5 The Market for Foreign Exchange

advertisement

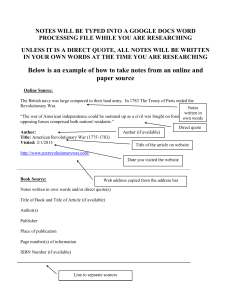

The Market for Foreign Exchange 5 Chapter Five Chapter Objective: This chapter introduces the institutional framework within which exchange rates are determined. determined It lays the foundation for much of the discussion throughout the remainder of the text, thus it deserves your careful attention. 5-1 Outline z Spot Market for Foreign Exchange » Market characteristics » Interpreting quotes » Cross exchange rates z Forward Market for Foreign Exchange » Why is it used » Market characteristics » Estimating forward premium and discount 2 1 The Spot Market FX Market Structure z Spot Rate Quotations z The Bid-Ask Spread z Spot FX trading z Cross Rates z 5-3 FX Trading Levels Source: www.bis.org 2 FX Market Participants z The FX market is a two-tiered market: » Interbank Market (Wholesale) – About 100-200 banks worldwide stand ready to make a market in foreign exchange. – Nonbank dealers account for about 40% of the market. – There are FX brokers who match buy and sell orders but do not carry inventory and FX specialists. »C Client e t Market a et ((Retail) eta ) z Market participants include international banks, their customers, nonbank dealers, FX brokers, and central banks. 5-5 Function and Structure of the FX Market FX Market Participants z Correspondent Banking Relationships z 5-6 3 Correspondent Banking Relationships z International commercial banks communicate with one another with: » SWIFT: The Society for Worldwide Interbank Financial Telecommunications. » CHIPS: Clearing House Interbank P Payments t System S t » ECHO Exchange Clearing House Limited, the first global clearinghouse for settling interbank FX transactions. 5-7 FX Market Share: By Countries 5-8 4 FX Market Share: By Currencies 5-9 FX Market Trading Hours 1 2 3 4 5 6 7 8 9 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 London New York Sydney Tokyo New York opens at 8:00 am to 5:00 pm EST Tokyo opens at 7:00 pm to 4:00 am EST Sydney opens at 5:00 pm to 2:00 am EST London opens at 3:00 am to 12:00 noon EST The best time to trade is when the market is the most active and therefore has the biggest volume of trades. 5-10 5 Circadian Rhythms of the FX Market Electronic Conversations per Hour average peak 45000 40000 35000 30000 25000 20000 15000 10000 5000 0 1:00 3:00 5:00 07:00 9:00 10 am in Lunch Europe Asia Tokyo hour in coming in going out Tokyo 11:00 1:00 15:00 5:00 19:00 9:00 11:00 Lunch Americas London New 6 pm in hour in coming in going out Zealand NY London coming in 5-11 Spot Market z z z z z z Transactions at the same point in time. The market is a network Large money center banks are wholesalers Major currencies: USD; Yen ; Euros; British Pounds, Swiss Francs; Australian Dollars; Canadian Dollars Spot Rate : The price at which a foreign currency can be bought/sold, today. Each spot exchange rate can be expressed in two ways: » Direct quote: price of the foreign currency expressed in units of the home currency (example: 1BP = USD 2.00) » Indirect quote: price of one unit of the home currency expressed in units of the foreign currency (example: 1USD = BP 0.50) 12 6 Currency Symbols z In addition to the familiar currency symbols ((e.g. g £,, ¥,, €,, $) there are three-letter codes for all currencies. It is a long list, but selected codes include: CHF Swiss francs GBP British pound CNY Chinese yuan CAD Canadian dollar JPY Japanese yen MXN Mexican peso 5-13 FX