Notes 5: Monopoly and Price Discrimination I. A.

advertisement

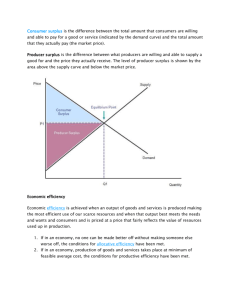

Economics 335 February 16, 1999 Notes 5: Monopoly and Price Discrimination I. The Monopolist, Market Size and Price Discrimination A. Definition of a monopoly A firm is a monopoly if it is the only supplier of a product for which there is no close substitute. A monopoly sets the price of its product without concern that the price might be undercut by rivals. A monopoly faces a downward sloping demand curve. B. Example of price discrimination 1. setup Consider a elderly farmer named Grandpa Jones who owns all the 1924 John Deere “Spoker D” tractors in existence. He wants to sell them all. They have marginal value to him of 0. As it turns out he has 7 tractors. Suppose that there are N individuals interested in buying these tractors. They are identical and each have a demand schedule as follows. Tractors First Second Third Fourth Fifth Sixth Seventh Price $16,000 $12,000 $8,000 $6,000 $4,000 $2,000 $1,000 Aggregate demand is obtained by summing the demand over consumers. For example, if N = 4, and the price is $16,000, the demand is 4. If N = 4 and the price is $12,000, the demand is 8. Specifically, at a price of $16,000, the demand is between 0 and N, at a price of $12,000, the price is between N+1 and 2N. At $10,000, it is between 2N+1 and 3N and so on. 2. uniform pricing Grandpa Jones practices uniform pricing, that is, he announces a price and all who want can buy at that price. 3. case when N $ 7 If N $ 7, then the demand curve is perfectly elastic at a price of $16,000. Grandpa Jones isn’t really a monopolist because he is small relative to the market. 2 4. N=2 The demand now looks like this: Price (Demand) Total Revenue Marginal Revenue > $16,000 0 0 — $16,000 1 16,000 16,000 $16,000 2 32,000 16,000 $12,000 3 36,000 4,000 $12,000 4 48,000 12,000 $8,000 5 40,000 -$8,000 $8,000 6 48,000 $8,000 $6,000 7 42,000 -$6,000 $6,000 8 48,000 $6,000 $4,000 9 36,000 -$12,000 $4,000 10 40,000 $4,000 $2,000 11 22,000 -$18,000 $2,000 12 24,000 $2,000 $1,000 13 13,000 -$11,000 $1,000 14 14,000 $1,000 To sell all 7 tractors, Grandpa Jones must set a price of $6,000. Doing so he will obtain total revenue of $42,000. This is not Grandpa Jones’s best strategy, however. If he sets a price of $12,000, he will sell 4 tractors and have revenue of $48,000. This is clearly larger than the $42,000 obtained from selling 7 tractors at $6,000 a piece. 5. marginal revenue for the monopolist Consider the change in revenue that occurs from lowering the price from $12,000 to $8,000. Total revenue at $12,000 is $48,000. Total revenue at $8,000 is also $48,000. The change is revenue is 0.00. The change in the number of tractors sold is 2 (from 4 to 6) and so marginal revenue is $0.00. Notice that marginal revenue is less or equal to price at all points in the table. Marginal revenue is often significantly less than price. 6. efficiency loss Even though Grandpa has puts no value on the tractors, an individual who would pay $6,000 for them is closed out of the market. 3 7. non-uniform pricing to the consumers If Grandpa could charge different prices to different buyers, he might choose to sell two tractors to one person at $12,000 each, and sell the other 5 tractors to the other at person for $6,000, for total revenue of $30,000. This would give total revenue of $54,000. This is larger than the revenue obtained when a uniform price of $6,000 was charged. And notice that all 7 tractors are sold. But to do so Grandpa must be able to decide who gets the 5 tractors and who gets 2 tractors. 8. auction pricing Consider an auction where the tractors are auctioned off one at a time. Suppose the two individuals buying are Matt and Derrick. Suppose Derrick wins the first auction and buys the tractor for $16,000. The second tractor will be obtained by Matt for $12,001 because Derrick will drop out at this point. The third tractor will also be obtained by Matt for $12,001. This is because the most Derrick will pay for two tractors is $28,000 and having already spent $16,000, he is not willing to spend more than 12,000 for a second one. Matt, on the other hand would also pay up to $28,000 for two, and having only spend $12,001, he can