Should you source your next Direct Store Executive White Paper

advertisement

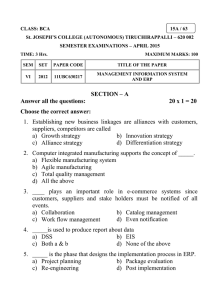

Should you source your next Direct Store Delivery system from your ERP Vendor? Executive White Paper March 2006 Numeric Computer Systems Executive Summary • Do your existing ERP modules limit your ability to execute your optimal sales and distribution strategy? Modern ERP systems are almost ubiquitous amongst large and medium sized Food and Beverage firms around the world. Despite the seductive lure offered by ERP vendors of snapping in a single application to address all the business needs, many firms have found that a single-vendor suite of software does not contain the depth of features to yield the organisational efficiency, flexibility and business strategy • Does your sales and distribution system accommodate emerging trends like EDI and Vendor Managed Inventory? alignment sought. For Fast Moving Consumer Goods (FMCG) companies engaged in Direct Store Delivery (DSD) distribution, as is common around the world, the inability of software to match the business needs is critical; as frequently a majority of sales revenue is • Does your generic sales and distribution system cost you revenue opportunities? generated via this complex sales and distribution model. The emergence of flexible middleware, standardised integration models and the Internet has allowed progressive firms to adopt a best-of-breed DSD system at no • Are your processes so different from similar businesses around the world that there are none that can be leveraged? additional total cost, while also preserving one of the significant benefits gained from ERP system implementations, the common data model. Best-of-breed systems encapsulate the know-how and specific industry experience of niche software vendors to better align IT with business needs, resulting in increased flexibility and improved business performance. In Praise of ERP Systems Since modern packaged software first emerged at an enterprise level in the 1980’s with Oracle Financials, and in 1991 with SAP R/3 the adoption of these ERP packages, as they came to be known, has been the singular most dominant IT project. The thrust of the marketing argument used by package ERP software vendors was that by supporting data and business process integration under a single application umbrella users could better integrate their business functions and better manage and scale their business processes1. Whether the need was driven by Year 2000 compliance requirements, a desire to integrate departments, a fear of not keeping up with technology, or globalisation / standardisation needs, companies have lined up to spend enormous amounts of money and resources to implement ERP systems2. Various surveys have suggested that historically the opportunity to replace a tangle of complex, disparate and obsolete applications with a single system from a reputable 1. Various SAP marketing literature produced between 1999 and 2004 2. O’Leary, D., “Enterprise Resource Planning Systems: Systems, Life Cycle, Electronic Commerce, and Risk”, Cambridge University Press, 2000 and stable vendor was a very attractive proposition3. In the future it appears likely that the already installed ERP systems will form the infrastructure for the next generation of systems, while specialised line-of-business systems will be added to address specific business processes and thereby better align the IT infrastructure with the business needs4 and allow the business to climb the staircase of IT value (figure 1). Competitive Advantage Process effectiveness Process efficiencies Build on ERP infrastructure and extend capabilities through use of new technologies IT cost savings Improve business processes and capture savings through incremental initiatives Source: Adapted from “A second wind for ERP”, McKinsey & Company, 2000, Number 2 Figure 1 - The Staircase of IT Value What unique functions are needed by a DSD FMCG business? Despite many FMCG firms implementing modern ERP systems, the uniqueness of the DSD sales and distribution model demands specific features seldom found in generic ERP systems (figure 2). That many large FMCG firms continue to use legacy systems for their DSD requirements5 despite extensive ERP projects demonstrates that critical gaps exist in an ERP suite within a FMCG firm. Unique FMCG Customer Need DSD System Feature Needed Allow consolidation of transactions into logical groups A FMCG firm is typified by a large number of low-value before posting to the ERP system reducing the numtransactions. ber of ERP transactions significantly. The short time between manufacturing, order, distribuRemoval of all un-necessary process steps, screens tion and consumption means that the transactions and fields to enable high speed throughput. need to be processed at light speed Use pre-configured routes, delivery schedules, Cost of transaction must be low as the FMCG typically historical activity, reporting by exception and other has low profit margin per transaction. features to process transactions cost effectively. In the FMCG environment there is a need for Standard Hand helds, vendor managed inventory and other Orders, Stock