Question 3 : Cost Volume Profit (CVP) Analysis

advertisement

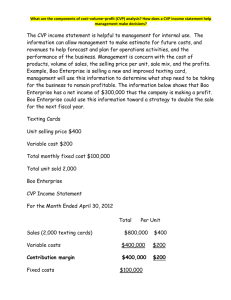

Question 3 : Cost Volume Profit (CVP) Analysis Kumpanart Kavalee Reclassification of Expense CVP Analysis in this lecture is based on variable costing approach CVP Formula CVP Analysis : Illustration 1 CVP Analysis : Illustration 1 CVP Chart CVP Formula with Tax Application Before tax CVP formula : (P-VC)Q – TFE = EBT With tax consideration : [(P-VC)Q – TFE] – [((P-VC)Q – TFE)T] = NP [(P-VC)Q – TFE].[1 – T] = NP CVP Analysis : Illustration 2 CVP Analysis : Illustration 2 CVP Chart What is Cost-Volume-Profit Analysis? Cost-Volume-Profit (CVP) Analysis CVP analysis is a sensitivity analysis of interrelationships of selling price, costs, quantity sold and profit (“CVP interrelationships”) for short-term profit planning Basic applications of CVP (1) Determination of Break-Even and Target Profit (2) Sensitivity Analysis of Profit Planning (Pricing Decision, Cost Reduction, and Sales Mix Strategies) (3) Determination of Margin of Safety (4) Risk management (Operating leverage) Types of CVP Analysis There are generally 2 broad types of CVP analysis 1) Non-linear CVP analysis 2) Linear CVP analysis Non-Linear CVP Analysis Non-linear CVP analysis is mostly used in economics because economics are based on many economic principles such as law of diminishing returns, productivity, etc.. which are more realistic and applicable to long-term perspective However, economic (non-linear) based CVP comes up with (1) Difficult and unreliable to estimate input parameters (2) Calculation difficulty (use of complicated mathematics like calculus to solve a non-linear equation) (3) Impractical and unrealistic approach for short-term profit planning because many variables are remain unchange in short-term Linear CVP Analysis Based on economic principles “costs of input normally remain unchanged in short-run”; therefore linear CVP analysis becomes more realistic, more applicable and more practicable for short-term analysis To make linear CVP become realistic, applicable and practicable to short-term analysis, we need 2 things (1) Holding 5 assumptions for doing analysis Constant sales price Constant variable cost per unit Constant total fixed costs Constant sales mix (for multi-products analysis) Units sold equal units produced (2) Need to revise sales price, variable cost per unit, total fixed costs, sales mix proportion regularly and constantly Illustration 3 : Break-Even, Margin of Safety, and Target Profit Analysis Illustration : Break-Even, Margin of Safety, and Target Profit Analysis Behavioural P/L (Answer to Question 1) Unit cost Ratio and Percentage (Answer to Question 2 – 5) Contribution Margin VS Fixed Costs Total contribution margin = total sales revenue – total variable costs or profit before tax + total fixed costs Total Contribution margin is an amount of profit available to absorb fixed costs The more fixed costs incurred, the more contribution margin is used to absorb the fixed costs incurred, and the less profit is a result. On the other hand, the less fixed costs incurred, the less contribution margin is used to absorb the fixed costs incurred, and the more contribution margin is turned to profit. Figure Out Break-Even Point (Answer to Question 6 -7) Margin of Safety (Answer to Question 8) Margin of Safety Target Profit (Answer to Question 9 – 10) Target Profit (Answer to Question 11 – 12) Derivations of CVP Formula Without Tax Consideration Unit variable cost or selling price are Known (Solve for Q) Unit variable cost or selling price are unknown (Solve for S) With Tax Consideration Analysis of Operating Risk (Operating Leverage) Operating Leverage = The use of fixed operating cost (TFC) to alter the relative percent changes in sales to percent change in EBIT or EBT. The more TFC use, the more profit fluctuation, the more operating risk Effect of Gearing (Leverage) Measurement of Operating Leverage How much the extent of operating risk as being measured by operating leverage? We can calculate numeric expression to show the extent of operating leverage by Measurement of Operating Leverage DOL (TCM / EBT) DOL (% Change) 1.42 1.25 1.18 1.25 The greater the ratio the greater TFC and the