pay up to $15,999 and still break even. Now consider the fourth tractor. Matt would pay up to $36,000 for 3 tractors. He has spent $24,002 and so would be willing to spend $11,998 for the third tractor. Derrick has only one tractor and would pay up to $28,000 for two. So he would spend up to $12,000 for his second tractor. Derrick this win the bidding for tractor number 4 with a bid of $11,999. Now consider tractor number 5. Each individual has 2 tractors at this point. Each would pay up to $36,000 for 3 tractors. Matt has spend $24,002 and so he would be willing to spend $11,998 on a third tractor. Derrick has spend $27,999. So he would bid up to $8,001 for a third tractor. Matt will win the bidding and will pay $8,002 for his third tractor (the fifth tractor overall). Now consider tractor number 6. Matt has 3 tractors and will pay up to $42,000 for 4 tractors. Derrick has only 2 tractors and will pay up to$36,000 for 3 tractors. Matt has spent $32,004 to this point (12,001 + 12,001 + 8,002), So he would pay up to $9,996 for his fourth tractor. Derrick has spent 27,999 (16,000+ 11,999) and so would pay $8,001 for a third tractor. Matt will win this bidding and pay $8,002 for total expenditure at this point of $40,006. Derrick has still only spend $27,999. Now consider tractor number 7. Matt has 4 tractors and will pay up to $46,000 for 5 tractors. Derrick has only 2 tractors and will pay up to$36,000 for 3 tractors. Matt has spent $40,006 to this point (12,001 + 12,001 + 8,002 + 8,002), So he would pay up to $5,994 for his fourth tractor. Derrick has spent 27,999 (16,000+ 11,999) and so would pay $8,001 for a third tractor. Derrick will win this bidding and pay $5,995 for total expenditure at this point of $33,994. All seven tractors have been sold for a total cost (revenue) of $74,00 (40,006 + 33,004). This is much higher than in any previous case. The table below summarizes the data. Tractor # 1 2 3 4 5 6 7 Cumulative Derrick’s Matt’s Purchased by Price Paid Revenue Derrick’s Value Matt’s Value Total Expense Total Expense Derrick 16,000 16,000 16000 16000 16000 0 Matt 12,001 28,001 12000 16000 16000 12001 Matt 12,001 40,002 12000 15999 16000 24002 Derrick 11,999 52,001 12000 11998 27,999 24002 Matt 8002 60,003 8001 11998 27,999 32004 Matt 8002 68,005 8001 9996 27,999 40006 Derrick 5995 74,000 8001 5994 33,994 40006 4 C. Some simple observations from the example 1. Price discrimination is the selling of two varieties of a product to two different buyers at different net prices, where the net price is the price paid by the buyer adjusted for any cost of product differentiation. In our example, there was no product differentiation and so the two varieties of the tractor were the same. 2. In order to practice price discrimination, the seller must be able to identify the different buyers. In the case of an auction, the identification is easy because of the pricing mechanism. But an auction is expensive in terms of transactions costs. One way to discriminate without an auction would be to offer an early morning special ½ price sale and sell 5 tractors at $6,000 and then sell the other two at $12,000 a piece later in the day. 3. Another problem with price discrimination is that the seller must prevent arbitrage. For example, the early bird buyer may come back and resell the tractors for $10,000, make a profit and put an end to more sales by Grandpa Jones. 4. With uniform pricing, the monopolist cannot extract all of the surplus that he generates. As a result he may limit the amount supplied. In this example, with uniform pricing, Grandpa Jones chose to hold back 1 tractor because his marginal revenue from its sale was negative, even though its sale created positive surplus for society. 5. A monopolist who can price discriminate can extract more surplus and will typically supply more. In the example, Derrick got 3 tractors and paid $33,994. So Grandpa got $2,006 of Derrick’s surplus (36,000 - 33, 994). Matt got 4 tractors and paid $40,006. So Grandpa got $1,994 of Matt’s consumer surplus. In this case Grandpa got $74,000 out of possible consumer surplus of $78,000. In the non-uniform pricing case, Grandpa Jones got total surplus of $42,000. II. Strategies and Degrees of Price Discrimination A. Ways to identify consumers and their separate demand 1. 