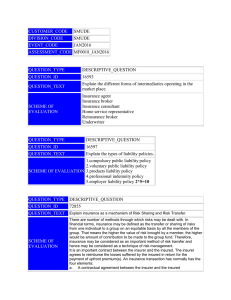

INTRODUCTION & INSURANCE FUNDAMENTALS ! WHAT IS RISK MANAGEMENT?

advertisement