THE UNIVERSITY OF THE WEST INDIES, MONA ECON1002: Introduction to Macroeconomics Description

advertisement

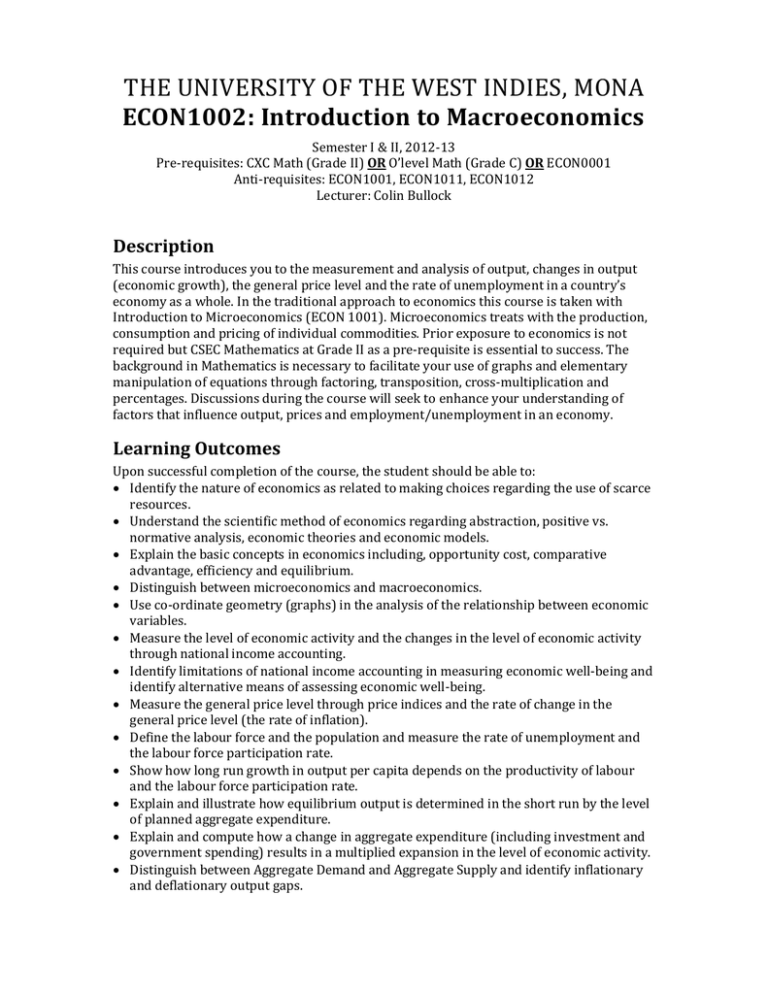

THE UNIVERSITY OF THE WEST INDIES, MONA ECON1002: Introduction to Macroeconomics Semester I & II, 2012-13 Pre-requisites: CXC Math (Grade II) OR O’level Math (Grade C) OR ECON0001 Anti-requisites: ECON1001, ECON1011, ECON1012 Lecturer: Colin Bullock Description This course introduces you to the measurement and analysis of output, changes in output (economic growth), the general price level and the rate of unemployment in a country’s economy as a whole. In the traditional approach to economics this course is taken with Introduction to Microeconomics (ECON 1001). Microeconomics treats with the production, consumption and pricing of individual commodities. Prior exposure to economics is not required but CSEC Mathematics at Grade II as a pre-requisite is essential to success. The background in Mathematics is necessary to facilitate your use of graphs and elementary manipulation of equations through factoring, transposition, cross-multiplication and percentages. Discussions during the course will seek to enhance your understanding of factors that influence output, prices and employment/unemployment in an economy. Learning Outcomes Upon successful completion of the course, the student should be able to: Identify the nature of economics as related to making choices regarding the use of scarce resources. Understand the scientific method of economics regarding abstraction, positive vs. normative analysis, economic theories and economic models. Explain the basic concepts in economics including, opportunity cost, comparative advantage, efficiency and equilibrium. Distinguish between microeconomics and macroeconomics. Use co-ordinate geometry (graphs) in the analysis of the relationship between economic variables. Measure the level of economic activity and the changes in the level of economic activity through national income accounting. Identify limitations of national income accounting in measuring economic well-being and identify alternative means of assessing economic well-being. Measure the general price level through price indices and the rate of change in the general price level (the rate of inflation). Define the labour force and the population and measure the rate of unemployment and the labour force participation rate. Show how long run growth in output per capita depends on the productivity of labour and the labour force participation rate. Explain and illustrate how equilibrium output is determined in the short run by the level of planned aggregate expenditure. Explain and compute how a change in aggregate expenditure (including investment and government spending) results in a multiplied expansion in the level of economic activity. Distinguish between Aggregate Demand and Aggregate Supply and identify inflationary and deflationary output gaps. Define money, explain the process of money creation by the banking system and the role of the central bank in managing this process. Distinguish between the money market and the market for goods and services and the interaction between these markets in determining interest rates, prices, output and employment. Identify the role of fiscal and monetary policy in closing output gaps. Discuss why countries trade with each other and explain the role of comparative advantage and exchange rates in influencing the direction and incidence of trade. Analyze the accounting for the international economic transactions of an economy. Modes of Delivery Two lecture hours and one tutorial hour per week. Problem sets (not for grading) will be provided for practice at problem solving. Assessment A mid-semester examination accounting for 40% and a comprehensive final examination accounting for 60% Syllabus Basic Economic Tools and Concepts Scarcity and choice. Cost-benefit as incentive for human behavior Comparative advantage Opportunity Cost Economic efficiency and equilibrium Abstraction as scientific method in economics Positive vs. normative economics Economic theories and models The use of co-ordinate