Statement of Cash Flows

advertisement

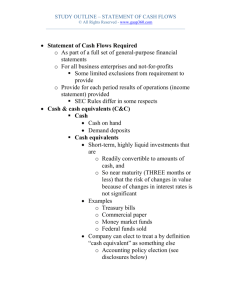

Statement of Cash Flows THE CONTENT AND VALUE OF THE STATEMENT OF CASH FLOWS The cash flow statement reconciles beginning and ending cash by presenting the cash receipts and cash disbursements of an enterprise for an accounting period. The receipts and disbursements are segregated into three classes of activities. Cash receipts and disbursements from operating activities report on the cash flows of the enterprise related to its business operations. Cash receipts and disbursements from investing activities report on the cash flows of the enterprise related to the acquisition and disposition of noncurrent assets. Cash receipts and disbursements from financing activities report on the cash flows of the enterprise related to the acquisition and repayment of debt and equity. The information contained in the statement is useful to creditors and investors for the following reasons: 1 To assess the entity’s ability to generate cash flows in the future 2 The ability of the entity to pay dividends and meet its obligations 3 Reconciliation between net income in the income statement as net cash flow from operating activities in the statement of cash flows. 4 To assess cash and noncash investing and financing activities of the entity during the accounting period. Classification of Cash Flows There are three classifications of cash flows: 1 Operating activities Cash receipts and disbursements are transactions that relate to net income. More specifically these transactions relate to operating income. They include cash receipts from the sale of products or services, the payment to vendors for inventory and the payment of salaries and wages to employees. 2 Investing activities Cash receipts and disbursements are transactions that relate to noncurrent assets. They include the purchase and disposition of investments and long-lived assets and loans and collection of loans to outside parties. 3 Financing activities Cash receipts and disbursements are transactions that relate to long-term debt and stockholders’ equity. They include borrowing cash from creditors and repayment of such loans and the sale of capital stock and the payment of dividends and return of capital to equity investors. Format of the Statement of Cash Flows The following format is for a statement of cash flows using the indirect method of reporting cash flows from operating activities. F:\Teaching\3322\web\post\module5\c21\tnotes\c21a.doc 3/14/2007 1 Statement of Cash Flows Spencer Company Statement of Cash Flows For the Period Ended December 31, 20001 Cash flows from operating activities Net income Amortization Depreciation Changes in current assets: Increases Decreases Changes in current liabilites: Increases Decreases Gains from investing or financing Losses from investing or financing Net cash flow from operating activities $ + + + + + Cash flows from investing activities Sale of long-term assets Sales of investments Collection of loans Purchase of long-term assets Purchase of investments Loan of funds to outside entities Net cash flow from investing activities + + + - Cash flows from financing activities Sale of equity securities Issuance of long-term debt Dividends to stockholders Repayment of long-term debt Reacquisition of capital stock Net cash flow from financing activities + + - Net increase (decrease) in cash Cash at beginning of period Cash at ending of period $ $ $ $ $ $ $ Steps in Preparation The statement of cash flows is prepared using the following information: 1 Comparative balance sheets F:\Teaching\3322\web\post\module5\c21\tnotes\c21a.doc 3/14/2007 2 Statement of Cash Flows 2 3 The changes between the beginning and ending balance sheets are analyzed to determine the sources of changes in cash flows. Current income statement The current income statement provides the information required to determine the sources and uses of cash during the accounting period. T-account analysis of selected general ledger accounts A T-account analysis must be conducted on each account that resulted in a gain or loss from investing or financing activities during the accounting period. There are five steps involved in preparing the statement of cash flows: 1 Determine the change in cash Using the work sheet approach (which will be discussed in lesson 2) we compare the beginning and ending cash balances to determine the change in cash during the accounting period. 2 Determine the net cash flows from operating activities a) Direct Method The direct method reports cash receipts from sales, cash disbursements as a result of the cost of goods sold, operating expenses and income taxes. It is essentially a cash flow statement using the income statement format. To determine the cash receipts from sales a T-account analysis is conducted of the changes in accounts receivable. Any increase in the accounts receivable during the accounting period is subtracted from sales to derive the cash collected from sales activities for the period. Likewise, to determine the cost of goods sold a T-account analysis of accounts payable and inventory must be conducted to calculate the cash paid for inventory sold. The cash disbursements are segregated so that cash payments to suppliers (vendors for inventory items), operating expenses and income taxes are presented separately. Although the FASB recommends this approach in practice few companies actually report using this method. Not only is this more complicated and time consuming but entities reporting under this approach must still provide the reconciliation that is presented using the indirect method as well. Exercise: Spencer Company had the following 2003 income statement: Sales Cost of goods sold Gross profit Operating expenses Deprecation Net income $200,000 120,000 80,000 29,000 21,000 $ 30,000 The following accounts increased during 2003: Accounts receivable $17,000 Inventory 11,000 Accounts payable 13,000 Prepare the cash flows from operating activities section of Azure’s 2002 statement of cash flows using the direct method. F:\Teaching\3322\web\post\module5\c21\tnotes\c21a.doc 3/14/2007 3 Statement of Cash Flows Cash flows from operating activities: Cash received from customers Cash payments: Vendors Operating expenses Net cash provided by operating activities $ $ $ $ Solution: Cash flows from operating activities: Cash received from customers ($200,000 - $17,000) Cash payments: Vendors ($120,000 + $11,000 - $13,000) Operating expenses Net cash provided by operating activities 183,000 118,000 29,000 147,000 $36,000 b) Indirect Method The indirect method or reconciliation method reports cash flow from operating activities by starting with net income. Added back are all noncash charges such as amortization and depreciation. Next changes in most current assets and current liabilities are added or subtracted. The last adjustment to net income includes the gains and losses from investing and financing activities. This reconciliation clearly shows the adjustments from the income statement that result in cash flows from operating activities for the accounting period. This method is easier to use and is widely used in practice. Exercise: Use the information from the exercise above for Spencer Company. Prepare the cash flows from operating activities section of Spencer Company’s 2003 statement of cash flows using the indirect method. Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation Increase in accounts payable Increase in accounts receivable Increase in inventory Net cash provided by operating activities F:\Teaching\3322\web\post\module5\c21\tnotes\c21a.doc 3/14/2007 $ $ $ $ $ $ $ 4 Statement of Cash Flows Solution: Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation Increase in accounts payable Increase in accounts receivable Increase in inventory Net cash provided by operating activities 3 30,000 21,000 13,000 (17,000) (11,000) 6,000 $36,000 Determine the net cash flows from investing activities Cash flows from investing activities requires an analysis of the purchase or disposition of noncurrent assets. This is accomplished by conducting a T-account analysis of the general ledger accounts affected by the transaction. For example, if we disposed of a piece of equipment, we would need to look at the change in the equipment account, the change in the accumulated deprecation account and the reported gain or loss on the income statement. To determine the cash flow we would need to start with the gain or loss, add the original cost of the equipment that was removed from the general ledger account and subtract the accumulated deprecation that was removed from the general ledger account. The result would be the actual cash flow from the sale of the piece of equipment. Exercise: Spencer Company had the following activities in 2003: Sale of long Purchase of inventory Purchase of treasury stock Purchase of equipment Issuance of common stock Purchase of available-for-sale securities $130,000 845,000 72,000 415,000 320,000 59,000 Compute the amount Spencer Company should report as net cash provided (used by investing activities in its statement of cash flows. Cash flows from investing activities: Sale of land Purchase of equipment Purchase of available-for-sale securities Net cash used by investing activities $ $ Solution: F:\Teaching\3322\web\post\module5\c21\tnotes\c21a.doc 3/14/2007 5 Statement of Cash Flows Cash flows from investing activities: Sale of land Purchase of equipment Purchase of available-for-sale securities Net cash used by investing activities 4 130,000 (415,000) (59,000) (344,000) Determine the net cash flows from financing activities Cash flows from financing activities requires an analysis of the issuance or repayment of long-term debt, issuance or repurchase of equity securities and the payment of dividends. This is accomplished by conducting a T-account analysis of the general ledger accounts affected by the transaction. For example, if the entity issued 100 shares of common stock with a par value of $5 for $45 per share, we would analyze the changes in the capital stock account and the additional paid-in capital accounts to determine the cash received from the sale of stock. Exercise: Spencer Company had the following activities in 2003: Payment of accounts payable Issuance of common stock Payment of dividends Collection of note receivable Issuance of bonds payable Purchase of treasure stock $770,000 250,000 300,000 100,000 510,000 46,000 Compute the amount Spencer Company should report as net cash provided (used) by financing activities in its 2003 statement of cash flows. Cash flows from financing activities: Issuance of common stock Issuance of bonds payable Payment of dividends Purchase of treasury stock Net cash provided by financing activities $ $ $ $ $ Solution: Cash flows from financing activities: Issuance of common stock Issuance of bonds payable Payment of dividends Purchase of treasury stock Net cash provided by financing activities F:\Teaching\3322\web\post\module5\c21\tnotes\c21a.doc 3/14/2007 250,000 510,000 (300,000) (46,000) 414,000 6 Statement of Cash Flows 5 Determine the noncash transactions that explain changes in some of the balance sheet accounts Every once in a while we will notice a change in a general ledger account that was not the result of a cash transaction. For example, if an entity acquires a piece of land worth $100,000 by issuing 10,000 share of $5 par value common stock, we would have a debit to the land account for $100,000, a credit to the common stock account for $50,000 and a credit to additional paid-in capital for $50,000. There was no cash that changed hands but we need to reconcile this in our analysis and report if at the bottom of the cash flow statement as a noncash transaction that took place during the accounting period. Exercise: In 2002, Spencer Company issued 1,000 shares of $10 par value common stock for land worth $50,000. Prepare the journal entry to record the transaction. ACCOUNT DEBIT CREDIT Land Common stock Additional paid-in capital, common stock To record the purchase of land through the issuance of 1,000 shares of $10 par value common stock. Solution: ACCOUNT Land Common stock Additional paid-in capital, common stock DEBIT 50,000 CREDIT 10,000 40,000 To record the purchase of land through the issuance of 1,000 shares of $10 par value common stock. Sources of Information for the Statement of Cash Flows The comparative balance sheets provide the foundation for analyzing changes in cash. Information contained in the current year income statement and analysis of selected general ledger accounts will be necessary in order to complete the analysis. One of the more difficult accounts to analyze will be the change in retained earning from the beginning to the end of the period. The two basic entries will include a credit for net income and a debit for dividends declared. We will discuss additional analysis when we get to C22b where we introduce the use of the work sheet method. Writedowns, amortization charges, deprecation and amortization are among those items that have no affect on cash flow although they are include in the income statement. They must be backed out of net income in order to get cash flows. F:\Teaching\3322\web\post\module5\c21\tnotes\c21a.doc 3/14/2007 7