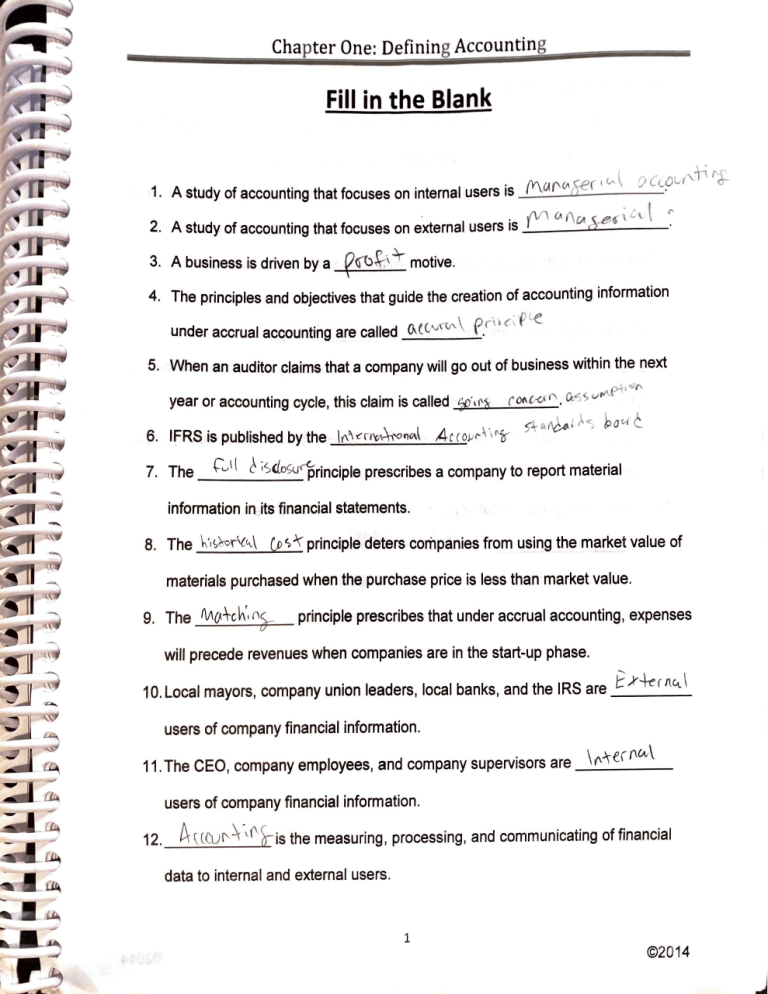

Chapter One: Defining Accounting

Fill in the Blank

.

M

"6' CP( IV-\

1· A study of accounting that focuses on internal users 1s ' · ~GI , · er-:

·

2. A study of accounting that focuses on external users is

3. A business is driven by a

NI {,\ (\~ c

1· ·

?~~\'1"' motive.

a..e

OC<..~L,('-ti'&-

6" l..; l

I

·

r

4. The principles and objectives that guide the creation of accounting information

.

under accrual accounting are called OJ 0\J

r~\

Dr\, c, Pt.e

1.

5. When an auditor claims that a company will go out of business within the next

year or accounting cycle, this claim is called

'itfo'x

/'Of\t-<,r (\ . G,".iS v

6. IFRS is published by the \/\~ .::~-o.,G\\ A ce oJ.,r-\ \ "7r

7. The

fvi I

5'-t r, ~

/ ~<:i

~ •"'"

~o« t_

t ;sclo>ifprinciple prescribes a company to report material

information in its financial statements.

8. The k,~~r'lc,,\ (p'-'f principle deters companies from using the market value of

materials purchased when the purchase price is less than market value.

9. The 1\.11.o-\-cl.', "~

principle prescribes that under accrual accounting, expenses

will precede revenues when companies are in the start-up phase.

10. Local mayors, company union leaders, local banks, and the IRS are

t )'-t,e r llCI.. \

users of company financial information.

11 .The CEO, company employees, and company supervisors are \f\-\er f\w\

users of company financial information.

12. AuCtJf'-~-,(\hs the measuring, processing, and communicating of financial

data to internal and external users.

1

©201 4

j

Chapter One: Defining Accounting

13.The US group that establishes GAAP is

U)

•

t; e-uJ, ';:)-"3 .

(ii\~

y'\,'-' ".;iS I 2) (\

et~~,0qe UY''\ . '

t· g. one is

14. There are two ways someone conveys an ethical character ,n accoun '"

being ethical is

15, Lo s; c<A

8°1) 6-,

6<J.- 6-

and another is being ethical In

-

information is the data that could affect the judgment of a rational

decision maker.

16.A business is an organization that is selling goods and services for a

1

effi\-,.\

17.Cost principle is also known as the h, 51tf1C4l Cl6+- principle.

18.

CCtt';h

basis of accounting recognizes revenue only when cash Is received

for goods or services provided. ·

fv"et-~" ,: (-c,

19. ____ basis of accounting recognizes expenses when the company legally

owes the expense for goods or services received.

20. The national, professional organization •for CPAs is called the

AMe,,ri..¼,(\

. LL.

' l\'5,\ \11.r\v

\

'

c,I\'

Cq

,

,

~i ~.tt,o

llu' :11.,,

\I

O\ ,c..,,

a t CO tJr'i--~N1-~

2

©2014

Chapter One: Defining Accounting

Multiple Choice

1. Which of these tasks are conduc~d by Accountants and not Bookkeepers.

a. Input financial information

b. Receiving source documents

c. Write checks

@ Interpret financial information to external users and decision makers.

