Perfect Competition Practice Questions | Economics

In-class Practice questions for Perfect Competitive Market

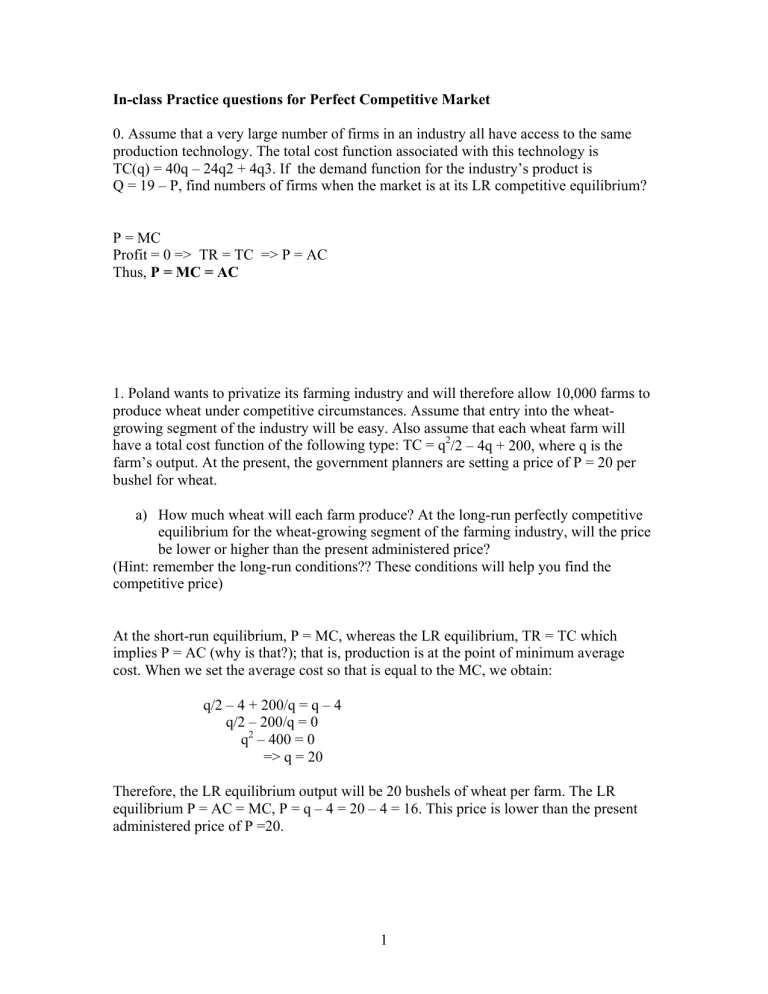

0. Assume that a very large number of firms in an industry all have access to the same production technology. The total cost function associated with this technology is

TC(q) = 40q – 24q2 + 4q3. If the demand function for the industry’s product is

Q = 19 – P, find numbers of firms when the market is at its LR competitive equilibrium?

P = MC

Profit = 0 => TR = TC => P = AC

Thus, P = MC = AC

1. Poland wants to privatize its farming industry and will therefore allow 10,000 farms to produce wheat under competitive circumstances. Assume that entry into the wheatgrowing segment of the industry will be easy. Also assume that each wheat farm will have a total cost function of the following type: TC = q 2 /2 – 4q + 200, where q is the farm’s output. At the present, the government planners are setting a price of P = 20 per bushel for wheat. a) How much wheat will each farm produce? At the long-run perfectly competitive equilibrium for the wheat-growing segment of the farming industry, will the price be lower or higher than the present administered price?

(Hint: remember the long-run conditions?? These conditions will help you find the competitive price)

At the short-run equilibrium, P = MC, whereas the LR equilibrium, TR = TC which implies P = AC (why is that?); that is, production is at the point of minimum average cost. When we set the average cost so that is equal to the MC, we obtain: q/2 – 4 + 200/q = q – 4

q/2 – 200/q = 0

q 2 – 400 = 0

=> q = 20

Therefore, the LR equilibrium output will be 20 bushels of wheat per farm. The LR equilibrium P = AC = MC, P = q – 4 = 20 – 4 = 16. This price is lower than the present administered price of P =20.

1

b) If each wheat farm had ten acres before privatization and produced a yield of four bushels per acre, should the size of these farms be increased or decreased after the market becomes competitive? In other words, will it be cheaper to grow wheat on larger or smaller farms when the market is competitive?

