The risk premium (in yields) between an AAA corporate bond, maturing in 1 year, and the risk-free Treasury is 2.9%. Currently the Fed has maintained an extremely low interest rate environment. A one-year Treasury note yields 0.1% annually. Find the price of an AAA corporate bond that has 5% coupon rate (paying semi-annually, next payment is exactly six months away) and matures in one year. ANS: Yield to maturity = 2:9% + 0:1% = 3%; semi-annual rate = 1000 5% = 25 2 25 1025 1+1:5% + (1+1:5%)2 = 3% 2 Coupon payment = Bond Price = 24:63 + 994:93 = $1; 019:56 2 = 1:5%: 10. (3 points) If the Dividend Discount Model (DDM) adequately explains a stock’s price and the Capital Asset Pricing Model (CAPM) accurately describes a stock’s required rate of return, …nd company Lakatos Inc.’s beta, given the following information: risk-free rate = 5%, market risk premium (excess return) = 10%, P=E = 16 23 ; ROE = 24%; b (plowback ratio) = 2=3: ANS: P E = 1 b k ROE b 16 32 = 1=3 k :16 = 1 2=3 k :24 2=3 ) k = :18 From CAPM, :18 = :05 + :1 ) = 1:3 3