Chapter Valuation of Valuation of Inventories: Inventories:

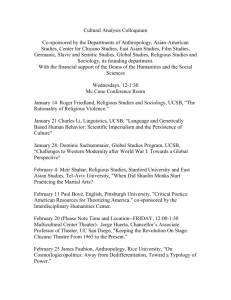

advertisement

Valuation of Inventories: A Cost Basis Approach Chapter Valuation of Inventories: Classification A Cost Basis Approach rs Erro Perpetual v. Periodic Flow Cost UCSB, Anderson Slide 8-1 UCSB, Anderson What is Inventory? Slide 8-2 Manufacturing Companies Asset items held for sale in the ordinary course of business or ... goods that will be used or consumed in the production of goods to be sold. Classification of inventories: Raw Materials z Work in Progress z Finished Goods z Generally a significant asset Generally a primary source of revenue Impacts both balance sheet and income statement UCSB, Anderson Slide 8-3 UCSB, Anderson Slide 8-4 Inventory- the basics Inventory issues introduced Four basic questions/ issues: 1. What is it? The costs necessary to make the product available for sale, including costs of holding it once completed. 2. Whose is it? It belongs to the party with whom the risks and rewards lie. 3. How many units are there? Where does inventory go? COS- Therefore Pretty important If inventory is overstated, then what else is impacted? – – – – z z COS is understated (rollforward) Net income AND gross profit are overstated Various ratios impacted Next year it reverses (COS is overstated etc.) z z z z It is stated at Lower of Cost or Market (LCM) Perpetual, OR Periodic How much did it cost? Can be tricky, because prices change over time and consequently how do you know which unit you sold and how you paid for it. 4. Specific identification- no “methodology” or assumptions, but costly and perhaps not possible; Average or weighted average, can be moving average FIFO (first in first out, aka last in still here) LIFO (last in first out, aka first in still here) z Can result in some strange results when inventory levels are depleted (called LIFO Liquidation). Consequently the following has been designed to mitigate: z z UCSB, Anderson Slide 8-5 Items to be Included in Inventory Specific goods pooled LIFO approach Dollar Value LIFO Items to be Included in Inventory Purchase cost Purchase cost Goods in transit Goods in transit Consigned goods Consigned goods Sales with high rates of return Sales with high rates of return Sales with buyback Sales with buyback UCSB, Anderson Slide 8-7 Slide 8-6 UCSB, Anderson UCSB, Anderson Product cost -z invoice cost, freight in, labor, and other direct production costs (up to time of sale) Period costs -z selling, general, and administrative z not inventoriable Slide 8-8 Items to be Included in Inventory Purchase cost Goods in transit Consigned goods Sales with high rates of return Items to be Included in Inventory Purchase cost Goods in transit When title passes z fob shipping point z fob destination Consigned goods Property of the consignor Sales with high rates of return Sales with buyback Sales with buyback ABC Freight Line Slide 8-9 UCSB, Anderson Items to be Included in Inventory Items to be Included in Inventory Purchase cost Purchase cost Goods in transit Goods in transit Consigned goods Consigned goods Sales with high rates of return not to be removed from seller’s inventory acct. Sales with high rates of return Sales with buyback UCSB, Anderson Sales with buyback Slide 8-11 Slide 8-10 UCSB, Anderson UCSB, Anderson parking transaction, no sale should be recorded Slide 8-12 Perpetual vs. Periodic J/E’s UPDATE- NEW LITERATURE FASB issued new statement which aligned US GAAP with International Standards. As a result, “abnormal” costs are NOT to be included as a cost of inventory, and accordingly expensed as incurred. UCSB, Anderson Slide 8-13 Perpetual vs. Periodic J/E’s Sale of 600 units @ $12: Perpetual -Debit Credit Accounts receivable 7,200 Sales 7,200 Cost of goods sold 3,600 Inventory 3,600 Periodic -Accounts receivable 7,200 Sales 7,200 Under PERIODIC-COS