2. 3. 4. 5. 6. 7. 8. long term relationships such as insurance agents, car dealers, appliance repairmen, jewelers, furriers, tailors, doctors, etc. age sex family status type of job method of payment other commonly bought items place of residence 5 B. C. Prevention of arbitrage in price discrimination 1. Sale of products that are customer specific a. haircuts b. dental filling c. house plans 2. Sales of products where use is predicated on a characteristic a. senior citizen discount cards b. student bus passes c. air travel with a weekend stay 3. Sales where it is hard to resell because of distance or transactions costs a. purchase of cattle in a local market b. sale of specialty product with limited number of buyers First-degree price discrimination 1. Definition A firm practices first-degree or perfect price discrimination is it is able to charge the maximum price each consumer is willing to pay for each unit sold. Specifically, perfect price discrimination involves the seller charging a different price for each unit of the good in such a way that the price charged for each unit is equal to the maximum willingness to pay for that unit. For the tractor example, this means selling the first two tractors at $16,000, the next two at $12,000, the 4th an 5th ones at $8,000 and the 7th one at $6,000. In this case the firm would obtain revenue of $78,000. All consumer surplus goes to the seller. 2. Efficiency implications Under first degree price discrimination, the monopolist will produce the socially optimal level of output but will appropriate all the economic surplus. The monopolist will not have to lower the price on a unit to sell the next unit and so marginal revenue will always equal price. 3. Two-part or non-linear pricing as a means to price discriminate a. form: A two-part pricing scheme is a policy that consists of i) ii) b. a fee that entitles the consumer to buy the good a price (or usage fee) charged for each unit purchased examples i) ii) iii) membership in a club amusement park wholesale warehouse 6 c. analysis of a racquet club Demand P = V - Q P = price is the price per game (court) Q = number of games played per week V = maximum amount the consumer would pay for 1 game per week Cost of service C(Q) = F + cQ F = fixed cost c = cost per game Uniform pricing Revenue = PQ = (V-Q)Q = VQ - Q2 Marginal revenue = V - 2Q Marginal cost = c Solving we obtain P ' V & Q MR ' V & 2Q ' c ' MC Y 2Q ' V & c V & c Y Q ' 2 V % c Y Pu ' 2 The monopolist will earn some surplus from each consumer. The surplus is given by the difference between the price received and the cost for each unit of service. Specifically u ' (Pu & c) Q ' ' ' V % c V & c & c 2 2 V & c V & c 2 2 V & c 2 2 In the diagram below, the surplus is given by the area dbeg. 7 First-Degree Price Discrimination Price a V Demand (V+c)/2 b d MC f c g e MR 0 (V-c)/2 V/2 V-c V Quantity If there are n customers per week, then profit per week will be u ' n ' n u & F (V & c)2 4 & F The issue is whether the club owner can obtain more surplus. Each consumer is obtaining surplus equal to the area abd in the figure. This area is CSu ' ' V & (V % c) 2 V & c 2 1 2 ( V & c) 2 8 The club owner is thus losing out on this area. If the owner got this area, this total surplus would be TSu ' 3 ( V & c) 2 . 8 Suppose the owner charges an weekly fee just less than ( V & c) 2 and continues to charge a 8 8 price per game of ( V % c) . The consumer will continue to choose to enter since total surplus 2 is positive (just larger than 0) and play the same number of games as before because the entry fee is independent of the number of games played. Surplus has gone up by ( V & c) 2 . 