Price Quote (September 27, 2010) Source: http://finance.yahoo.com/currency 14 7 Spot Foreign Exchange Quotes z Direct Quote: U.S. US dollar equivalent » Online Quotes GBP: 1 BP = $1.5850 JPY: 1 JY = $0.0119 » Direct quote = 1 / Indirect quote GBP: 1 BP = 1 / 0.6309 = $1.5850 JPY: 1 JY = 1 / 84.285 = $0.0119 z Indirect Quote: Currency per USD » Online Quotes GBP: 1 USD = BP0.6309 JPY: 1 USD = JY84.285 » Indirect quote = 1 / Direct quote GBP: 1 USD = 1 / 1.5850 = BP0.6309 JPY: 1 USD = 1 / 0.0119 = JY84.285 15 Long-term FX Rates: USD & Yen (Direct Quote) 16 8 Long-term FX Rates: USD & Yen (Indirect Quote) 17 Long Term FX Rates: USD & Major World Currencies Source: http://research.stlouisfed.org/fred2 9 Applying Direct and Indirect Quotes to Convert Currency Currency Conversion Formulas: Converting USD into FC Converting FC into USD Using DQ USD / DQ = FC FC * DQ = USD Using IQ USD * IQ = FC FC / IQ = USD DQ = Direct quote IQ = Indirect quote USD = US Dollars FC = Foreign currency 19 Bid and Ask Quotes and Spread z Ask Quote (currency dealer dealer’ss selling price) » z Bid Quote (currency dealer’s buying price) » z z z $ 1.3472 / 1 Euro $ 1.3463 / 1 Euro Ask price > Bid price Bid A k Q Bid-Ask Quotes: t $1 $1.3463-72 3463 72 or jjustt 63 63-73 73 Bid-Ask Spread (in %) = 100 * (Ask - Bid) / Ask » 100 * (1.3472 - $ 1.3463) / 1.3472 = 0.0668% 20 10 Indirect Price Quotes (Foreign Currency / USD) Direct quotes Indirect quotes S b l Symbol C Currency Bid A k Ask Bid A k Ask JPY Yen 0.01184 0.01189 84.10429 84.45946 EUR Euro 1.3463 1.3472 0.74230 0.74280 GBP British Pound 1.5810 1.5823 0.63200 0.63250 MXN Mexican Peso 0.07937 0.08036 12.44332 12.5997 CHF Swiss Franc 1.01564 1.01609 0.98416 0.98460 21 Percentage Change: Direct Quotes Formula: % change in DQ = 100*(DQ1– DQ0) / DQ0 DQ0 = Direct quote quote, at the beginning of the period DQ1 = Direct quote, at the end of the period Interpretation: Measures appreciation or depreciation of the foreign currency, in terms of the USD. As seen from the US viewpoint Example: On 1/1/X1 the DQ for SF was $0.50, on 1/1/X2 it was $0.60, and on 1/1/X3 it was $0.57 Period Percentage Change in DQ 20X1 - 20X2 100*(0.60-0.50) / 0.50 = 20.00% 20X2 - 20X3 100*(0.57-0.60) / 0.60 = - 5.00 % Interpretation SF appreciated by 20% SF depreciated by 5% 22 11 Percentage Change: Indirect Quotes Formula: % change in IQ = 100*(IQ1 – IQ0) / IQ0 IQ0 Q0 = Indirect d ec quo quote, e, a at the e beg beginning go of the e pe period od IQ1 = indirect quote, at the end of the period Interpretation: Measures appreciation or depreciation of the USD, in terms of the foreign currency. As seen from the foreign country’s viewpoint Example: On 1/1/X1 the IQ for MP was 10.00, on 1/1/X2 it was 9.00, and on 1/1/X3 it was 11.25 Period Percentage Change in IQ Interpretation 20X1 - 20X2 100*(9.00-10.00) / 10.00= -10.00% USD depreciated by 10% 20X2 - 20X3 100*(11.25-9.00) / 9.00= 25.00% USD appreciated by 25% 23 Percentage Change in Direct Quotes: Using Indirect Quotes % change in DQ = 100*[100 / (100 + % change h in i IQ) - 1] Example: Suppose, on 1/1/X1 the IQ for JY was 120, and on 1/1/X2 it was 100. It means that during this period, USD depreciated by 20% from the Japanese viewpoint. What was the % change in the value of JY from the US viewpoint? Solution: During the 20X1-X2, IQ for JY changed by – 20% Percentage in DQ (over the same period): 100* [100 / (100 – 20) – 1] = 100* [(100/80) – 1] = + 25% During this period, JY appreciated