All of the following are external stakeholders of a.company except

a. Stockholders

b. Local Mayor

c. LocalBank

, ~mployee of the company

The assumption that is the basis in which LLC's are legally developed.

~Business Entity Assumption

b. Going Concern Assumption

c. Monetary Unit Assumption

d. Time Period Assumption

3

©201 4

,Chapter One:,Defining Accounting

4

- The assumption that informs s~arehold~rs that th~ir company has the capabilities

to produce annual, bi-annual, and quarterly reports is.

a. Business Entity Assumption

b.~ Going Concern Assumption

c. Monetary Unit Assumption

i

@Time Period Assumption

r •

'

5. Which of the following assumptions defines that US financial statements be

communicated in US dollars?

a. Business Entity Assumption

• , · .•

b. Going Concern Assumption

Monetary Unit Assumption

d. Time Period Assumption

6. Which of the following assumptions dictates that a company will be doing the

same·thing a year from now that it is doing today?

a. Business Entity Assumption

,....

{f;)Going Concern Assumption

•

'

'

j

I

c. Monetary Unit Assumption

d. Time Period Assumption

4

©2014

Chapter One: Defining Accounting

7. The principle says that if a company purchases a piece of.property valued at$1

0

;,

;i

million for $1, the company must reflect that purchase on its balance sheet as

$1?

a. Full Disclosure Principle

;~

Cost Principle

c. Matching Principle

,

1

d., Recognition ,Principle .

8. The principle on which cash and accrual basis is based on.

a. Measurement Principle

b. Cost Principle

Matching Principle

d. Full Disclosure Principle

9. Theiprinciple that all material information should be stated in the financial

statements is.

a. Measurement Principle

b. Cost Principle

c.

Q)

Matching Principle

Full Disclosure Principle

1O. Which of the following business organizations is the easiest to create?

Sole Proprietorship

b. Partnership

c. S-Corporation

d. C-Corporation

5

©2014

r

Chapter One: Defining Accounting

11. Which of.the following business organizations require a statement of

-

. • shareholder's equity?

a. Sole Proprietorship

b. Partnership

c. S-Corporation

®C-Corporation

12. Which of the following business organizations has two or more owners that have

undertaken unlimited ,risk in order to pursue their business interests?

a. Sole Proprietorship

;@ Partnership

c. S-Corporation

d. C-Corporation

13. The government entity that has oversight authority over the accounting

profession.

a. IRS

'&- SEC

c. EPA

d. CIA

6

©2014

Chapter One: Defining Accounting

=

14

- If a company decides to changed its corporate model from selling running shoes

to providing information technology services, this company can be seen in

violation of what assumption.

a. Business Entity Assumption

f@)

Going Concern Assumption

C.

Monetary Unit Assumption

I

d. Time Period Assumption

15. When an auditor engages in a company audit and begins by not asking for the

company's CEO personal banking statements, the auditor is exhibiting what

accounting assumption.

Business Entity Assumption

b. Going Concern Assumption - ,

c. Monetary Unit Assumption

.

d. Time Period Assumption

I ,•

16. When an investor reads the data ,on a financial statement they retrieved from the

New York Stock Exchange database in US dollars that.are exhibiting what

accounting assumption.

I,

a. Business Entity Assumption

•

1 ,

Going Concern Assumption

c. Monetary Unit Assumption

d. Time Period Assumption

7

©2014

Chapter One: Defining Accounting

17. The framework in-which accrual ,,ccounting ,is conducted in US accounting.

-

a. IASB

% FASB

;t,J

c. US GAAP

f'

I

'(

I

d. PCAOB

nd

18. The organization created by SOX to oversee the audits of ,public companies a

other entities.

a. IASB

I

, , b. FASB

I

. ·1

•

j

c. US GAAP

~

PCAOB

19. Accountants do all of the following except. · .

a. Record financial information

b. Interpret financial information

i'JC. ·

re)

;·•~

Communicatei inancial information

Receive Inventory Materials

20. The business entity that has an indefinite life.

a. Sole Proprietorship

b. Partnership

c. Proprietorship

(~C-Corporation

I

,

8

©2014

Chapter One: Defining Accounting

-

f

Generally Accepted Accounting Principles

t\

-.LL The assumption that the company will be in operation and co

nd

t the same or a

uc .

.

very similar business one year after the report.

!__ The principle that assets are recorded at their cost.

_B__ International Accounting Standards Board

(7 International Financial Reporting.Standards

&_

The assumption that the business and the individual owning the busine~s are

f' .

' .

separate entities.

17__

• •

•

h

· d they are incurred.

_:V_ The principle that expenses should be recorded during t e peno

-----f'

The assessment of a transaction on the basis of whether it would change the

.

judgment of a rational investor.

_l::,_ 1nternal Revenue Service

,

r

_£_ The assumption that the financial statements are recorded in one monetary unit.

/If\ The branch of accounting that is geared to create fina.ncial infonnation for i~ter~al

users.

--5

Financial Accounting Standards Board

J

V

The moral concepts and principles of an individual or entity.

10

R

Chapter One: Defining Accounting

Stakeholders that exist outside of the organization that created the financial

statements they are invested in.

The profession that identifies, records, measures, processes, analyzes, and

communicates financial information.

;he profession that records and processes fi~ancial transactions.

Stakeholders that exist inside of the organization that created the financial statements

they are invested in.

}:' American Institute of Certified Public Accountants

Securities and Exchange Commission

N

The branch of accounting that is geared to create financial information for external

users.