8 The owner can do better by lowering the price per game and raising the fee per week. The best two-part price is obtained as follows. i) ii) set the cost per game equal to marginal cost (c) set the weekly fee equal to the consumer surplus at this price (afg). This is equal to CS ' V & c ' 1 2 V & c ( V & c) 2 2 Profit per game is now zero, like with perfect competition. But the entire weekly fee is profit (because the per-game fees covers the variable costs). Total profit is now equal to f ' n (V & c)2 2 & F This is much larger than before. Total expenditure by each consumer is the entry fee plus the cost per game times the number of games. This is equal to Expenditure ' ( V & c) 2 % c (V & c) 2 ' V 2 & 2cV % c 2 % cV & c 2 2 ' V2 c2 2c 2 & cV % % cV & 2 2 2 V2 & c2 2 (V & c) (V % c) ' 2 V % c ' (V & c) 2 ' 9 Because the quantity of games purchased is (V - C) then the average price per game has to be ( V % c) . This is the same as the profit maximizing uniform price. The average price per 2 game has remained the same, but the monopolist has increased profits significantly. 1. Two-part tariffs with non-identical consumers a. procedure i) ii) b. Set price per unit equal to marginal cost per unit Set the fixed tariff for each consumer type equal to the consumer surplus for that type at the unit price. example Two types of consumers - college students and professors where PCS = 12 - 2QCS PPR = 20 - 2QPR Assume that the marginal cost per game is $2.00. At a price equal to marginal cost the college students will demand 5 games per week. PCS ' 12 & 2 QCS Y 2 ' 12 & 2 QCS Y 2 QCS ' 10 Y qCS ' 5 Similarly the professors will demand 9 games per week. Consumer surplus for the college students will be $25.00. Consumer surplus for the professors will be $81.00. 10 First-Degree Price Discrimination College Students Price a 12 Demand 25 2 b MC 5 6 Quantity c 0 First-Degree Price Discrimination Professors Price 20 a 81 Demand b 2 MC c 0 9 10 Quantity The owner of the racquet club should charge a weekly fee for professors of $81.00 and then charge $2.00 per game. He should charge the college students a weekly fee of $25.00 and also charge them $2.00 per game. 11 c. applications i) ii) iii) iv) v) vi) vii) D. amusement park telephone company that has a flat fee plus a price per call or minute car rental or machinery rental copy machines fertilizer application equipment buying club or group feed cooperative Second degree price discrimination 1. Definition Second-degree price discrimination or nonlinear pricing, occurs when prices differ depending on the number of units bought, but not across consumers. That is, each consumer faces the same price schedule, but the schedule involves different prices for different amounts of the good purchased. Second degree price discrimination is sometimes called block pricing. 2. Problems with implementing first degree price discrimination using a two-part tariff a. b. c. 3. customers may not be identical or may not be easily identifiable there may be no way to effectively limit access to those not paying the fixed fee if customers are not easily identifiable, they will have an incentive to cheat Possible solutions for the racquet club policy if there is no identification of customers a. Charge $81 per week and $2 per game to everyone. If there are NPF professors in town, this will given profits of = 81 NPF. No college students will buy a membership. b. Charge $25 per week and $2 per game to everyone. If there are NPF professors and NCS in town, this will given profits of = 25 NPF + 25 NCS . Everyone will now buy a membership. c. The lower weekly fee will have a larger profit if 25 NCS > 56 NPF. For example if there are 100 professors and 300 students the weekly fees under the two schemes will be Student Purchases/Profit Professor Purchases/Profit Total Profit Fee = $81 0/0 100 / 8100 8100 Fee = $25 300 / 7,500 100 / 2,500 10,000 If the ratio of college students to professors is more than 56/25 = 2.24, the lower price scheme will be preferable. 12 4. An alternative solution that may work a. If you pay $81, you may play up to 9 games per week at a cost of $2.00 per game. If you pay $25.00, you may play up to 5 games per week at a cost of $2.00 per game. c. What happens with the college students? b. They pay the $25 fee and then play 5 games per week as we previously determined. They have zero consumer surplus. d. What happens with the professors? If they pay the $81 fee, they will play 9 games per week and have zero consumer surplus. If they pay the $25 fee and play 5 games per week at $2.00 as allowed, they will have some consumer surplus. We can determine this by looking at the following figure. Professors CS with $25.00 Package and 5 Game Limit Price 20 a 25 10 f d Demand 40 2 e c 0 MC b 10 5 Quantity 9 10 If