to Orders, Peddle Orders, Tele-sales industry specific requirements are at the core of orders and hand held computers specialised DSD systems. The ability to handle COD type deliveries and track containers delivered and returned Handling various distribution and payment models is inherent. Reporting by reason code and exception ensures cost effective transaction processing. The movement of Inventory is unique in the FMCG Industry. The need to “balance” the inventory through Route Settlement is essential to FMCGs. Route Settlement is a core function. Systems keep track of inventory from platform to customer and back, charging the Driver for any discrepancies. Figure 2 – The Unique Needs of FMCG DSD firms 3. James, D. & Wolf, M., “A second wind for ERP”, McKinsey Quarterly Review, 2000, Number 2 4. Greenburn, J., “Build vs Buy in the 21st Century”, Intelligent Enterprise, 22 April 2003 5. For example “Sizing up Sales Solutions”, Beverage World, October 2005 Don’t ERP systems provide all the functions my business needs? The vision of snapping a single application into a complex sales and distribution business is seductive, but the reality is complex. Despite the efforts of ERP vendors a single vendor ERP suite providing all the business functions is less prevalent than their marketing messages would imply6. For FMCG companies the unique complexity of the DSD sales and distribution model makes the ‘shoe-horning’ of a single vendor solution into a complex business almost impossible. Further evidence of the need for ERP system extensions to better align IT with business needs is provided in a recent survey of CIO’s wherein industry-specific ERP system extensions was the second largest budget item for leading CIO’s7. The inability of installed ERP systems to produce tight alignment with business strategy for FMCG systems was also highlighted in the 2004 Grocery Manufacturers Association Technology Investment and Effectiveness Study (excerpt in figure 3). In this study Optimising Business Processes and Aligning Business and IT Strategies, both symptoms of the ERP system failing to address the functions needed for the business, were identified by business executives as being the two most significant drivers of IT spending. High Medium Low Optimise Business Processes Reduce IT Budgets Reduce ROI of IT Capital Aligning Business and IT Strategy Business Agility Improve Trade Customer Service Support Cost-Reducing Projects IT Organisation Governance Disaster Recovery /Bus contingency Global data Synchronisation Financial Reporting Security Satisfying Customer Imperatives Improve Service to Bus Users Retain skilled IT staff RFID/EPC Regulatory Compliance Maintain Pace with Technology Support Growth Initiatives Customer Collaboration E-business Supplier Collaboration Source: 2004 GMA Technology Investment and Effectiveness Study Figure 3 – Business Executive drivers of IT Spending in FMCG Firms Clearly vanilla ERP system implementations are not able to address the needs of all customers, including FMCG firms. Despite ERP vendors attempting to close this functionality gap by developing new modules and systems, often in partnership with their FMCG clients8, the ability for ERP vendors to effectively close the gaps remains very unclear9. Moreover, when, and if, such gaps are addressed by the ERP vendors will their new and unproven systems offer more value to customers than the existing and proven best-of-breed DSD systems offered by experienced niche software vendors? 6. “The End of the ERP Suite?“, Peerstone Research, 2004 7. Kanakamedala, K., Krishnakanthan, V. & Mark, D., “CIO Spending in 2006”, McKinsey on IT, Spring 2006 8. For example, “Coca-Cola Enterprises Joins SAP in Direct Store Delivery Initiative to Enhance Sales, Logistics, Service and Mobile Applications”, SAP Press Release, 12 February 2004 9. For example “Falling Flat?”, Ziff Davis media Inc, 14 January 2005 Evaluating Single-Vendor Suite and Best-of-Breed The most common argument in favour of the single-vendor suite approach is that best-of-breed solutions are more difficult and more expensive to integrate into the ERP infra-structure. All else being equal, this is a sensible view. Unfortunately, all else is usually not equal. The integration advantage of the single vendor suites has, in most cases, proven too small to outweigh the benefits of the tighter business fit with specific business processes promised by best-of-breed systems10. Although application pricing is generally shrouded in non-dislcosure agreements, and therefore a little opaque, software license fees for best-of-breed applications do not appear to be higher than for equivalent suite modules. This is hardly surprising as suite vendors do not enjoy any special cost advantage in developing software compared to best-of-breed vendors and economies of scale are weak in software development. Indeed, it might be argued that best-of-breed vendors possess unique know-how and experience to allow them to develop niche solutions more cost effectively than single suite ERP vendors. Moreover, applications built by best-ofbreed vendors must be successful as such vendors have few alternative revenue streams to cross