by 25% (from US view point) 24 12 Percentage Change in Indirect Quotes: Using Direct Quotes % change in IQ = 100*[100 / (100 + % change h in i DQ) - 1] Example: Suppose, on 1/1/X1 the DQ for SF was $0.50, and on 1/1/X2 it was $0.55. It means that during this period, SF appreciated by 10% from the US viewpoint. What was the % change in the value of USD from the Swiss viewpoint? Solution: During 20X1-X2, DQ for SF changed by + 10% Percentage in IQ (over the same period): 100* [100 / (100 + 10) – 1] = 100* [(100/110) – 1] = - 9.09% During this period, USD depreciated by 9.09% from the Swiss viewpoint 25 Cross Exchange Rates Quotes z Deriving the exchange rates between two currencies from their respective direct quotes » Example: Use the direct dollar quotes for SF and BP to calculate: – how many SF per BP – how many BP per SF » Direct dollar quotes: (SF= $ 1.0166, BP = $ 1.5850) » Cross exchange rates: – The price of BP in terms of SF = (DQ of BP / DQ of SF) z (1.5850 / 1.0166) = SF 1.5591/ BP z One BP = SF 1.5591 – The price of SF in terms of BP = (DQ of SF / DQ of BP) z (1.0166 / 1.5850) = BP 0.6414 / SF z One SF = BP 0.6414 26 13 Cross Exchange Rates Quotes:With Bid and Ask Quotes z Direct dollar quotes: » z z For Swiss Francs: Bid price: $ 1.01564 Ask price: $ 1.01609 – Quote: $1.01564-609 » For Euro: – Bid price = $ 1.3463 – Ask Price = $1.3472 – Quote: $1 $1.3463-72 3463 72 z Cross exchange rates: Find the direct bid-ask quote for Swiss Francs in terms of Euros. 27 LOCATIONAL ARBITRAGE z Buy low in one location & sell high in another l location ti » In the FX market – z The buying price (ask price) in one bank is lower than the selling price (bid price) of another bank Market adjustments which will eliminate locational arbitrage g » In the FX market: – – The ask price will rise and bid price will fall Till ask price (of one bank) is greater than or equal to bid price (of another bank) 28 14 LOCATIONAL ARBITRAGE PROFIT z Case 1: No Arbitrage Possible z Case 2: Arbitrage Possible z New York Bank Quotes » Ask $1.581 / 1 BP » Bid $1.583 / 1 BP London Bank Q Quotes » Ask $1.582 / 1 BP » Bid $1.586 / 1 BP z Chicago Bank Quotes » Ask $1.347 / 1 euro » Bid $1.346 / 1 euro Frankfurt Bank Q Quotes » Ask $1.350 / 1 euro » Bid $1.348 / 1 euro z 29 Triangular Arbitrage: When Implied & Actual Cross Rates are Different 1 BP = $1.50 1 SF = $ $0.50 Implied cross rate: 1 BP = 1.5/0.5 = 3.0 SF If actual cross rate: 1 BP = 3.50 SF (It is better to sell BP in return for SF) If actual cross rate: 1 BP = 2.50 SF (It is better to buy BP with SF) $ BP $ SF BP SF 30 15 Triangular Arbitrage: When Implied Cross Rate is Less than Actual Cross Rate 1 BP = $1.50 $0.50 1 SF = $ Implied cross rate: 1 BP = 1.5/0.5 = 3.0 SF If actual cross rate: 1 BP = 3.50 SF. Have $1,000 $ 1,000 $1,166.67 BP 666.67 666.67 X 3.5 SF 2,333.33 31 Triangular Arbitrage: When Implied Cross Rate is Less than Actual Cross Rate z $ exchanged for BP » z The price of BP falls against SF: (SF 3.50/BP ) SF exchanged for $ » z ) BP exchanged for SF » z The price of BP rises against the $: ($1.50 /BP The price of SF falls against the $: ($ 0.50/SF ) The implied Th i li d cross rate t approaches h the th actual t l cross rate 32 16 Triangular Arbitrage: When Implied Cross Rate is Greater than Actual Cross Rate 1 BP = $1.50 $0.50 1 SF = $ Implied cross rate: 1 BP = 1.5/0.5 = 3.0 SF If actual cross rate: 1 BP = 2.50 SF. Have $1,000 $ 1,200 $1,000 BP 800 2,000 / 2.5 SF 2,000 33 Triangular