entry delayed until physical count, closing entries. Inventory is overstated and COS understated, until count & closing entry. UCSB, Anderson Slide 8-15 Beginning inventory 100 units @ $6 ($600): Purchase 900 units @ $6: Perpetual -Inventory Accounts payable Periodic -Purchases Accounts payable Debit 5,400 Credit 5,400 5,400 5,400 UCSB, Anderson Slide 8-14 Perpetual vs. Periodic J/E’s Ending inventory 400 units @ $6: Perpetual -Debit Credit No entries (all balance are correct) Periodic – (remember there was $600 to start) Inventory 5,400 Purchases 5,400 Inventory 3,600 Cost of good sold (plug) 3,600 UCSB, Anderson Slide 8-16 Cost Flow Assumptions Cost Flow Assumptions First-in-First-out (FIFO) Balance = $ 45 Purchase 2/25/96 for $20 Purchase 2/15/96 for $15 Purchase 2/2/96 for $10 First-in-First-out (FIFO) Young & Crazy Company Income Statement For the Month of Feb. 1996 Sales Cost of goods sold Gross profit Expenses: Administrative Selling Interest Total expenses Income before tax Taxes Net Income Balance = $ 35 $ 90 0 90 Purchase 2/25/96 for $20 14 12 7 33 57 17 40 Purchase 2/15/96 for $15 Purchase 2/2/96 for $10 Slide 8-17 UCSB, Anderson Cost Flow Assumptions Purchase 2/25/96 for $20 Purchase 2/15/96 for $15 Purchase 2/2/96 for $10 UCSB, Anderson $ 90 10 80 14 12 7 33 47 14 33 Slide 8-18 Cost Flow Assumptions Last-in-First-out (LIFO) Young & Crazy Company Income Statement For the Month of Feb. 1996 Sales Cost of goods sold Gross profit Expenses: Administrative Selling Interest Total expenses Income before tax Taxes Net Income Sales Cost of goods sold Gross profit Expenses: Administrative Selling Interest Total expenses Income before tax Taxes Net Income UCSB, Anderson Last-in-First-out (LIFO) Balance = $ 45 Young & Crazy Company Income Statement For the Month of Feb. 1996 Balance = $ 25 Purchase 2/25/96 for $20 $ 90 0 90 Purchase 2/15/96 for $15 14 12 7 33 57 17 40 Purchase 2/2/96 for $10 Slide 8-19 UCSB, Anderson Young & Crazy Company Income Statement For the Month of Feb. 1996 Sales Cost of goods sold Gross profit Expenses: Administrative Selling Interest Total expenses Income before tax Taxes Net Income $ 90 20 70 14 12 7 33 37 11 26 Slide 8-20 Cost Flow Assumptions Cost Flow Assumptions Average Cost Balance = $ 45 Purchase 2/25/96 for $20 Purchase 2/15/96 for $15 Purchase 2/2/96 for $10 Average Cost Young & Crazy Company Income Statement For the Month of Feb. 1996 Sales Cost of goods sold Gross profit Expenses: Administrative Selling Interest Total expenses Income before tax Taxes Net Income Balance = $ 30 $ 90 0 90 Purchase 2/25/96 for $20 14 12 7 33 57 17 40 Purchase 2/15/96 for $15 Purchase 2/2/96 for $10 Slide 8-21 UCSB, Anderson Cost Flow Assumptions Purchase 2/25/96 for $20 Purchase 2/15/96 for $15 Purchase 2/2/96 for $10 UCSB, Anderson $ 90 15 75 14 12 7 33 42 12 30 Slide 8-22 Cost Flow Assumptions Specific Identification Young & Crazy Company Income Statement For the Month of Feb. 1996 Sales Cost of goods sold Gross profit Expenses: Administrative Selling Interest Total expenses Income before tax Taxes Net Income Sales Cost of goods sold Gross profit Expenses: Administrative Selling Interest Total expenses Income before tax Taxes Net Income UCSB, Anderson Specific Identification Balance = $ 45 Young & Crazy Company Income Statement For the Month of Feb. 1996 Balance = $ 45 $ 90 0 90 Purchase 2/25/96 for $20 14 12 7 33 57 17 40 Purchase 2/15/96 for $15 Purchase 2/2/96 for $10 Slide 8-23 UCSB, Anderson Young & Crazy Company Income Statement Depends which one is sold For the Month of Jan. 1996 Sales Cost of goods sold Gross profit Expenses: Administrative Selling Interest Total expenses Income before tax Taxes Net Income $ 90 0 90 14 12 7 33 57 17 40 Slide 8-24 Trade Discounts Cost Flow Assumptions Same as we did for accounts rec./ sales Income Statement Summary FIFO $ 90 10 80 Sales Cost of goods