Solution: Optimal Plant Investment – Determination of NPV

advertisement

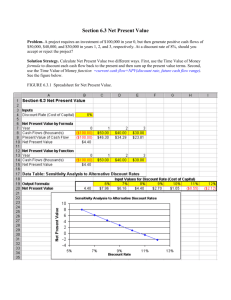

Engineering Systems Analysis for Design, ESD.71 Solution for Optimal Plant Investment Solution: Optimal Plant Investment – Determination of NPV In this assignment, Plan A (build for large capacity) is taken as the benchmark for demonstrating economies of scale effects, and Plan B (build for smaller increments in capacity) is considered as having less benefits from economies of scale. Also, the benchmark time horizon is 10 years. Table 1 shows the NPV for Plans A and B for a discount rate of 13%. The take-away is that as you decrease the time horizon from 10 years to 5 years, Plan B becomes the better choice. Increasing the time horizon to 20 years make Plan A the better choice. Why? The longer the time horizon (20 years), the more the large plant can benefit from economies of scale when functioning at maximum capacity. After year 10, full capacity is reached, so the plan functions for an addition 10 years with better benefits from economies of scale than Plan B. The shorter the time horizon (5 years), the more you have built upfront for large capacity that you do not use, and you do not have enough time to recoup on your initial investment. In this case, it is more advantageous to build smaller as done in Plan B. The time horizon for 10 years shows the transition point between 5 and 20 years where both NPVs are almost equal. Table 1: NPV values for Plans A and B with different time horizons at discount rate of 13% Timeframe 5 years 10 years 20 years NPV values Plan A Plan B 8,11 $ 9,05 $ 24,24 $ 24,25 $ 37,95 $ 37,19 $ Economies of scale occur when the cost of production increases slower that the production output, such that average cost per unit produced is decreasing. Figure 1 below shows the effect of the discount rate on the difference in NPV between Plan A and Plan B. For a given time horizon (say 20 years), the benefit from building large upfront capacity diminishes as the discount rate increases. Why? For a low discount rate, it is worth investing now in higher capacity (Plan A) early so you benefit from economies of scale, which is why for all time horizons Plan A gives a higher NPV than Plan B. Also, the longer the time horizon, the higher NPVA is compared to NPVB because there is longer to actually get benefits from economies of scale. Now as you increase the discount rate, you start to lose the benefit of building large upfront, and it becomes more favorable to defer investment to later and build smaller initially, as done in Plan B. This is why for time horizons of 5 years or less the difference is negative, showing that Plan B provides a higher NPV than Plan A. Massachusetts Institute of Technology Page 1 of 2 Engineering Systems Analysis for Design, ESD.71 Solution for Optimal Plant Investment 7 6 5 4 3 2 1 0 25 % 23 % 21 % 19 % 17 % 15 % 13 % 11 % 9% 7% 5% -2 3% 1% -1 Discount Rate (%) 5 years 10 years 20 years Figure 1: Graph showing the difference between NPVA and NPVB for discount rates ranging from 1% to 25%. This is because it becomes more advantageous to delay investment in the future where the present value of cost is smaller since a higher discount rate penalizes early investment in large capacity. A higher discount rate favors deferring investment to a later, and building smaller capacity initially, which is why Plan B becomes favored as the discount rate increases. Massachusetts Institute of Technology Page 2 of 2