Arbitrage: When Implied Cross Rate is Greater than Actual Cross Rate z $ exchanged for SF » z The price of BP rises against SF: (SF 2.50/BP ) BP exchanged for $ » z ) SF exchanged for BP » z The price of DM rises against the $: ($0.50 /SF The price of BP falls against the $: ($ 1.50/BP ) The implied Th i li d cross rate t approaches h the th actual t l cross rate 34 17 Triangular Arbitrage: Eaxmple Bank Quotations Bid Ask D Deutsche h B Bank k ££:$ $ $1 9712 $1.9712 $1 9717 $1.9717 Credit Lyonnais €:$ $1.4738 $1.4742 Credit Agricole £:€ €1.3310 €1.3317 “No Arbitrage” £:€ €1.3371 €1.3378 Byy going g g through g Deutsche Bank and Credit Lyonnais, y we can sell pounds for €1.3371. $1.9712 = €1.3371 Bid price for £ in terms of € = $1.4742 The arbitrage is to buy those pounds (at ask price) from Credit Agricole for €1.3317 5-35 Triangular Arbitrage Bank Quotations Bid Ask Deutsche Bank £:$ $1.9712 $1.9717 Credit Lyonnais €:$ $1.4738 $1.4742 Credit Agricole £:€ €1.3310 €1.3317 Start with £1m: sell £ to Deutsche Bank for $1,971,200. $1.9712 = $1,971,200. £10,000,000 × £1 00 £1.00 Buy euro from Credit Lyonnais receive €1,337,132 €1.00 $1,971,200 × = €1,337,132. $1.4742 Buy £ from Credit Agricole receive £1,004,078.89 5-36 18 The Forward Market Forward Rate Quotations z Forward Premium z Long and Short Forward Positions z Motivations for using Forward contracts z » Speculation » Hedging 5-37 Forward Currency Market Market where Forward Contracts by traded z Forward Contracts are agreements to deliver (or take delivery of) a specified amount of foreign currency at a fixed future date and at a fixed exchange rate. z Used by businesses and currency traders to: z Hedge against currency (exchange rate) risk » Speculate (make trading profits) » 38 19 Forward Exchange Rate z The dollar price at which a foreign currency can be bought and sold at future date. This rate is set at the time when the contract is signed. No money is exchanged at this time. 39 Forward Rate Quotes z Direct Dollar Quotes from WSJ (attached): » Swiss Franc (FF) – spot rate (direct quote): $0.8401 – 6-months forward rate (direct quote): $0.8492 » Japanese Yen (JY) – spot rate (direct quote): $0.009646 – 6-months forward rate (direct quote): $0.009788 40 20 Using Forward Contracts z Two major applications of forward contracts: » Hedging » Speculation 41 5-42 21 5-43 Forward Rate Quotations Consider these exchange h rates: t for f British pounds, the spot exchange rate is $1.9717 = £1.00 while the 180-day 180 day forward rate is $1.9593 = £1.00 zWhat does that mean? 5-44 Country/currency in US$ per US$ UK pound 1.9717 .5072 1-mos forward 1.9700 .5076 3-most forward 1.9663 .5086 6-mos forward 1.9593 .5104 Clearly market participants expect that the pound will be worth less in dollars in six months. 22 Forward Rate Quotations z Consider the (dollar) holding period return of a dollar-based investor who buys £1 million at the spot exchange rate and sells them forward: gain $1,959,300 – $1,971,700 –$12,400 $HPR= = = $1,97,1700 $1,971,700 ppain $HPR = –0.00629 Annualized dollar HPR = –1.26% = –0.629% × 2 5-45 Forward Premium z z The interest rate differential implied by forward premium or discount. discount Annualized % premium (discount) » [(Forward rate – Spot rate ) / Spot rate ] * [ 360/ Days to Maturity] * 100 For example, suppose the € is appreciating from S($/€) ($ ) = 1.55 to F180($ ($/€)) = 1.60 z The 180-day forward premium is given by: 1.60 – 1.55 360 F180($/€) – S($/€) = ×2 