Because each farm will produce 20 bushels of wheat at the LR equilibrium and it takes 1 acre to produce 4 bushels, the optimum size for a wheat farm after the industry becomes competitive will be only 5 acres, compared to 10 acres before privatization.

2. Assume that the taxi industry in the town of New City is perfectly competitive. Also assume that the constant marginal cost of a taxi ride is $5 per trip and that each taxi is capable of making 20 trips a day. We will let the demand function for taxi rides each day be D(p) = 1,100 – 20p. a) What is the perfectly competitive price of a taxi ride?

At the perfectly competitive equilibrium, P = MC. Therefore, the competitive price of a taxi ride is $5. b) How many ride will the citizens of New City make every day?

Substituting the P into the demand function, we find that the equilibrium numbers of taxi rides every day is 1,100 – 20*5 = 1,000. c) How many taxis will operate in New City?

Given that each taxi is capable of making 20 trips a day, the number of taxis needed in

New City is 1,000/20 = 50.

Assume that every taxi that operates in New City has a special license. Therefore, the number of such licenses is the same as the number of taxis that you calculated in Part c) of this problem. Further assume that the demand for taxi rides has increased and is now

D(p) = 1,200 – 20p. The cost of operating a taxi is still $5 per ride, and the number of taxis has not changed.

2

d) Calculate the price that will equate demand with supply

The number of taxi licenses in New City is 50, the same as the number of taxis we calculated in Part c), which means that the “supply” of taxi rides every day is 1,000.

Equating demand to supply, we find that 1,200 – 20p = 1,000, or p =10. Thus, each taxi ride costs $10. e) Calculate the profit that each taxi will earn per day. (each taxi operates at its full capacity)

Given the cost of each taxi ride is $5 and the fare is $10, the profit each taxi earns on a ride is $5. The profit per day is 20*5 = $100.

3. Suppose that there is an economy with two firms whose products are completely independent. By “independent,” we mean that when one firm changes its price, the other firm’s demand is totally unaffected. The only possibilities for employment in this economy are a career running firm 1 or firm 2 or a career as an economics professor who earns $20,000 a year. There are no barriers to entry in these careers, and anyone currently employed in one occupation can costlessly change to another.

The only input that either firm needs to make its product is seaweed, which costs

$2 a pound. Each firm requires one pound of seaweed to produce one unit of its product.

The cost of the input (seaweed) does not include the cost of an entrepreneur’s time .

There are no costs involved in being an economics professor. The demand for the product of firm 1 is P

1

= 2,002 – 4Q

1

, and the demand for the product of firm 2 is P

2

= 4,004 –

5Q

2

. a) If anyone can become an economics professor, what will the long-run equilibrium prices be for firm 1 and 2.

As we know that at the LR equilibrium a competitive firms economic profit is driven down to zero. But in this case, the definition of economic profit must include an entrepreneur’s opportunity cost of not being an economics professor, which is $20,000.

Therefore, the LR profit of each firm will be driven down to $20,000.

We can express the two firms’ total cost function as C

1

= 2Q

1

and C

2

= 2Q the profit so that it is equal to $20,000 for firm 1, we find that:

2

. When we set

20,000 – 2Q

1

2,002Q

=

1

1

– 4Q

– 4Q

1

2

2

1

– 2Q

1

3

Solving for P

1

, we have P

1

= 42.83 or 1,961.63, but at price 42.83 firm 1 produces Q

1

=

489.8 at the lower average cost. Solving for firm 2 in a similar manner, we find that firm

2 will produce Q

2

= 795.4 at a price of $27. b) Is the price of each firm’s product forced down to the level of the marginal cost of the seaweed?

No, see the answer to Part a). (still have to consider the opportunity cost of being a professor)

4.Consider an economy with the supply of soccer balls q s soccer balls given by q s = 270 – 5p.

= 4p and the demand for a) Calculate the equilibrium price and quantity. b) Graph the supply and demand functions.

First we write both supply and demand having price on the left hand side,

4

c) Calculate both the consumer and producer surplus.

Now suppose the government imposes a sales tax, such that consumers much pay $5 to the government each time they buy a soccer ball. d) calculate the new equilibrium price and quantity.

Now consumers pay $5 more for each unit of soccer ball that they purchase, there fore new demand curve is: e) Draw a graph marking the after tax consumer surplus and producer surplus as well as the tax revenue

5

f) Calculate the consumer surplus, the producer surplus, and the dead-weight loss. g) Calculate the dead-weight loss imposed by the tax.

6