there is no fee the consumer’s surplus for the professors can be determined by integrating the inverse demand function from Q = 0 to Q = 5. This will give 5 CS(5 games, professor) ' m (20 & 2 x) dx 0 5 ' 20 x & x 2 * 0 ' 100 & 25 & 0 ' 75 13 We can also compute this by using the area of the triangles and the fact that inverse demand will intersect the quantity line for Q = 5 at a price of $10.00 (P = 20 - (2) (5)). The cost of the games is $10.00 because each game costs $2.00. The cost of the package is $25.00. So the professors end up with $40.00 (75-10-25) of consumer surplus. They will choose the low cost package even though they end up with only 5 games per week. So the professors will not choose the high price package and the firm will end up with only low profits if there are lots of professors. 5. An alternative solution that does work a. College students Figure out what is the maximum they will pay for 5 games. This can be done by integrating their inverse demand from 0 to 5. Doing so we obtain 5 CS(5 games, student) ' m (12 & 2 x) dx 0 5 ' 12 x & x 2 * 0 ' 60 & 25 & 0 ' 35 An strategy might be to then offer a 5 game per week package for a total price of $35.00. The students will pick this package and have 0 consumer surplus. b. Professors and the student package Figure out how much consumer surplus the professors get if they buy the 5 game per week package. We integrate their demand curve from 0 to 5 and subtract the fee. We know the area under the curve is $75.00 from before. So if they buy this package, they get surplus of $40.00 (75- 35). 14 Second-degree Price Discrimination College Students Price 12 a Demand 25 2 c 0 b. b MC 5 6 Quantity 10 Owner of racquet club With this pricing scheme and everyone buying the $35.00 package, the owner of the club will have profit of $25.00 per package because his cost per package is only $10.00 [(5)(2)]. c. A “better” package for the professors What the owner would like to do is offer a package to the professors that will entice them to play more than 5 games per week. The professors would pay $100 per week to play 10 games. But if the owner offered this package along with the $35.00 package the professors would take the $35.00 package and have $40.00 in consumer surplus. What the owner needs to do is create a package that will give the professors at least $40 in consumer surplus, plus give him more profits. A package that will entice the professors to take it instead of the $35.00 package is called an incentive compatible package meaning that it is provides that same incentives as the $35.00 package. So what the owner does is offer the 10 game package for $60.00. This gives consumer surplus of $40.00 (100 - 60) and induces the professors to play 10 games. The owner makes $40 per professor ([60 - (10)(2)]. The college students will not take this package because the most they will pay to play per week 6 is $36.00 CS(6 games, student) ' m 0 6 (12 & 2 x) dx ' 12 x & x 2 * ' 72 & 36 ' 36 . 0 The racquet club owner will now have profit of $25 for each college student and $40 for each professor. A better solution, indeed. 15 d. average price per game Average price per game for the students is $7.00 (35/5). Average price per game for the professors is $6.00 (60/10). Those who play more get a quantity discount. 6. Examples of second degree price discrimination a. b. c. d. e. 7. fertilizer feed chemicals pizza sub sandwiches Determining the optimum packages a. b. Consider a college student package for $36.00 and 6 games per week. This will give revenue of $36.00 with a cost of $12 with profit to the owner of $24.00. This is less than before. Consumer surplus for professors with $36.00 package 6 CS(6 games, professor) ' m (20 & 2 x) dx 0 6 ' 20 x & x 2 * 0 ' 120 & 36 & 0 ' 84 Now subtract the cost of the package (36) to obtain net surplus of $48 (84 - 36). The owner must offer a professor package with at least $48.00 of consumer surplus to match the student package in terms of attractiveness. This means he offers the 10 game package for $52.00 (100 - 48). The owner has net profit of $32 (52- 20). This is also less than before. The owner was better off with the $35.00, 5 game package. c. Consider a college student package for $32.00 and 4 games per week. This