f180,€v$ = × 1.55 180 S($/€) = 0.0645 or 6.45% z 5-46 23 Long and Short Forward Positions If you have agreed to sell anything (spot or forward), you are “short”. z If you have agreed to buy anything (forward or spot), you are “long”. z If y you have agreed g to sell FX forward,, you are short. z If you have agreed to buy FX forward, you are long. z 5-47 Payoff Profiles profit If you agree to sell anything in the future at a set price and the spot price later falls then you gain. S180($/¥) 0 F180($/¥) = .009524 If you agree to sell anything in the future at a set price and the spot loss price later rises then you lose. Short position (DQ) 5-48 24 Payoff Profiles profit short position (IQ) 0 F180(¥/$) = 105 Whether h h the h payoff profile slopes up or down depends upon whether S180((¥/$)) you use the direct or indirect quote: F180(¥/$) = 105 or F180($/¥) = .009524. -F180(¥/$) loss 5-49 Payoff Profiles profit short position S180(¥/$) 0 F180(¥/$) = 105 -F180(¥/$) loss When the short entered into this forward contract, he agreed to sell ¥ in 180 days at F180(¥/$) = 105 5-50 25 Payoff Profiles profit short position 15¥ S180(¥/$) 0 F180(¥/$) = 105 -F180(¥/$) loss 120 If, in 180 days, S180(¥/$) = 120, the short will make a profit by buying ¥ at S180(¥/$) = 120 and delivering ¥ at F180(¥/$) = 105. 5-51 Payoff Profiles profit F180(¥/$) Since this is a zero-sum zero sum game, the long position payoff is the opposite of the short. short position S180(¥/$) 0 F180(¥/$) = 105 -F180(¥/$) loss Long position 5-52 26 Payoff Profiles profit -F F180(¥/$) The longg in this forward contract agreed g to BUY ¥ in 180 days at F180(¥/$) = 105 If, in 180 days, S180(¥/$) = 120, the long will lose by having to buy ¥ at S180(¥/$) = 120 and delivering ¥ at F180(¥/$) = 105. S180(¥/$) 0 120 F180(¥/$) = 105 –15¥ Long position loss 5-53 Forward Market Hedge If you are going to owe foreign currency in the future, agree to buy the foreign currency now by entering into long position in a forward contract. z If you are going to receive foreign currency in the future, agree to sell the foreign currency now by entering into short position in a forward contract. z 5-54 27 Forward Market Hedge: an Example You are a U.S. U S importer of British woolens and have just ordered next year’s inventory. Payment of £100M is due in one year. Question: How can you fix the cash Answer: Oneinway is to put yourself in a position outflow dollars? that delivers £100M in one year—a long forward contract on the pound. 5-55 Forward Market Hedge: an Example 0 Step 1 Order Inventory; agree to pay supplier £100 in 1 year. Step 2 Take a Long position in a Forward Contract on £100 million. 1 Step 3 Fulfill your contractual obligation to forward contract counterparty and buy £100 million for $195 million. million Step 4 Pay supplier £100 million (Suppose that the forward rate is $1.95/£.) 5-56 28 Forward Market Hedge Suppose the forward exchange rate is $1.95/£. $30m If he does not hedge the £100m payable, in one $0 year his gain (loss) on the –$30m unhedged position is shown in green. The importer p will be better off if the pound depreciates: he still buys £100m but at an exchange rate of only $1.65/£ he saves $30 million relative to $1.95/£ Value of £1 in $ $1.65/£ $1.95/£ $2.25/£ in one year But he will be worse off if the pound appreciates. Unhedged payable 5-57 Forward Market Hedge If he agrees to buy £100m in one year at $30m $1.95/£ his gain (loss) on the forward $0 are shown in blue. –$30m If you agree to buy £100 million at a price of $1.95 per pound, you will make $30 million if the price of a pound reaches $2.25. Long forward Value of £1 in $ $1.65/£ $1.95/£ $2.25/£ in one year If you agree to buy £100 million at a price of $1.95 per pound, you will lose $30 million if the price of a pound is only $1.65. 