PH 742A: Health Services Financial Management

advertisement

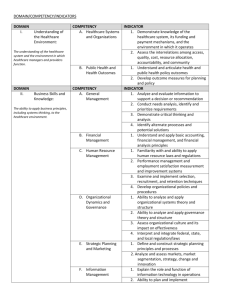

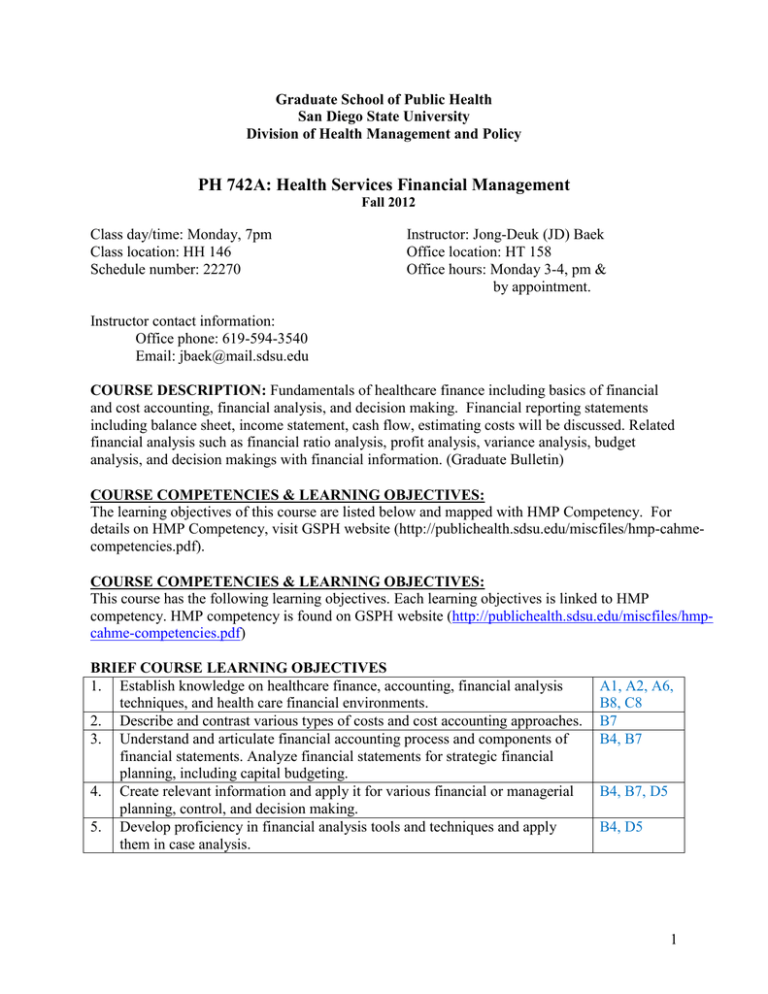

Graduate School of Public Health San Diego State University Division of Health Management and Policy PH 742A: Health Services Financial Management Fall 2012 Class day/time: Monday, 7pm Class location: HH 146 Schedule number: 22270 Instructor: Jong-Deuk (JD) Baek Office location: HT 158 Office hours: Monday 3-4, pm & by appointment. Instructor contact information: Office phone: 619-594-3540 Email: jbaek@mail.sdsu.edu COURSE DESCRIPTION: Fundamentals of healthcare finance including basics of financial and cost accounting, financial analysis, and decision making. Financial reporting statements including balance sheet, income statement, cash flow, estimating costs will be discussed. Related financial analysis such as financial ratio analysis, profit analysis, variance analysis, budget analysis, and decision makings with financial information. (Graduate Bulletin) COURSE COMPETENCIES & LEARNING OBJECTIVES: The learning objectives of this course are listed below and mapped with HMP Competency. For details on HMP Competency, visit GSPH website (http://publichealth.sdsu.edu/miscfiles/hmp-cahmecompetencies.pdf). COURSE COMPETENCIES & LEARNING OBJECTIVES: This course has the following learning objectives. Each learning objectives is linked to HMP competency. HMP competency is found on GSPH website (http://publichealth.sdsu.edu/miscfiles/hmpcahme-competencies.pdf) BRIEF COURSE LEARNING OBJECTIVES 1. Establish knowledge on healthcare finance, accounting, financial analysis techniques, and health care financial environments. 2. Describe and contrast various types of costs and cost accounting approaches. 3. Understand and articulate financial accounting process and components of financial statements. Analyze financial statements for strategic financial planning, including capital budgeting. 4. Create relevant information and apply it for various financial or managerial planning, control, and decision making. 5. Develop proficiency in financial analysis tools and techniques and apply them in case analysis. A1, A2, A6, B8, C8 B7 B4, B7 B4, B7, D5 B4, D5 1 FULL COURSE LEARNING OBJECTIVES LINKED TO HMP COMPETENCIES; HMP Competency: A1 Discuss health care organizations and their relationship to access, quality, cost, accountability, and the health of patients and the community. Identify/discuss implications of major types of payment systems such as FFS, Medicare PPS system and Capitation in MCOs on healthcare financial management. HMP Competency: A2 Describe trends in health care expenditures, and their causes and consequences on health and health care organizations. Identify/discuss implications of major types of payment systems such as FFS, Medicare PPS system and Capitation in MCOs on healthcare financial environment including health expenditure, and discuss challenges in health care financial management. HMP Competency: A6 Identify revenue sources and reimbursement methods in the U.S. health care system, including historical origins and current policy, and their impact on health service delivery. Identify/discuss implications of major types of payment systems such as FFS, Medicare PPS system and Capitation in MCOs on healthcare financial environment including health expenditure, and discuss challenges in health care financial management. Discuss revenue cycle/management and cost determination in PPS and managed care environments. HMP Competency: B4 Apply quantitative methods, such as survey research, health care market analysis, operations research, and statistical analysis, to health care managerial decision making. Analyze financial statements including cash flow and use them to evaluate financial condition of healthcare organizations o Interpret financial and operational ratios to evaluate business performance of healthcare organizations. Conduct managerial and capital decision making; o Discuss concepts of time value of money (present and future values) and apply them for health care financial planning/decisions. o Discuss the relationships of price, cost, and quantity relative to breakeven analysis. o Describe budget planning, and