will give revenue of $32.00 with a cost of $8 for profit to the owner of $24.00. This is the same as for the 6 unit package. d. Consumer surplus for professors with $32.00 package 16 4 CS(4 games, professor) ' (20 & 2 x) dx m 0 4 ' 20 x & x 2 * 0 ' 80 & 16 & 0 ' 64 Now subtract the cost of the package (32) to obtain net surplus of $32 (64 - 32). The owner must offer a professor package with at least $32.00 of consumer surplus to match the student package in terms of attractiveness. This means he offers the 10 game package for $68.00 (100 - 32). This is more than the previous cases. He has profit of $48.00 per professor. This is the highest so far. We could also consider other cases such as a 3, 2, 1 or 0 unit package. Once we compute the profit per consumer type for the various packages, we can compute the overall profits using the numbers of consumers of each type. 8. A general rule Consider a two-package pricing scheme. Assume that there are NL low demand consumers and NH high demand consumers. The owner makes L from each low demand consumer who takes the package. Assume that if the owner prices them out of the market and chooses a single package for the high demand consumers they will have consumer surplus of 0. Assume the owner has profit per consumer of HE where E denotes the exclusive package. If instead the owner provides two packages, the package for the high demand consumers must provide consumer surplus at least equal to CSHL where HL stands for high demand consumers taking the low demand package. The profits per high demand consumer will thus be CSHL lower than in the exclusive package case. Profits in the two cases are then Low Demand Purchases / Profit High Demand Purchases / Profit Total Profit Exclusive Package 0/0 NH / NH NH Two Packages NL / NL L N H / NH ( H H - CSHL) NL H L + NH ( H - CSHL) NL L + NH ( H - CSHL) - NH = NL L - NH CSHL Profit Difference Now rewrite the profit difference equation as Profit difference ' NL L & NH CSHL In order for the owner to offer two packages, this difference must be positive. Writing it out and rearranging we obtain H 17 Profit difference ' N L Y NL Y Y 9. NL NH NH NL & NH CSHL > 0 > NH CSHL > CSHL L > L CSHL General conclusions for second-degree price discrimination a. b. c. d. e. 10. L L offer a series of price quantity discount packages extract all the consumer surplus from the lowest demand class leave some consumer surplus for the other classes provide a quantity less than the social optimum for all but the highest demand class use quantity discounting Comment Second-degree price discrimination involves a sorting mechanism. The firm cannot identify the consumers and so designs a scheme so that the consumers sort themselves D. Third degree price discrimination 1. Definition Third-degree price discrimination means that different purchasers are charged different prices, but each purchaser pays a constant amount for each unit of the good bought. In the case of third-degree price discrimination, there is some easily observable criterion by which the firm can group consumers in terms of willingness to pay. It is also assumed that arbitrage is prevented. 2. Examples a. b. c. d. e. f. g. h. i. j. k. airline tickets under 12 discounts senior citizen discounts college student magazine subscriptions early bird specials at stores or restaurants or seed stores coupons end of season sales movies first and economy class seats classy and junky stores good and lousy service where the cost difference in providing good service is less than the price difference in the service 18 3. Basic rule for third degree price discrimination If there are two groups, the group with the lower demand elasticity pays the higher price. Intuition: If the quantity purchased is not very sensitive to price, charge a high price. 