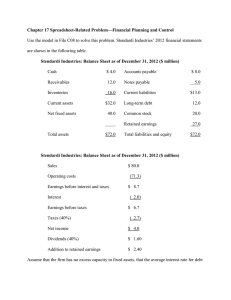

4 Financial Statements

advertisement