The Outlook for the Broadcast Networks

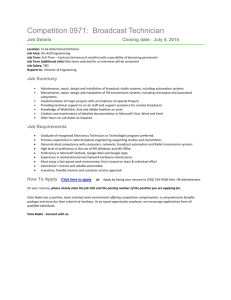

advertisement