Accounting 201: The Standard Course Outline (SCO)

advertisement

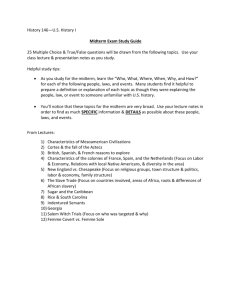

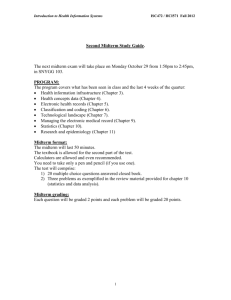

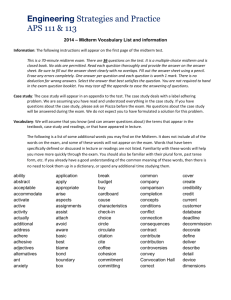

Accounting 201: The Standard Course Outline (SCO) I. General Information: Course number: Accounting 201 Title: Elementary Financial Accounting Units: 3 Prerequisites: None Course Coordinator/SCO Prepared by Steven A. Fisher, John Valenzuela, John Lacey Date prepared: August 5, 2008 II. Catalog Description: Introduction to financial accounting, practice. For business majors. Laboratory and/or class computer applications required. III. Curriculum Justification(s): The objective of this course is to provide users of financial statements the ability to understand and interpret accounting data and financial statements. It will also provide a foundation to those students who choose to major in accounting. Where possible, examples from financial reports of public companies will be used to illustrate the application of the accounting principles in practice. The first part of the course focuses on the accounting process. The source of accounting principles will be discussed along with the process accountants use in recording, summarizing, and reporting "accounting events". Topics discussed will include what the accountant records and does not record, how that recording is accomplished, and the aggregation process that occurs prior to the issuance of financial statements. During this portion of the course the double-entry bookkeeping process will be presented and the concept of accrual accounting will be contrasted to cash flows. Accounting for accounts receivable, accounts payable, and a basic introduction to inventory accounting and manufacturing accounting are also included here. In the second part of the course, specific issues in financial reporting will be addressed. The first topic will be revenue recognition. This is the critical point at which accountants recognize the accomplishments of a company through increased values on the financial statements. The various times revenue is recognized in accounting will be compared and contrasted with value concepts in economics and finance. Next, inventory accounting is discussed in greater depth, including the effects of alternative inventory cost-flow assumptions and the holding gains that result from changing prices in the factor and product markets. Other topics will include plant asset accounting (including depreciation), liabilities (including pensions, leases, and income taxes), and owners equity (including earnings per share and contingent securities). IV. Course Objective(s): The learning goals of Accounting 500 include: 1. Quantitative and Technological Skills: Students will possess quantitative and technological skills enabling them to analyze, interpret, and communicate business data effectively and to improve business performance. Students will be able to construct financial statements from business transactions, apply basic www.cba.20150213 accounting principles, and perform basic financial statement analysis. 2. Management-Specific Learning Goals: Students will be able to demonstrate understanding of all business functions, practices, and related theories and be able to integrate this functional knowledge in order to address business problems. More specifically, students will gain competency and knowledge in solving complex business problems. V. Outline of Subject Matter: Section 1: Accounting Environment and Transaction Analysis This section will introduce the process used by accountants in recording, summarizing and reporting the operations of the enterprise. The basic accounting equation will be discussed along with the criteria used by accountant for recording economic events in the accounting records. The books of original entry will be presented in the context of double-entry bookkeeping through a simple business example. The basic financial statements will be illustrated and discussed. Section 2: Accounting Recordkeeping and Accruals and Deferrals The focus of this section will be on the important difference between accounting numbers using the "accrual process" and those based on the flow of cash into and out of the organization. Accountants' recording of sales and purchases on credit will be illustrated along with the problems such reporting poses for the readers of financial statements. Midterm Exam 1 Section 3: Merchandising Companies & Inventory Management This section continues the discussion of differences between accrual accounting and cash flows with an emphasis on inventories. Problems in accounting for both merchandising and more complex manufacturing entities will be illustrated. The effects of alternative inventory cost-flow assumptions (FIFO, LIFO, weighted average) on the financial statements will be illustrated. Section 4: Short-term Liquid Assets Accounting concepts and classified financial statements will be discussed. Cash, accounts receivable, and notes receivable will be discussed along with the control of cash. Midterm Exam 2 Section 5: Plant Assets www.cba.20150213 Historical cost valuation is the principal topic of interest in accounting for plant assets. Acquisition, disposition, refurbishment, and value impairment of plant will all be discussed. The topics of depreciation and depletion will be related to the valuation issue. Intangible assets, including "goodwill", will also be discussed. Section 6: Short and Long Term Borrowing This section will be used to introduce the relationship between interest and value. These topics should be familiar from your economics classes and will be extremely important throughout the rest of your study in the business school. Also short and long-term liabilities of the firm will be discussed along with the accounting treatment afforded to bonds and leases. Section 7: The Owner's Equity & Cash Flow Statement Accounting for the stockholders' claim against the firm is the topic of this section. The relationship between the income statement and the balance sheet will be reinforced here. Also, the third basic financial statement, the cash flow statement, will be discussed here. Final Exam VI. Methods of Instruction: This course is taught primarily through lecture and class discussion of concepts and applications. Active interaction between the instructor and students is encouraged. The instructor may make use of homework assignments, group work, and a capstone project to enhance the learning process. The required textbook for the class is Kimmel, Weygandt, & Keiso, Financial Accounting, Tools for Decision Making, Fourth Edition, 2007. The Study Guide to accompany the text is strongly recommended. Anthony, Robert N., Essentials of Accounting. Addison Wesley, is also recommended. VII. Instructional Policies and Other Requirements: Each session includes a reading and problem or case assignment. It is expected that the reading assignment will be completed prior to the first class session listed for that assignment. The problems or cases should be attempted by the second session for which they are listed. If you get behind (which I strongly encourage you not to do) or if you find that you are struggling with the material please come to see me. The supplementary text by Anthony is also an excellent source of help. It is a self-study text that covers most of the material in the course with a different approach. Evaluation will be based upon homework assignments, two midterm examinations and a final exam. Late homework will not be accepted, but you may miss one homework assignment without penalty. Homework will be graded based upon effort, not correctness. Complete homework receives a grade of 2, incomplete but significant effort receives a grade of 1, little or no effort receives a grade of 0. Examination day procedures will be distributed and must be followed by all students. You must bring a university photo identification card to the exam and you must sit in your assigned seat during the exam. You will not be allowed to leave the examination www.cba.20150213 room until your exam has been checked in to the exam monitor. Any failure to follow the examination procedures or any dishonesty in the conduct of any student in the class will be pursued through the University disciplinary process. There will be no make-up exams. Grades will be assigned based upon the following weighting: Midterm 1 Midterm 2 Final Exam Homework Total www.cba.20150213 30% 30% 30% 10% 100%