LEGAL OUTSOURCING INTO INDIA —

advertisement

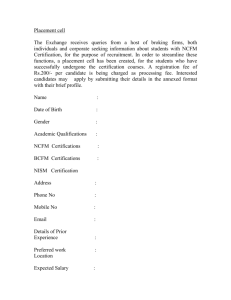

LEGAL OUTSOURCING INTO INDIA - A CONCEPT PAPER 87 LEGAL OUTSOURCING INTO INDIA — A CONCEPT P APER PAPER SATISH MENON* BUSINESS PROCESS OUTSOURCING Business Process Outsourcing (BPO) refers to the conscious decision of organizations to contract a significant amount of their respective non-core business processes to third party service providers. This helps the organization not only in being able to concentrate quality time on their core businesses but also enables achievement of quality and cost efficiencies in the handling of non core business processes thereby resulting in an enhanced value for stakeholders. The traditional forms of BPO envisage the outsourcing of functions such as payroll, accounting, billing or real estate management, claim processing to third parties. BPO also depends significantly on Information Technology and are therefore often also known as IT Enabled Services in India. Notification No.SO 890(E) dated 26.9.2000 issued under Section 10A/ 10B of the Income Tax Act,1961 notifies the following IT and IT Enabled/ BPO Services for the purpose of the tax holiday envisaged therein : — Back Office Operations — Call Centres — Content Development or Animation — Data Processing — Engineering and Design — Geographic Information Systems Services — Human Resource Services — Insurance Claim Processing — Legal Databases — Medical Transcription — Payroll — Remote Maintenance — Revenue Accounting — Support Centres, and — Web-site Services As per the figures available from NASSCOM the Worldwide spending on IT/ IT Enabled BPO services totaled approximately US$ 712 billion in 2001. IDC projects that by 2006, the potential ITES-BPO market may increase to US$ 1.2 trillion, with an overall compounded annual growth rate (CAGR) of 11 percent. While traditionally the key driver for ITES-BPO activities has been cost reduction, companies are increasingly viewing these services as strategic and essential elements for organic growth. * Practising Company Secretary, Bangalore. 87 88 7TH NATIONAL CONFERENCE OF PRACTISING COMPANY SECRETARIES KNOWLEDGE PROCESS OUTSOURCING Knowledge Process Outsourcing (KPO) as compared to the traditional back office BPO covers the outsourcing of higher end processes. Legal Outsourcing is a far more sophisticated form of off-shoring. According to an article in India Daily, knowledge process outsourcing (KPO) will eventually outstrip business process outsourcing (BPO) in revenue. KPO (an acronym I hadn’t heard before today) covers the outsourcing of higher-end processes such as research and analysis in industries like data and market research, financial research and planning, engineering, medical content, animation and design and legal services. Although very few Indian companies are working in this space now, KPO will be one of the major segments of the outsourcing business in terms of creation of new jobs and generation of billions of dollars in business. LEGAL OUTSOURCING As per NASSCOM’s BPO Newsline one of the Emerging Opportunities in the arena of Legal Outsourcing, NASSCOM observed that the legal industry across the globe is gradually turning towards outsourcing for gaining efficiencies and staying profitable in a hotly competitive marketplace. Recognition of the fact that legal companies need to focus on their core competencies and leave back office processes to the hands of competent outsourcers, is creating a compelling case for giving out non-core processes. The availability of outsourcing ventures with world class resources and expertise is also boosting the growth of outsourcing by legal entities. NASSCOM quotes that the Worldwide ITES-BPO spending for Legal in 2006 is projected at US$ 163 billion. This gives a tremendous opportunity to the Indian BPO Sector and in particular the legal professionals in India to tap the opportunity of Legal outsourcing. OPPORTUNITIES IN LEGAL OUTSOURCING Legal Transcription Services Legal Transcription Services involves both the voice dictation transcription as well as the conversion of physical data into electronic format for electronic storage and retrieval. This service presupposes that the person who is transcribing the tapes and voice must have in addition to a very good typing skills, an excellent knowledge of various legal terms used. The work product must be reviewed by qualified legal professionals before being sent out. Document Management Services Document Management Services involve the support and assistance not only in the designing and formulation of an efficient system for storage and retrieval of files and documents building in appropriate levels of confidentiality, security and efficiency but also the successful implementation of the system predominantly in the electronic form. Knowledge Management Services Knowledge Management Services involve the capturing, reviewing and analysis of various information that is available in the WEB including case laws for use of the same within a law firm. Legal Billing Services Involves the processing of time sheets and related billing functions for a legal firm. Legal Translation Services Language Translation Services involve the translation of summons and complaint or the transcription of an evidentiary tape or a document in a foreign language, to be used in litigation. Data Entry Services Data entry services involves the taking over by the service provider of the clients hard copy data of depositions, hearings, arbitrations, meetings, and other events etc. that need to be documented for the purpose of data entry. LEGAL OUTSOURCING INTO INDIA - A CONCEPT PAPER 89 Secretarial and Paralegal Services These services involve the processing of claims, data entry, proofreading services, document review, deposition digesting, etc. Support Services in complying with the Sarbanes Oxley Act, 2002 Involves support to companies listed in USA in the formulation and implementation of Disclosure Controls and Procedures and Internal Control Over Financial Reporting. One of the most significant corporate governance provisions contained in the Sarbanes-Oxley Act of 2002 (“SOX”) is the requirement imposed on the management of public company to evaluate the effectiveness of the company’s internal controls and procedures over financial reporting and the related requirement for auditors to attest to management’s evaluation. Major public companies, i.e., accelerated filers, have already begun to comply with these requirements for their first fiscal year ending on or after November 15, 2004. Various public company issuers have outsourced financial and accounting business process functions (e.g., accounts receivable, accounts payable, cash treasury, fixed asset accounting) to third-party service organizations or outsourcing suppliers. Some of these arrangements could involve off shoring certain activities to operational sites outside the