PS5 Solutions Chapter 12: Fiscal policy 24 points

advertisement

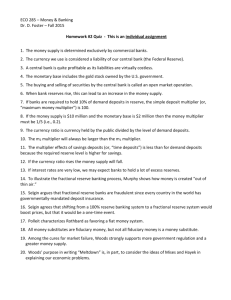

PS5 Solutions 24 points Chapter 12: Fiscal policy 1. If the marginal propensity to save is 0.05, how large is the multiplier? If the marginal propensity to save doubles to 0.10, what happens to the multiplier? With an MPS of 0.05, the MPC is 0.95. Since the multiplier is 1/(1-MPC) = 1/MPS = 1/0.05 = 20 1 pt. If the MPS doubles to 0.10, the multiplier decreases to 10 1 pt. 3. a. b. c. The multiplier process depicted in Table 12.1 is based on an MPC of 0.75. Recompute the first five cycles using an MPC of 0.50. What is the value of the multiplier in this case? What is the multiplier when the MPC is (1) 0.80 and (2) 0.90? (a) Using an MPC of .5, the impact of $100 spent the government will be as follows: Cycle Change in Spending Cumulative Change This cycle 1 100 100 2 50 150 3 25 175 4 12.5 187.5 5 6.25 193.75 1 pt (b) (c) When the MPC = .5, the Multiplier is 2. = 1/(1-.5) 1 pt When the MPC = .8, the Multiplier is 5. = 1/(1-.8) 1 pt When the MPC = .9, the Multiplier is 10. = 1/(1-.9) 1 pt 6. If taxes were cut by $1 trillion and the MPC were 0.95, by how much would total spending: a. increase in the first year with two spending cycles? b. increase over five year, with two spending cycles per year? c. increase over an infinite time period? Spending Cycle 1 One year 2 3 Two years 4 5 Three years 6 7 Four years 8 9 Five years 10 Total Change in Spending Spending $950 billion $950 billion 1,852.5 billion 902.5 billion 2,709.88 billion 857.38 billion 3,524.39 billion 814.51 billion 4,298.17 billion 773.78 billion 5,033.27 billion 735.1 billion 5,731.61 billion 698.34 billion 6,395.03 billion 663.42 billion 7025.28 billion 630.25 billion 7,624 billion 598.74 billion Using the table above, a) is $1.86 trillion 1 pt and b) is $7.62 trillion 1 pt c. Over an infinite time period, the economy would expand by $19 trillion when the full multiplier effect takes place. This is calculated as: Tax Multiplier x $1 trillion = MPC/(1-MPC) x $1 trillion = 0.95/(1-0.95) x $1 trillion = 19 x $1 trillion = $19 trillion 1 pt Chapter 13: Money and banking 4. What volume of loans can the banking system in Figure 13.2 support? If the reserve requirement were 50 percent, what would the system’s lending capacity be? With a reserve ratio of 0.75, the money multiplier is 1/rr = 1/0.75 = 1.33. With an initial injection of $100 into the system, a total of $33 in new loans can be made. 1 pt. If the rr = 0.50, then the money multiplier is 2 and $100 of new loans can be supported in the banking system. 1 pt 5. Suppose that an Irish Sweepstakes winner deposits $10 million in cash into her transactions account at the Bank of America. Assume a reserve requirement of 25 percent and no excess reserves in the banking system prior to this deposit. Show the changes on the Bank of America balance sheet when the $10 million is initially deposited. Changes in the balance sheet when the initial deposit is made are as follows: Assets Reserves $10,000,000 Required 2,500,000 Excess 7,500,000 1 pt. Liabilities Demand Deposits +$10,000,000 Chapter 14: Monetary policy 1. Suppose the following data apply: Total Bank Reserves Total Bank Deposits Cash Held by the Public Bonds Held by the Public a. b. c. d. $5 billion Stocks held by public $140 billion $100 billion $5 trillion $10 billion Gross Domestic Product Interest rate 6 percent $220 billion Required reserve ratio 0.04 How large is the money supply as measured by M1? How much excess reserves are there? What is the money multiplier? What is the available lending capacity? a. b. c. d. The basic money supply (M1) is transaction account balances and cash. Assuming that the total bank deposits are in transactions accounts the money supply is $110 billion. 1 pt If the required reserve ratio is 0.04, then banks are required to keep $4 billion in reserve ($100 billion X 0.04). Since banks have total reserves of $5 billion, there is $1 billion in excess reserves. 1 pt The money multiplier is calculates as 1/(required reserve ratio). Thus, the money multiplier is 1/0.04 = 25. 1 pt Since there are $1 billion in excess reserves and the money multiplier is 25, there is $25 billion in available lending capacity. 1 pt 3. Suppose the Federal Reserve decided to purchase $10 billion worth of government securities in the open market. a. How will M1 be affected initially? b. How will the lending capacity of the banking system be affected if the reserve requirement is 25 percent? c. How will banks induce investors to utilize this expanded lending capacity? When the Fed purchases $10 billion of securities on the open market: a. b. c. M1 will increase by $10 billion, assuming that the sellers of the securities hold the proceeds as cash or deposit them in a transactions account, e.g., checking account. 1 pt Lending capacity will increase by $30 billion. (A money multiplier of 4 x excess reserves of $7.5 billion.) 1 pt As the money supply increases, interest rates go down and investors will want to borrow more funds. 1 pt 4. a. Suppose the economy is initially in equilibrium at an output level of 100 and price level of 100. The Fed then manages to shift aggregate demand rightward by 20. Illustrate the initial equilibrium (E1) and the shift of AD. b. Show what happens to output and prices if the aggregate supply curve is (1) horizontal 1 pt., (2) vertical 1 pt., and (3) upward sloping 1 pt.. When the economy is at an equilibrium output of 100 and a price level is 100, the impact of a shift in AD rightward by 20 is illustrated below: (a) Initial equilibrium is E1. (b) Output and price changes vary according to the shape of the AS curve. 1 1 Aggregate su pply P1 P5 Ag gregate supp ly P4 A D1 0 0 0 E1 A D2 A D5 1 QF 0 0 A D4 0 E1 R ATE O F OU TPUT RATE O F OUTPUT 1 Agg regate su pply P7 P6 A D7 AD6 0 0 0 E1 Q7 R ATE O F O U TPU T 1 1 5. Illustrate the effects on bank reserve of an open-market sale (See Figure 14.5) An open market sale of government securities by the Federal Reserve would have exactly the opposite effect of the change illustrated in Figure 14.5: Step 1, FMOC sells government bond to the public, who pays by check. Step 2, Funds are withdrawn from buyer’s private bank. Step 3, Private bank’s account at Regional Federal Reserve Bank is debited. 1 pt. (okay to just explain that selling bonds decreases lending power) 6. How did the money multiplier change when China increased its reserve requirement? (see Headline p. 320) When the reserve requirement increased from 6 percent to 7 percent, the money multiplier decreased from 16.7% to 14.3%. 1 pt.