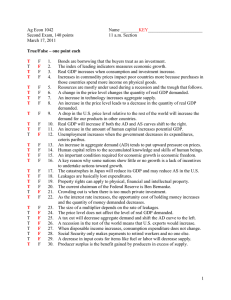

The US as a Net Debtor: Nouriel Roubini

advertisement