Fair Trade and Free Entry:

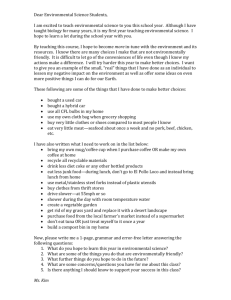

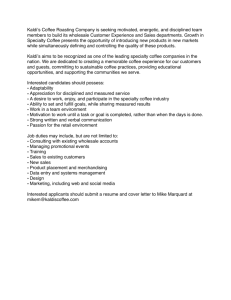

advertisement