sold Gross profit Operating expenses: Administrative Selling Interest Total expenses Income before taxes Income tax expense Net income $ LIFO $ 90 20 70 Average $ 90 15 75 14 12 7 33 47 14 33 14 12 7 33 37 11 26 14 12 7 33 42 12 30 Inventory Balance 35 $ $ 25 UCSB, Anderson 30 – Gross (record full amount and treat discount appropriately when it happens) – Net (record net of discount and deal with any lost discounts as an increase in COS when it happens) GROSS METHOD Purchase Cost $10,000 terms 2/10 net 30 Purchases 10,000 Accounts Payable 10,000 NET METHOD Purchases 9,800 Accounts payable Invoices of $4,000 paid within discount period Accounts payable 4,000 Accounts payable Purchase discount 80 Cash Cash 3,920 Invoices of $6,000 paid after discount period Accounts payable 6,000 Cash 6,000 Slide 8-25 9,800 3,920 3,920 Accounts payable Purchase discounts lost Cash 5,880 120 6,000 UCSB, Anderson Slide 8-26 More mechanics Misc. Considerations What happened during 2001: Units z Interest typically not capitalized to inventory – Inventory should be “turning” quick enough that this should not matter – Long-term discreet projects do get interest capitalized though. Opening inventory Purchases Inventory available for sale 11 150 161 SOLD 140 UNITS Ending inventory should be (140) 21 Company erroneously records inventory at Error 22 Unit Price 10 10 10 Value 110 1,500 1,610 (1,400) COGS SHOULD BE 210 220 (10) The error overstates inventory. The only reasonable way that could occur is if the Company understatrd COS. What happens in 2002: During 2002, the Company "catches up". In order to do so, they Must overstate COS because their opening inventory is overstated. Units Unit Price Value Inventory count is made, there are 20 units 20 10 200 Bal Sheet should reflect They made purchases of $1,600 and sold $1,610 (161 units), therefore they should record COS of $1,610right? UCSB, Anderson Slide 8-27 Opening inventory Purchases Ending inventory COS recorded to "get to" proper invent. BUT the proper amount is UCSB, Anderson 220 1,600 (200) 1,620 1,610 (10) THIS IS WHAT WE CALL THE "TURNAROUND IMPACT" Slide 8-28 DOLLAR VALUE LIFO MECHANIX Dollar Value Lifo seeks to account for inflation by looking at the change from year to year in “base year” dollars and then converting THE CHANGE back to current dollars. STEPS: 1) Convert ending inventory to base year (divide ending by price index) 2) Compute change in base year dollars 3) If increased, convert the increase back to current year by multiplying the increase by the price index and adding to the prior year balance 1) 4) DOLLAR VALUE LIFO EXAMPLE (Text p. 388) Inventory at 31-Dec Year-end Prices 2001 200,000 2002 299,000 2003 300,000 2004 351,000 Price Index 100 115 120 130 Inventory at Base-year Price 200,000 260,000 250,000 270,000 Base Yr Convert Change Back n/a n/a 60,000 115 (10,000) 115 20,000 130 Base Yr Layer 200,000 69,000 (11,500) 26,000 INVENTORY AT YEAR END 200,000 269,000 257,500 283,500 In 2003, we "convert back" using the prior year index- BECAUSE there was a decline in the base year inventory, meaning the inventory came out of the prior year…. If it was purchased in the prior year, then the proper index is from the prior year. If decreased, then subtract from the prior year base, recompute the prior year change using the prior year price index. Add Layers all back together to compute ending inventory. Divide Subtract Multiply Add Slide 8-29 UCSB, Anderson Cost Flow Assumptions Last-in-First-out (LIFO) Balance = $ 25 Purchase 2/25/96 for $20 Purchase 2/15/96 for $15 Purchase 2/2/96 for $10 27 UCSB, Anderson Young & Crazy Company Income Statement For the Month of Jan. 1996 Sales Cost of goods sold Gross profit Expenses: Administrative Selling Interest Total expenses Income before tax Taxes Net Income $ 90 20 70 14 12 7 33 37 11 26 10/13/96 Slide 8-31 UCSB, Anderson Slide 8-30