U.S. Section 404 of SOX requires the Securities and Exchange Commission (SEC) to prescribe rules requiring each annual report of a public company issuer to make an internal control report containing: (1) a statement of management’s responsibility for establishing and maintaining an adequate internal control structure and procedures for financial reporting; and (2) an assessment by management at the end of the company’s most recent fiscal year of the effectiveness of the company’s internal control structure and procedures for financial reporting. Section 404 of SOX also requires every registered public accounting firm that prepares or issues an audit report on a company’s annual financial statement to attest to, and report on, the assessment made by management. The accounting firm must make this attestation in accordance with standards issued or adopted by the Public Company Accounting Oversight Board (PCAOB). The SEC rules implementing Section 404 of SOX provides that controls subject to assessment by management include, but are not limited to: 1. controls over initiating, recording, processing, and reconciling account balances; classes of transactions and disclosure and related assertions included in the financial statements; 2. controls related to the initiation and processing of non-routine and non-systematic transactions; 3. controls related to the selection and application of appropriate accounting policies; 4. controls related to the prevention, identification, and detection of fraud. There may be cost-savings and other benefits for a public company issuer by outsourcing and/or offshoring financing and accounting business process functions to outsourcing suppliers. An outsourcing supplier might also do several things to assist the public company auditor, e.g., engage its own auditor to review and report on the systems it uses to process the company’s transactions or engage an auditor to test the effectiveness of the controls applied to the company’s transaction to enable the auditor to evaluate controls of the supplier. Compliance Management Services Involves help and support in the formulation and implementation of a robust and a structured Compliance Management System meeting World Class Standards which includes the formulation and successful implementation of the following : Legal Process Management Legal processes are Standard Operating Procedures (SOPs) which help and guide organizations comply with all applicable laws and regulations while pursuing business objectives. 90 7TH NATIONAL CONFERENCE OF PRACTISING COMPANY SECRETARIES These SOPs are detailed and precise road maps, which capture every little step that needs to be followed and every little information that needs to be kept in mind when complying with applicable laws. Legal Process Management concerns with the systematic : 1. Preparation and formulation of SOPs 2. Identification of compliance requirements therein 3. Risk profiling of these compliance requirements 4. Periodical self review of these compliance requirements 5. Ascertainment of areas of non compliance 6. Implementation of appropriate corrective action plans Compliance Risk Management Compliance risks are risks associated with non-compliance of any legal obligation under any applicable laws and regulations to be complied with by an organization in every location from which it operates its business. Compliance Risk Management concerns with the systematic : 1. Preparation of detailed checklists of obligations 2. Risk profiling of the obligations 3. Periodic self review of these checklists 4. Periodic ascertainment of non compliance of obligations 5. Implementation of corrective action plans Contract Execution Management Contract Execution Management concerns with the process of : 1. Systematic drafting of contracts relevant for the business 2. Structured vetting of contracts sent by business associates 3. Risk profiling of clauses in a contract being negotiated 4. Evolving alternative strategies for negotiating contracts 5. Negotiation and execution of contracts with business associates Contractual Risk Management Contractual Risk Management concerns with the process of : 1. Taking inventory of all executed contracts 2. Assessment and evaluation of risks in all executed contracts 3. Risk profiling of every clause of every executed contract 4. Preparation of compliance checklists for executed contracts 5. Monitoring implementation under executed contract 6. Initiating risk mitigation strategies under executed contracts LEGAL OUTSOURCING TO INDIA THROUGH AN OFF SHORE STRATEGY India is emerging as the preferred offshore destination for organizations across the world, for outsourcing in general and in particular legal outsourcing, predominantly due to the following factors : 1. Its cost effectiveness, costs being a tenth of what it is in the US as a result of very low salary levels, not very expensive real estate, etc. 2. Availability of highly educated legal professionals and other skilled workforce with strong work ethics as well as capabilities to provide high quality work. LEGAL OUTSOURCING INTO INDIA - A CONCEPT PAPER 91 3. Robustness of its IT and other infrastructure including emergence of high bandwidth telecom networks as well as technological support. 4. India’s unique geographic positioning which enables a 24x7 service as well as a reduction in turnaround times by leveraging the time zone differences. 5. Significant political patronage in the promotion of BPO and KPO. 6. Applicability of Tax holidays on profits generated from BPO and KPO. Structure for Legal Outsourcing through an Off Shore Strategy The following Structures are available for Legal Outsourcing through an Off Shore Strategy : 1. Either as a third Party service provider or as an In house initiative by either the outsourcing Legal firm or Overseas company 2. In case of an In house initiative ,the strategy could be pursued either through a liaison or a branch office in India Key challenges in implementing Legal Outsourcing in India 1. Resolving conflicts , if any, associated with law practice in US/India 2. Obtaining the “ buy in ” of the Clients to this unique process 3. Maintaining the confidentiality of the clients and client’s information 4. Ensuring compliance with the Privacy and Data Protection laws 5. Getting the support and “ buy in ” of the Legal Firm’s or Overseas Company support staff 6. Educating Indian legal professionals in the relevant International laws 7. Training Indian legal professionals in principles and practices of International law 8. Handling security concerns arising out of remote processing 9. Risk profiling of the compliance and contractual obligations 10. Training legal professionals in process and risk management strategies and the preparation of cross functional SOPs 11. Capturing legal data on a global basis to prepare checklists 12. Capturing contractual data from executed contracts and monitoring it.