5-58 29 Forward Market Hedge The red line shows the payoff of the $30 hedged m payable. Note that gains on $0 one position are offset by losses on the –$30 m other position. Long forward Hedged payable Value of £1 in $ in one year $1.65/£ $1.95/£ $2.25/£ Unhedged payable 5-59 Using Forward Contracts for Hedging: Theory z Buy Forward Contracts (take a Long Position in the FM): » When yyou expect p to make a p payment y in Foreign g currency, y, at a future date: – You gain when the spot rate at the future date is higher than the forward exchange rate – You lose when the spot rate at the future date is lower than the forward exchange rate z Sell Forward Contracts (take a Short Position in the FM): » When you expect to receive a payment in Foreign currency, currency at a future date: – You gain when the spot rate at the future date is lower than the forward exchange rate – You lose when the spot rate at the future date is higher than the forward exchange rate 60 30 Using Forward Contracts for Speculation: Theory z Buy Forward Contracts (take a Long Position in the FM): » When yyou expect p the future spot p rate to be higher g then the current forward rate: – You will gain when the future spot rate is higher than the current forward exchange rate – You will lose when the future spot rate is lower than the current forward exchange rate z Sell Forward Contracts (take a Short Position in the FM): » When you expect the future spot rate to be lower then the current forward rate: – You will gain when the future spot rate is lower than the current forward exchange rate – You will lose when the future spot rate is higher than the current forward exchange rate 61 Using Forward Contracts for Speculation: Examples z Today, the 6-month forward rate on SF is $0.8492 » If you expect that 6-months from today today, the spot rate of SF will be greater than $0.8492: – The you should BUY SF forward contracts z z If 6-months latter, the SR for SF is $0.8495: » you make (0.8495 – 0.8492) = $0.0003 / SF (profit) If 6-months latter, the SR for SF is $ 0.8485: » you make (0.8485 – 0.8492) = - $0.0007 / SF (loss) » If you expectt that th t 6-months 6 th from f today, t d the th spott rate t off SF will be less than $0.8492: – Then you should SELL SF forward contracts z z If 6-months latter, the SR for SF is $0.8495: » you make (0.8492 – 0.8495) = - $0.0003 / SF (loss) If 6-months latter, the SR for SF is $0.8485: » you make (0.8492 – 0.8485) = $0.0007 / SF (profit) 62 31 Currency Conversion Problem Set #1 Please use the following quotes, to answer the questions listed below: Currency Quotes Swiss francs 1 SF for $0.50 Mexican pesos 10 MP for 1 USD British pounds 0.75 BP for 1 USD Direct or Indirect ? 