Capital Structure Optimal Capital Structure What is capital structure? •

advertisement

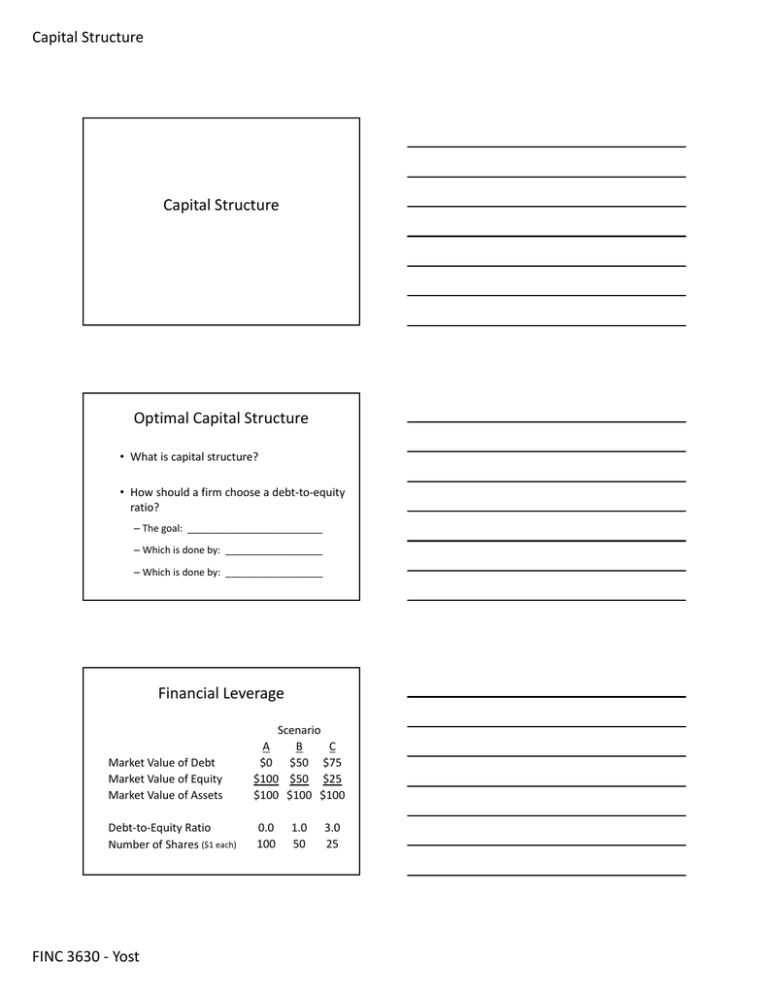

Capital Structure Capital Structure Optimal Capital Structure • What is capital structure? • How should a firm choose a debt‐to‐equity ratio? – The goal: _________________________ – Which is done by: __________________ – Which is done by: __________________ Financial Leverage Market Value of Debt Market Value of Equity Market Value of Assets Scenario A B C $0 $50 $75 $100 $50 $25 $100 $100 $100 Debt‐to‐Equity Ratio Number of Shares ($1 each) 0.0 100 FINC 3630 ‐ Yost 1.0 50 3.0 25 Capital Structure Financial Leverage Corporate Borrowing Rate Scenario A B C 8% 8% 8% EBIT Interest Expense Taxes (assume 0%) Net Income $20 $20 $20 $0 $4 $6 $0 $0 $0 $20 $16 $14 Financial Leverage ROA ROE EPS e (assume A= 1) A Scenario B C 1.0 2.0 4.0 Asset Betas and Equity Betas Asset Equity Equity Equity [(1 - TC) Debt] Equity Asset 1 1 - TC FINC 3630 ‐ Yost Debt Equity Capital Structure Financial Leverage • What is financial leverage? • What are the effects of financial leverage? • What is meant by “homemade leverage”? – The use of personal borrowing to change the overall amount of financial leverage to which an individual is exposed. Homemade Leverage • Assume the firm in the previous example has no debt (Scenario A). • Also assume you personally prefer to have the leverage in Scenario C. • How could you do this on your own? The M&M Propositions • Why is Keven obsessed with M&Ms? • Franco Modigliani and Merton Miller won Nobel prizes for the following (irrelevance) propositions. • Consider a world of no taxes (we will consider the role of taxes later), no bankruptcy costs, and perfect, efficient capital markets. People can borrow and lend at the same rate as the firm. FINC 3630 ‐ Yost Capital Structure M&M Proposition I (no taxes) • Does capital structure matter? • In our world of no taxes, bankruptcy costs, and perfect, efficient markets, is an individual firm’s capital structure important? M&M Proposition I (no taxes) • The value of the firm is independent of the firm’s capital structure. VL = VU M&M Proposition II (no taxes) • What happens to the risk shareholders face when the firm increases its use of debt? • What happens to beta? • What happens to the cost of equity? FINC 3630 ‐ Yost Capital Structure M&M Proposition II (no taxes) • The firm’s cost of equity capital is a positive linear function of the firm’s debt‐ to‐equity ratio. D R E R A R A R D E M&M Proposition II (no taxes) RE Cost of Capital RA • WACC RD Debt‐to‐Equity Ratio An Example (no taxes) • Executive Chalk is financed solely by common stock and has outstanding 25 million shares with a market value of $10 per share. It now announces that it intends to issue $160 million of debt and use the proceeds to buy back common stock. The firm’s current cost of equity is 10 percent. The cost of debt is 8 percent. FINC 3630 ‐ Yost Capital Structure An Example (no taxes) ‐‐ continued • How many shares can the company buy back? • What is the market value of the firm after the change in capital structure? • What is the firm’s new debt‐to‐equity ratio? • After the repurchase, what will be the firm’s new cost of equity? New cost of capital? Agree or Disagree? • The assumption of no taxes is a fair and realistic assumption. Agree or Disagree Capital Structure: The Sequel FINC 3630 ‐ Yost Capital Structure Review • Financial Leverage: 1. Magnifies the gains and losses to shareholders. 