Dr. M.D. Chase Long Beach State University

advertisement

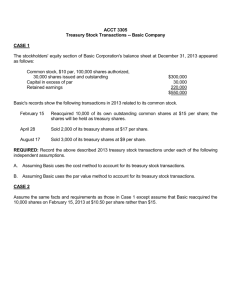

Dr. M.D. Chase Advanced Accounting 810-51Cd Long Beach State University Special Issues: Changes in Ownership Interest Page 1 Subsidiary Stock transactions: --Accounting Issues: 1. Valuation of the investment account; 2. adjusting the parents ownership percentage --Types of subsidiary stock transactions: 1. Subsidiary stock dividends or splits 2. Subsidiary sales of additional newly issued shares to MI; 3. Subsidiary sales of additional newly issued shares to "P"; 4. Subsidiary purchases of its own common stock (treasury stock) 5. Subsidiary sales of treasury stock --General rules: 1. Stock sales by "S" to outsiders may be handled in two ways: a. GAAP (APB-9) requires adjustment on "P's" books to the accounts Investment in "S" and "P" PIC b. The SEC and AICPA allow recognition of gains and losses if the sale is part of a "public offering" by and SEC reporting entity and not part of a broader reorganization; 2. Sales of stock by "S" to "P" result only in book value differential equal to "P's" share of the change in "S" SHE resulting from the sale of stock; this change must be reflected on the books of "P" by adjustments to the investment account and future amortizations of the excess of cost over book value; -- SUBSIDIARY STOCK DIVIDENDS OR SPLITS: Small stock dividends (<20-25% of previously issued shares; Dr. "S" RE by FMV of shares issued; Cr. C/S @ par; plug PIC) Procedure: --the valuation of the investment account is unchanged; --the parents ownership interest is unchanged 1. make note of the increase in the number of shares of stock with a memo entry; the total number of shares owned by "P" has increase but the ownership percentage has remained the same Large stock dividends (>25% of previously issued shares; use par to make adjustments to "S" RE and C/S) 1. make note of the increase with a memo entry; Stock splits: same as above --SUBSIDIARY SALES OF ADDITIONAL NEWLY ISSUED SHARES TO MI the valuation of the investment account is changed if the sale price is at an amount different from the book value per share recognized by the parent (refer to IV A above); in so far as gains and losses cannot result from transactions of an entities own stock (APB-9, paragraph 28) o If a credit ("constructive gain") is required, credit "P" PIC from subsidiary stock transactions; o If a debit ("constructive loss") is required, debit “P” PIC from subsidiary stock transactions until it is zero balance then debit "P" retained earnings as required THE EXCEPTION TO THIS RULE is when shares are sold in a "PUBLIC OFFERING"; gains and losses may be recognized in public offering sales that are not part of a broader reorganization that will involve other capital transactions (1980 AICPA Accounting Standards Executive Committee "Accounting in Consolidation for Issuances of a Subsidiary's Stock"; 1983 SEC Staff Bulletin 51). --In this case "P" is assumed to have sold a portion of its interest in the entity; the percentage sold is computed as follows: [(ownership interest prior to sale-ownership interest after sale)/ownership interest prior to sale] NOTE: APB-9 remains GAAP; the exception is not GAAP but is considered permissive; this means that to apply the exception the stock issuance should be at public offering by an SEC covered company. --the ownership interest of "P" is changed (reduced); the new percentage must be used in all present and future computations unless changed again Dr. M.D. Chase Advanced Accounting 810-51Cd Long Beach State University Special Issues: Changes in Ownership Interest Page 2 Example: Sales of Newly Issued Shares to MI (Continued) Example: --"S" stockholders equity consists of: Common Stock ($10 par)............ $ 100,000 PIC in excess of par.............. 60,000 Retained earnings................. 40,000 Total SHE.................... $ 200,000 --"P" purchases 80% of "S" for $180,000 with the excess attributed to Patent with a 10 year life; Cost.............................. $ 180,000 Purchased BV: (.8)(200,000)....... 160,000 Excess attributed to PATENT........... $ 20,000 --At the end of 3 years, "S" sells 2,000 shares to minority stockholders. Required: 1. record the necessary adjustments required by "P" if the sale is for $20, $30 and $10 per share respectively. Solution: "S" SHE immediately subsequent to sale of 2,000 shares............... "P" adjusted ownership interest...................................... "P" equity in "S" after sale......................................... "P" equity in "S" prior to sale (.8)(200,000)........................ Increase (decrease) in equity in "S" as a result of sale to MI....... Sales Price: Adjusting entries: GAAP followed; no "gain" or "loss" recorded: Sale at $20/share.............................................................. Sale at $30/share: Investment in "S"......................................................... "P" PIC from subsidiary stock transactions........................... $ $ $20 $30 240,000 $ 260,000 $ 8/12 8/12 160,000 $ 173,333 $ 160,000 160,000 -0- $ 13,333 $ $10 220,000 8/12 146,667 160,000 (13,333) Memo entry only 13,333 13,333 Sale at $10/share: "P" retained earnings (assumes no PIC from sub stock transactions) * 13,333* Investment in "S".................................................... 