11.437 Financing Community Economic Development Class 5: Working Capital Financing

advertisement

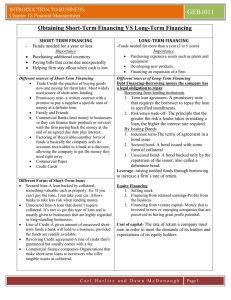

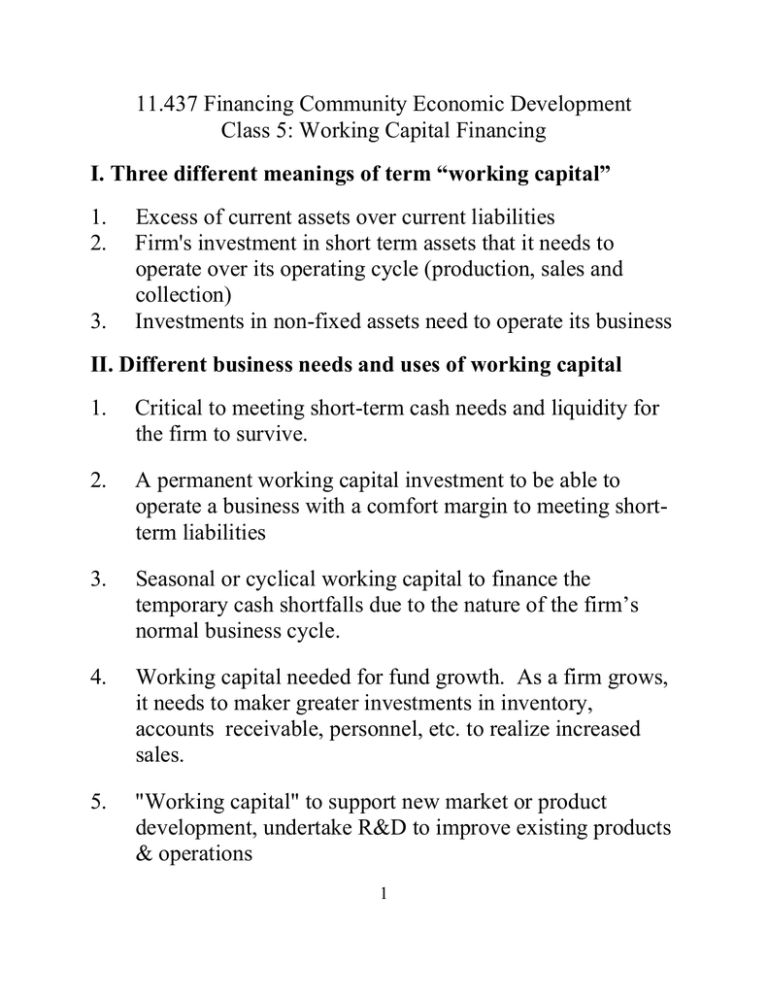

11.437 Financing Community Economic Development Class 5: Working Capital Financing I. Three different meanings of term “working capital” 1. 2. 3. Excess of current assets over current liabilities Firm's investment in short term assets that it needs to operate over its operating cycle (production, sales and collection) Investments in non-fixed assets need to operate its business II. Different business needs and uses of working capital 1. Critical to meeting short-term cash needs and liquidity for the firm to survive. 2. A permanent working capital investment to be able to operate a business with a comfort margin to meeting shortterm liabilities 3. Seasonal or cyclical working capital to finance the temporary cash shortfalls due to the nature of the firm’s normal business cycle. 4. Working capital needed for fund growth. As a firm grows, it needs to maker greater investments in inventory, accounts receivable, personnel, etc. to realize increased sales. 5. "Working capital" to support new market or product development, undertake R&D to improve existing products & operations 1 Relationship between permanent and short-term working capital Firms usually need a permanent investment that increases as they grow. Above this permanent working capital investment is the needs for seasonal short-term working capital financing. Since small businesses have less access to long-term sources of capital to fund permanent working capital, they have to rely more on short term working capital financing. This leaves them with poorer liquidity and smaller net working capital positions, which makes it harder to secure short-term loans. III. Sources of working capital for small businesses ` Largest sources: Commercial banks Vendor trade credit Commercial finance companies Other sources: SBA programs Business Development Companies & higher risk loan pools Public and non-profit loan funds Venture capitalists\SBICs (for long term permanent working capital) Informal sources: Credit cards Second mortgages on homes 2 IV. Working capital debt financing tools 1. Line of credit: can be unsecured or secured. Terms ¾ Annual clean-up (full repayment of line before renewal) ¾ Compensating balance requirements ¾ Financial covenants (debt\equity; working capital) ¾ Fees (points) on full line whether used or not ¾ Interest payment based on amount borrowed Advantages: easier to set up, fewer transaction and legal costs, may not have to pledge collateral Disadvantages: full cost may be high, esp. w/compensating balance; can only serve seasonal or cyclical needs since it must be fully repaid each year 2. Accounts receivable financing: Terms and conditions ¾ Security interest in accounts receivables ¾ Lending limit based on % of accounts receivable, ranging from 60-80%, depending on credit quality of customers ¾ May require bank controlled collection (lock box) Advantages: may not require compensating balances, option for firms where financial position doesn't permit line of credit Disadvantages: requires pledge of collateral, higher transaction costs 3 3. Factoring: Terms and conditions ¾ Sale of accounts receivables at a discount ¾ Factoring firm assume risks and costs of collection ¾ May be recourse provisions for deficiency Advantages: quick and efficient source of cash, not really a loan if non-recourse; reduces collection costs for firm Disadvantages: may be expensive (require a steep discount); may effect customer relations; perceptions