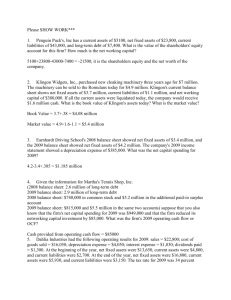

4 Financial Statements

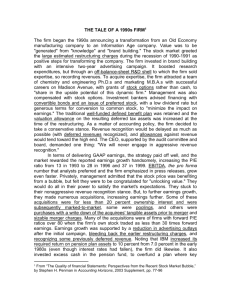

advertisement