13,333 * it is permissible to debit ordinary PIC of "P" but is less conservative to do so; however, this procedure is often followed because it avoids a reduction of RE. Adjusting entries: "S" is SEC reporting company and sale is in "public offering"; gain or loss on sale recognized; Because the shares are considered to be sold, any portion of the excess of cost over book value in the analysis of the investment must be adjusted to reflect the indirect sale; in this case the excess of cost over book value is entirely allocated to patent so the adjustment is simple: Patent (per analysis)......... $ 20,000 percentage sold: [(.8-.6667)/.8] = .1667 $ 3,333 Patent has already been amortized over 3 years of its ten year life so ($3,333/10)x3 years or $1,000 of the patent applicable to the interest sold has already been amortized on the consolidated financial statements. Because of the sale, the adjustments made in the past must no longer be consolidated and must be adjusted through the retained earnings account. Sale at $20 per share: "P" retained earnings (prior amort of patent allocable to % sold)...... Loss on sale of "S" C/S (3,333-1,000).................................... Investment in "S" (reduce be excess of cost>bv allocable to part sold) 1,000 2,333 Sale at $30 per share: "P" retained earnings (prior amort of patent allocable to % sold)...... Investment in "S" (13,333- 3,333)........................................ Gain on sale of "S" C/S............................................. 1,000 10,000 Sale at $20 per share: "P" retained earnings (prior amort of patent allocable to % sold)...... Loss on sale of "S" C/S ................................................. Investment in "S" (13,333 + 3,333).................................. 1,000 15,666 3,333 11,000 16,666 Dr. M.D. Chase Advanced Accounting 810-51Cd Long Beach State University Special Issues: Changes in Ownership Interest Page 3 --SALES OF NEWLY ISSUED SUBSIDIARY STOCK DIRECTLY TO "P" --No special accounting treatment; handled like any other investment --SUBSIDIARY TREASURY STOCK TRANSACTIONS --There are two approaches in handling subsidiary treasury stock acquisitions: Method 1: --The acquisition is considered an indirect purchase of "S" by "P"(APB-16, par 26); as such, the rules of piecemeal or block acquisition described above apply; --if this approach is followed, the treasury stock account is eliminated against the underlying equity accounts associated with it; --this approach can get very complex if "S" uses the par method and has a lot of excess of cost over book value to allocate on the treasury stock acquisition; Method 2: --Acquisition of T/S is recognized by adjusting the investment account to reflect the adjusted book value of the investment resulting from the treasury stock acquisition; --this approach is not theoretically consistent with the handling of other acquisitions put just like the cost method of accounting for treasury stock transactions, it is frequently followed due to ease of use and the relative immateriality of subsidiary treasury stock transactions. --General rules: --Shares acquired from MI at BV: "P" ownership percentage increases but no adjustments are necessary because "P" owns more of less "S" SHE; BV per share of "P" investment is unchanged; --Shares acquired from MI at < or > BV:"P" ownership percentage increases and the investment account must be adjusted to reflect change in underlying BV per share Example: --"P" owns 80% of "S" --"S" has 10,000 shares of $10 par C/S outstanding on 12/31/x5 --"S" had PIC of $50,000 and RE of $90,000 --on 1/1/x6 "S" purchases 500 shares from MI stockholders; --"S" accounts for treasury stock under the cost method; Required: 1. compute the effect of the treasury stock purchase on "P's" book value if the purchase is made at $23, $30 and $10 per respectively; 2. give the necessary adjusting entry to reflect the change for each situation described above Solution: Capital stock................. $ PIC........................... RE............................ Total PIC and RE.............. $ Less: T/S @ cost.............. Total SHE..................... $ "P" ownership interest........ "P" total book value.......... $ Adjustment.................... Prior to Purchase 100,000 50,000 80,000 230,000 -0230,000 8/10 184,000 $ $ $ $ 500 sh @ $23 100,000 50,000 80,000 230,000 11,500 218,500 8/9.5 184,000 -0- $ $ $ $ 500 sh @ $30 100,000 50,000 80,000 230,000 15,000 215,000 8/9.5 181,053 (2,947) $ $ $ $ 500 sh @ $10 100,000 50,000 80,000 230,000 5,000 225,000 8/9.5 189,474 5,474 Adjusting entries: Purchase at $23/sh: memo entry to record change in ownership percentage only Purchase at $30/sh: PIC from subsidiary stock transactions (or "P" RE)..... Investment in "S"................................. 2,947 2,947* Purchase at $10/sh: Investment in "S"...................................... 5,474 PIC from subsidiary stock transactions............ 5,474* * "P" PIC (from any source) can be used but is less conservative share