CHAPTER 13 Financial Analysis: The Big Picture

advertisement

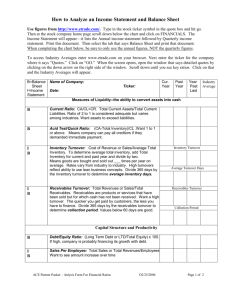

CHAPTER 13 Financial Analysis: The Big Picture Discuss the Need for comparative analysis and identify the tools of financial statement analysis ♦ Throughout the book we will rely on three types of comparisons to provide decision usefulness of financial information: 1. Intracompany basis. Comparisons within a company are often useful to detect changes in financial relationships and significant trends. 2. Intercompany basis. Comparisons with other companies provide insight into a company’s competitive position 3. Industry averages. Comparisons with industry averages provide information about a company’s relative position within the industry ♦ Three basic tools are used in financial statement analysis to highlight the significance of financial statement data: 1. Horizontal analysis 2. Vertical analysis 3. Ratio analysis Study Objective 4 - Explain and Apply Horizontal Analysis ♦ Horizontal analysis, also known as __________________analysis, is a technique for evaluating a series of financial statement data over a period of time. The purpose of horizontal analysis is to determine___________________________________. The increase or decrease can be expressed as either an amount or a percentage. We can measure all percentage increases or decreases from this base-period amount with the following formula: Change Since =CURRENT YEAR AMOUNT – BASE YEAR AMOUNT Base Period BASE-YEAR AMOUNT Study Objective 5 - Describe and Apply Vertical Analysis ♦ Vertical analysis, also called ______________________analysis, is a technique for evaluating financial statement data that expresses each item in a financial statement as a percent of a base amount. ♦ On a balance sheet we might say that current assets are 22% of total assets. ♦ ________________________is always the base amount in vertical analysis of a balance sheet. ♦ On an income statement we say that selling expenses are 16% of net sales. ♦ _________________________is always the base amount in vertical analysis of an income statement. ♦ Vertical analysis enables you to compare companies of __________________. Study Objective 6 - Identify and Compute Ratios and Describe Their Purpose and Use in Analyzing a Firm’s Liquidity, Solvency, and Profitability ♦ For analysis of the primary financial statements, ratios can be classified into three types: 1. Liquidity ratios: measures of the short-term ability of the enterprise to pay its maturing obligations an to meet unexpected needs for cash 2. Solvency ratios: measures of the ability of the enterprise to survive over a long period of time 3. Profitability ratios: measures of the income or operating success of an enterprise for a given period of time ♦ Liquidity ratios—measure the short-term ability of the enterprise to pay its maturing obligations and to meet unexpected needs for cash. Short-term creditors such as ________________are particularly interested in assessing liquidity. The measures that can be used to determine the enterprise’s short-term debt paying ability are the current ratio, the acid-test ratio, the current cash debt coverage ratio, the receivables turnover ratio, the average collection period, the inventory turnover, and the average days in inventory. 1. The current ratio expresses the relationship of current assets to current liabilities, computed by dividing current assets by current liabilities. The current ratio is widely used for evaluating a company’s ____________ The current ratio does not take into account the ________________________. 2. The acid-test ratio or quick ratio is a measure of a company’s _________________________ liquidity. • The acid-test ratio is computed by dividing the sum of _______________________________ by current liabilities. • The ratio does not include_________________________________. • Cash, short-term investments, and receivables (net) are highly liquid compared with inventory and prepaid expenses. 3. Current cash debt coverage ratio is the ratio of cash provided by operating activities to average current liabilities. • A disadvantage of the current ratio is that it uses year-end balances of current asset and current liability accounts. • Because it uses cash provided by operating activities rather than a balance at one point in time, it may provide a better representation of liquidity. 4. The receivables turnover ratio measures liquidity by determining how quickly certain assets can be converted to cash. • The receivables turnover ratio measures the number of times, on average, receivables are collected during the period. • The receivables turnover ratio is computed by dividing net credit sales (net sales less cash sales) by average gross receivables during the year. 5. The average collection period is a popular variant of the receivables turnover ratio. • The average collection period converts the receivables turnover into an average collection period expressed in days. • The ratio is computed by dividing the receivables turnover ratio into 365 days. • The general rule is that the collection period should not greatly exceed the_____________________. • Analysts frequently use the average collection period to assess the effectiveness of a company’s________________________________. 6. The inventory turnover ratio measures the number of times on average the inventory is sold during the period. • The purpose of this ratio is to measure the ______________of the inventory. • The inventory turnover ratio is computed by dividing the cost of goods sold by the average inventory during the period. • Generally, the ____________the inventory turnover the less cash is tied up in inventory and the less the chance of inventory becoming obsolete. • A downside of high inventory turnover is that the company can run out of inventory when it is needed. 