greater operating risk (potential profit fluctuation) Operating Leverage in Decision Making As variable costs and fixed costs sometimes can be use interchangeably For example : Company X uses more workers (more variable costs) whereas company Y uses more machines (more fixed costs) Therefore, the company management normally use different mix of variable costs and fixed costs to earn different amount of profit and also borne different level of operating risk. Operating Leverage in Decision Making Illustration Total fixed costs 375,000 100,000 Operating Leverage in Decision Making Behavioural format profit and loss statement at 10,000 units sold Operating Leverage in Decision Making CVP Application on Operating Leverage Q : Which alternative of system should management select? A : It is depend on whether which alternative will result in higher expected profit after taking possibility and magnitude of potential loss into consideration CVP Application on Operating Leverage CVP Application on Operating Leverage If an average annual sales volume during life of automated system is 10,000 units per year and there is very rare possibility that sales volume will drop below 9,167 units (Margin of Safety Ratio = 8.33%) Management should select Automate System CVP Application on Operating Leverage Illustration Operating Leverage in Decision Making High leverage Choice Low leverage Choice Basic Features Unit variable cost Relative lower Relative higher Total fixed expense Relative higher Relative lower Contribution margin Relative higher Relative lower Break-even point Relative higher Relative lower Margin of safety Relative lower Relative higher Degree of operating leverage (DOL) Relative higher Relative lower Risk / Return Profiles Down-side risk Relative higher Relative lower Up-side potential Relative higher Relative lower CVP Application on Sale Mix Strategy CVP analysis on sale mix strategy is mostly used by the company when the company has two or more complementary products that normally sell in bundle e.g. coffee and creamy powder Basic Application : Figure out breakeven or target profit of two or more assorted products sold in bundle with a constant mix (e.g. 1 coffee : 3 creamy powers) Finding new mixture of assorted products that will result in lower breakeven or higher target profit CVP Application on Sale Mix Strategy Formula for find out Composite Break-Even or Target Profit in Unit CVP Application on Sale Mix Strategy Illustration : Baubles and Trinkets are complementary products. The company’s sale mix analysis shows that every 3 units of Bauble sold 1 units of Trinkets could be sold. The unit information of Baubles and Trinkets are as follows : Now, the company management wants to increase sale of Trinket. Consequently the management arrives at a decision to avail a strong demand of Bauble for increasing sale of Trinkets by wrapping 3 units of Bauble and 2 units of Trinket in a single bundle for sale. Assuming that the company management does not change a package’s selling price, how much is the company’s breakeven for a bundle sale CVP Application on Sale Mix Strategy Solution Numerator : Total fixed costs + Target profit before tax = $7600 + $0 = $ 7,600 Denominator : The composite (or weighted average) unit contribution margin is ($0.40)(.6) + ($0.875)(.4) = $0.59. The break-even point for both products combined is $7600 / $0.59 = 12,881 units. Breakeven in units sold of Baubles = (12,881)(60%) = 7,729 units Breakeven in units sold of Trinkets = (12,881)(40%) = 5,152 units CVP Application on Sale Mix Strategy Determination of feasible mix After conducting marketing research Maximum units of Baubles and Trinkets could be sold are 7,729 and 5,961 units respectively. Therefore, the feasible mix of Baubles and Trinkets that make the company’s profit is at break-even are 50% : 50% or 60% : 40% CVP Application on Sale Mix Strategy Illustration CVP Application on Combined Capacity CVP Application on Combined Capacity Profit – Volume Ratio (PVR) Profit – Volume Ratio (PVR) Cash Break Even Point BEP in case of Opening Stock CVP Analysis with Relevant Range BEP in case of Relevant Range of Variable Cost BEP in case of Relevant Range of Fixed Cost BEP in case of Semi-Variable Cost