4. Third degree price discrimination with constant marginal costs a. marginal cost of production is constant and equal to c b. consumers are of two types and can be segregated The inverse demand functions are Type 1: P ' A1 & B Q1 Type 2: P ' A2 & B Q2 A1 > A2 The demand equations for each market are given by A1 Type 1: Q1 ' B A2 Type 2: Q2 ' B A1 > A2 & 1 P B & 1 P B The demand elasticity for market 1 is given by D1 A1 1 P B B dQ P ' dP Q Q1 ' ' ' & A1 & B Q1 &1 B Q1 B Q1 & A1 ' 1 & B Q1 A1 B Q1 19 Similarly for market 2 dQ P dP Q A2 ' 1 & B Q2 ' D2 With A1 > A2, market 1 is less elastic at any given Q because we are subtracting a larger number from 1. c. optimality conditions MR1 = MR2 MRi = c Marginal revenue in each market is given by Ri ' P Qi ' (Ai & B Qi )Qi MRi ' Ai & 2 B Qi This then implies that MR1 ' A1 & 2 B Q1 ' A2 & 2 B Q2 ' c Y 2 B Q1 ' A1 & c Y Q1 ' Y Q2 ' A1 & c 2B A2 & c 2B We can substitute these into the inverse demand function to obtain the prices charged in each market. 20 P1 ' A1 & B Q1 A1 & c ' A1 & B ' ' P2 ' 2B 2 A1 & A1 % c 2 A1 % c 2 A2 % c 2 With A1 > A2, P1 > P2. d. graphical analysis Third Degree Price Discrimination P D1 A1 (A1+c)/2B A2 MC (A2+c)/2B D2 0 (A2-c)/2B A2/2B (A1-c)/2B A1/2B A1/B A1/B Q 21 5. Third degree price discrimination with increasing and non-identical marginal costs between plants a. marginal cost of production is increasing and is different between two different plants owned by the firm 2 cost(y1) ' 10 % 10 y1 % y1 MC(y1) ' 10 % 2 y1 2 cost(y2) ' 5 % 10 y2 % .5 y2 MC(y2) ' 10 % y2 b. consumers are of two types and can be segregated The inverse demand functions are P1 ' 22 & q1 P2 ' 16 & 2 q2 Marginal revenue in each market is given by R1 ' P1 q1 ' (22 & q1 ) q1 MR1 ' 22 & 2 q1 R2 ' P2 q2 ' (16 & 2 q2 ) q2 MR2 ' 16 & 4 q2 For later reference the demand functions are q1 ' 22 & P1 q2 ' 8 & c. 1 P 2 2 aggregate marginal revenue We get aggregate marginal revenue by adding the marginal revenue curves horizontally. This means we need to invert them to get q on the left hand side. When MR (and P) is greater than 16, only the first set of consumers will be in the market, so we will have a kinked marginal revenue curve. First for MR > 16. 22 MR1 ' 22 & 2 q1 Y 2 q1 ' 22 & MR1 Y q1 ' 22 & MR 2 Y Q ' q1 % q2 ' ' 11 & 22 & MR % 0 2 1 MR 2 For MR # 16, we must aggregate the two curves as follows 16 − MR 1 = 4 − MR2 4 4 1 1 3 ⇒ Q = q1 + q2 = 11 = MR + 4 − MR = 15 − MR 2 4 4 MR2 = 16 − 4q2 ⇒ q2 = For MR # 16, we can reinvert to obtain for aggregate marginal revenue Q ' 15 & Y 3 MR 4 3 MR ' 15 & Q 4 4 Y MR ' 20 & Q 3 This will apply as long as Q $ 3. If Q < 3, MR > 16. d. aggregate marginal cost We set marginal cost in each plant equal. Then we aggregate the marginal cost curves horizontally as follows 23 MC(y1) ' 10 % 2 y1 Y 2 y1 ' MC & 10 1 Y y1 ' MC & 5 2 MC(y2) ' 10 % y2 Y y2 ' MC & 10 3 Y Q ' y1 % y2 ' MC & 15 2 We need not worry about any kinks because the 2 marginal cost curves have the same intercept. We can then reinvert to get aggregate marginal cost Q ' y1 % y2 ' Y e. 3 MC & 15 2 3 MC ' Q % 15 2 2 Y MC ' Q % 10 3 optimality We set aggregate marginal revenue equal to aggregate marginal cost and solve as follows MC ' 2 4 Q % 10 ' MR ' 20 & Q 3 3 6 Q ' 10 3 Y 2 Q ' 10 Y Q ' 5 Y 24 Aggregate marginal revenue is 4 Q 3 4 ' 20 & (5) 3 20 ' 20 & 3 2 ' 20 & 6 3 1 ' 13 3 MR ' 20 & Aggregate marginal cost is 2 Q % 10 3 2 ' (5) % 10 3 1 ' 3 % 10 3 1 ' 13 3 MC ' We can find the quantity sold in the first market by using the equation for marginal revenue MR1 ' 22 & 2 q1 1 ' 22 & 2 q1 3 40 Y 2 q1 ' 22 & 3 26 Y 2 q1 ' 3 13 1 Y q1 ' ' 4 3 3 Y 13 25 Using the equation for marginal cost we obtain the quantity produced in the first plant MC(y1) ' 10 % 2 y1 1 ' 10 % 2 y1 3 1 Y 2 y1 ' 3 3 2 Y y1 ' 1 3 Y 13 We can do the same for the second market by using the equation for marginal revenue MR2 ' 16 & 4 q2 1 ' 16 & 4 q2 3 40 Y 4 q2 ' 16 & 3 8 Y 4 q2 ' 3 2 Y q2 ' 3 Y 13 Using the equation for marginal cost we obtain the quantity produced in the second plant MC(y2) ' 10 % y1 1 ' 10 % y1 3 1 Y y1 ' 3 3 Y 13 26 Note that q1 + q2 = 5 and y1 + y2 = 5. The price in each market is given by P1 ' 22 & q1 1 2 ' 17 3 3 P2 ' 16 & 2 q2 ' 22 & 4 2 ' 16 & (2)( ) 3 4 ' 16 & 3 2 ' 14 3 The following table summarizes the results Demand Market 1 Market 2 4.3 3 0.6 6 Production Plant 1 17.3 3 14.6 6 Revenue 75.11 9.7 7 Marginal Revenue 13.3 3 13.3 3 3.3 3 5 84.8 8 Cost 29.4 4 43.8 8 Marginal Cost 13.3 3 13.3 3 Profit Total 5 1.6 6 Price Plant 2 73.3 3 11.5 5 27 Demand elasticities are computed as D1 ' dQ P dP Q ' (&1) D2 17.3 3 4.3 3 ' &4 dQ P ' dP Q 1 14.6 6 ' (& ) 2 0.6 6 ' &11 So market 1, with the lower elasticity, has the higher price.