discuss and analyze different types of budgets in strategic planning and managerial control purposes. Analyze variances in budgets for performance improvement. o Utilize computer applications like Excel spreadsheet for financial analysis. HMP Competency: B7 Apply managerial and cost accounting information to evaluate financial performance and decision making in health care organizations. Describe financial accounting process and evaluate its relations with financial statements. Describe and contrast components in financial statements in healthcare organizations. Describe and contrast capital financing methods, capital cost, and capital planning in either 2 investor-owned or not-for-profit (including managing community funding) healthcare organizations. Conduct financial condition analysis. HMP Competency: B8 Understand and calculate different reimbursement formulas and strategies for cost containment and revenue enhancement used by the government and health services organizations. Identify implications of major types of payment systems such as FFS, Medicare PPS system and Capitation in MCOs on healthcare financial management. Discuss revenue cycle/management and cost determination in PPS and managed care environments. HMP Competency: C8 Understand the importance of compliance for health organizations related to data privacy, confidentiality, data security, coding, billing, and government regulations. Discuss revenue cycle/management and cost determination in PPS and managed care environments. HMP Competency: D5 Form and lead teams to improve organizational, project, and task performance. Describe budget planning, and discuss and analyze different types of budgets in strategic planning and managerial control purposes. Analyze variances in budgets for performance improvement. Apply financial management concepts through case study assignment. COURSE MATERIALS: Textbooks: Required: Fundamentals of Healthcare Finance, AUPHA, Louis C. Gapenski. Further readings (selected chapters or parts): Financial Management in Healthcare, AUPHA, Louis C. Gapenski. CLASS FORMATS: This course is consisted of lectures, class discussions/demonstrations/exercises, and assignments. The instructor will hand out lecture material and other resources for discussions and exercises. Lecture and discussion: See the class schedule for details. Preparation/Review Questions: Some questions (T/F, multiple choices) will be used to review concepts and techniques learned in the previous week. Practice: A case/calculation questions are to be used to practice application of theories. Excel spreadsheet may be used for the selected topics such as present value analysis. Resources for practices will be posted on the BlackBoard. 3 COURSE REQUIREMENTS: Class Participation (10%) - Assignment (30%) o Case analysis (15%) o Homework (15%) - 1st Exam (30%) nd - 2 Exam (30%) GRADING SCALE: A A AB+ B B- 97-100 96-93 92-90 89-87 86-83 82-80 C+ C CCD F 79-77 76-73 72-70 69-67 66-63 62 or less ASSIGNMENTS: - Written Case Analysis: One case analysis will be assigned. Each student is required to a written report that analyzes and provides possible answers to questions (less than five pages, 12 font size, double spaced; excluding cover page, references, and appendix if any). Each case will be introduced in class in detail by the instruction with a simple guide of report. No presentation required. - Homework: Each homework assignment requires write-ups and calculations. Expect two homework assignments. BLACKBOARD, EMAIL, AND COMPUTER RESOURCES: All of material used in class including announcements, course documents, weekly reading and lecture handouts will be posted on Blackboard. Students must check the Blackboard regularly, several times a week. Lecture handout (in a pdf format) will usually be posted a couple days before the class of week but can be as late as the day of lecture. COURSE POLICIES: Missing class: If you miss a class, it is your responsibility to contact the instructor to discuss alternatives to any quiz or exercise you miss, and to obtain lecture notes, handouts, other materials or instructions from the course Blackboard site or a classmate. Religious holidays: The University Policy File includes the following statement on absence for Religious Observances: By the end of the second week of classes, students should notify the instructors of affected courses of planned absences for religious observances. Extenuating circumstances: If severe difficulties (e.g., illness, injury, death of a family member) prevent you from completing an assignment on time, please contact the instructor to discuss alternative arrangements as soon as possible. 