7. Days in inventory is a variant of the inventory turnover ratio. • The days in inventory measures the average number of days it takes to sell the inventory. • It is computed by dividing the inventory turnover ratio into 365 days. ♦ Solvency ratios—measure the ability of the enterprise to survive over a long period of time. _______________________________________are interested in a company’s long-run solvency, particularly its ability to pay interest as it comes due and to repay the fact value of debt at maturity. 8. The debt to total asset ratio measures the percentage of total assets provided by creditors. • This ratio indicates the degree of financial leveraging and provides some indication of the company’s ability to withstand losses without impairing the interests of its creditors. The higher the percentage of debt to total assets, the greater the ____________that the company may be unable to meet its maturing obligations. 9. The times interest earned ratio, also called interest_______________, indicates the company's ability to meet interest payments as they come due. • The ratio is computed by dividing income before interest expense and income taxes by interest expense. 10. The cash debt coverage ratio is the ratio of cash provided by operating activities to average total liabilities. • This ratio is a cash-basis measure of solvency. • The cash debt coverage ratio indicates a company's ability to repay its liabilities from cash generated from operating activities without having to liquidate the assets used in its operations. 11. Free cash flow is an indication of a company's solvency and its ability to______________________________________. • Free cash flow is the amount of excess cash generated after investing to maintain current productive capacity and pay dividends. ♦ Profitability ratios—measure the income or operating success of an enterprise for a given period of time. Profitability ratios are important because a company’s income or lack of it, affects its ability to obtain debt and equity financing, its liquidity position, and its ability to grow. Profitability is frequently used as the ultimate test of ____________________ __________________________. • 12. The return on assets ratio measures the overall profitability of assets in terms of the income earned on each dollar invested in assets. • The return on assets ratio is computed by dividing net income by average total assets. 13. The profit margin ratio, or rate of return on sales, is a measure of the percentage of each dollar of sales that results in net income. • The return on assets ratio is affected by two factors, the first of which is the profit margin ratio. The profit margin ratio is computed by dividing net income by net sales for the period 14. The gross profit rate indicates a company's ability to maintain an adequate selling price above its cost of goods sold. • The profit margin is one of two factors that strongly influence the profit margin ratio. • The gross profit rate is found by dividing gross profit (net sales less cost of goods sold) by net sales. 15. Earnings per share (EPS) is a measure of the net income earned on each share of common stock. • Expressing net income earned on a per share basis provides a useful perspective for determining profitability. • Earnings per share is computed by dividing net income by the average number of common shares outstanding during the year. • When we use "net income per share" or "earnings per share," it refers to the amount of net income applicable to each share of common stock. 16. The price-earnings (P-E) ratio measures the ratio of the market price of each share of common stock to the earnings per share. • The price-earnings ratio is a reflection of investors' assessments of a company's future earnings. • The ratio is computed by dividing the market price per share of the stock by earnings per share. 17. The payout ratio measures the percentage of earnings distributed in the form of cash dividends. • Companies that have high growth rates are characterized by low payout ratios because they reinvest most of their net income in the business. • The payout ratio is computed by dividing cash dividends declared on common stock by net income. Study Objective 7 – Understand the Concept of Quality of Earnings ♦ A company that has a high ________________________provides full and transparent information that will not confuse or mislead users of financial statements. ♦ The issue of quality of earnings has taken on increasing importance because recent accounting scandals suggest that some companies are spending too much time managing their income and not enough time managing their business. ♦ Some of the factors affecting quality of earnings include the following: • Alternative accounting methods – Variations among companies in the application of generally accepted accounting principles may hamper comparability and reduce quality of earnings. • Pro Forma Income – Companies whose stock is publicly traded are required to present their income statement following generally accepted accounting principles (GAAP). • Improper recognition – Because some managers have felt the pressure to continually increase earnings to meet Wall Street’s expectations, they have manipulated the earnings numbers to meet these expectations.