Chapter 3: CVP Analysis Horngren 13e 2 -1

Horngren 13e

Chapter 3:

CVP Analysis

2 -1

3-2

3-3

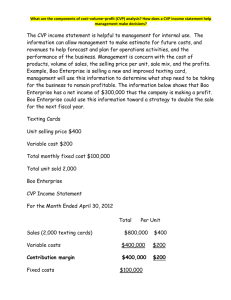

Learning Objective 1. Explain the features of cost-volume-profit (CVP) analysis . . . how operating income changes with changes in output level, selling prices, variable costs, or fixed costs

Learning Objective 2. Determine the breakeven point and output level needed to achieve a target operating income . . . compare contribution margin and fixed costs

[EXERCISE]

3-4

Learning Objective 1. Explain the features of cost-volume-profit (CVP) analysis . . . how operating income changes with changes in output level, selling prices, variable costs, or fixed costs

Learning Objective 2. Determine the breakeven point and output level needed to achieve a target operating income . . . compare contribution margin and fixed costs

[SOLUTION]

3-5

Learning Objective 3. Understand how income taxes affect CVP analysis . . . focus on net income

Learning Objective 4. Explain CVP analysis in decision making and how sensitivity analysis helps managers cope with uncertainty . . . determine the effect on operating income of different assumptions

[EXERCISE]

Alex Miller, Inc., sells car batteries to service stations for an average of $30 each.

The variable cost of each battery is $20 and monthly fixed manufacturing costs total $10,000. Other monthly fixed costs of the company total $8,000.

Required: a. What is the breakeven point in batteries?

b. What is the margin of safety, assuming sales total $60,000?

c. What is the breakeven level in batteries, assuming variable costs increase by 20%?

d. What is the breakeven level in batteries, assuming the selling price goes up by 10%, fixed manufacturing costs decline by 10%, and other fixed costs decline by $100?

3-6

Learning Objective 3. Understand how income taxes affect CVP analysis . . . focus on net income

Learning Objective 4. Explain CVP analysis in decision making and how sensitivity analysis helps managers cope with uncertainty . . . determine the effect on operating income of different assumptions a.

b.

c.

d.

N = Breakeven units

$30N - $20N - $10,000 - $8,000 = 0

$10N - $18,000 = 0

N = $18,000/$10 = 1,800 batteries

[SOLUTION]

Margin of safety = $60,000 - ($30 × 1,800) = $6,000

N = Breakeven units

$30N - $24N - $10,000 - $8,000 = 0

$6N - $18,000 = 0

N = $18,000/$6 = 3,000 batteries

N = Breakeven units

$33N - $20N - $9,000 - $7,900 = 0

$13N - $16,900 = 0 N = $16,900/$13 = 1,300 batteries

3-7

Learning Objective 5. Use CVP analysis to plan variable and fixed costs . . . compare risk of losses versus higher returns

[EXERCISE]

3-8

Learning Objective 5. Use CVP analysis to plan variable and fixed costs . . . compare risk of losses versus higher returns

[SOLUTION]

3-9

Learning Objective 6. Apply CVP analysis to a company producing multiple products

. . . assume sales mix of products remains constant as total units sold change

[EXERCISE]

3-10

Learning Objective 6. Apply CVP analysis to a company producing multiple products

. . . assume sales mix of products remains constant as total units sold change

[SOLUTION]

3-11