1. $3,000,000 can be converted into ______________ British pounds 2. SF 1,500,000 can be converted into ____________ USD 3. MP 600,000 can be converted into __________ Swiss francs 4a. How many SF does it take to buy 1 BP? 4b. How many BP does it take to buy 1 SF? Currency Conversion Problem Set #2 1/1/X0 1/1/X1 BP quotes $2.00 per BP $2.18 per BP SF quotes SF 2.50 per USD SF 2.00 per USD JY quotes JY100 per USD JY 120 per USD For the time period: 1/1/X0 - 1/1/X1, please calculate: 1. The percentage appreciation / depreciation of BP in terms of the USD 2. The percentage appreciation / depreciation of USD in terms of SF 3. The percentage appreciation / depreciation of JY from the US viewpoint 4. Suppose during this time period the indirect quote for MP decreased by 15%. (i) By what % did the MP appreciate/depreciate from the US viewpoint? (ii) By what % did the USD appreciate/depreciate from the Mexican viewpoint? Currency Conversion Problem Set #3 Currency Quotes on 1/1/X1 Quote on 1/1/X2 1 CD = $0.50 1 CD = $0.54 Swiss francs SF 1.80 = 1 USD SF 1.90 = 1 USD Japanese yen 1 USD = JY 100 1 USD = JY 120 Canadian dollars a. Based on the 1/1/X2 quote, convert 8,000,000 Canadian dollars into US dollars: b. Based on the 1/1/X2 quotes, convert $25,000,000 into Swiss francs: c. During the one-year period, what was the percentage appreciation / depreciation of the Japanese yen from the US point of view ? d. During the one-year period, what was the percentage appreciation / depreciation of the US dollar from the Swiss point of view? Bid-Ask Spread Problem Set #1 The following table presents bid and ask quotes for BP from currency dealers in New York and London: Currency Dealer in New York London Bid Quote for BP $ 1. 58 $ 1.65 Ask Quote for BP $ 1. 68 $ 1.70 1. Assume that you dealt with the New York currency dealer only. You converted $100,000 into pounds, and immediately afterwards sold the pounds for dollars. Estimate the dollar amount you lost in this round trip transaction. 2. Assume that you dealt with the London currency dealer only. What is the percentage bid-ask spread for this dealer? 3. Which dealer (s) would you buy from, and sell to ? Cross Exchange Rates Quotes With Bid and Ask Quotes: In-Class Exercise • Direct dollar quotes: – For Swiss Francs: • Bid-Ask Quote: $0.5205-50 – For Canadian Dollar: • Bid-Ask Quote: $0.8510-95 • Cross exchange rates: Find the direct bid-ask quote for Canadian dollars, stated in Swiss Francs 1 EXAMPLE: FX FORWARD MARKET BASICS Today: 1/1/XX Spot Rate for BP = $1.50 6-Month Forward Rate for BP = $1.60 FC BUYER / LONG POSITION HOLDER: 6-Month Forward Contract for BP 1,000,000 Current Financial Obligations: None Six Months Latter: 6/1/XX Financial Obligations of Forward Contract Buyer: Pay: 1.60 x 1,000,000 = $1,600,000 Receive: BP 1,000,000 Suppose on 6/1/XX SR = $1.63 Then for BP 1,000,000 You have paid: $1,600,000 And it is worth: $1,630,000 Your profit/loss: $ 30,000 FC SELLER / SHORT POSITION HOLDER: 6-Month Forward Contract for BP 1,000,000 Current Financial Obligations: None SR = $1.58 Then for BP 1,000,000 You have paid: $1,600,000 And it is worth: $1,580,000 Your profit/loss: - $ 20,000 Financial Obligations of Forward Contract Seller: Pay: BP 1,000,000 Receive: 1.60 x 1,000,000 = $1,600,000 Suppose on 6/1/XX SR = $1.63 Then for BP 1,000,000 You have received: $1,600,000 And it is worth: $1,630,000 Your profit/loss: - $ 30,000 SR = $1.58 Then for BP 1,000,000 You have received: $1,600,000 And it is worth: $1,580,000 Your profit/loss: $ 20,000 EXERCISE: FX FORWARD MARKET BASICS Today: 1/1/XX Spot Rate for Euro = $1.15 6-Month Forward Rate for E = $1.20 Six Months Latter: 6/1/XX FC BUYER / LONG POSITION HOLDER: 6-Month Forward Contract for E 5,000,000 Current Financial Obligations: Financial Obligations of Forward Contract Buyer: Pay: Receive: Suppose on 6/1/XX E = $1.13 Then for E 5,000,000 You have paid: $ And it is worth: $ Your profit/loss: $ FC SELLER / SHORT POSITION HOLDER: 6-Month Forward Contract for E 5,000,000 Current Financial Obligations: E = $1.25 Then for E 5,000,000 You have paid: $ And it is worth: $ Your profit/loss: $ Financial Obligations of Forward Contract Seller: Pay: Receive: Suppose on 6/1/XX E = $1.13 Then for E 5,000,000 You have received: $ And it is worth: $ Your profit/loss: $ E = $1.25 Then for E 5,000,000 You have received: $ And it is worth: $ Your profit/loss: $ FX Spot / Forward Market Transactions Problem Set #1 Forward and Spot Prices Quotes for Foreign Currencies: From Wall Street Journal Today: 01/15/XX (Wednesday) 1-month latter: 02/15/XX (Tuesday) 6-months latter: 07/15/XX (Monday) 1. Today (1/15/XX), you bought 100 million JY in the spot market from Credit Suisse First Boston (CSFB), and sold it back to CSFB one month latter: Your cash flows today, are: Your cash flows on 2/15/XX are: Your profit/loss is: CSFB’s cash flows today, are: CSFB’s cash flows on 2/15/XX are: CSFB’s profit/loss: 2. Today (1/15/XX), you bought a one-month forward contract for 100 million JY from Credit Suisse First Boston (CSFB) : Your cash flows today, are: Your cash flows on 2/15/XX are: Your profit/loss (in the FM) is: CSFB’s cash flows today, are: CSFB’s cash flows on 2/15/XX are: CSFB’s profit/loss (in the FM) is: FX Spot / Forward Market Transactions Problem Set #1 (Contd.) 3. Today (1/15/XX), you sold a six-month forward contract for 100 million JY to Credit Suisse First Boston (CSFB) : Your cash flows today, are: Your cash flows on 7/15/XX are: Your profit/loss (in the FM) is: CSFB’s cash flows today, are: CSFB’s cash flows on 7/15/XX are: CSFB’s profit/loss (in the FM) is: 4. Today (1/15/XX), you bought a one-month forward contract for 1 million BP from Credit Suisse First Boston (CSFB) : Your cash flows today, are: Your cash flows on 2/15/XX are: Your profit/loss (in the FM) is: CSFB’s cash flows today, are: CSFB’s cash flows on 2/15/XX are: CSFB’s profit/loss (in the FM) is: 5. Today (1/15/XX), you sold a six-month forward contract for 10 million SF to Credit Suisse First Boston (CSFB) : Your cash flow today, is: Your cash flows on 7/15/XX is: Your profit/loss (in the FM) is: CSFB’s cash flow today, is: CSFB’s cash flows on 7/15/XX is: CSFB’s profit/loss (in the FM) is: Formula: Currency Conversion Quotes: DQ (direct quote): The dollar price of one unit of foreign currency (FC) IQ (indirect quote): Number of units of FC per one dollar; DQ = 1 / IQ and IQ = 1 / DQ DQ0 = DQ now; DQ1 = DQ 1-year later; IQ0 = IQ now; IQ1 = IQ 1-year later Calculating Percentage Change in DQ and IQ: % change in DQ = 100 * (DQ1 - DQ0) / DQ0 = 100*[100 / (100 + % change in IQ) - 1] % change in IQ = 100 * (IQ1 - IQ0) / IQ0 = 100*[100 / (100 + % change in DQ) - 1 Currency Conversion: Converting USD into FC Converting FC into USD Using DQ USD / DQ = FC FC * DQ = USD Using IQ USD * IQ = FC FC / IQ = USD Ask Price (A): The buying price for one unit of FC from the currency dealer; Bid Price (B): The selling price for one unit of FC to the currency dealer; Bid-Ask Spread = 100* (A – B) / A Cross-Quotes: DQ1= $ price of FC1; DQ2 = $ price of FC2; The price of FC1 in terms of FC2 (how many unit of FC2 does it take to buy one FC1) = DQ1 / DQ2 The price of FC2 in terms of FC1 (how many unit of FC1 does it take to buy one FC2) = DQ2 / DQ1 Forward Premium or Discount: [(forward rate – spot rate) / spot rate] * [360/days to maturity] * 100