geometry. Macroeconomics vs. Microeconomics and the Central Macroeconomic Questions Differentiating between the study of individual units and products and the study of the economy as a whole. The subject matter of macroeconomics: aggregate output and growth, the average price level and unemployment. The co-ordination tasks of an economy: what is produced, how it is produced and who benefits. Alternative economic systems: command economy, free market and mixed. The basic decision making units. Key markets, products, and income types. The circular flow of income, withdrawals and injections. The production possibilities frontier and economic growth. The Measurement of Output (National Income Accounting) Definition of Gross Domestic Product, National Income and other national income aggregates. Expenditure, output and income methods of measuring economic activity. Consumption of durable and non-durable consumer goods and services. Fixed vs. Inventory Investment. The GDP Deflator and Nominal vs. Real GDP Limitations of GDP and per capita income as measures of economic well-being. Alternative means of measuring economic well-being. The Measurement of Prices, Price Changes (Inflation) and Economic Growth • • • • • • • Concept and the need to measure inflation. The use of price indices to measure inflation Measuring changes in real GDP The causes of inflation Real interest rates and the market for loanable funds The impact of inflation Anticipated vs. unanticipated inflation. Employment and Long Run Growth Definition of labour force, population and unemployment. Measurement of unemployment rate and labour force participation rate. Problems with unemployment figures. Sources/types of unemployment. Definition of full employment Output per head related to labour productivity and the labour force participation rate. Influences on labour productivity and the labour force participation rate. Planned Aggregate Expenditure and the Multiplier Components of planned aggregate expenditure, withdrawals and injections. The role of unplanned inventory investment. Balance between output and planned expenditure and between withdrawals and injections. The impact of changes in planned aggregate expenditure on income through the multiplier. The paradox of thrift. Government expenditure, taxes, and .disposable income The government, tax and balanced budget multiplier Fiscal policy and aggregate demand. The Interaction of Aggregate Demand and Aggregate Supply Derivation of Aggregate Demand curve from changes in price levels Derivation of aggregate supply curve from deviations of actual prices from expected prices. Determination of equilibrium income, price level and unemployment. Factors causing shifts in Aggregate Demand and Aggregate Supply curves. The impact of shifts in Aggregate Demand and Supply curves on equilibrium, prices, output and unemployment Definition of inflationary and deflationary output gaps. Introduction to the use of fiscal and monetary policy to close output gaps. Money, Money Creation and Monetary Policy Definition of money The functions and characteristics of money Fractional reserve banking, money creation and the money multiplier Central banking and the tools of monetary policy Money supply, money demand and money market equilibrium Interaction between the money market and the market for goods and services (including the crowding out effect) and the impact on prices, interest rates, output and employment. International Economics Planned aggregate expenditure, output and the multiplier in an open economy The reasons for international trade. Absolute and comparative advantage in international trade. Restrictions on international trade and why they are implemented. The foreign exchange market and exchange rate determination The impact of exchange rate changes on international trade. Balance of payments accounting Resources Prescribed William J. Baumol and Alan S. Blinder, Economics Principles and Policy (International Student Edition), Thomson South-Western, United States. Recommended Karl E. Case, Ray C. Fair and Sharon M. Oster, Principles of Economics (9th ED) Pearson International Edition (2009)