of financial distress 4. Inventory financing: Terms and conditions: ¾ Pledge of inventory as security ¾ Control of inventory by warehousing agent or direct assignment by serial numbers ¾ Financing based on percent of inventory (varies with type); may be only 50-60% depending on quality of inventory Advantages: can help finance large inventory requirements; may be a cost effective source of financing for high quality inventory; may be the only source if AR are weak or firm’s overall financial position doesn't allow a Line of Credit Disadvantages: Pledge of collateral; higher transaction and administrative costs 4 5. Term working capital loan: Terms and conditions: ¾ Pledge of assets (senior or subordinate) ¾ Financial covenants ¾ Fixed repayment terms Advantages: can finance long-term working capital needs, lower monthly\annual payments Disadvantages: may tie up much of the firm’s collateral; restrictive covenants are a burden; higher cost Sample term sheets from Fleet Bank V. Underwriting Issues with working capital: 1. Track record of firm principals/owner in running the business and personnel credit history Track record of the firm: financial and competitive performance of business Financial position of the business (net working capital, current and quick ratios, net worth, debt/equity ratio, etc.) Sources of repayment of the loan: (1) cash flow analysis of the business over term of the loan; (2) collateral securing loan; (3) guarantees securing loan 2. 3. 3. 5 Cash study: Crystal Clear Window Company 1. What is Crystal Clear Company’s situation? Why are they seeking financing? What are their financing needs? a. b. Repay $40,000 loan from Mr. Mulder, one principal's Additional working capital to finance sales growth What do these needs suggest about appropriate types of financing? 2. What is firm's financial condition? How well is it performing? What does its condition suggest about the firm’s credit worthiness or risks of making the loan? Liquidity position and trends Financial structure and leverage Profitability 3. What about the firm's capacity to repay the loan? Cash flow Strength of collateral Strength of guarantees 4. What is your view of the firm's market and business plan? Strengths of business' market & operations (growing market, quality product, competent principals, good employee morale, history of solid growth Weaknesses (sells to only one type of customer, limited financial expertise in firm management, may be outgrowing facilities) 6 Don't know much about competition and competitive factors in their market. 5. What do these conditions imply about firm's future sales and earnings? What more would you want to know? 6. What is your opinion of proposed $75,000 Accounts Receivable loan to Crystal Clear Window? Do you recommend it? Why or why not? What problems do you see with the proposed financing? What benefits or advantages does it have for the firm? 7. From an economic development perspective, is this the type of firm you would want to finance? What economic development benefits does it offer? 8. What are alternatives for how the lender might structure the loan? What financing might better match the firm’s needs? 9. What are Crystal Clear Window's options to address its working capital needs and reduce its required loan amount? 10. As a CED lender, what might you do to help make the loan stronger and/or improve the Crystal Clear's situation? Draw out 3 issues: Different type of WC needs: cyclical vs. permanent; structuring loan to address which ones apply Working capital finance options: considerations of different tools and their benefits Underwriting issues 7