CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

advertisement

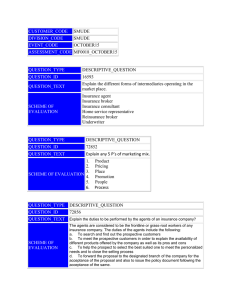

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE EVENT_CODE JAN2016 ASSESSMENT_CODE MF0018_JAN2016 QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 16593 QUESTION_TEXT Explain the different forms of intermediaries operating in the market place. SCHEME OF EVALUATION Insurance agent Insurance broker Insurance consultant Home service representative Reinsurance broker Underwriter QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 16597 QUESTION_TEXT Explain the types of liability policies. 1.compulsory public liability policy 2.voluntary public liability policy SCHEME OF EVALUATION 3.products liability policy 4.professional indemnity policy 5.employer liability policy 2*5=10 QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 72855 QUESTION_TEXT Explain insurance as a mechanism of Risk Sharing and Risk Transfer. SCHEME OF EVALUATION There are number of methods through which risks may be dealt with. In financial terms, insurance may be defined as the transfer or sharing of risks from one individual to a group on an equitable basis by all the members of the group. That means the higher the value of risk brought by a member, the higher would be amount of contribution to be made to the group fund. Therefore, insurance may be considered as an important method of risk transfer and hence may be considered as a technique of risk management. It is an important contract between the insurer and the insured. The insurer agrees to reimburse the losses suffered by the insured in return for the payment of upfront premium(s). An insurance transaction has normally has the four elements: a. A contractual agreement between the insurer and the insured b. The insured is bound to pay the premium upfront to the insurance company c. A benefit payment by the insured based upon the occurrence of the contingent event d. A pool of resources to be held and managed by the insurer to reimburse the losses suffered by the few unfortunate individuals. QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 126196 QUESTION_TEXT What is pure risk? Mention different types of pure risk The risk that can be insured is generally referred to as pure risk. The risk management function has traditionally focused on the management of pure risk. The major types of pure risk that affect businesses include: (1) Property Risk: The risk of reduction in value of business assets due to physical damage, theft, and expropriation (i.e., seizure of assets by foreign governments). SCHEME OF EVALUATION (2) Legal Liability Risk: The risk of legal liability for damages for harm to customers, suppliers, shareholders, and other parties. (3) Other Risks: The risk associated with paying benefits to injured workers under workers’ ¾compensation laws and the risk of legal liability for injuries or other harms to employees that are not governed by workers’ compensation laws. The risk of death, illness, and disability to employees (and sometimes family members) ¾for; which businesses have agreed to make payments under employee benefit plans, including obligations to employees under pension and other retirement savings plans. QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 126197 QUESTION_TEXT What is causa proxima? Explain through examples. This is applied to decide the amount of loss. SCHEME OF EVALUATION If there are multiple causes to damage then only immediate cause and not the distant cause is considered Proximate cause is nearest cause of damage Proximate cause means the most closely and directly connected of the perils insured against with loss. Thus the insurer is liable for loss, if the risk must be insured against is the proximate or the last cause of loss occurred If there is one cause of loss identified, it is not required to go further into the cause of causes. If there is a series of causes of damage or loss is identified in such the nearest peril is the one insured against the principle of because proxima is applied. And also the insurer is bound to be responsible only if the closest cause comes within the meaning of the risk insured Thus the closest peril is the one insured against risk, the loss of the subject matter would be compensated. For examples related to marine or other policies QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 126199 What are pricing objectives in case of life and health insurance? QUESTION_TEXT Rate Adequacy: SCHEME OF EVALUATION The first regulatory requirement is that rates must be adequate. This means the rates charged by insurers should be high enough to pay all losses and expenses. If rates are inadequate, an insurer may become insolvent and fail. As a result, policy owners, beneficiaries, and third-party claimants may be financially harmed if their claims are not paid However, rate adequacy is complicated by the fact that the insurer does not know its actual costs when the policy is sold The premium is paid in advance, but it may not be sufficient to pay all claims and expenses during the policy period It is only after the period of protection has expired that an insurer can determine its actual costs. Rate Not Excessive: The second regulatory requirement is that the rates must not be excessive. This means that the rates should not be so high that policy-owners are paying more than the actual value of their protection. Exorbitant prices are not in the public interest. Rate Equity or Not Unfairly Discriminatory: The third regulatory requirement is that the rates must not be unfairly discriminatory. This means that exposures that are similar with respect to losses and expenses should and expenses should not be charged substantially different rates. It is one of the goals of underwriting