4 Academic misconduct: Misconduct by a student shall include, but not be limited to: disrupting classes; giving or receiving unauthorized aid on examinations, reports or other assignments; knowingly misrepresenting the source of any academic work; falsifying research results; plagiarizing another’s work; violating regulations or ethical codes for the treatment of human subjects; or otherwise acting dishonestly. If an instance of academic misconduct is suspected, the student will be informed of the infraction and the penalty to be imposed. If appropriate, the matter will be referred to the Department Chair and Dean of the College for mediation. Potential sanctions include a warning, an admonition, censure, reduction of grade (including a grade of F for the course), disciplinary probation, suspension, or expulsion. Safety: Students are encouraged to consult with SDSU public safety regarding parking and other safety issues. San Diego State University is dedicated to a safe, supportive and nondiscriminatory environment. It is the responsibility of all students to familiarize themselves with University policies regarding nondiscrimination, misconduct and academic honesty. Statement on Nondiscrimination Policy San Diego State University complies with the requirements of Title VI and Title VII of the Civil Rights Act of 1964, as well as other applicable federal and state laws prohibiting discrimination. No person shall, on the basis of race, color, or national origin be excluded from participation in, be denied the benefits of, or be otherwise subjected to discrimination in any program of the California State University SDSU does not discriminate on the basis of disability in admission or access to, or treatment or employment in, its programs and activities. Students should direct inquiries concerning San Diego State University’s compliance with all relevant disability laws to the Director of Student Disability Services (SDS), Calpulli Center, Room 3101, San Diego State University, San Diego, CA 92128 or call 619-594-6473 (TDD: 619-594-2929). SDSU does not discriminate on the basis of sex, gender, or sexual orientation in the educational programs or activities it conducts. More detail on SDSU’s Nondiscrimination Policy can be found in the SDSU General Catalog, University Policies. Student Conduct and Grievances SDSU is committed to maintaining a safe and healthy living and learning environment for students, faculty and staff. Sections 41301, Standards for Student Conduct, and Sections 4130241304 of the University Policies regarding student conduct should be reviewed. If a student believes that a professor’s treatment is grossly unfair or that a professor’s behavior is clearly unprofessional, the student may bring the complaint to the proper university authorities and official reviewing bodies. See University policies on Student Grievances. Statement on Plagiarism and Academic Dishonesty Academic dishonesty includes cheating, plagiarism or other forms of academic dishonesty that are intended to gain unfair academic advantage. See section 41301 of the University policies. Plagiarism is an important element of this policy. Plagiarism is defined as ‘formal work publicly misrepresented as original; it is any activity wherein one person knowingly, directly and for 5 lucre, status, recognition, or any public gain resorts to the published or unpublished work of another in order to represent it as one’s own’. Any work, in whole or in part, taken from the Internet or other computer-based source without referencing the source is considered plagiarism. http://its.sdsu.edu/classic/resources/turnitin/pdf/Plagiarism_AcadSen.pdf. COURSE SCHEDULE Week Topics Date Topics: Introduction - Introduction: syllabus 1 Foundation Concepts Aug 27 - Healthcare finance - Healthcare business basic Readings: chs 1 and 2 2 Labor Day: No Class Sep 3 Topics: Revenue sources and reimbursement - Paying for health services 3 - Reimbursement: FFS and Capitation Sep 10 - Provider incentive and financial risk Readings: chs 3 and supplemental readings Topics: Costs - Types of costs 4 - Cost allocation Sep 17 - ABC Readings: ch 4 Topics: Pricing Decisions 5~6 - Price setting strategy Sep 24 - Profit analysis, breakeven analysis Oct 1 - Marginal analysis Readings: ch 5 Topics: Budgeting and Budget evaluation 6~7 - Strategic planning Oct 1 - Budgeting types Oct 8 - Variance analysis Readings: chs 6 and 7 8 1st Exam Oct 15 Debrief Topics: Financial Operations 9 - Revenue cycle Oct 22 - Cash management - Receivables management Readings: ch 7 10 APHA, No Class Oct 29 Practice/ HMP Assignments Competency Practice A1 A2 Practice Practice Case 1 introduction Practice A1 A2 A6 B8 C8 B7 B8 B4 (case analysis report) A2 A6 B4 B8 Practice HW1 B4 Practice A6 B4 6 Week Date 11 Nov 5 12 Nov 12 13 Nov 19 14 Nov 26 15 Dec 3 Topics Topics: Reporting profits - Accounting process - Financial statements Readings: chs 11 and 12 Practice/ HMP Assignments Competency Case 1 Due A6 B7 B8 Veteran’s Day, No Class Topics: Reporting Assets, financing, and Cash Flow - Financial statements Readings: chs 12 and 13 Topics: Analyzing Financial Statements - Financial statement analysis - Du Pont analysis Readings: chs 13 Topics: Business Financing and Cost of Capital - Financing decisions - Cost of capital Readings: ch 8 A6 B7 B8 Practice HW2 B4 B7 Practice B4 B7 Topics: Capital investment Decisions (if time allowed) - Time line analysis - Breakeven analysis - Discount cash flow analysis - Cash flow estimation - Risk analysis Readings: chs 9 and 10 16 2nd Exam Dec 10 This course schedule is subject to change. Supplementary Readings and Resources (will be updated) Hsiao, Braun, Kelly, and Becker, "Results, Potential Effects, and Implementation Issues of the ResourceBased Relative Value Scale, JAMA, October 28, 1988. Cleverly and Nutt, “The Decision Process Used for Hospital Bond Rating-and its Implications,” Health Services Research, December 1984. Wheeler and Smith, ‘The Discount Rate for Capital Expenditure Analysis in Health Care,” Healthcare Management Review, 13(2), 1988, 43-51. Kennedy and Plath, “A Return-Based Alternative to IRR Evaluations,” Healthcare Financial Management, March 1994, 38-49. 7 Bolster, “Planning during Turmoil: Credit Challenges and Healthcare Finance,” Healthcare Financial Management, 62;11, 2008, 55-62. Gapenski, “Capital Investment Analysis: Three Methods,” Healthcare Financial Management, Aug. 1993, 60-66. Cleverly, “Financial Ratios, Summary Indicators for Management Decision-Making,” Hospital and Health Services Administration / Special I, 1981, 26-47. Baker and Boyd, “Activity-Based Costing in the Operating Room at Valley View Hospital,” Journal of Health Care Finance, 24;1, 1997, 1-9. Kaplan, “The Demise of Cost and Profit Center.” White Paper, 2006, 1-7. Kis and Bodenger, “Cost Management Information Improves Financial Performances,” Healthcare Financial Management, 43;5, 1989, 36-48. Cleverly, W. and Harvey, R. 1992. “Does Hospital Financial Performance Measure Up?” Health Care Financial Management 46(5), 21-26 Epstein, A. M., and Cumella, E. J. 1988. “Capitation Payment: Using Predictions of Medical Utilization to Adjust Rates.” Health Care Financing Review 10(1), 51-69. Giacomino, D. 1993. “Cash Flows: Another Approach to Ratio Analysis.” Journal of Accountancy, March 1993, 55-? Muller, A. 1993. “Medicare Prospective Payment Reforms and Hospital Utilization: Temporary or Lasting Effects.” Medical Care 31(4), 296-308. Rogers, M., and Rothe, K. 1993. “Integrating Capital Budgeting techniques.” Health Care Strategic Management 10(2), 7-10. Sherman, B. 1990. ‘How Investors Evaluate Hospitals’ Creditworthiness.” Healthcare Financial Management 44(3), 24-30. Sunders, R., and et. al. 1993. “Strategic Capital Planning Scenarios for the Future.” Healthcare Financial Management 48(4), 50-53. Whitcombe, M. E., and Cleverly, W. O. 1993. “Financial Performance of Academic Medical Center Hospitals.” Academic Medicine 68(10), 729-31. 8