NORFOLK SOUTHERN CORPORATION Three Commercial Place, Norfolk, Virginia 23510

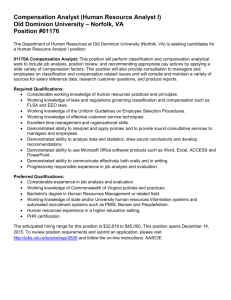

advertisement