2. Increases the risk (e) to shareholders. e = A [1 + (1 ‐ t)(D/E)] Review • In our happy financial world world of no taxes, perfect, efficient financial markets, and no costs of financial distress, with homemade leverage… M&M Proposition I (no taxes) • The value of the firm is independent of the firm’s capital structure. • VL = VU FINC 3630 ‐ Yost Capital Structure M&M Proposition II (no taxes) • The firm’s cost of equity capital is a positive linear function of the firm’s debt‐to‐equity ratio. RE = RA + (RA – RD)(D/E) M&M Proposition II (no taxes) RE Cost of Capital RA • WACC RD Debt‐to‐Equity Ratio But then the IRS said, “Let there be taxes.” And there were. FINC 3630 ‐ Yost Capital Structure Features of Debt • Two features of debt that we ignored in our “perfect” financial world in the previous lecture: 1. ____________________________ 2. _____________________________ Back to our previous example… Scenario B C 8% 8% Corporate Borrowing Rate A 8% EBIT Interest Expense Taxes (assume 50%) Net Income $20 $20 $20 $0 $4 $6 $10 $8 $7 $10 $8 $7 Back to our previous example… Scenario A B C Cash Flow to Stockholders Cash Flow to Debtholders Total Cash Flow from Assets • What, then, should happen to firm value? FINC 3630 ‐ Yost Capital Structure Firm Value with Debt and Taxes M&M Proposition I (with taxes) • VL = VU + tcD • How do we calculate the value of the firm? • VU = [EBIT x (1 – tc)] / RA • Assume that the cost of equity for the firm in scenario A is 10%. Complete the following balance sheet: Back to our previous example… Market Value of Debt Market Value of Equity Market Value of Assets Debt‐to‐Equity Ratio ROE (assume $1 per share) FINC 3630 ‐ Yost A Scenario B C $0 $50 $75 Capital Structure M&M Proposition I (with taxes) Value of the Firm (V) VL = VU + (tc x D) Tc x D VU VU Debt‐to‐Equity Ratio M&M Proposition II (with taxes) • The firm’s cost of equity capital is a positive linear function of the firm’s debt‐ to‐equity ratio. RE = RA + (RA – RD)(D/E)(1 ‐ tc) M&M Proposition II (with taxes) • Assume that the cost of equity for the firm in scenario A is 10%. What is the required rate of return on equity for each scenario? • What is the WACC in each scenario? FINC 3630 ‐ Yost Capital Structure M&M Proposition II (with taxes) RE Cost of Capital • RA WACC RD Debt‐to‐Equity Ratio Therefore… • What is the optimal capital structure? • Let’s take another look… • Executive Chalk is financed solely by common stock and has outstanding 25 million shares with a market value of $10 per share. It now announces that it intends to issue $160 million of debt and use the proceeds to buy back common stock. The firm’s current cost of equity is 10 percent. The cost of debt is 8 percent. The tax rate is 35 percent. Assume a M&M world where all assumptions hold. FINC 3630 ‐ Yost Capital Structure Let’s take another look… • What is the market value of the firm after the announcement? • How many shares can the company buy back? • What is the firm’s new debt‐to‐equity ratio? • After the repurchase, what will be the firm’s new cost of equity? New cost of capital? Optimal Capital Structure (with taxes and bankruptcy costs) • Why do different firms have different capital structures? – ____________________________ greater for some firms. – ____________________________ greater for some firms. The Costs of Financial Distress • Direct Costs – Legal expenses – Administrative expenses • Indirect Costs – Lost sales – Lost time – Loss of morale and employees FINC 3630 ‐ Yost Capital Structure Optimal Capital Structure (with taxes and bankruptcy costs) • Trade‐Off Theory of Capital Structure: The firm borrow up to the point where the tax benefits from an extra dollar of debt is exactly equal to the cost that comes from the increased probability of financial distress. Optimal Capital Structure (with taxes and bankruptcy costs) Value of the Firm (V) VL = VU + (tc x D) PV of Financial Distress Costs Tc x D Actual Value VU VU D* Chapters 15 and 16 Suggested Problems • Questions: – 15‐1(a ‐ b), 15‐4, 15‐5, 15‐8 – 16‐4 • Problems: – 15‐9, 15‐10, and 15‐11 – 16‐4, 16‐5, 16‐6, and 16‐9 FINC 3630 ‐ Yost Debt‐to‐Equity Ratio