NI Equilibrium - Oldfield Economics

advertisement

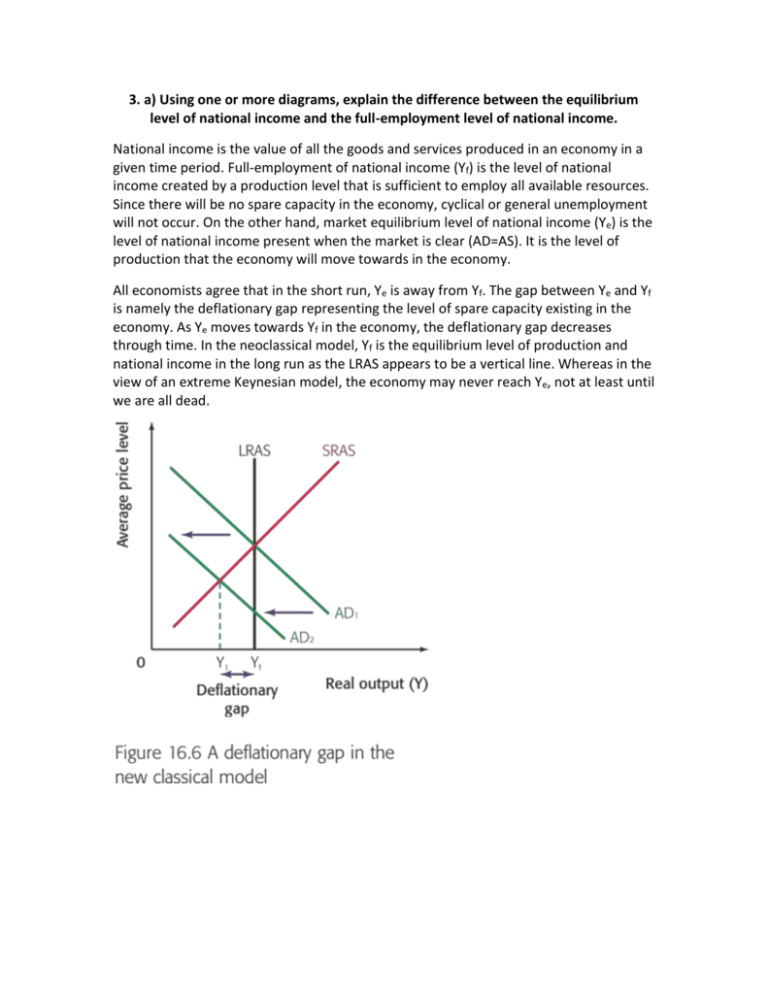

3. a) Using one or more diagrams, explain the difference between the equilibrium level of national income and the full-employment level of national income. National income is the value of all the goods and services produced in an economy in a given time period. Full-employment of national income (Yf) is the level of national income created by a production level that is sufficient to employ all available resources. Since there will be no spare capacity in the economy, cyclical or general unemployment will not occur. On the other hand, market equilibrium level of national income (Ye) is the level of national income present when the market is clear (AD=AS). It is the level of production that the economy will move towards in the economy. All economists agree that in the short run, Ye is away from Yf. The gap between Ye and Yf is namely the deflationary gap representing the level of spare capacity existing in the economy. As Ye moves towards Yf in the economy, the deflationary gap decreases through time. In the neoclassical model, Yf is the equilibrium level of production and national income in the long run as the LRAS appears to be a vertical line. Whereas in the view of an extreme Keynesian model, the economy may never reach Ye, not at least until we are all dead. b) Evaluate the policies a government may use to increase the full-employment level of national income. In the level of full employment, the factors of production in an economy are all employed, in other words, there is no spare capacity. Also, as the labour is included in the factors of production, there is no disequilibrium employment as the number of job vacancies are equal to the number of workers; there is only natural unemployment such as frictional unemployment. In Keynesian perspective, when the AD curve reaches the full employment level, it cannot increase the level of national income as it has already reached the full employment level. Therefore, further increase in AD will only increase the price of goods and services in an economy or increase the inflation rate by creating the inflation gap. In order to increase the level of national income and experience the economic growth, the government can use the supply side policies. Supply side policies are divided to two groups. The first group is market-oriented supplyside polices and the second group is interventionist supply side policies. The market oriented supply side policies are asserting for minimum government intervention to allow markets to operate freely. This is done in several ways. First, reduce the income taxes. When people work harder and longer than before, there will be an increase in their income but also (when their income taxes remain constant) in their increase in their income tax. Therefore, even though they work harder and longer, which shift the aggregate supply curve to the right and increase the full employment level, there is no incentive to constantly work hard because there is small increase in disposable income. In order to keep workers to constantly work hard, the government can reduce the tax on income so that it will give incentive to work hard for long term. The government’s revenue decreases because they decrease taxes, therefore the government expenditure will decrease. When the government expenditure decreases, then the aggregate demand decreases. As there is less demand for the goods and services in an economy, the aggregate supply will also decrease by firing the labour and so increase the unemployment rate in an economy. The other policy, interventionist supply-side policies basically means that the government has a direct role in encouraging growth. This can be done by education and training this helps as the labour is constantly getting educated and to develop their skills. When the people are educated they can enter the labour force much easier as they are now skilful labour, as they are educated it will be easier to retrain these workers as it helps them adjust to the changing economic status. This is all great but there are negative effects to this government intervention. It takes about 18 years to fully educate one individual so there is a great time lag. This policy is also very expensive, thus there are many opportunity costs. The Aggregate Demand (AD) will increase significantly due to the increase of government spending; it can happen due to the increase in AD that there is some inflation. This type of government intervention is more beneficial in the long-term than in the short-run. In conclusion, demand-side policies when it reached the full employment level, further increase in aggregate demand will only increase the inflation rate. Bold parts not done