subsidise unsuccessful applications. This inevitably encourages cost effective development and a close fit with market needs within best-of-breed vendors. It will certainly cost less to integrate a single-vendor suite DSD function than to integrate a best-of-breed application. However, the integration benefit needs to be balanced against the frequent need to either customise the single-vendor application or accept a significant compromise in functionality. The previously referenced surveys and studies suggest that business executives are no longer prepared to accept this compromise as it impacts on the execution of their business strategy. All cost components considered, the integration benefit offers little or no net reduction in the final costs for professional services6. Modern middleware applications are eliminating the requirement that all ERP modules share the same database. Middleware allows application components to communicate through standardised messages and thereby share data. As a result, the integration of disparate best-of-breed applications has become increasingly flexible and manageable (figure 4). ERP vendors have recognised this trend and have been shifting their product development efforts to focus on emerging open suite architectures using Web Services and XML standards11. Importantly, this architectural transition further diminishes the integration value associated with single-vendor suite applications. 10. “ERP Benefits Realisation: What it takes to see results”, AMR Research, 2004 11. Various SAP marketing literature, 2005 Single-vendor ERP Open-component architecture Internal user Proprietary user interface External user Web browser Web browser Internet Financial-software component from Vendor A Finance Human resources Internal user Inventory management Single database Production planning Sales and distribution Message hub Order-entry software component from Vendor A Human-resources Supply-planning software component software component from Vendor C from Vendor B Source: “A second wind for ERP”, McKinsey Quarterly Review, 2002 Number 2 Figure 4 - New Technologies create new choices for ERP Systems While the large ERP vendors marketing continues to trumpet the benefit of a singlevendor suite they are aggressively moving to make it easier to integrate best-of-breed applications. FMCG firms, even those with the greatest implementation budget and resources, continue to rely upon best-of-breed applications for critical business functions5. What does the future hold? As evidenced by surveys, the truth is that companies have never stopped wanting applications that best fit their business need and allow them to climb the staircase of IT value. They accepted compromises in functionality when the costs of integration outweighed the costs of the lost functionality. As the cost of integration reduces through the use of standardised interface protocols the pendulum will naturally swing back towards best-of-breed applications. In any FMCG firm some ERP modules will likely be considered best-of-breed, but specialised niche software vendors will supplement the ERP modules to provide a rich ecosystem of functionality. The integration of niche best-of-breed vendors, encapsulating specialised know-how and experience that is difficult for generalised ERP vendors to replicate, will result in a better alignment of IT with business needs. Taking the analogy of ecology to its logical conclusion, it is not hard to predict that some of the ERP vendors currently most feared best-of-breed competitors will morph into symbiotic partners who contribute to the overall health of the system, even as they pick off the mother brand’s weaker modules. This competitive ecosystem model is the model that must be adopted by the successful ERP vendors as it is the only model that scales efficiently. Conclusion The unique DSD sales and distribution model employed by FMCG firms has proven difficult for generic ERP vendors to incorporate into their application. The unique know-how and experience provided by niche software vendors has meant that bestof-breed applications have produced more value to organisations than the equivalent functions offered by single-vendor ERP suites. The evidence is unclear whether modules provided by ERP vendors central to a FMCG firm, like a DSD module, are weak or simply non-existent. In any event, the largest FMCG firms with the largest ERP implementation projects have retained their best-of-breed DSD applications as the cost of poor business alignment was too great to outweigh the benefit of integration. It is likely that the use of best-of-breed applications will continue, and indeed grow, despite the attempts of ERP vendors to address the functionality gaps. Through the use of standardised interface protocols integration is becoming easier, cheaper and faster, eliminating the integration benefit single-suite ERP vendors tout. Indeed, the unique know-how and experiences inherent in best-of-breed applications is almost impossible for single-suite ERP vendors to replicate. Andrew Dove (andrew.dove@ncssuite.com) has 18 years IT experience in the FMCG environment and manages our Asia Pacific business from Sydney, Australia